Clapp Weekly: Dip after Bitcoin ATH, Circle's IPO, Trump's $2.5B crypto raise

BTC price

Bitcoin is back below $110k following its Pizza Day ATH. The coin is holding firm after Trump delayed EU tariffs until July 9, rekindling optimism across risk assets. Investors are piling into crypto amid a storm of global economic uncertainty, a downgrade of US debt, and growing confidence in the GENIUS Act regulation.

BTC rallied from under $107k to a new all-time high of $111,814 on May 22. It nearly revisited $107k in two days and breached $109k again before hitting $107k over the weekend. On Monday, May 26, BTC surged above $110k, followed by a peak of $110,370 yesterday.

Currently at $108,818, BTC is down 0.3% over the past 24 hours but up 1.7% over the past week.

ETH price

Ether has recovered from its $2,513 low on renewed market confidence — while spot ETFs have seen steady seven-day inflows, led by BlackRock's ETHA at $136.4 million. The second-biggest cryptocurrency has gained 45% in a single month after the crucial Pectra upgrade.

ETH surpassed BTC after soaring from $2.5k last Wednesday, May 21, to $2,720.76 on Friday, May 23. Reversing sharply, the price hit $2,546.75 within hours and dropped to $2,480.54 on Sunday, May 25. A gradual ascent culminated in yesterday's high of $2,695.96.

At press time, ETH is changing hands at $2,641.51, up 3.1% in 24 hours and 3.6% over the past week.

7-day altcoin dynamics

The US-EU tariff tensions have created market uncertainty, limiting altcoin growth. Profit-taking continues ahead of Friday's PCE report — fresh inflation data, following today's FOMC minutes, should provide more clarity regarding the much-anticipated rate cuts.

Yesterday, DOGE (-1.5%) rebounded amid whale accumulation — wallets holding between 100 million and 1 billion DOGE now control 26.5B coins, up from 22.8B in January. Despite global tensions and uncertainty, the meme coin maintains $2.7 billion in open interest.

XRP (-2.3%) remained in the green until Trump's EU tariff announcement on May 23. The much-anticipated launch of XRPFi — decentralized finance on the XRP Ledger — can engage Ripple's 4+ million inactive XRPL wallets holding roughly $2.15 billion in XRP. Strobe Finance is working to let users deposit XRP to earn yield or borrow against it.

Winners & losers

HYPE (+34.0%) has mirrored Solana’s 2021 breakout structure, eyeing a 240% rally by July. The surge was sparked by the team's formal responses to the US Commodity Futures Trading Commission (CFTC) on proposed regulation of perpetual swaps and 24/7 crypto trading.

Virtuals Protocol's VIRTUAL (+24.1%) has reclaimed $2. Its rally continues, supported by user engagement, accumulation, and demand for its AI agents.

Meanwhile, WLD (+22.9%) is enjoying its seventh consecutive bullish week. The issuer, World Foundation, has confirmed a16z and Bain Capital invested $135 million via token spot purchases. These funds will be used to scale the biometric Orb technology worldwide — part of a push for proof-of-personhood in the AI age.

