Inside the vault: Deep dive into Solana treasuries

You've read the headlines about Strategy's Bitcoin bets. But while everyone was watching crypto's giants, a smarter corporate trend was taking root. Companies are now turning to Solana, merging the dream of price surges with the real-world power of staking rewards.

SOL treasuries are turning a static asset into a dynamic, income-generating engine. Let's open the vault and explore the companies leading this charge in 2025.

Why companies are accumulating SOL

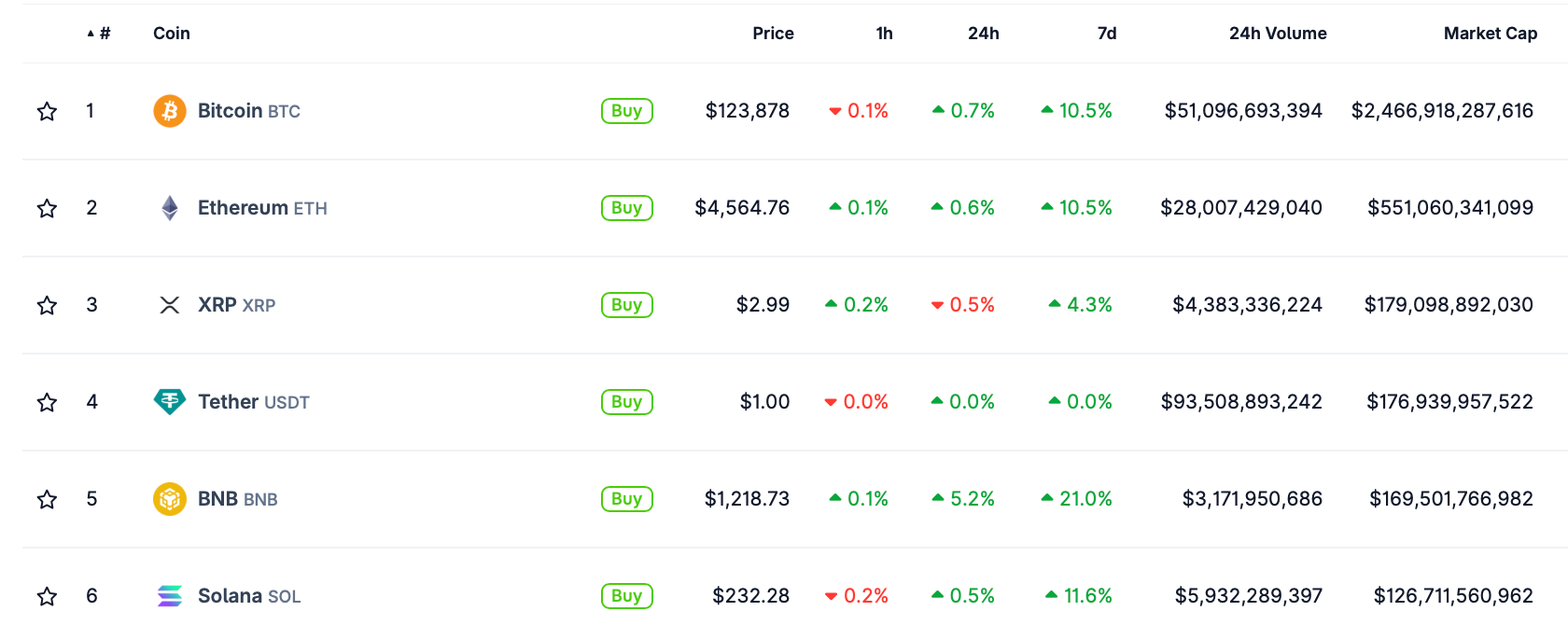

While Bitcoin (BTC) adoption is championed by Strategy's Michael Saylor, and BitMine proudly holds the largest corporate ether (ETH) stockpile, Solana’s SOL offers a strategic stake in a high-octane and explosively growing coin with the sixth-largest market cap ($6.1 billion at press time).

Solana is a premier blockchain network celebrated for its speed (over 65,000 transactions per second) and unmatched scalability. It has solidified its reputation as the epicenter for high-throughput applications like decentralized finance (DeFi), non-fungible tokens (NFTs), and tokenized assets.

