Decoding crypto markets with ChatGPT: Pros and cons

Crypto investors are now turning to AI to simplify and enhance their analysis, generate trading strategies, interpret technical signals, and backtest portfolio ideas. However, it's crucial to remember that AI isn't a substitute for human decision-making. Its insights are best used to shore up your own research and must always be treated with caution.

Let's dive into their capabilities and limitations.

Tapping into AI for crypto analysis

ChatGPT, DeepSeek, Gemini, and other AI assistants have completely reshaped how we interact with information. Unsurprisingly, it didn’t take long for crypto traders to start tapping into them for market edge.

In the hectic, fast-paced world of crypto, getting ahead of trends is crucial. With thousands of altcoins, wildly swinging prices, and macro drivers — everything from geopolitics to interest rates — constant monitoring is a massive time-sink. Traditional methods often don't cut it in terms of depth, speed, and insight.

For some traders, AI has already become an absolute must-have.

What can ChatGPT actually do?

ChatGPT, created by OpenAI, has digested a huge chunk of the internet to interpret, summarize, and generate human-like text based on prompts. It excels at spotting patterns in data, figures, news, and market sentiment to hand you actionable insights.

In the world of crypto, it can churn out:

- Insights on trading metrics and indicators like the Relative Strength Index (RSI), Fibonacci retracements, Moving Average Convergence Divergence (MACD), and Bollinger Bands.

- The gist of market mood based on social media and news articles.

- Brand new or polished trading strategies.

- Level-headed risk assessments.

- Big-picture price predictions.

Reality check: ChatGPT can't predict the market

AI isn't a stand-in for live data feeds or professional analytical tools. It simply can't predict market moves with real-time accuracy. It spits out hypothetical scenarios and forecasts that should never be taken as financial advice.

However, it's hard to ignore its positive impact on productivity and clarity, making it a handy sidekick to your existing toolkit. Its effectiveness lives and dies by the quality of your prompts, which must be concise and specific.

For example, you could ask:

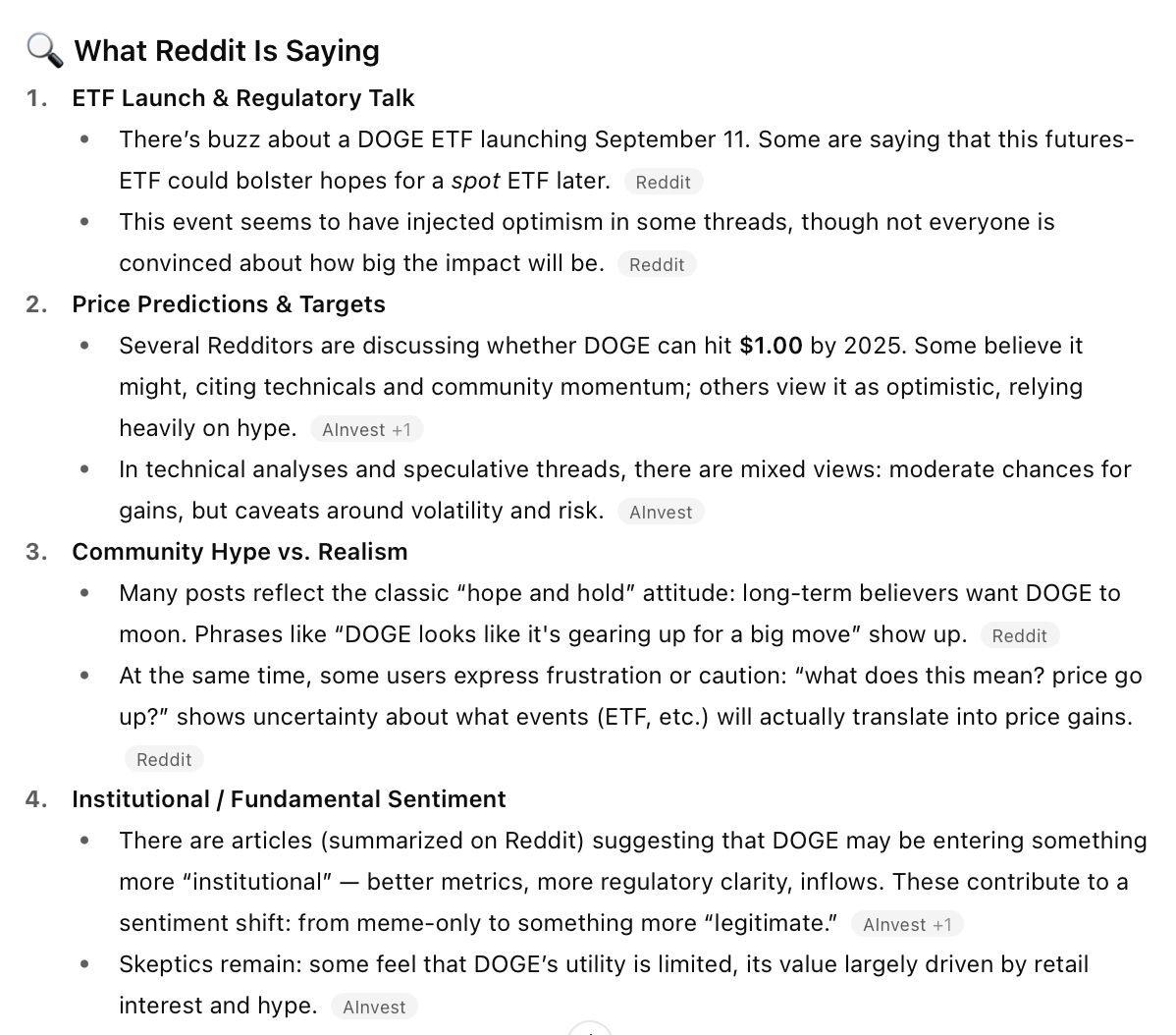

“Summarize DOGE sentiment from Reddit between Sept. 11, 2025, and Sept. 15, 2025.”

Here is an extract from ChatGPT's response. As you can see, AI added a news outlet (AInvest) to its sources, but it gets the job done as the articles directly reference Reddit discussions.

Your prompts could also look like this:

“Code a simple bot that triggers trades when the RSI drops below 30 and the MACD shows a bullish divergence.”

“Break down this week's XRP price action based on its historical data and moving averages.”

The good and the bad: ChatGPT for crypto

So, should ChatGPT be the main engine of your trading analysis? Absolutely not — but it works wonders as a helper. Here are the key strengths and limitations.

Why ChatGPT shines

On the upside, tools like ChatGPT give traders an edge to make smarter decisions in a fast-paced market, helping them stay on top of trends and sentiment shifts. Key advantages include:

- Easy to use: It doesn't require any tech wizardry or coding knowledge. You just need to learn how to ask sharp, focused questions to get detailed answers.

- Blazing fast: The speed of AI analysis leaves humans in the dust. You can whip up comprehensive reports, craft strategy templates, or summarize market sentiment in seconds, freeing up hours or even days of manual research.

- Customizable: AI can cook up insights and templates for any strategy, from HODLing to swing trading and scalping. It can help you handle any portfolio, no matter what you hold.

- Flexible: It tackles every angle of market analysis, from pure fundamentals and tokenomics to technical analysis and sentiment-based insights.

- Automation-friendly: You can weave ChatGPT into various trading dashboards and bots.

Where ChatGPT falls short

Despite its cool features, AI can't replace critical human thinking. No user should take its answers as gospel truth.

- Garbage in, garbage out: Poorly worded prompts return wonky answers. These models are only as good as the input they get. Being detailed and clear is non-negotiable.

- Not a financial advisor: Treat every response as a suggestion, never as the only reason to pull the trigger on a trade. For licensed investment advice, you gotta talk to a pro.

- Doesn't fact-check itself: AI won't automatically sniff out wrong numbers or false info unless you hook it up to external, reliable data sources via APIs.

