Clapp Weekly: Pre-Fed caution, Western Union stablecoin, Trump's prediction market

BTC price

Bitcoin is consolidating as liquidity is parked in stablecoins ahead of today's Fed decision. Amid easing US-China tensions, gold’s plunge to a three-week low suggests capital rotation, while US spot ETFs have seen four straight green days. However, the correction from the Black Friday plunge may not be over yet.

BTC bottomed out at $107,088 last Thursday, October 23, and traded close to $112k until Sunday, October 26, when it pushed higher. After Monday’s high of $115,957, BTC slipped below $113k and reversed course again.

Currently at $113,531, BTC has lost 0.6% over the past 24 hours but gained 5.1% over the past week.

ETH price

Ether is showing rekindled bullish energy. Rising open interest and exchange activity reflect market engagement, both institutional and retail, after Ethereum completed the final dress rehearsal for the Fusaka upgrade — the Hoodi test. That said, bleeding spot ETFs did not reverse course until Monday, October 27, lagging behind their BTC rivals.

Mirroring BTC, ETH rebounded from $3,749.98 last Thursday, October 23, and traded below $4k until Sunday, October 26. The surge to $4,232.02 the next day gradually lost steam as the coin sank to the sub-$4k zone hours ago — only to climb back yet again.

Currently at $4,016.11, ETH has lost 2.4% over the past 24 hours despite gaining 4.1% over the past week.

Seven-day altcoin dynamics

Yesterday, the broader crypto market saw mostly red, with limited reaction to new spot ETF listings in the US — the Bitwise Solana Fund, Canary Capital Litecoin and HBAR Fund, and the Grayscale Solana Trust. For all three coins (SOL, LTC, and HBAR), those ETF-fueled gains proved fleeting.

A quiet decline accelerated as US stocks soared to new peaks — the S&P 500 hit 6,900, while the Nasdaq also clinched a record high. Crypto stocks fell sharply into the red.

