How Layer 2 & Layer 3 scaling improves Ethereum network

Despite mass adoption and around 1.357 million daily transactions, Ethereum has room for improvement. First, this public blockchain is so expensive that users compare gas fees to Uber surge prices. Secondly, it is relatively slow due to very few Ethereum transactions per second. Both problems have the same solution — Layer 2 scaling.

As a system for processing transactions, building apps, and launching tokens, Ethereum is imperfect. Scaling solutions improve its usability, affordability, and speed. Transactions become nearly instant while the fees approach zero. Discover the fundamentals of existing Ethereum Layer 2 networks in our guide.

What is Layer 2 Ethereum scaling?

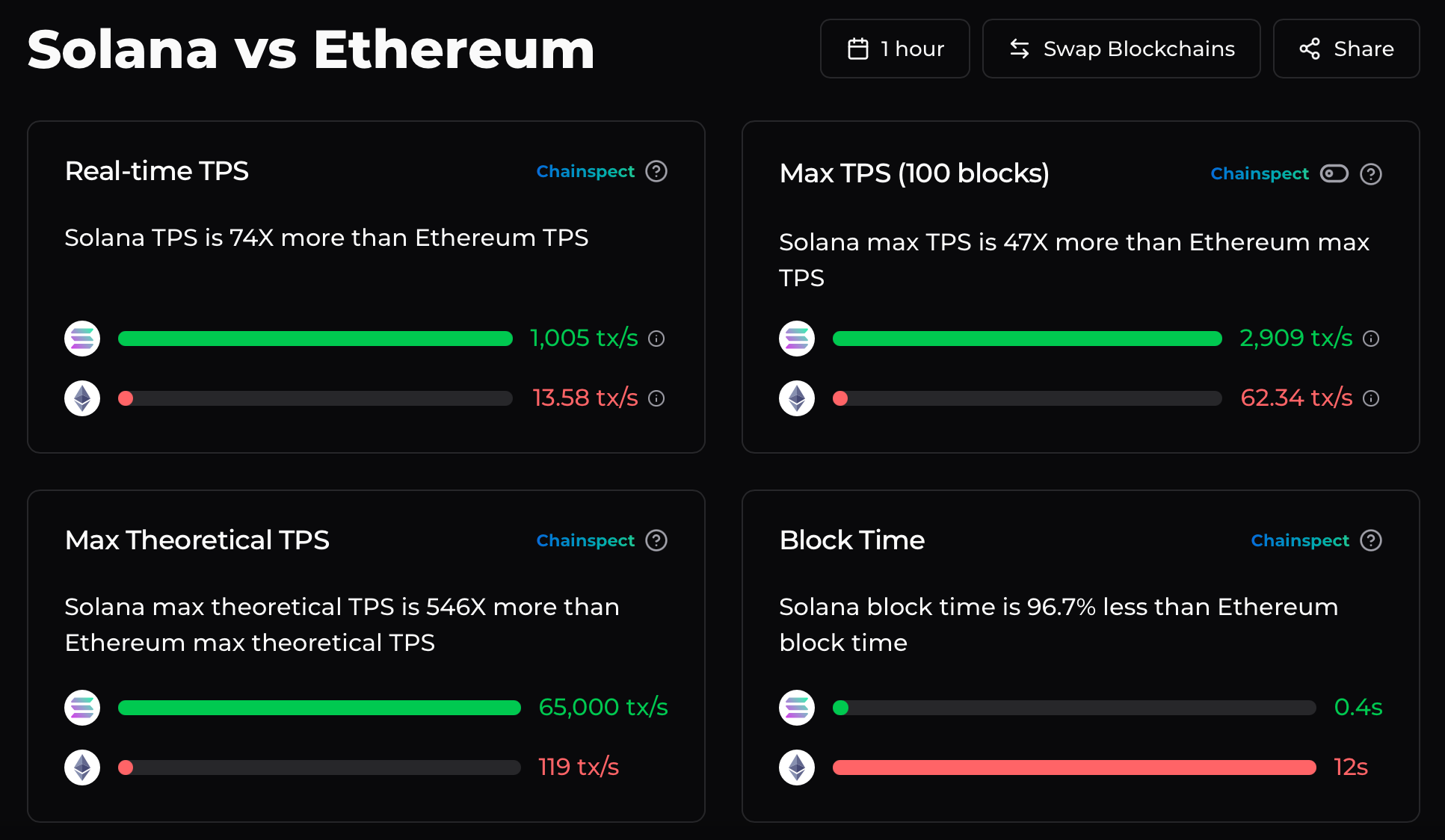

The primary Ethereum network, or Layer 1, is where all transactions happen. Its throughput (20-30 TPS) does not match the demand, and each transaction takes up to five minutes on average. The more users, the higher the congestion and the longer the delays. Ethereum’s performance ceiling hinders growth, and gas fees can reach $200.

