How to invest in DeFi in 2025: Starter guide

Decentralized finance (DeFi) redefines many products available in the traditional system, such as borrowing, interest accounts, and trading. The absence of intermediaries creates a low-cost, high-reward space — but investing can also be intimidating for beginners. Here's how to get started with DeFi in 2025.

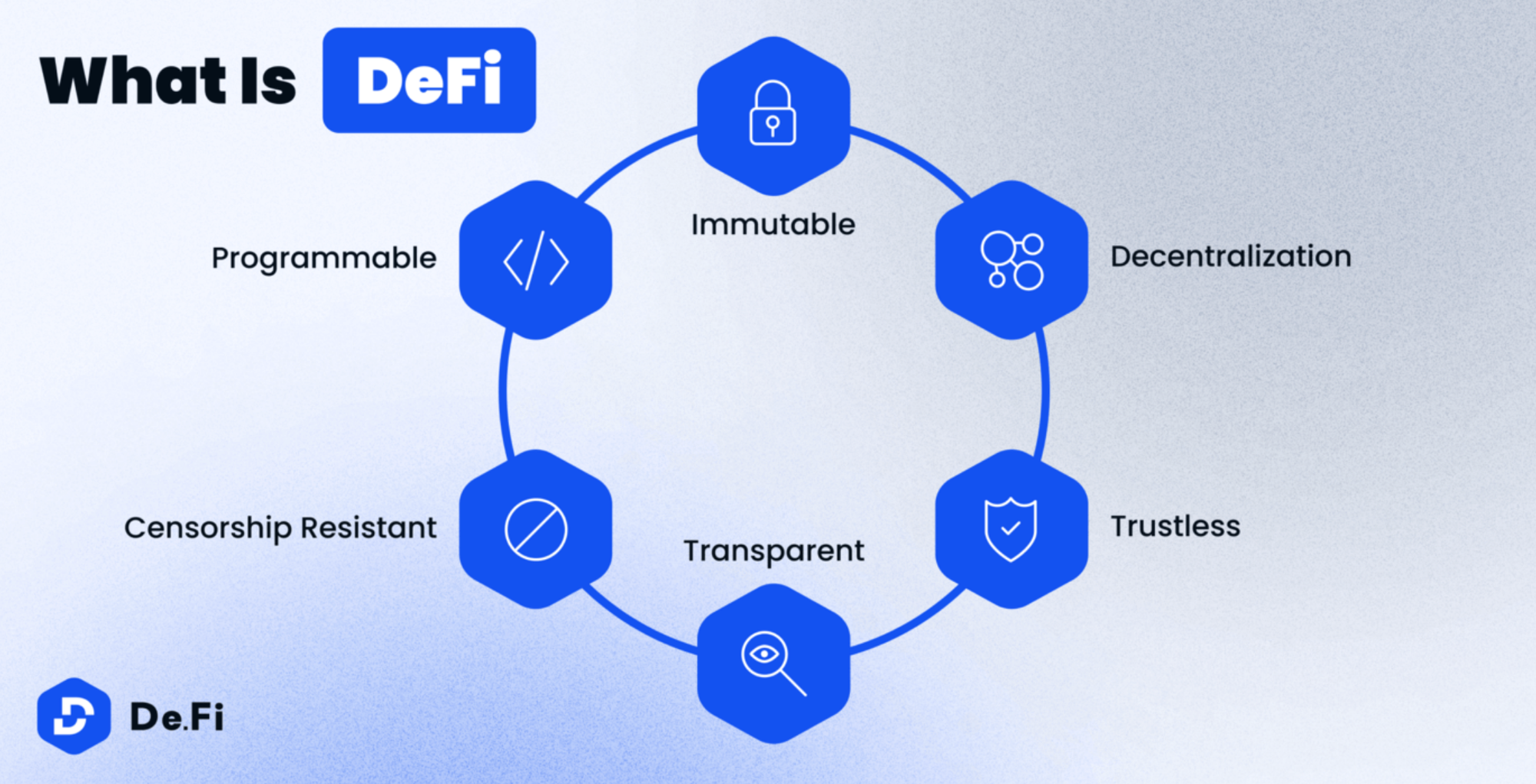

What is DeFi?