The real differentiator is Solana's Proof-of-Stake consensus mechanism, combined with Proof of History. The former provides holders with a game-changing advantage — the ability to earn passive yield by staking. Thus, companies aren't just parking tokens for potential appreciation; by staking SOL, they activate a recurring income stream that stacks on top of any price gains.

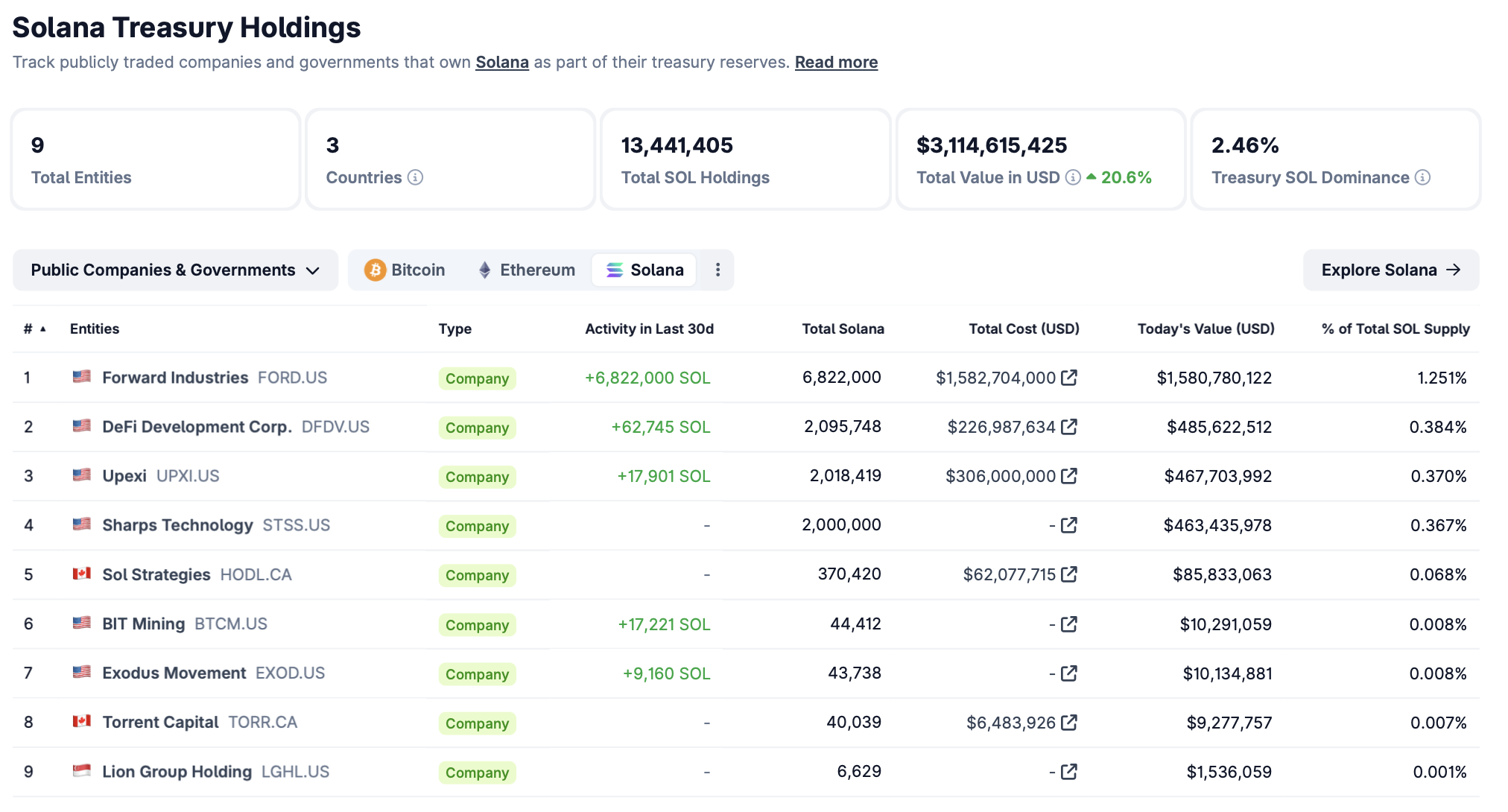

Major players: Top corporate SOL treasuries

As of October 6, 2025, the top four publicly traded firms hold a combined 13.4 million SOL (worth over $3 billion) in their treasuries. But don't let the big numbers fool you — each has a unique flavor and focus.