These limitations are particularly frustrating compared to widespread centralized systems. Visa alone processes about 2,000 transactions per second. This shows how much the network needs to change to achieve broader adoption. If it is ever to grow to serve billions of Ethereum users, scaling is inevitable.

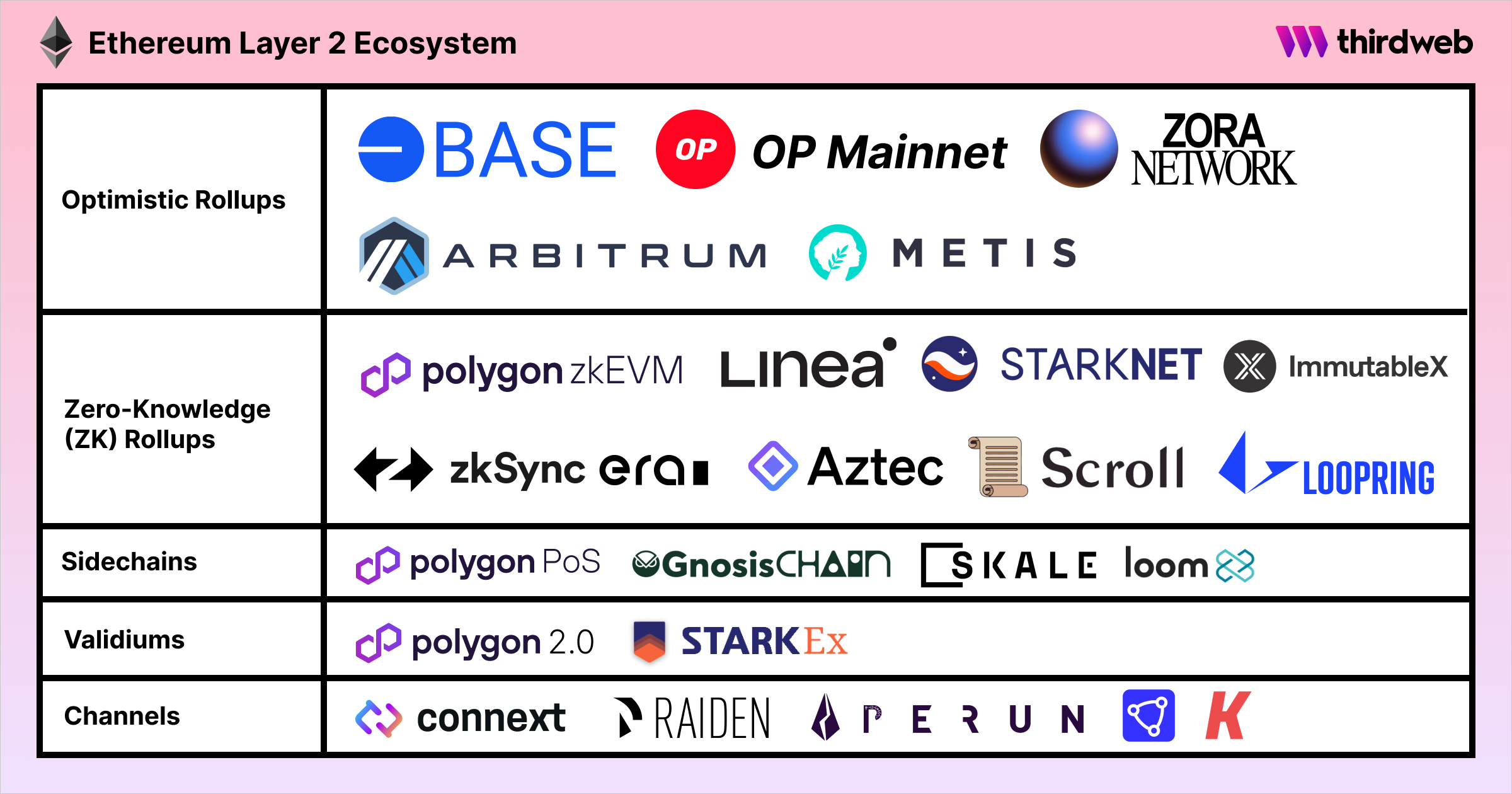

In 2023, the network implemented Ethereum 2.0, an upgrade with enhanced scaling performance. In the meantime, Layer 2 solutions are making the network faster, cheaper, and more usable. Each of them is an Ethereum-connected blockchain (or sidechain).

How top ETH Layer 2 solutions work

Without exaggeration, L2 solutions are game changers. They are particularly useful for transaction-intensive systems and processes — smart contracts, payments, DeFi yield farming, and NFT minting. Now, users do not have to pay exorbitant fees when they add or remove liquidity or claim rewards. Here is how the Ethereum Layer 2 scaling works:

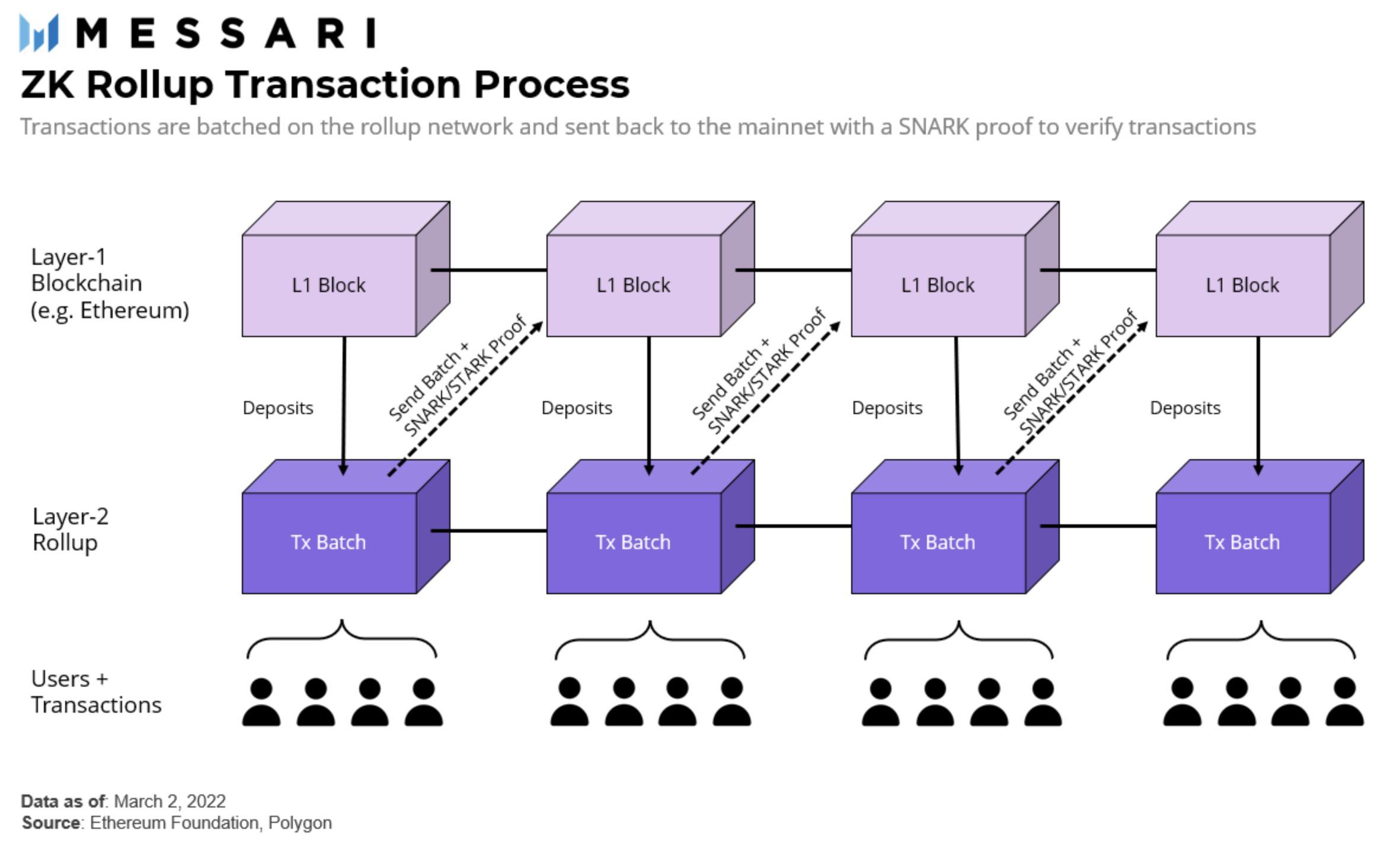

- An L2 sidechain processes a series of transactions.

- These microtransactions are grouped into a single rollup block.

- The L2 sidechain sends the rollup block to the Layer 1 crypto network at once.

- The transaction fee for the rollup block is split between the participants.

As you can see, the Ethereum Layer 2 networks bundle transactions before execution to lower the costs. This explains why they are also referred to as “rollups”. Instead of sending 1,000 separate transactions, a rollup groups them, handles the computation, and submits its results.

Optimistic rollups “assume” that the transaction data is valid and incentivize watchers who detect and prove fraud. ZK (Zero Knowledge) rollups submit validity proof themselves, which eliminates the risk of relayer cheating. The absence of the “fraud-proof” window lets the transaction speed soar.

Disadvantages of Ethereum scaling solutions

As you can see from this example of Layer 2 crypto hierarchy, combining microtransactions into bundles is key to cheaper use. L2 networks provide Ethereum with a much-needed boost, helping it maintain popularity despite its inherent flaws. However, these scaling solutions have their own limitations.

No interoperability

Unfortunately, L2 sidechains to the Ethereum network cannot communicate with one another yet. They are, in essence, separate markets. Thus, liquidity providers looking for lower gas fees may face a dilemma — to choose only one L2 sidechain or split liquidity between two or more of them.

The second scenario requires thoughtful allocation. Suppose Uniswap opened markets on two Ethereum Layer 2 sidechains, and you divided your liquidity between them. What if one of them never took off? You would miss out on transaction fee rewards.

Security concerns

Liquidity disparity is another challenge in Ethereum scalability. As smaller sidechains accumulate less liquidity, they are less reliable than the Ethereum main chain. To afford comparable security guarantees, they need as much or more staked liquidity tied up in the consensus process.

Popular Ethereum Layer 2 projects