DeFi is an umbrella term for blockchain-based financial products. Operating without middlemen, they let users interact with smart contracts to deposit, trade, lend out, or borrow digital assets.

DeFi protocols are available 24/7 from anywhere in the world. Blockchain technology ensures transparency, as all transactions are recorded in public ledgers. Meanwhile, users do not have to disclose any personal information.

Getting started simply involves connecting a non-custodial wallet (e.g., Trust Wallet or MetaMask) to a DeFi platform of their choice. Similar to Bitcoin, DeFi is pseudonymous — while real identities are hidden, there is some level of traceable engagement (for example, if users share their wallet addresses publicly).

DeFi is accessed via protocols — autonomous programs — operating on a public blockchain like Ethereum, Solana, BNB Smart Chain, Tron, or Polygon. These are also known as smart contract networks.

Smart contracts — self-executing agreements on the blockchain—are the bedrock of DeFi, as they enable direct user interaction. They execute transactions based on predetermined conditions.

What is DeFi investing?

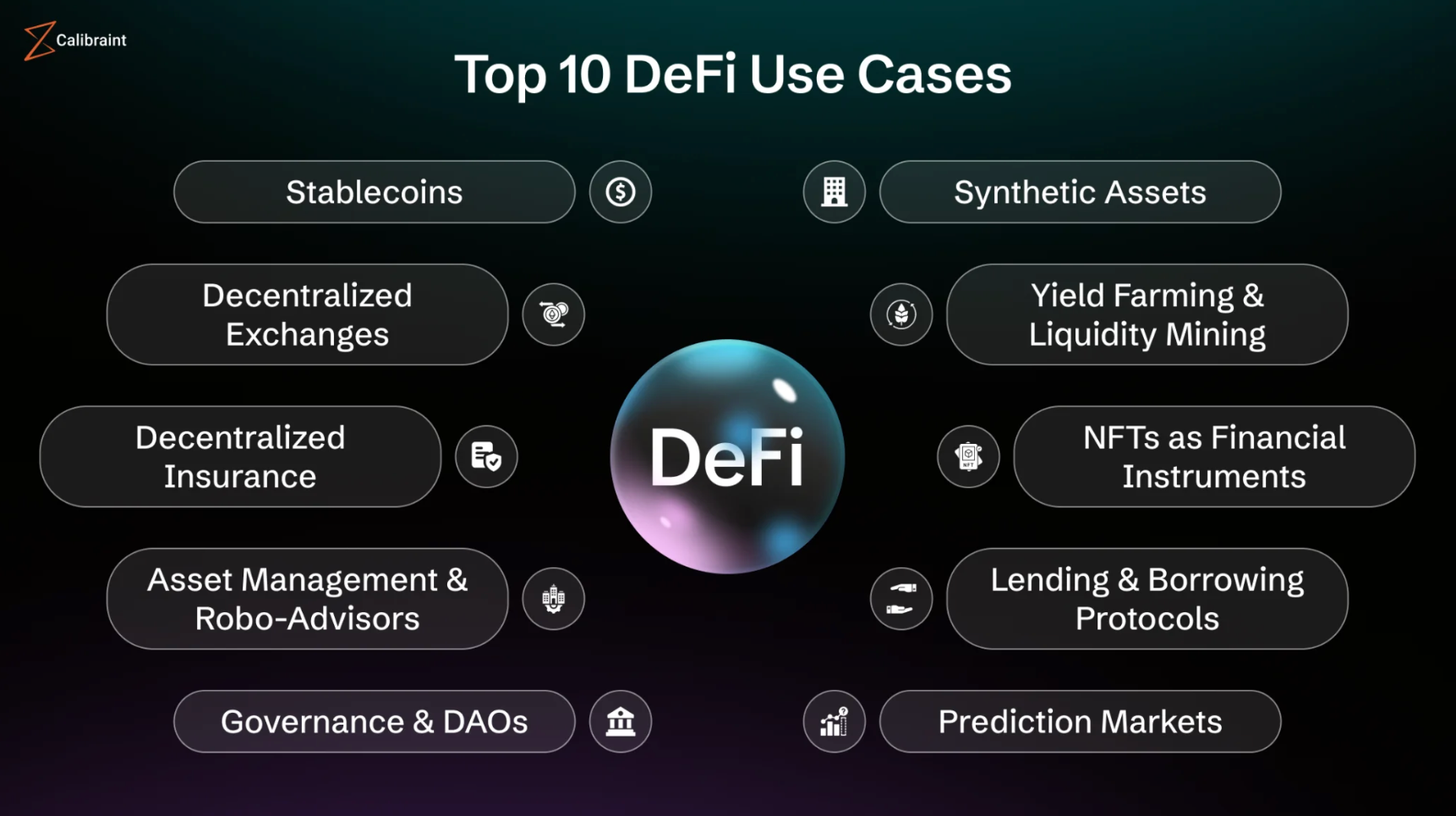

Investors can add DeFi exposure to their crypto portfolios by purchasing DeFi tokens or deploying their assets to specific protocols to earn returns. DeFi tokens are available on crypto exchanges (both centralized and decentralized), while other opportunities are only accessible through DeFi wallets:

- MetaMask — a crypto wallet for storing Ether (ETH) and other tokens based on Ethereum, the primary network used in DeFi.

- Ledger — a hardware wallet storing crypto in cold storage (offline), which means it cannot be remotely accessed by others.

- Trust Wallet — a mobile wallet that supports storage, swaps, purchases with a debit or credit card, and access to DeFi protocols via a Web3 browser.