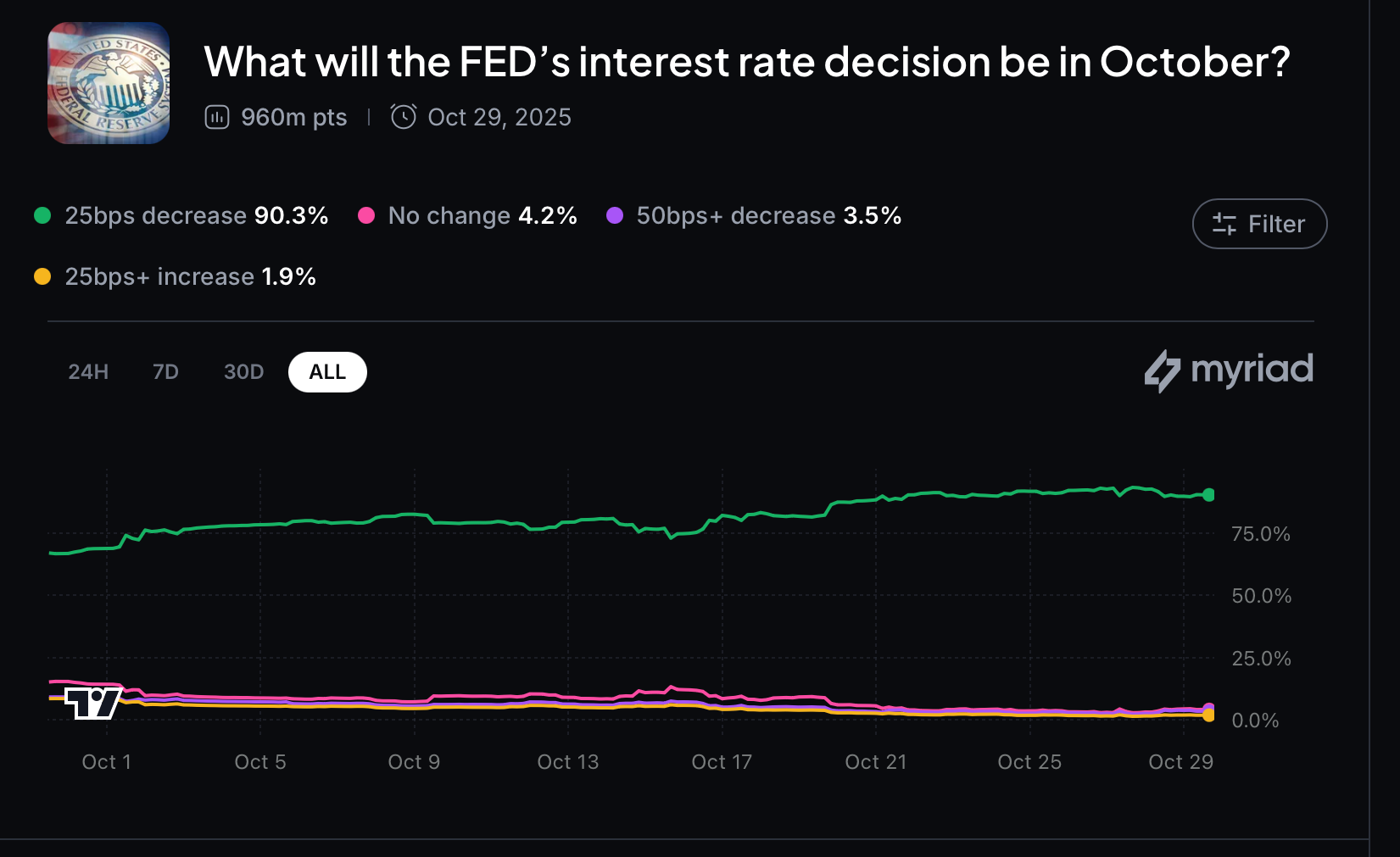

The Federal Open Market Committee (FOMC) — the Fed’s rate-setting group — is concluding its meeting today, with Chair Jerome Powell’s press conference scheduled for 2:30 p.m. ET. According to prediction markets, a quarter-point cut is nearly certain (90.3% on Myriad vs. 99.9% on CME FedWatch).

Rising open interest reflects optimism over the policy shift. Investor positioning ahead of today's event has fueled BTC's rally from $107k to $116k.

The cut, already priced in, could bolster appetite for risk assets, including crypto. Confidence stems from a confluence of macro developments, including a worsening labor market, which outweighed inflation concerns when the FOMC approved the initial cut in September.

Weekly winners

- HYPE (+36.3%) and KHYPE (+36.5%) extended last week's momentum as weekly inflows hit $25 million and revenue reached $20 million, making Hyperliquid the third top-earning protocol — behind only major stablecoin issuers. Additionally, stakers received over $90 million in cumulative rewards this month.

- PUMP (+31.7%) is supported by the broader recovery, whale accumulation, and retail interest. Average revenue surpassed $1 million, rising from $545k on October 22, while the buyback program crossed $150 million, with nearly 10% of supply already removed from circulation.

- PI (+30.3%) is clawing back value after a rough year, after an integration into the SWIFT system via OKX. Successful activation of internal cross-border banking for Pi Bank means that PI has been listed within the SWIFT system.

Weekly losers

- HASH (-16.2%) is struggling after crashing last Wednesday, October 23, with prices dipping progressively lower and falling below $0.032 hours ago.

- TRX (-8.1%) declined last Thursday, October 24, amid a lack of supportive news combined with strong intraday volatility and prevailing market caution.

- IP (-7.9%) is descending after rocketing above $5.80 on Monday, failing to maintain momentum despite spiking trading volumes.