Forward Industries (FORD): All-in newcomer (6.8 million SOL)

Forward Industries is cannonballing into the deep end. Once known for consumer electronics cases, the company has pulled off a stunning pivot, emerging as the undisputed leader in size with a breathtaking purchase of 6.8 million SOL.

With backing from crypto heavyweights like Galaxy Digital and Multicoin Capital (who also have seats on the board) Forward is leveraging top-tier expertise. Their game plan is elegantly simple: use staking and DeFi to generate a revenue stream with a single goal — to constantly buy more SOL.

DeFi Development Corp (DFDV): Yield engineer (over 2 million SOL)

If Forward is the brute force play, DFDV is the sophisticated architect. This company is all about maximizing every drop of yield from its 2-million-SOL treasury. They became the first public company to integrate a custom liquid staking token (dfdvSOL), a move unlocking staking rewards while keeping their capital fluid.

Through validator partnerships and a deal to make Solflare its official wallet, the company is weaving itself directly into Solana's infrastructure. Beyond holding, they're actively building and benefiting from the ecosystem itself.

Upexi Inc (UPXI): Market darling (over 2 million SOL)

After announcing its aggressive move into SOL, Upexi’s stock price rocketed over 330%, proving that investors are desperate for pure-play exposure to Solana's growth. The company's approach is a masterclass in aggressive accumulation.

By securing a credit line and purchasing over half of its stack at a steep discount, Upexi created instant, built-in gains for shareholders. Currently, its treasury generates a staggering ~$65,000 daily from staking alone.

Sharps Technology (STSS): Ecosystem insider (2 million SOL)

Sharps Technology has a deep, partnership-driven approach. This medical device maker made its foray into crypto with a whopping $400 million war chest from elite firms like Pantera Capital, instantly establishing itself as a major player.

From a potential deal with the Solana Foundation to collaborations with major ecosystem names like Bonk and Pudgy Penguins, Sharps is focused on more than just price appreciation. They're embedding themselves directly into the community and culture of Solana.

Common Solana treasury strategies

There is no universal playbook for building a SOL stack. The current approaches navigate a delicate dance between risk, return, and operational complexity.

Buying & staking directly

The most direct method involves scooping up tokens on the open market. These assets are then committed (or "staked") to the network to harvest yield.

Staking rewards provide a steady income stream, typically between 6-8% annually. For instance, Upexi has staked nearly its complete stack of over 2 million coins, earning roughly $65,000 daily, or a staggering $23-27 million annually.

