Clapp Weekly: Risk-off retreat, Senate approves GENIUS Act, ETH breaks records

BTC price

Bitcoin has dropped sharply due to fears of a potential US conflict with Iran, after President Trump called for unconditional surrender. After holding up relatively well amid the US tariff drama, the latest dip has dented the coin’s “digital gold” narrative, as noted by Barron’s.

After approaching $110k a week ago, BTC slid to $103,639 on Friday, June 13 — the day of Israel's attack on Iran — and struggled to breach $106k for three days. Monday's push propelled it to $108,771 yesterday before a drop to another low of $103,645.

Currently at $105,151, BTC has lost 2.2% over the past 24 hours, with a 4.1% loss over the past week.

ETH price

Ethereum whales have accumulated the most ETH since 2018 — 818,000 coins worth $2.5 billion — while institutional demand is also surging. Optimism around the Pectra upgrade and restructuring of the core team have supported a price gain of 90% over two months.

Mirroring the broader market dips, ETH slipped from $2,867.50 to $2,473.18 last Friday, June 13. The price held above $2.5k and eventually hit $2,671.94 on Tuesday, June 17, before collapsing to $2,464.15.

Changing hands at $2,529.52, the second-biggest coin is down 3.1% over the past 24 hours and 9.0% over the past week.

Seven-day altcoin dynamics

The crypto market doesn't like the prospect of the US going to war against Iran. This scenario would impact oil prices and the US economic outlook, renewing inflationary pressures if the military action affects Iran's oil production.

On Polymarket, the odds of US military action before July have soared to 65%. The CoinDesk 20 index has lost 6.1% in the past 24 hours, with crypto stocks also taking a hit. SHIB (-11.8%), the world's second-largest meme coin by market value, fell to a two-month low.

Risk markets are also affected by trade disputes and monetary tightening across major economies. An ADA (-13.8%) sell-off started late Monday, mirroring broader risk-off behavior due to worsening macro conditions. Lower volume and volatility signal consolidation.

Winners & losers

WBT (+54.5%) emerged as the top performer on June 16 after WhiteBIT exchange announced a 3-year sponsorship deal with Italian soccer club Juventus. Similarly, AB (+39.3%) rallied on growing optimism and the Binance Alpha airdrop, which allowed the project to test new features under real-world conditions.

Meanwhile, KAIA (+9.2%) gained traction after South Korea’s president proposed pro-stablecoin policies. Kaia's plans to launch a KRW stablecoin fuel bullish expectations.

On the losing side, ARB (-24.1%) failed to recover from its June 13 sell-off, exacerbated by a June 16 token unlock that flooded the market with 92.63 million tokens (worth ~$31 million). TIA (-22.5%) continues to struggle due to persistent sell pressure from repeated token unlocks over the past two years, compounded by reputational damage after its rebranding as "VC Chain."

ENA (-21.6%) has mirrored the broader downturn, unable to regain footing despite a potential lifeline. Mellow Finance placed a $4.48 million bet on its recovery, though this hasn’t yet reversed the bearish trend.