Ethereum settles an impressive volume of transactions — the mainnet processed ~1.2 million daily transactions in Q4 2024. Clearly, the public interest in the network is high despite its drawbacks — that is, low transaction speed, high costs, and inconvenience. It is still far behind Visa, which processed 233.8 billion transactions in 2024.

The shift to the proof-of-stake consensus mechanism (Merge) in 2022 has failed to increase the transaction speed to the projected 1,000 TPS — as of September 2024, its mainnet consistently processed around 12.87 TPS.

Ethereum has implemented other significant measures to address scalability, such as the launch of the Dencun upgrade in March 2024. The introduction of proto-danksharding (EIP-4844) increased rollup data availability, crucial for layer-2 scaling solutions, and lowered the cost of storing transaction data on the blockchain.

Polygon network – bringing transaction costs to zero

Previously known as MATIC, this ZK powerhouse has received high acclaim and financial support from Coinbase Ventures and many smaller projects. Its popularity soared during the NFT boom, and TVL currently stands at roughly $800 million.

Not only does Polygon have negligible transaction fees. This scaling solution gives users free tokens when they bridge assets, so they perform several transactions at zero cost. In terms of transactions per second, Ethereum gets a strong boost — from 15-45 up to 65,000 TPS. Polygon’s PoS has a peculiarity: transactions on the sidechain are periodically check-pointed to Ethereum by the validators.

This network hosts the most popular decentralized protocols, including Aave, Curve, and Sushi. QuickSwap, an AMM DeFi exchange resembling Uniswap, is a low-cost alternative to Ethereum DEXes. Polygon aims to become the default chain for everyday transfers, while value storage and high-volume transactions will still happen on Ethereum.

Optimism – empowering popular DEXes

Initially, Optimism fell behind Polygon due to development issues. Currently, its adoption rate is impressive — Uniswap, Synthetix, and the Lyra exchange (for crypto options) are already on board. This project has strong support from Andreessen Horowitz, a famous private American venture capital firm.