Selecting DeFi projects for Investment

DeFi projects are not created equal. Investors should assess their reputation, security track records, the extent of actual decentralization, and other aspects.

- Use cases and technology: How useful is the project? What problems, if any, does it solve? A project's whitepaper will reveal if it was created solely to capitalize on the DeFi boom, what goals it pursues, and how much thought and effort has gone into it.

- Reputation: This could be measured based on social media commentary and news coverage.

- Security & management: Hacking or mismanagement incidents in the past mean the project is not the ideal place for parking your assets.

- Age: For newer projects, the risk of scams or failure is statistically higher, so investors should be cautious.

- Decentralization: While this term is at the heart of DeFi, some projects are far from being community-governed. Having a core team make crucial financial decisions, sometimes with sole access to all user funds, is a potential recipe for a “rug pull.”

- Team: Exit scams are easier to pull off when the identities of team members are hidden. Hence, some investors pick projects whose staff are public and have a strong track record of ethical project management.

How to invest in DeFi: Top strategies

#1 Investing in DeFi tokens

Native cryptocurrencies of specific DeFi projects are the most accessible investment tool, available on popular crypto exchanges. Portfolio holders may keep DeFi tokens long-term to capitalize on future price movements and sector trends.

Such digital assets let holders interact with the issuing network in various ways depending on their purpose. For example, governance tokens provide voting rights — a say in decisions about the future of the issuing protocol.