Cryptocurrency news

Money transfer giant goes on-chain: Western Union's stablecoin bet

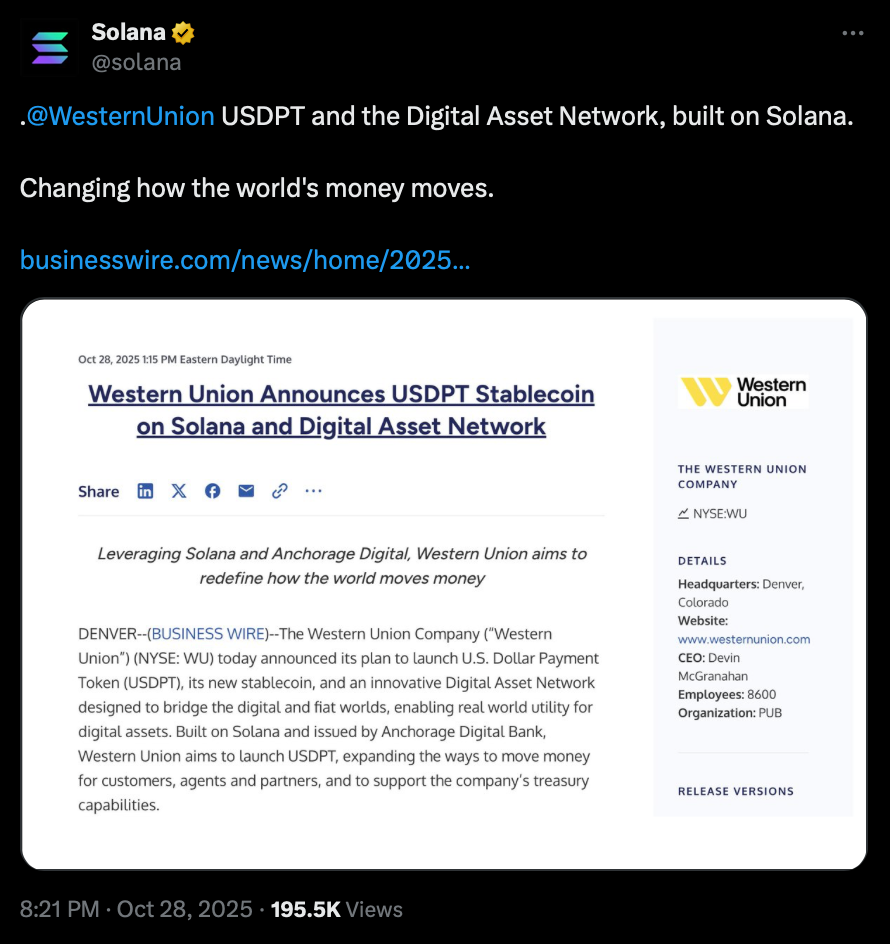

Western Union, a name synonymous with global money transfers for over a century, is launching a dollar-backed stablecoin, USDPT. The payments firm will also debut a "Digital Asset Network" enabling "real world utility for digital assets" — a strategic move to future-proof its network serving 100 million users.

USDPT on Solana: Key facts

- Western Union has joined forces with Anchorage Digital, a federally regulated digital asset bank, to issue the "US Dollar Payment Token (USDPT)."

- The USDPT stablecoin will be built on the Solana blockchain, chosen for its capacity to enable low-cost and fast settlements.

- The official launch is targeted for the first half of 2026.

- Western Union calls USDPT and the Digital Asset Network "an enabler" for its mission "to make financial services accessible to people everywhere," but it is unclear if other cryptocurrencies will also be supported.

Adapting to a new financial landscape

As of October 27, Western Union had a market cap of over $2.9 billion, generating over $1 billion in adjusted revenue in Q3 2025. Now its market share is moving on-chain in response to a shifting landscape.

Since the signing of the GENIUS Act in July 2025, the stablecoin market has grown to over $312 billion, with competitors like MoneyGram and PayPal already integrating digital dollars into their services. Western Union is jumping on the stablecoin bandwagon to avoid being left behind.

This initiative follows an ongoing pilot program — Western Union is exploring how stablecoins can reduce its dependency on legacy correspondent banking systems. It aims to shorten settlement times, improve capital efficiency, and introduce greater transparency into cross-border payments by utilizing a public ledger.

Bottom line for consumers

Western Union is leveraging blockchain technology to fundamentally enhance its core service. The bet is that digital dollars on a high-speed network will make global remittances faster, cheaper, and more efficient for its customers worldwide.

It is not clear how Western Union will handle volatile gas fees, particularly on Ethereum — but the move signals a fundamental shift in how TradFi is embracing crypto.