Cryptocurrency news

US Senate passes landmark GENIUS Act, paving the way for crypto regulation

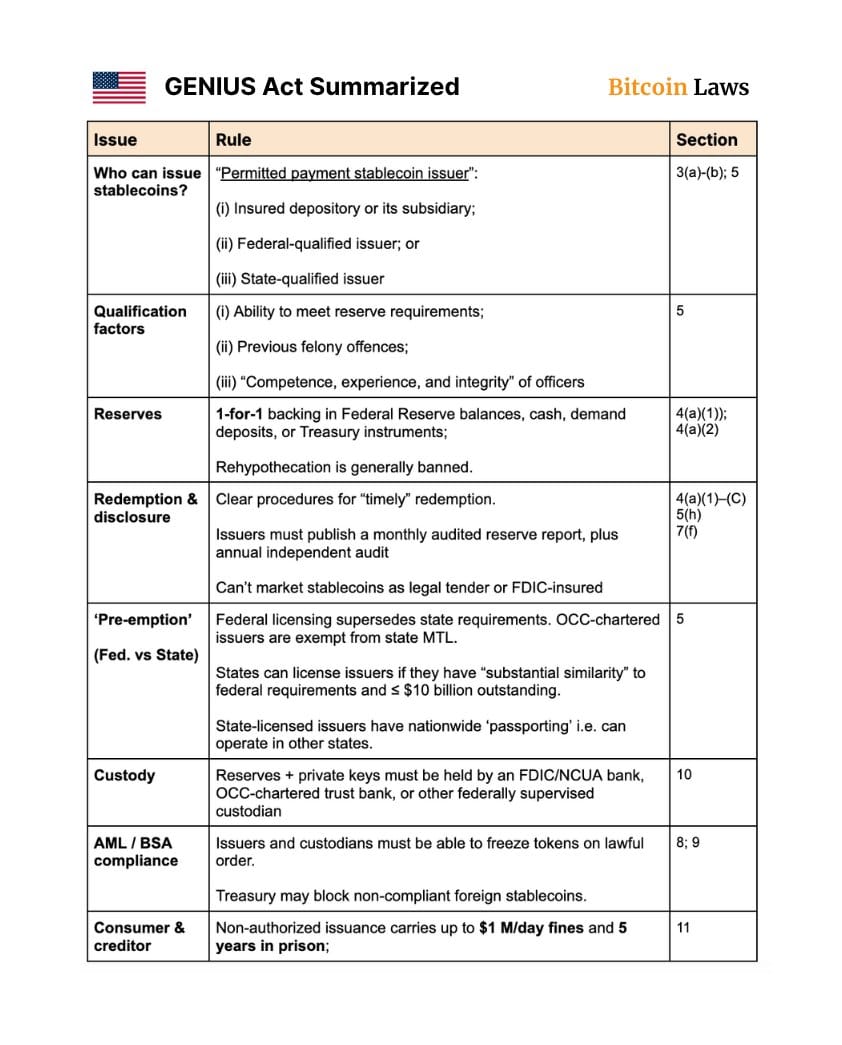

The GENIUS Act (Guiding and Establishing National Innovation for US Stablecoins of 2025) has cleared the US Senate, becoming the first major crypto legislation passed with strong bipartisan support. The bill, which aims to regulate stablecoin issuers, passed with a 68-30 vote, and now moves on to the US House.

Win for crypto innovation

This success signals a turning point for digital asset policy. GENIUS Act establishes clear regulatory guidelines for stablecoins — digital assets pegged to fiat currencies like the US dollar. Key provisions include:

- Reserve and transparency requirements for issuers like Circle (USDC) and Tether (USDT).

- Anti-money laundering (AML) compliance to mitigate illicit finance risks.

- Federal oversight to ensure consumer protection while fostering innovation.

Industry leaders have hailed the bill as a breakthrough. Ji Kim of the Crypto Council for Innovation called it a "historic step forward," while Amanda Tuminelli (DeFi Education Fund) praised it as a "a win for the US, a win for innovation and a monumental step towards appropriate regulation for digital assets in the United States."

French Hill, Chairman of the House Committee on Financial Services, issued the following statement:

"Clear rules of the road for stablecoins are long overdue, and today we’re one step closer to creating a functional regulatory framework. I applaud the Senate’s passage of the GENIUS Act and the work of Chairman Scott, Senator Hagerty, and Senator Lummis to make this historic day a reality. I look forward to working with my House colleagues to bring much-needed clarity and protections to the digital asset ecosystem.”

Critics vs. supporters

The bill has faced opposition from critics like Senator Elizabeth Warren, who warned of loopholes for foreign stablecoins and conflicts of interest (notably President Trump’s crypto holdings). Warren also noted that tech giants like Amazon and Meta may be allowed to launch their own stablecoins.

Supporters argued that inaction was riskier than imperfect regulation. Senator Bill Hagerty, the bill’s sponsor, emphasized that the legislation positions the US as a global crypto leader, with stablecoins backed by dollar reserves and Treasuries.

Ethereum’s rising role

Beyond stablecoins, the GENIUS Act is boosting Ethereum (ETH), which surged above $2,500 post-vote. Vivek Raman of Etherealize noted that regulatory clarity is unlocking Ethereum’s potential as the backbone for tokenized assets and institutional finance. "Eventually, it’s going to be viewed as just as pristine as bitcoin. It'll be the neutral asset for the whole ecosystem," he said.

What’s next?

The bill now heads to the House of Representatives, where its fate is uncertain. Some lawmakers want to pair it with the broader Digital Asset Market Clarity Act, which would define regulatory frameworks for the entire crypto market.

Ethereum’s staking boom: Explosive rally ahead?