Some protocols (e.g., Sky, formerly Maker) also issue stablecoins (USDS, formerly DAI) — assets pegged to stable assets like the US dollar — that may be used as collateral for loans. Other popular DeFi tokens include:

Uniswap (UNI)

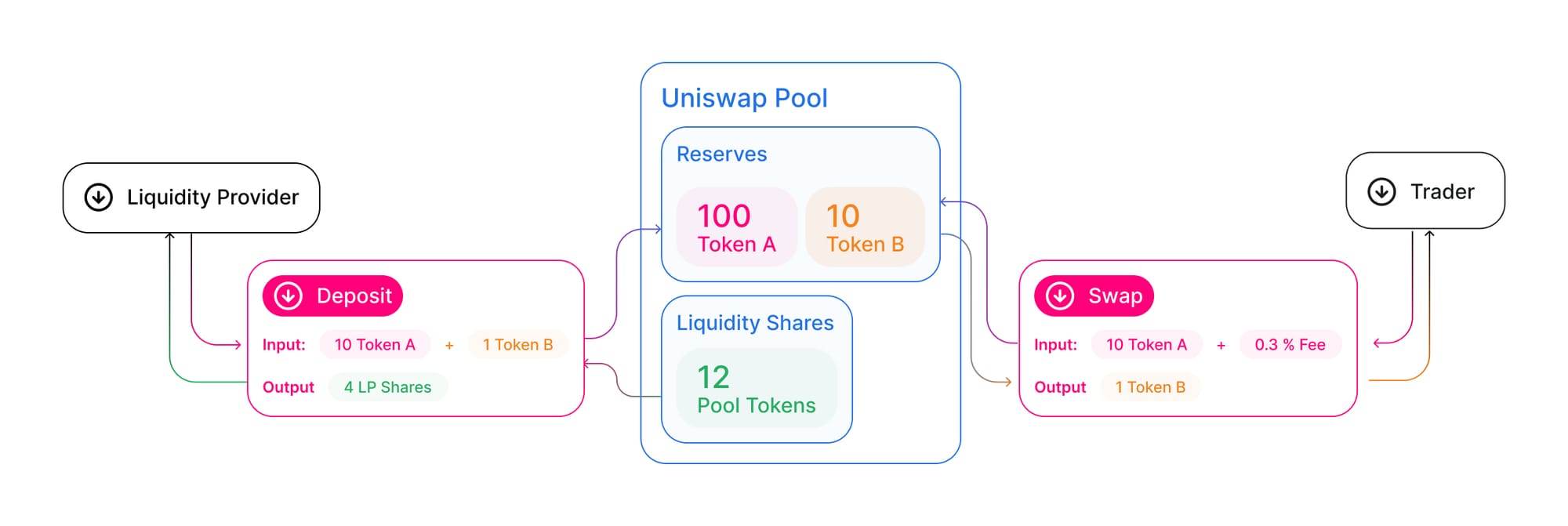

Launched in 2018, Uniswap was one of the first DeFi applications (DEXs) to gain substantial traction on Ethereum. Today, it maintains its competitive edge with over $2 trillion in trading volume as of April 2024.

Uniswap supports crypto-to-crypto trades and liquidity pools involving crypto pairs. It pioneered the Automated Market Maker model — users supply Ethereum tokens to the pools, and algorithms set market prices.

UNI, its native governance token, provides voting rights for key protocol changes.

SushiSwap (SUSHI)

Forked from Uniswap in 2020, SushiSwap is another popular Ethereum-based DEX. It leverages smart contracts to support liquidity pools for peer-to-peer trading. SushiSwap uses Uniswap’s Automated Market Maker model and also supports only crypto-to-crypto trading.

Users who become liquidity providers supply an equal value of two tokens. They receive Liquidity Provider (LP) tokens, which may be deposited into yield farms to earn additional APY rewards.

The SUSHI token unlocks voting rights on proposals and may be staked on the SushiSwap app.