The mainnet called Optimistic Ethereum is live. It hosts the Uniswap V3 market, which has accumulated upwards of $6.5 billion in TVL. This proves early success of Ethereum Layer 2 protocols. The throughput of this scaling solution ranges from 200 to 20,000 TPS.

Arbitrum – cheaper and faster for smart contracts

Traders and yield farmers are not the only users affected by high gas fees. Developers of DeFi apps based on Ethereum have to pay for smart contract executions, which are costly even in test phases. The Arbitrum L2 blockchain-primarily addresses their needs through acceleration and cheaper use. It raises the throughput to 40,000 TPS.

This Optimistic rollup lets developers get their projects off the ground at a relatively low cost. Currently, the protocol's mainnet beta release is only available to developers. Uniswap, Sushi, and Consensys have already tested or launched their blockchain layers on this protocol. A public release is expected in the near future.

Why Layer 1 networks are inferior to Layer 2

Layer 2 blockchain is not the only solution to Ethereum’s inherent flaws. There is an alternative — competing Layer-1 networks that handle more activity. Like Polygon, systems like Solana, Avalanche, Terra, and Binance Smart Chain enable faster transactions at a lower cost. Some of these stand-alone networks connect to the main Ethereum chain via compatibility with EVM (Ethereum Virtual Machine).

The first downside is increased centralization. For example, Solana has fewer nodes than Ethereum, and over 50% of its tokens are owned by Solana Labs, investors, and developers. In comparison, the Polygon sidechain views decentralization as “non-optional”.

Secondly, Layer-1 networks cannot “borrow” from Ethereum’s security. Unlike the L2 scaling solutions, they need their own cohort of miners or PoS validators. These independent blockchains have indefinite responsibility for validating and securing all transactions.