- Stuck in the past (unless you help it): If you want ChatGPT to analyze live charts and prices, you have to feed it data through specialized plugins or APIs.

Common ways to put ChatGPT to work

#1 Gauge the market's mood

ChatGPT can cut through the noise to break down the prevailing emotional tone. For instance, the impact of fear, hype, and FOMO on crypto prices is huge — they drive powerful rallies and crashes, often leaving fundamentals in the dust.

AI will analyze a summary or scraped content you provide. Here is an example prompt and a response from the standard version of ChatGPT:

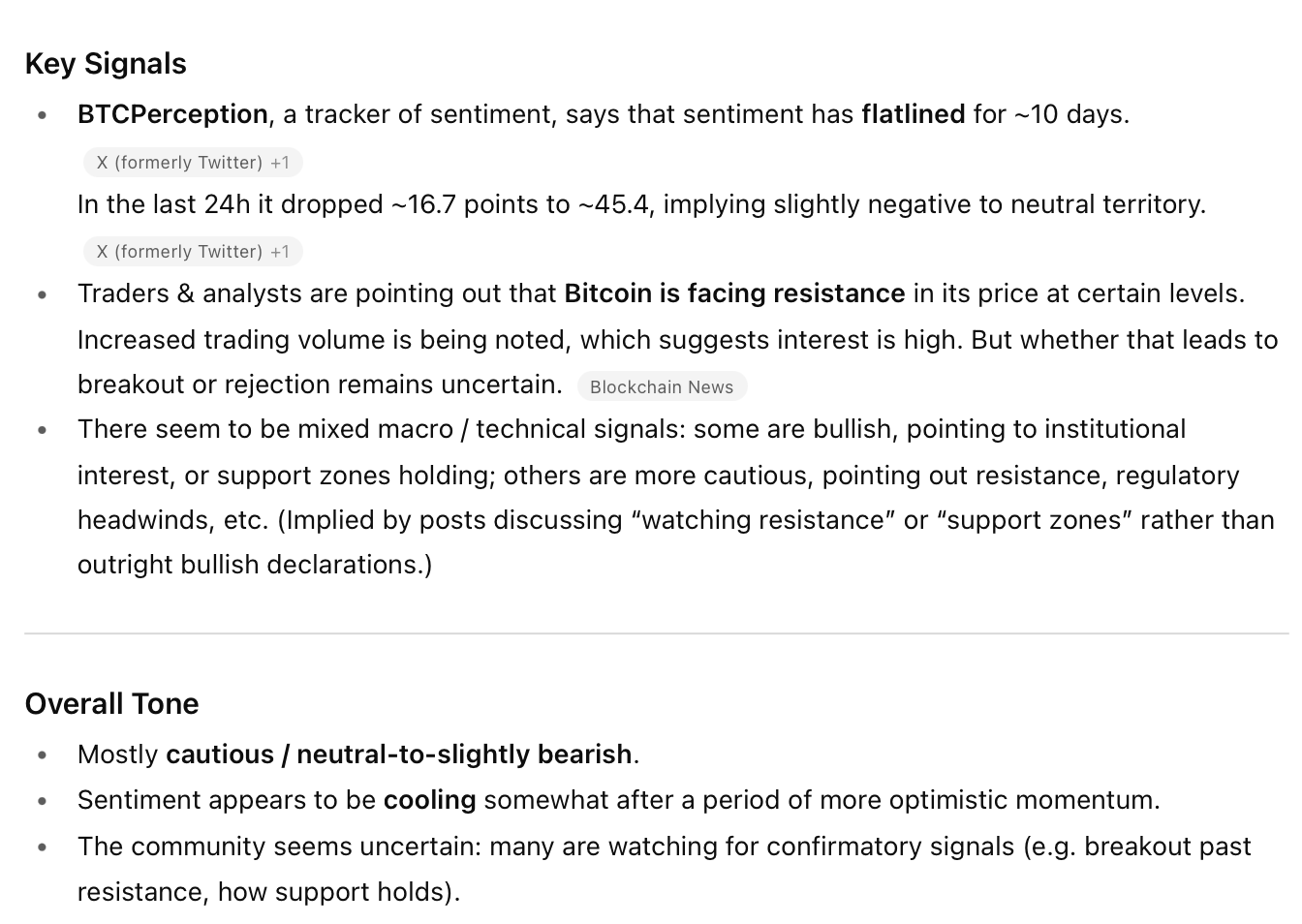

“Summarize the overall sentiment for Bitcoin based on a selection of X.com posts from the past 24 hours.”