The Graph (GRT)

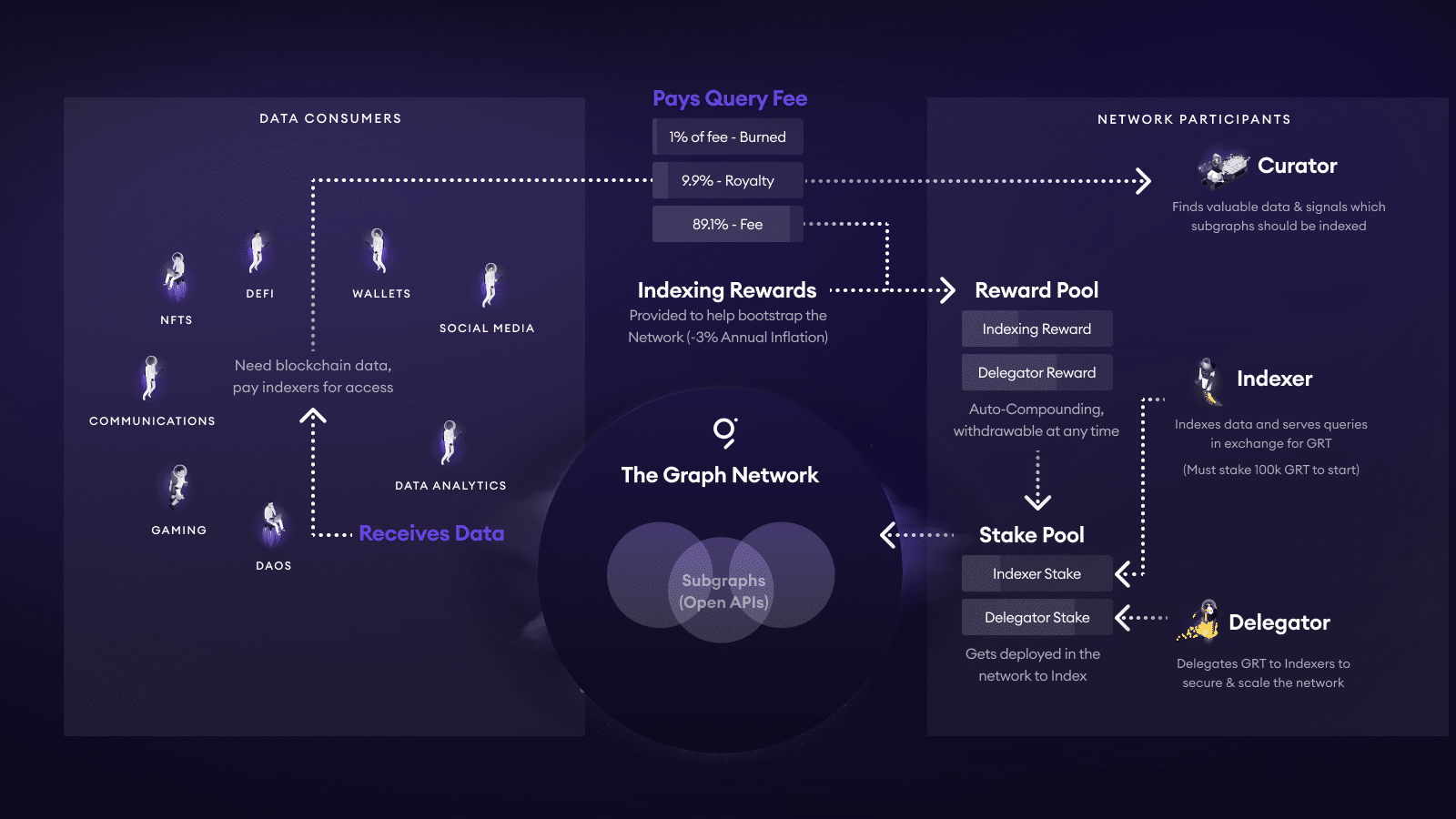

The Graph is an open-source protocol for indexing and querying blockchain data from networks like Ethereum and Filecoin. Launched in 2019, it works similarly to search engines like Google.

By making data accessible, The Graph provides DEXs with the information they need to operate effectively. While indexing requires significant GRT and technical knowledge, anyone can delegate GRT to Indexers and receive a cut of their rewards.