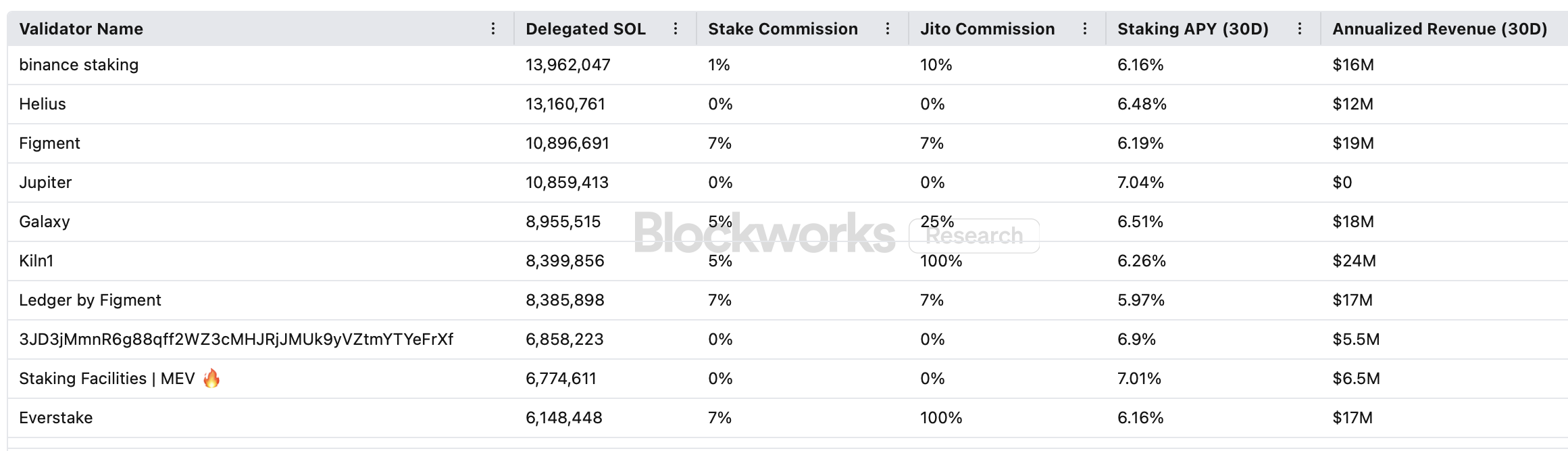

Validator operations

Instead of staking through third-party providers, companies can build their own validator nodes — or forge alliances with existing operators. This achieves the same dual goal of protecting the network and racking up rewards.

This model unleashes higher yields and provides unfettered control over the beating heart of the infrastructure. For example, SOL Strategies orchestrates large-scale validator operations involving 3.6 million delegated SOL. Its vast network includes over 7,000 unique wallets, including institutional powerhouses like ARK Invest among its participants.