As you can see, ChatGPT also included a media article in the analysis (Blockchain News); all links are valid, but it is recommended you double-check any suggested sources. The BTCPerception post was published on September 10 — 5 days ago, while we asked about a 24-hour period.

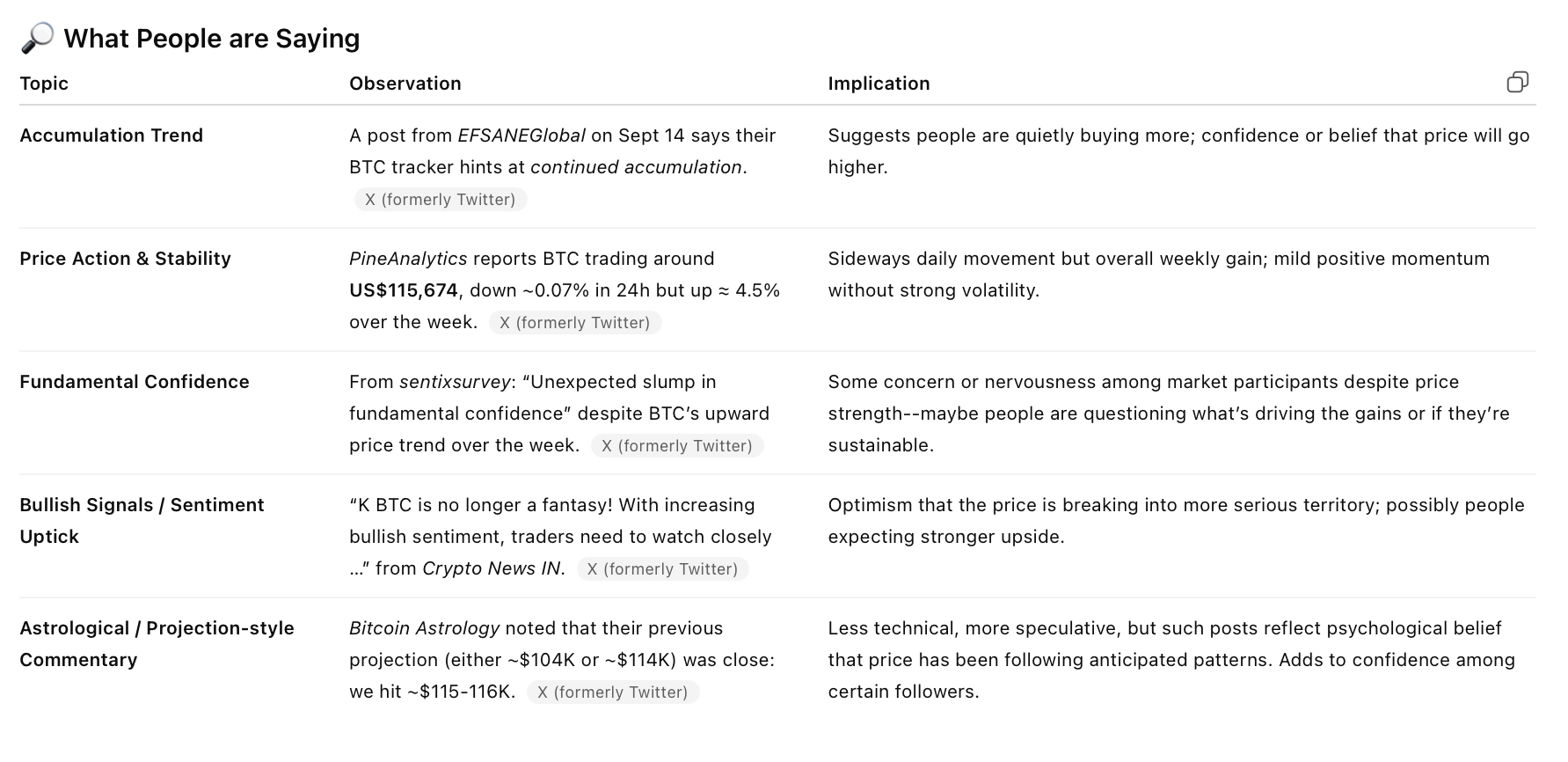

Specifying the exact date range (Sept. 14-15, 2025) returns more accurate results — this time, all the cited sourced are dated within the period.

#2 Get a second opinion on technicals

ChatGPT doesn't have a live chart feed. However, it can interpret technical conditions and talk you through the logic if you provide the data points yourself. Example:

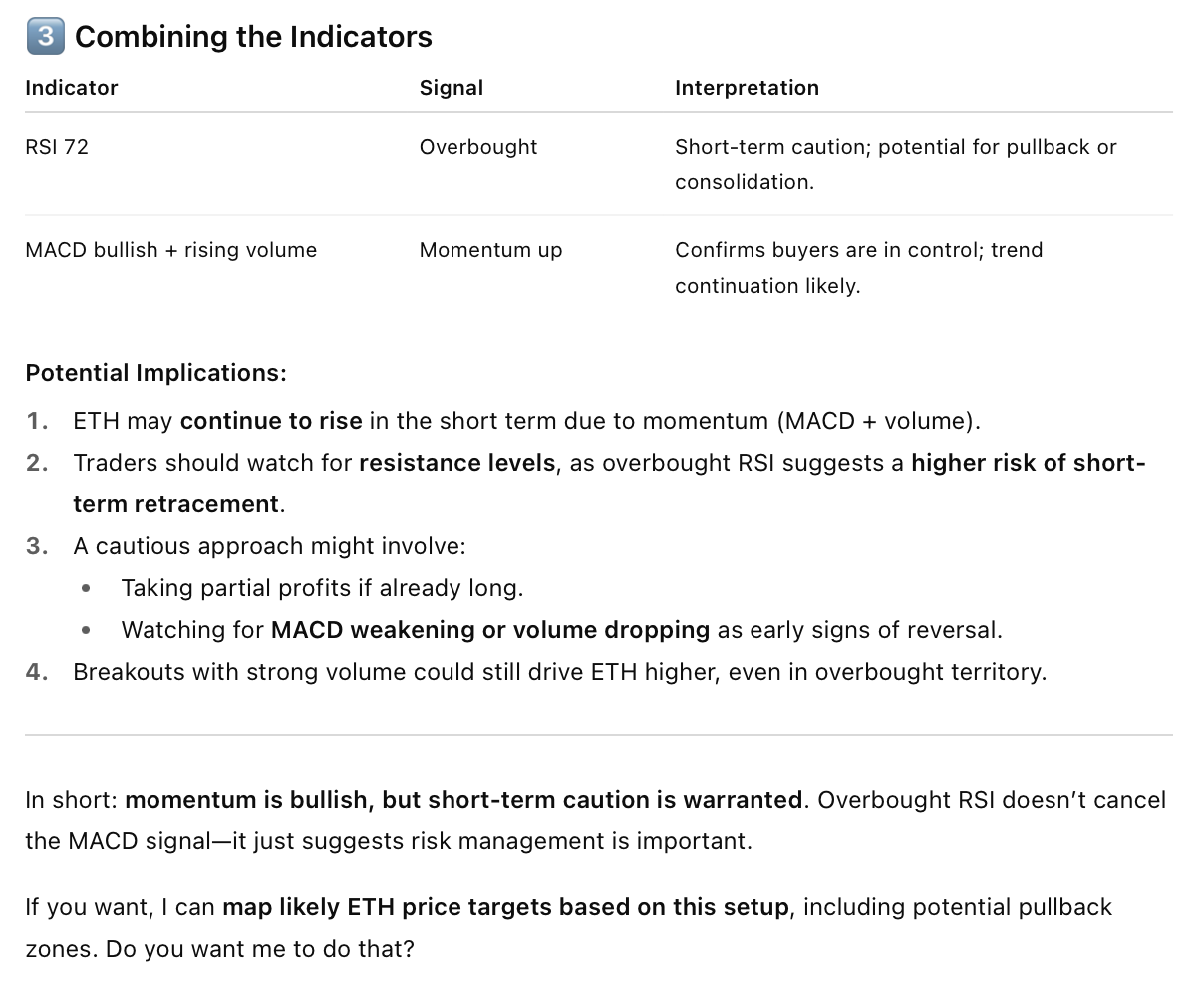

“ETH's RSI is 72, and the MACD just showed a bullish crossover with rising volume. What are the potential implications?”