Indexers — network participants who submit or verify data — are paid in GRT, the token that powers The Graph’s ecosystem.

Aave (AAVE)

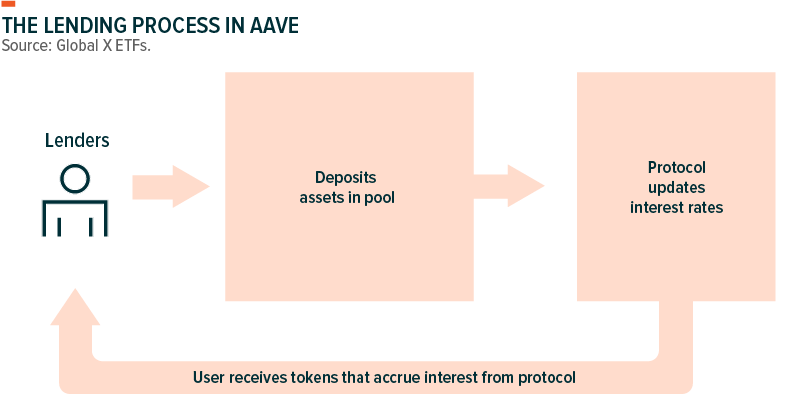

Aave is a DeFi lending protocol operating since 2017. Its users can borrow, lend, collateralize, and earn interest on their crypto without intermediaries. Deposits bring APY rewards.

Lenders deposit tokens into a pool and receive aTokens (e.g., aETH for depositing ETH), which entitle them to interest payments. Borrowers must provide sufficient collateral, but they can also access uncollateralized flash loans — settled instantly.

AAVE, the protocol's governance token, also unlocks discounts on fees and may be staked for additional rewards.