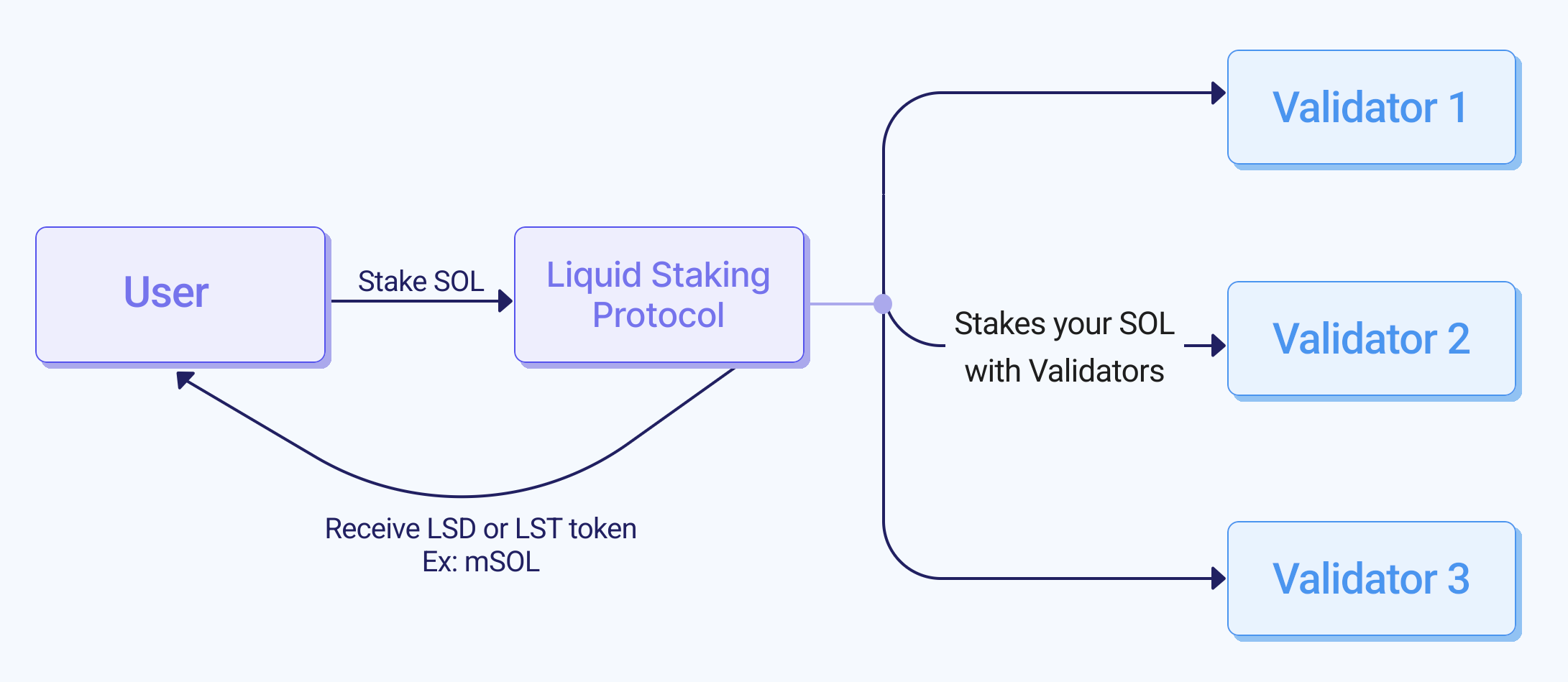

Liquid staking integration

Unlike direct staking, liquid staking issues companies liquid staking tokens (LSTs) that act as liquid proxies for their locked SOL. These tokens can be freely traded, used as loan collateral, or deployed into other high-yield strategies, supercharging capital efficiency.

DeFi Development blazed the trail with this approach among publicly traded companies. In a partnership with Sanctum, it stakes SOL in return for LSTs—collecting staking rewards while safeguarding liquidity and balance sheet flexibility.

Transparency through governance and data

Clear, well-defined frameworks are the bedrock of sharp treasury management. Leading institutions are now establishing formal governance structures to bring clarity to decision-making, performance monitoring, and risk management.

- SOL Strategies provides a clear window into its treasury value and validator revenue directly within its financial statements.

- DeFi Development consistently delivers updates on its SOL Per Share (SPS) metric, forging a direct link between treasury growth and shareholder value.

- Upexi broadcasts its staking yields and net asset value (NAV) multiples with full transparency.

Compelling benefits of SOL treasuries

Tapping into Solana's vibrant ecosystem delivers a host of advantages, from sizable price appreciation to reliable rewards.

#1 Staking yields deliver steady returns

Staking rewards of 6-8% furnish a predictable income stream — a major advantage in the volatile crypto market. The $23-27 million in annual staking rewards earned by Upexi, for example, helps cushion against SOL’s price swings, creating a more resilient reserve strategy.

#2 Thriving network growth

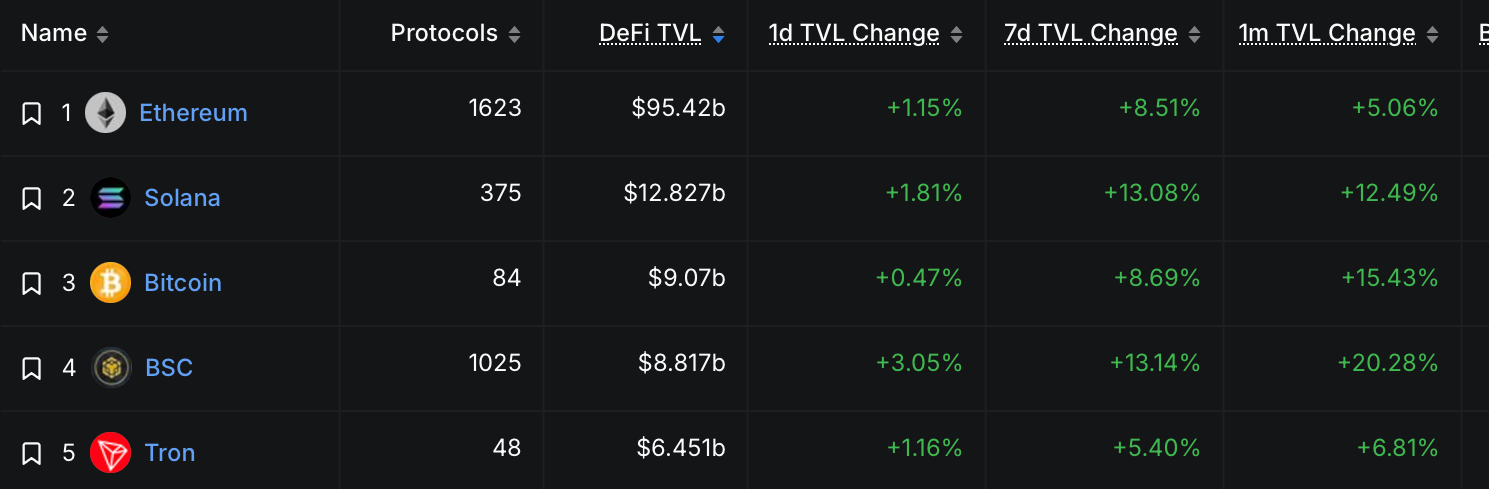

The Solana blockchain claims the second-largest DeFi Total Value Locked (TVL) after Ethereum ($12.8 billion vs. $95.4 billion as of October 6, 2025). It is a top contender for on-chain liquidity and capital deployment.