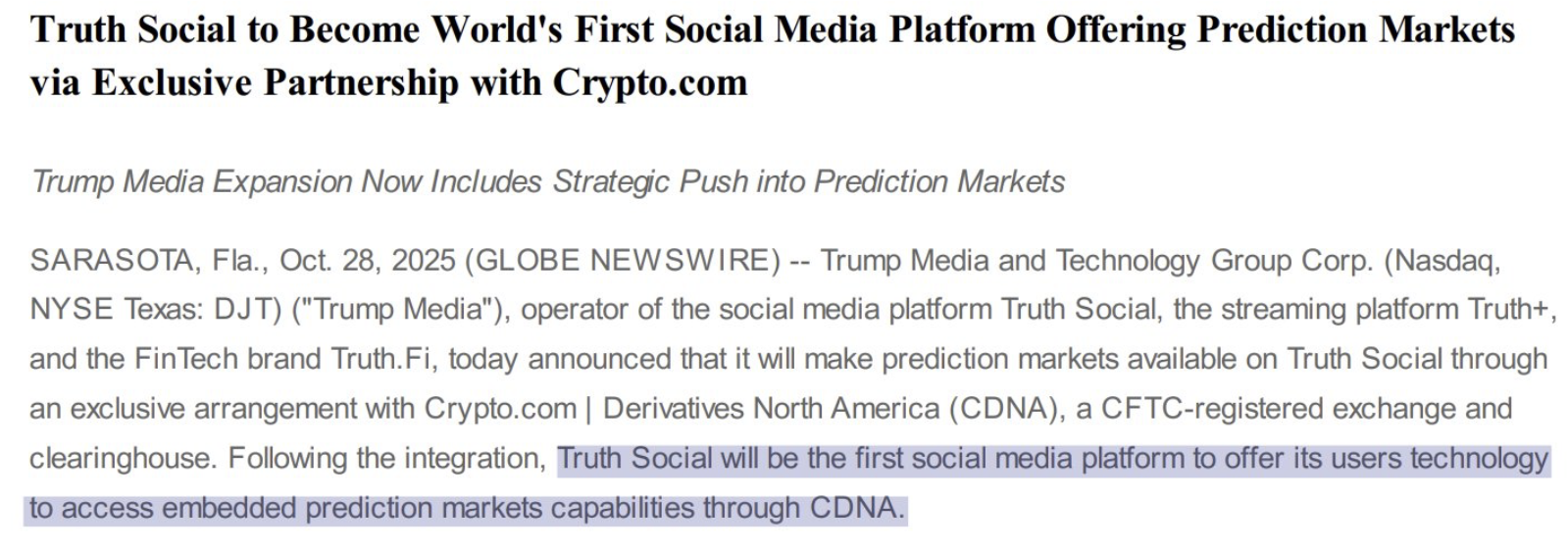

Trump Media brings prediction markets to Truth Social

Trump Media & Technology Group has partnered with Crypto.com to debut a prediction market called "Truth Predict." It will operate directly within the Truth Social platform, allowing users to wager on real-world events.

The platform will function through Crypto.com’s US derivatives arm, registered with the Commodity Futures Trading Commission (CFTC). Federal compliance will make Truth Social the first social media platform to natively incorporate such a feature.

Mechanics: From social engagement to wagers

Truth Predict will turn user opinions and discussions directly into actionable wagers. It will accept bets on a wide array of outcomes, including US elections, Federal Reserve interest rate decisions, sports games, and commodity prices.

The company plans to create a seamless loop between social interaction and financial activity. Users earn "Truth gems" by engaging with content on Truth Social and its streaming service, Truth+. These rewards can then be converted into Crypto.com’s CRO token to be used for placing prediction contracts.

Positioning in competitive landscape

This ambitious project positions Trump Media to compete directly with established prediction market platforms like Polymarket and Kalshi. By leveraging its existing social media user base, Trump Media aims to democratize access to these markets.

The beta test is expected to launch in the near future in the US, with international expansion planned pending regulatory approvals.