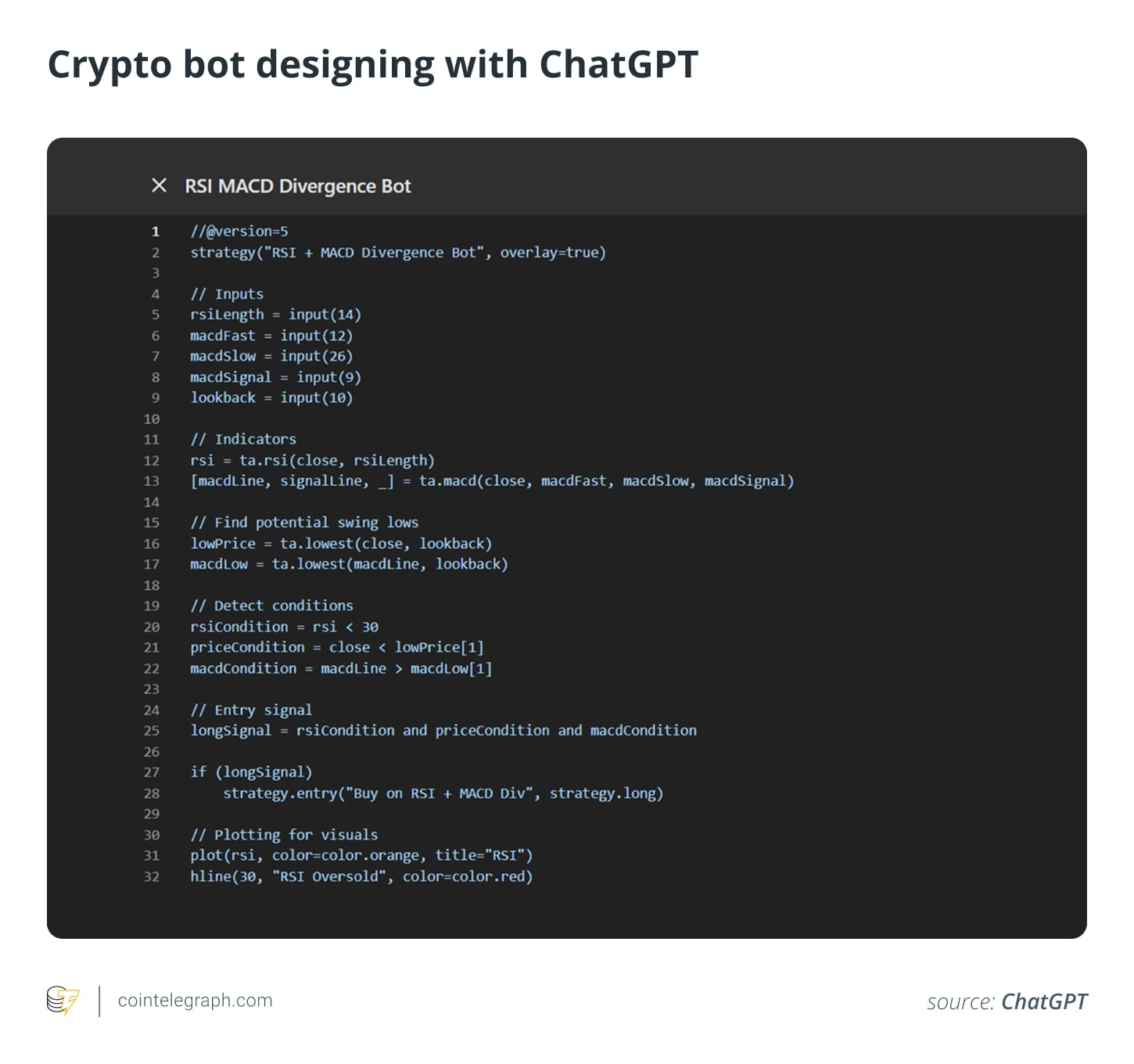

#3 Draft your trading bot code

AI can help you build your trading ideas. No deep programming knowledge required — just ask ChatGPT to sketch out the logic and initial code. For instance, one could prompt:

"Write a Python script for a trading bot that looks for buying opportunities when the market is oversold and momentum starts to turn bullish. It should check if the price is near a recent low, the MACD histogram is increasing, and the RSI is below 30."

ChatGPT might generate a script outline that:

- Scans for assets where the RSI has dropped below 30, flagging potential oversold conditions.

- Confirms if the MACD is showing a bullish crossover or increasing histogram, hinting at a potential shift in momentum.

- Places a buy order if these conditions are met, often with a suggested stop-loss to protect your capital.

That is a robust conceptual and coding foundation, but watch out: logical or syntactic errors can sneak in. Experts recommend putting the code through its paces on a testnet before live deployment.

#4 Stress-test your trading strategy

While ChatGPT isn’t built for statistical backtesting with real data, it excels at talking through the theory. Lay out a strategy and ask AI to walk through its theoretical performance under different historical market conditions.

Example prompt:

“Backtest a moving average crossover strategy on ETH from 2020 to 2023 with a 50/200-day setup.”

ChatGPT will simulate general outcomes based on its training data. It will explain the logic: a buy signal is generated when the 50-day moving average crosses above the 200-day (a "Golden Cross"), and a sell signal occurs on the opposite cross (a "Death Cross"). It will discuss the strategy's strengths, like catching big trends, and its weaknesses, such as getting chopped up in sideways markets.