This mature infrastructure means companies can seamlessly integrate their SOL into a suite of DeFi applications, minimizing hassle and simplifying participation.

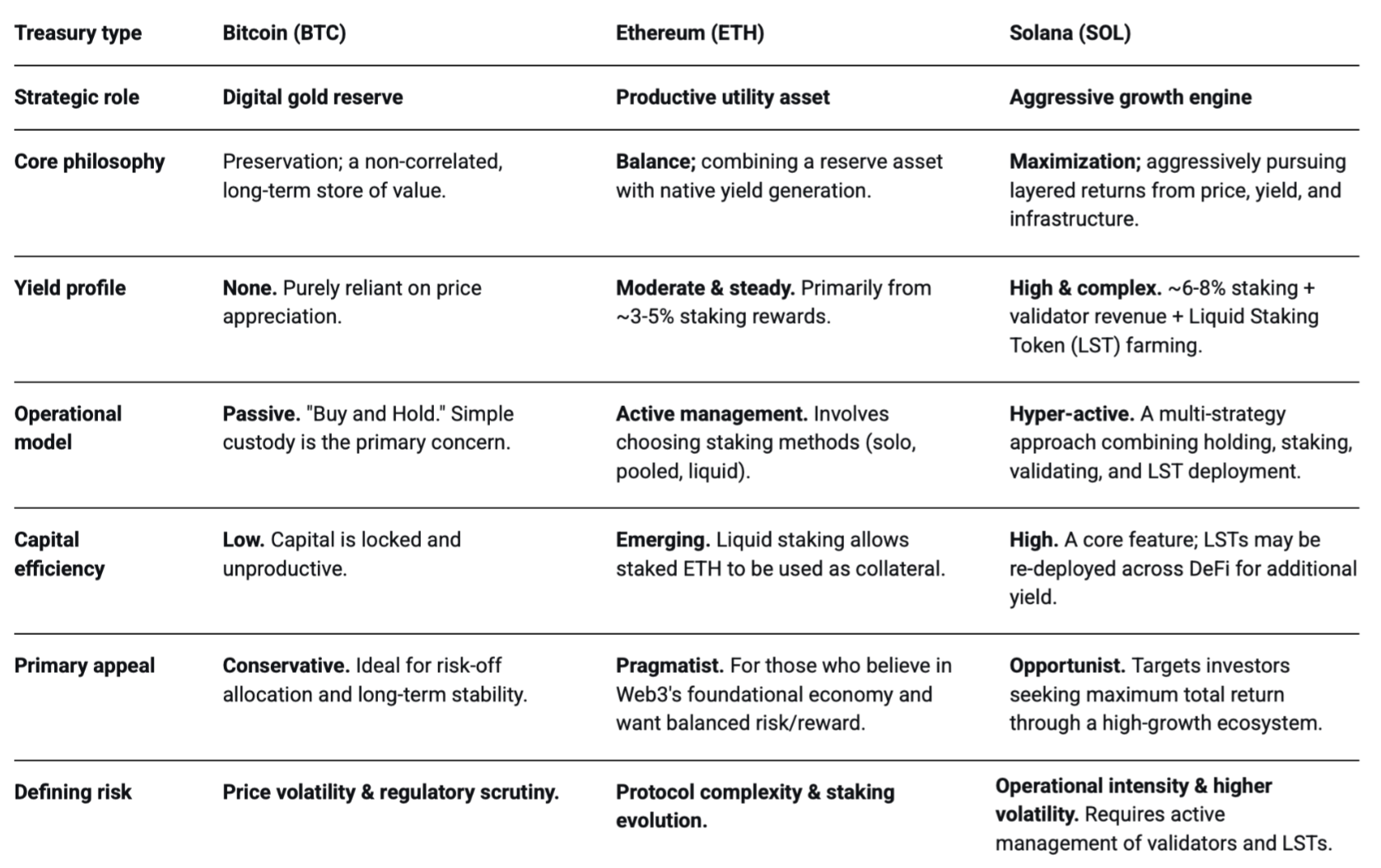

#3 Superior operational benefits

Bitcoin holdings are fundamentally passive. SOL holders, however, can actively harvest staking rewards and pursue additional revenue from running validator nodes.