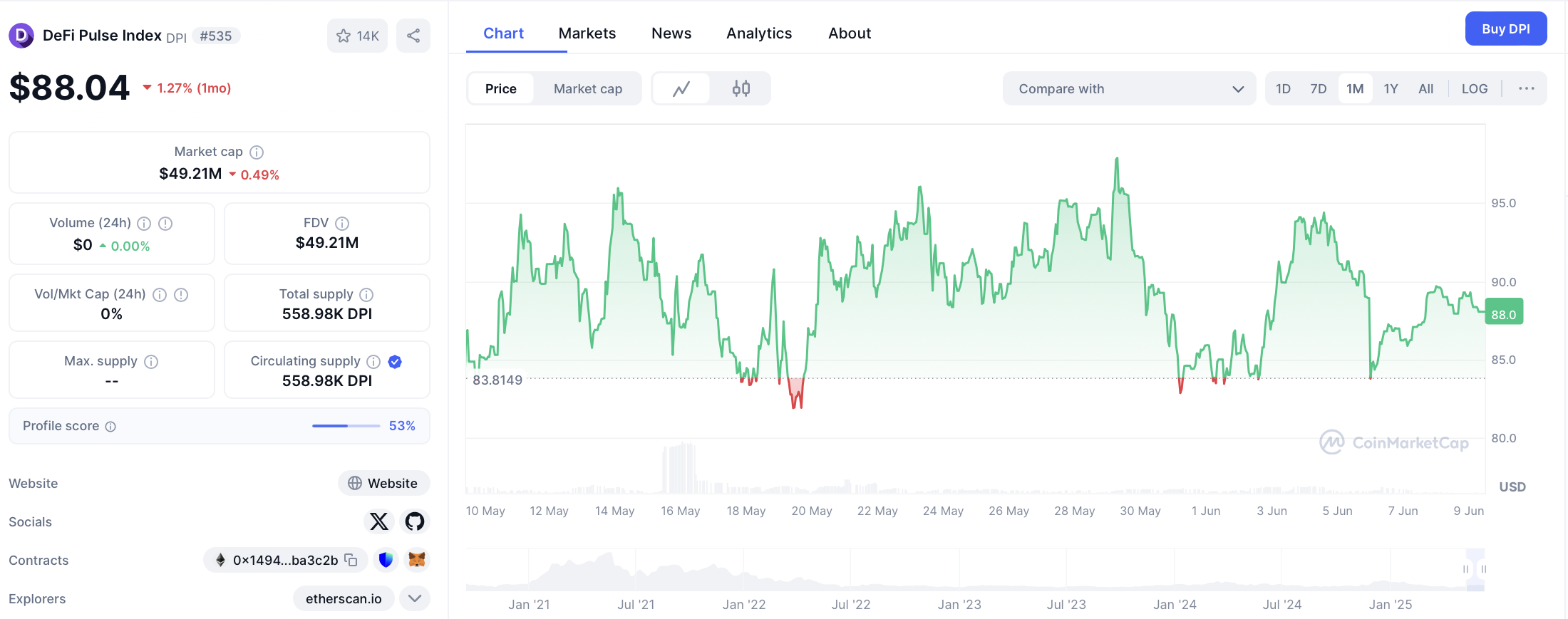

#2 Buying DeFi token index

Indices track the value of specific token bundles, supporting cost-effective diversification for lower-risk investment. The DeFi Pulse Index Token (DPI) is a prominent example.

DPI is an Ethereum-based token tracking the performance of a bundle of the top 10 DeFi tokens. The underlying assets, selected by Total Value Locked (TVL) — the amount of monetary value held within each protocol — meet the following criteria:

- Operating on Ethereum

- Representing DeFi protocols listed on DeFi Pulse—a website monitoring and ranking DeFi projects

- Having significant usage

- Demonstrating a proven commitment to protocol development

- Not being a security, synthetic digital asset, or wrapped token

DPI is flexible and dynamic — regularly rebalanced to reflect changes in the DeFi landscape. As it is “capitalization-weighted,” tokens with larger market caps have larger weightings.

Currently, the index includes tokens from projects like Uniswap, Aave, Sky, Synthetix, Compound, Lido DAO, Loopring Coin V2, Yearn Finance, Rocket Pool, and Balancer.

Another popular index is Phuture DeFi Index (PDI), providing exposure to the top Ethereum-based DeFi tokens by market cap listed on DeFi Llama. Unlike DPI, which is managed quarterly, PDI is maintained monthly. It is available on the Bancor Network and the Phuture website.