This is useful for kicking the tires on any idea. For true numerical accuracy and confidence, however, this conceptual analysis must be followed up with dedicated backtesting software like TradingView, Backtesting.py, or specialized crypto platforms.

#5 Playing out 'what-if' scenarios

ChatGPT can work as your strategic advisor for "what-if" analysis. Enter hypothetical scenarios based on upcoming events or fears and request a reasoned analysis of the potential implications, for example:

“What would happen to Bitcoin if US inflation spikes to 8% and interest rates rise by 1.5%?”

ChatGPT will respond based on historical patterns and economic theory. It might outline that such a scenario could create short-term bearish pressure for BTC and other risk assets due to a stronger US dollar and dried-up liquidity from tighter monetary policy.

Conversely, it might also note Bitcoin's potential long-term appeal as a hedge against fiat devaluation, leading to a complex, mixed-bag outcome.

Such outcomes are merely educated guesses based on historical logic and sentiment patterns — not to be confused with real-time or statistically driven predictions.

Wrapping up

Think of ChatGPT not as a crystal ball, but as the most well-read research assistant you’ve ever had. It’s phenomenal for connecting dots you might have missed and kicking off deep analysis, but it still needs your expertise to steer the ship.

The real magic happens when you blend its computational power with your own market intuition. Ultimately, it’s a tool that gives you back your most valuable asset: time, letting you focus on making the final, well-informed call. Just remember to always trust, but verify everything it hands you.