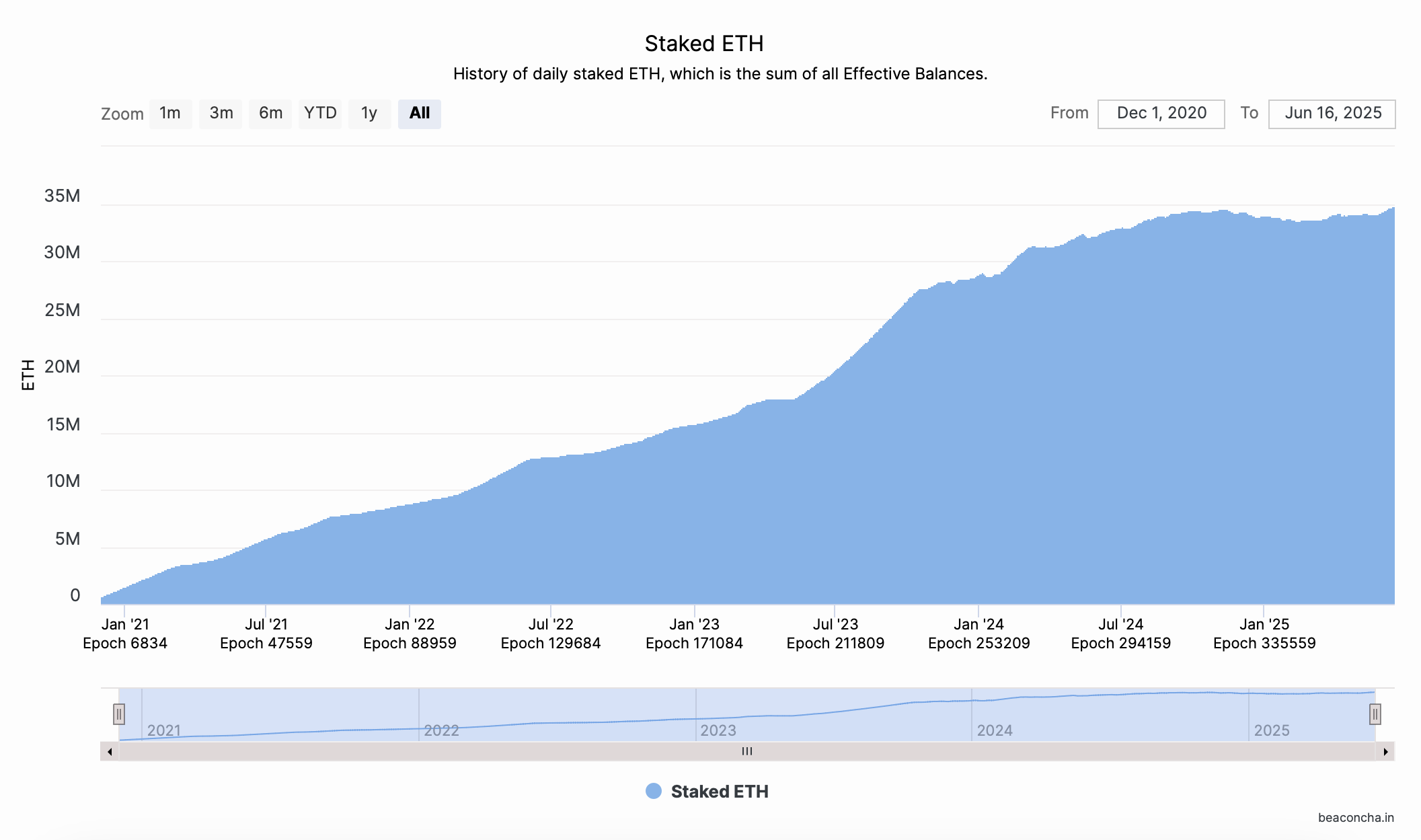

Ethereum staking has hit a historic milestone — over 35 million ETH is now locked in validation, accounting for 28.3% of the circulating supply. This surge follows the SEC’s regulatory clarity, which affirmed that staking does not constitute a securities transaction, removing a key barrier for institutional participation.

The latest staking record signals growing confidence in the network’s long-term potential, benefiting it in three distinct ways:

- Supply shock potential: Staking reduces liquid ETH supply, potentially driving price appreciation if demand rises. Over 500,000 ETH were staked in just two weeks, tightening market availability.

- Institutional adoption: BlackRock’s Ethereum ETF has seen 23 consecutive days of inflows, while corporate treasuries (like SharpLink Gaming) are staking millions in ETH for yield.

- Network participation and security: With 1.1 million validators, Ethereum’s decentralization strengthens, reducing risks like 51% attacks.

ETH is a deflationary asset, and its model incentivizes validators to lock capital. The more ETH is locked in staking, the slower the issuance rate. A burning nechanism introduced in the EIP-1559 hard fork in 2021 caps the network's maximum theoretical gross issuance at 1.51% annually.

Thus, while Bitcoin’s mining rewards are tied to computational effort, the Ethereum inflation rate would be capped at 1.51% even if the entire circulating supply were staked. This makes ETH "a very secure, sustainable asset," according to Etherealize co-founder Vivek Raman.

Fundamentals & market sentiment

Despite ETH’s recent dip to $2,500, analysts remain bullish. From the technical perspective, the price is consolidating in a multi-month range — mirroring its 2017 breakout pattern that preceded a 1,000% rally. Some predict a near-term target of $4,000.

Meanwhile, institutions are hedging ETH exposure via futures. While creating short-term pressure, this also reinforces long-term accumulation.

With staking yields (~2-5%) and regulatory tailwinds, Ethereum’s fundamentals are stronger than ever. If ETF staking gains approval, institutional inflows could accelerate, further reducing supply and fueling a new price cycle.

Overall, Ethereum’s staking surge reflects long-term conviction, but price action may remain volatile as markets digest institutional strategies and macroeconomic factors.