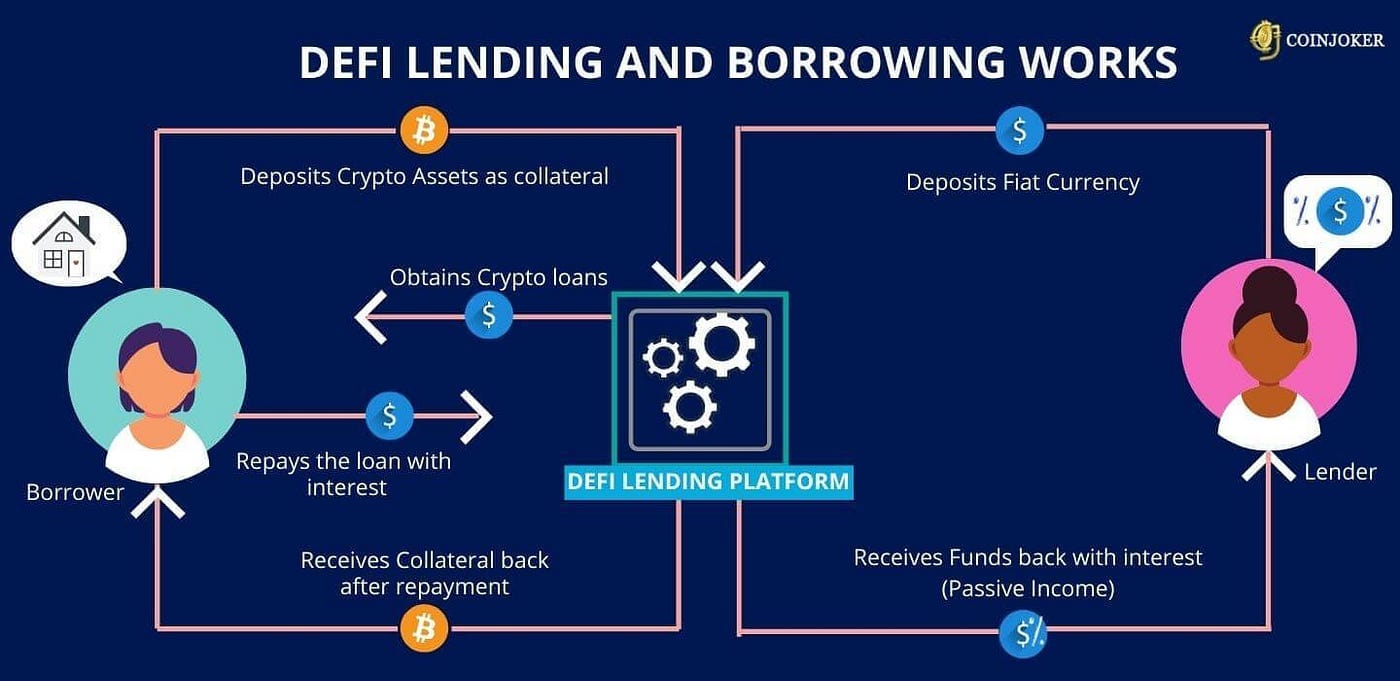

#3 Engaging in DeFi lending

Some DeFi protocols let crypto enthusiasts lend tokens to others to earn interest in crypto — auto-calculated based on the shifting supply and demand for loans.

To protect lenders, borrowers are required to over-collateralize their loans — provide collateral beyond the loan value. A margin call mechanism liquidates the collateral if the borrower fails to maintain it above the threshold. Thus, outstanding debt positions are guaranteed to be paid down.

#4 Yield farming & liquidity mining

Liquidity miners deposit assets into pools in exchange for rewards sourced from transaction fees — in the form of an annual percentage yield (APY).

Yield farmers also deposit their crypto into pools for rewards, but the latter include the protocol's native cryptocurrency (typically, governance tokens) in addition to fees. They may also move their assets around in search of pools with the best APYs — “farming” for higher yields.

Risks of DeFi investing

Like any form of investment into volatile cryptocurrencies, DeFi strategies bring both risks and rewards. The former are multifaceted:

- Smart contract risk: Bugs in poorly developed smart contracts create loopholes that hackers may exploit to siphon user funds.

- Market risk: Dramatic downtrends slash the value of pooled DeFi assets and remove significant liquidity from such pools — resulting in high slippage. Due to the gap between the actual and quoted prices at execution, buyers end up paying more than expected.

- Governance attacks: A malicious entity may buy the majority of a protocol's governance tokens to influence voting outcomes.

- Custody risk: DeFi platforms do not provide custody solutions. Ensuring safe storage for digital assets is the investor’s responsibility. Caution is a must — loss of private keys renders access to funds impossible.

- Regulatory risk: Unlike its CeFi (centralized finance) counterpart, the DeFi space is essentially unregulated. The absence of KYC checks ensures anonymity, but there is also a flip side. Investors should factor in the absence of legal protections and the potential negative impact of future regulations.

Wrapping up: Navigating DeFi investing

DeFi has revolutionized finance by offering permissionless access to lending, trading, and yield opportunities — all without intermediaries. Investing in this space ranges from simple token purchases to advanced strategies like liquidity mining, each with its own risk-reward balance.

While the potential rewards are compelling — pseudonymity, 24/7 markets, and innovative protocols — the risks demand careful research. The key is to start small, prioritize security, and diversify across reputable projects.