Furthermore, liquid staking tokens allow companies to maintain instant liquidity in their SOL positions, unlocking capital for other ventures or deploying it as collateral.

Winding down positions is also a seamless process — companies can swiftly convert or trade their tokens, ensuring a level of operational agility and capital efficiency unrivaled by TradFi.

#4 Upside of smaller market cap

Solana's smaller market cap compared to BTC and ETH turns it into a higher-octane asset, injecting higher volatility but also unleashing significantly more upside. This supercharges the price impact of every investment and adoption wave, offering a potential growth curve that the larger, more mature giants simply can't match.

Challenges of Solana treasuries

While SOL's volatility is well-known, companies must also confront significant operational risks inherent in validator infrastructure.

#1 Regulatory uncertainty looms

In the United States, the Securities and Exchange Commission (SEC) has clearly classified Bitcoin and Ether as commodities. However, a persistent cloud of doubt hangs over Solana. The agency has repeatedly grouped SOL with unregistered securities in its lawsuits.

This regulatory minefield creates major legal and reporting complications for corporate treasuries. Evolving regulations could spark enforcement actions at any time.

Therefore, corporate holders need nimble operational setups, detailed risk disclosures, and comprehensive legal reviews to stay compliant.

#2 Validator penalties

Validators can have their stakes "slashed"—a harsh financial penalty for misbehavior. Even brief periods of downtime result in missed rewards.

Running a validator is a round-the-clock operation, demanding highly reliable infrastructure, specialized hardware, and deep expertise. Companies must also maintain constant vigilance with software upgrades and pursue aggressive risk mitigation.

#3 FASB accounting requirements

The new FASB accounting standard (ASU 2023-08) requires crypto holdings to be measured at fair value, with changes immediately hitting net income. This creates major complications:

- More complex reporting due to detailed tracking and expansive disclosures.

- Quarterly earnings rollercoaster as SOL price swings directly impact the income statement.

- Distorted results due to rallies inflating earnings and steep drops potentially devastating quarterly results.

- Spooking investors during temporary price dips, as they can result in depressing reported net income.

#4 Volatility meets limited hedging tools

Solana's value is notoriously volatile and lacks the sophisticated, institutional-grade hedging tools available for Bitcoin. While SOL futures launched on the CME in March 2025, the market is still developing.

Most derivatives are traded on crypto-native exchanges, and advanced structured products are limited, leaving SOL treasuries highly vulnerable to the market's sudden shifts.

How retail investors can get exposure to Solana

Mainstream investors have several paths to capitalize on Solana's growth story.

Buying stock in the "proxy" players

Public companies like Forward Industries, Upexi, and DeFi Development hold massive SOL reserves, effectively acting as conduit investments. Buying their stock provides a backdoor to SOL's appreciation and the valuable staking yields.