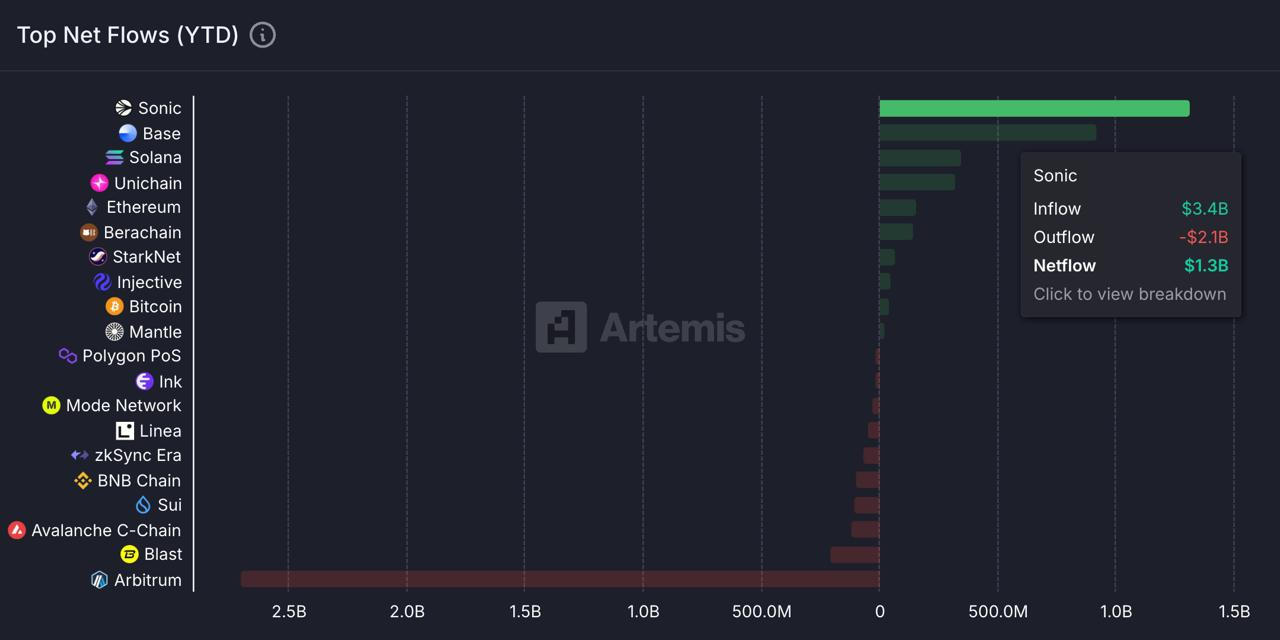

On the losing side, S (-12.0%) is struggling after a steep decline on May 23. However, the January rebrand has helped Sonic outshine all other blockchains in net inflows YTD.

TRUMP (-11.9%) is also wobbling, unmoved by the news of Trump's media group’s raise for crypto investment (see below). Previously, the price surged on May 22 — the same day as Trump's Gala Dinner for 220 whales, coinciding with Bitcoin's new ATH.

PI (-9.5%) is caught in consolidation as indicators paint a cautious picture. The lack of a live mainnet and delays are dulling investor enthusiasm — despite its listing on MEXC with Trump-backed USD1.

Cryptocurrency news

Stablecoin issuer Circle files for IPO on NYSE

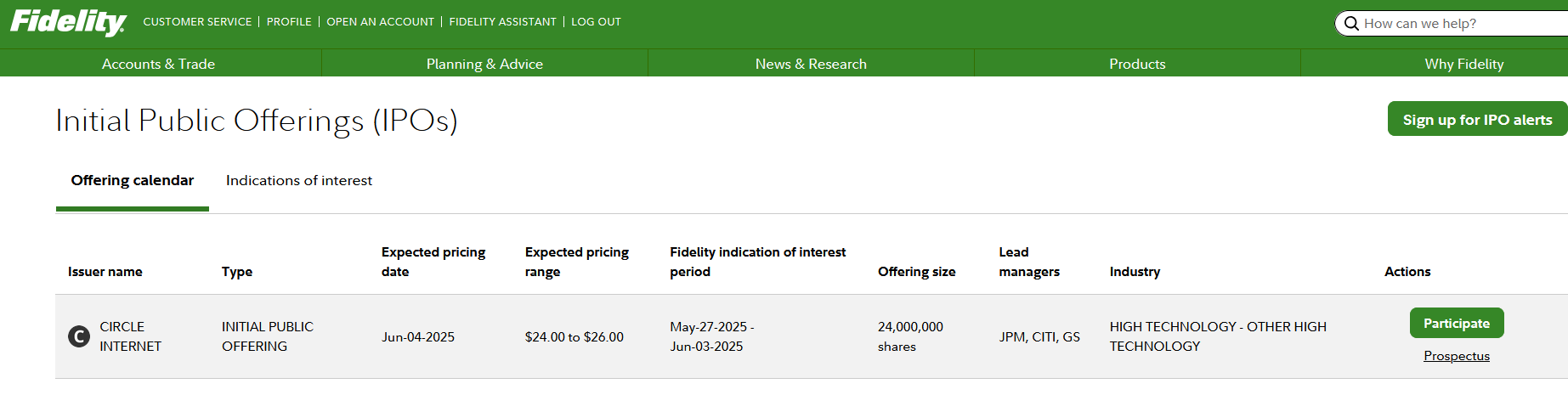

Circle, the firm behind the second-largest stablecoin is poised to become a publicly traded company. The USDC issuer has officially launched its initial public offering (IPO) on the New York Stock Exchange (NYSE) under the ticker symbol CRCL, marking a pivotal moment for both crypto and TradFi.