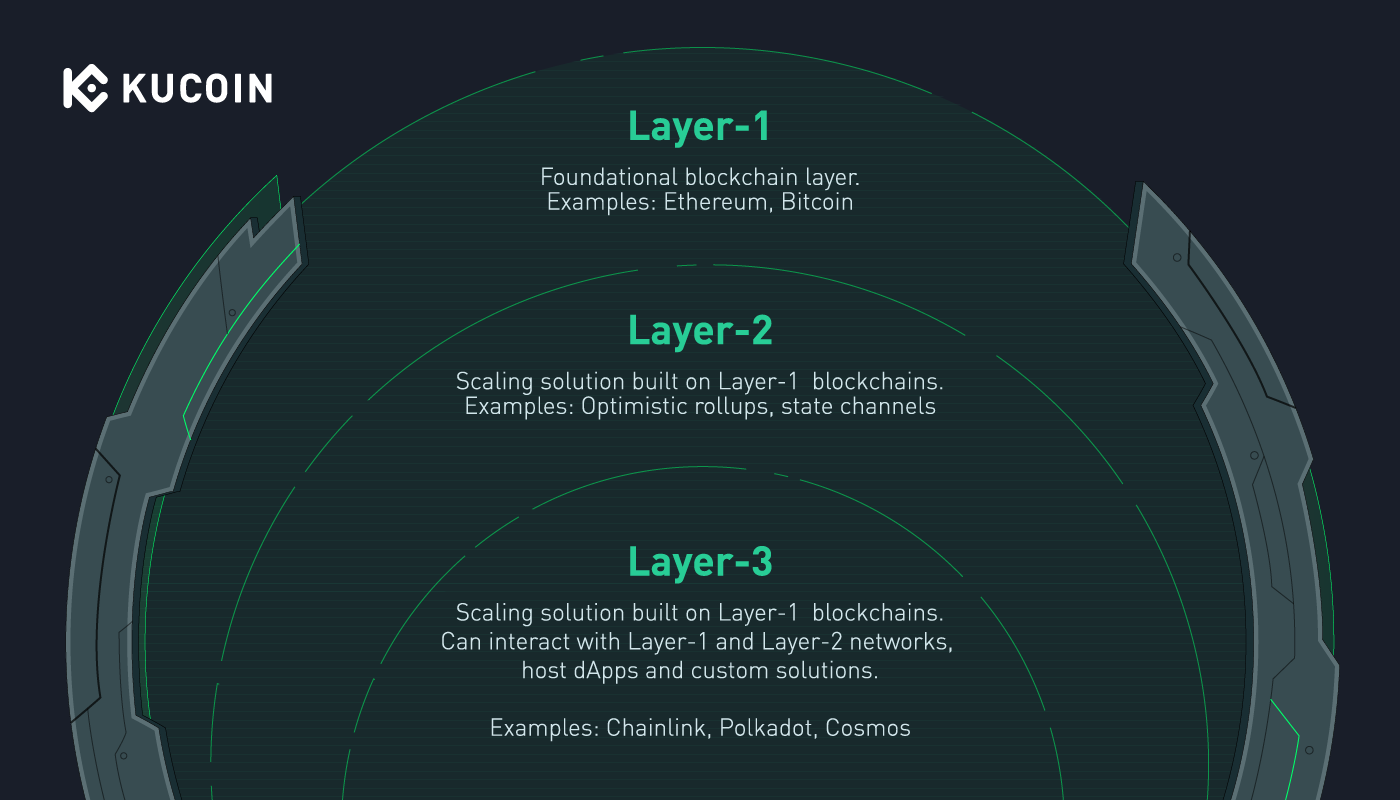

Layer 3 in the Ethereum Network

Layer 3 is a conceptual framework envisioned as a dynamic hub within the Ethereum ecosystem, designed to push scalability, interoperability, and functionality beyond what Layer 2 has achieved. While Layer 2 has made strides, it has not fully resolved the blockchain trilemma.

Layer 1’s expansion has relied on bridges and centralized or semi-centralized projects, which have exacerbated interoperability challenges. Layer 3 aims to address these issues by enabling cross-chain functionality for seamless asset transfers between Layer 1 and Layer 2, facilitating high-volume microtransactions, and supporting complex smart contract operations that are inefficient on Layer 2.

Core Layer 3 functionalities and use cases

In addition to ZK-proofs (mentioned earlier), Layer 3’s core functionalities include:

- Recursive proving: A technique that allows protocols to generate a single proof for a large number of transactions, which are first divided into batches. This ensures hyper-scalability without compromising security or performance.

- Payment atomicity: Ensures that any initiated transaction is either completed successfully or fully reversed, maintaining transactional integrity.

- Customization: Enables specialized use cases and decentralized applications (dApps) tailored to specific needs.

Potential use cases for Layer 3 include:

- Cross-chain DeFi platforms

- Microtransaction networks

- Privacy solutions

- Identity and reputation systems

- Customized smart contracts for niche markets

- AI and data analytics

- Interoperable gaming and Metaverse applications

Examples of Layer 3

- Orbs: Built on Ethereum (Layer 1) and Polygon (Layer 2), Orbs acts as a decentralized backend, enhancing both EVM and non-EVM smart contracts. The Open DeFi Notifications Protocol keeps DeFi traders informed about on-chain events, ensuring they stay updated on market movements.

- XAI: Combines Ethereum and Arbitrum to enhance Web3 gaming with improved efficiency, scalability, and security.

- Traverse: A cross-chain protocol designed for seamless interaction within and beyond Layer 2, offering minimal fees and low latency.

Developers are already building a new generation of dApps optimized for Layer 3. These applications are faster, more cost-effective, and capable of operating across multiple chains.

Criticism and challenges

Despite its potential, Layer 3 has faced criticism. Ethereum co-founder Vitalik Buterin has argued that these solutions do not inherently provide significant throughput improvements. Additionally, Polygon Labs CEO Marc Boiron has expressed concerns that Layer 3 could potentially devalue Ethereum by diverting value away from Layer 1 toward Layer 2.

Final words

Ethereum supports thousands of apps for DeFi, NFTs, and gaming. It settles transactions worth several trillion dollars annually, and the TVL has exceeded $59 billion. Yet its transaction throughput is still hampered.

Layer 2 and Layer 3 blockchain projects facilitate its further growth. Complementary networks like Polygon increase Ethereum’s throughput and reduce gas fees without sacrificing centralization, while Layer 3 aims for even more dramatic results with enhanced interoperability.

Layer 3 solutions usher in a new era of blockchain accessibility, with reduced network congestion and transaction fees. That said, Layer 3 faces its share of challenges like tech hurdles, governance debates, and the threat of cyber-attacks.