ETF landscape: Waiting for green light

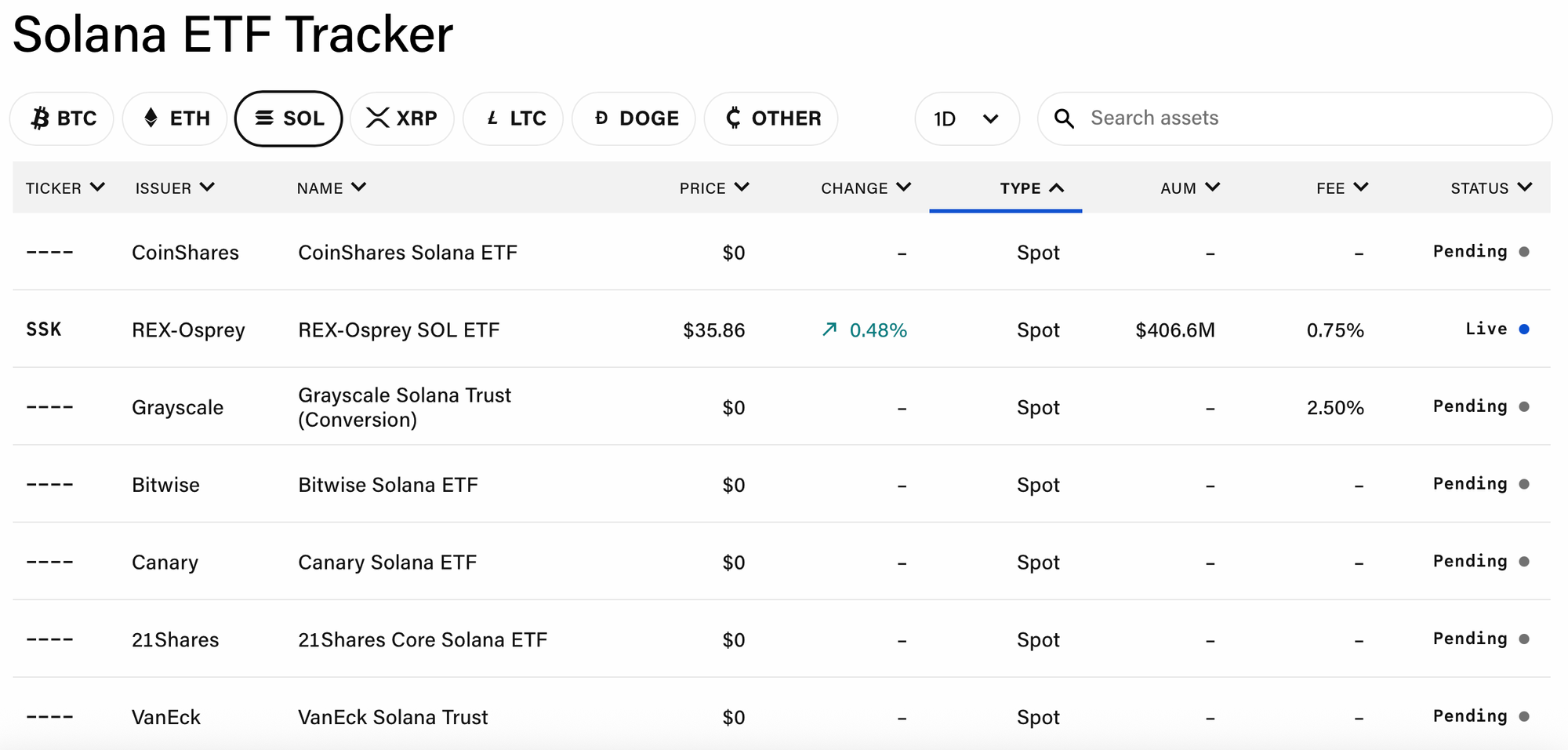

At press time, the SEC has approved only one US spot Solana ETF. The REX-Osprey Solana + Staking ETF (SSK) launched on July 2, 2025, marking a major milestone as the first US fund to offer spot Solana exposure and staking rewards.

Heavyweight firms like Fidelity and VanEck have also filed applications, but the ongoing US government shutdown threatens to postpone the process. Analysts had pegged October 2025 for potential launches, but that timeline is now colliding with a regulatory standstill.

Meanwhile, investors in Canada and Europe can already access Solana ETPs. Global crypto funds also bundle SOL exposure within broader, diversified portfolios.

Wrapping up

Solana treasuries signal a fundamental evolution from the passive "digital gold" model to a dynamic, yield-generating engine. For companies bold enough to embrace its higher volatility and operational complexity, SOL delivers a powerful triple-threat: a stake in a vibrant high-growth ecosystem, a reliable stream of staking income, and game-changingcapital efficiency through liquid staking.

In the end, the strategic choice isn't about choosing sides between Bitcoin or Ethereum, but about defining your company's ambition. Bitcoin remains the stable, conservative anchor, Ethereum the versatile utility play, and Solana the high-octane growth accelerator for those aiming to lead the pack.