Details of Circle’s IPO

Circle plans to offer 24 million shares of Class A common stock, with 9.6 million shares coming directly from the company and 14.4 million from selling stockholders. The shares are priced between $24 and $26, potentially raising up to $624 million at the higher end.

Major investment banks, including JPMorgan, Citigroup, and Goldman Sachs, are leading the offering, signaling strong institutional interest. Cathie Wood’s ARK Invest has expressed interest in purchasing up to $150 million worth of shares, though this is not a binding commitment.

If successful, the IPO could value Circle at $6.7 billion, a significant milestone for a company that previously attempted—and abandoned—a SPAC merger in 2022.

Where crypto and TradFi converge

Unlike its main competitor, Tether (USDT), which has dismissed the need for an IPO, Circle is embracing regulatory scrutiny and transparency. CEO Jeremy Allaire emphasized that becoming a publicly traded company aligns with Circle’s commitment to accountability, as it will now be subject to SEC reporting and corporate governance standards.

For the broader crypto market, a successful IPO could achieve three goals:

- Boost confidence in stablecoins as regulated financial instruments.

- Encourage more crypto firms to pursue public listings.

- Strengthen USDC’s position against Tether, despite its smaller market cap ($61.5B vs. USDT’s $152.7B).

Challenges and market conditions

Success hinges on market demand and investor sentiment. The company has faced hurdles before, including its failed SPAC deal and reports of exploring a $5 billion private sale instead of an IPO. Furthermore, the offering is subject to market conditions, so delays or pricing adjustments could still occur.

Circle’s IPO is a test of crypto’s maturity in TradFi. If successful, it could pave the way for more blockchain-based companies to enter public markets, further bridging the gap between decentralized finance and Wall Street.

Trump Media bets big on BTC with $2.5B treasury move

Trump Media & Technology Group (TMTG) — the parent company of Truth Social — has announced plans to raise $2.5 billion to purchase Bitcoin for its corporate treasury. The decision positions TMTG as the latest high-profile firm to follow Strategy’s playbook, using equity and debt offerings to accumulate BTC as a reserve asset.

TMTG's $2.5B strategy

The capital raise will consist of $1.5 billion in stock sales and $1 billion in convertible bonds, with the proceeds dedicated to acquiring Bitcoin. The company, which already holds $759 million in cash and investments, framed the move as both a defensive and strategic play.

Crypto.com and Anchorage Digital will serve as custodians for TMTG’s Bitcoin holdings, while Yorkville Securities and Clear Street are leading the capital raise. The offering is expected to close by May 29, with the convertible bonds featuring a 35% conversion premium and zero coupon.

Devin Nunes, CEO of Trump Media, calls Bitcoin an "apex instrument of financial freedom" that will help shield the company from "harassment and discrimination by financial institutions." The investment should also create synergies for Truth Social’s subscription payments, a planned utility token, and other transactions across its platforms.

Market reaction

Despite the ambitious plan, TMTG’s stock (DJT) fell sharply after the announcement, dropping over 11% to around $22.82. The decline followed a premarket rally spurred by earlier reports from the Financial Times, which had suggested a larger $3 billion raise and investments in multiple cryptocurrencies — claims the company dismissed as "dumb" in a fiery rebuttal.

The move also comes amid increasing crypto involvement from the Trump family. Earlier this year, TMTG announced Truth.fi, a fintech arm offering Bitcoin ETFs, while President Trump and his associates have launched NFTs, meme coins (TRUMP & MELANIA), and even hosted a high-profile dinner for TRUMP coin investors — drawing both enthusiasm and criticism.

Why this matters

The move also raises questions. It is unclear if Bitcoin can stabilize TMTG’s volatile stock, or if Truth Social will successfully integrate crypto payments. Another unknown is how regulators will respond to a high-profile, politically charged firm diving into digital assets.

TMTG’s Bitcoin bet is more than just a treasury strategy — it’s a political and financial statement. The company is tapping into a growing trend among corporations and conservative-leaning investors who view crypto as a hedge against traditional financial systems.