Is altseason here? How to spot and leverage crypto market shifts

Altseason is that electrifying phase when Bitcoin’s grip loosens, sending smaller cryptocurrencies rocketing to new heights. A surge of trading activity and FOMO-driven volatility pushes investors to tweak their portfolios for maximum gains. Here’s how to see it coming, spot it in real-time, and ride the wave.

Altseason vs. altcoin dominance

Picture the crypto market as a constant “tug-of-war” for money between Bitcoin and everything else. It swings through four distinct phases, much like the seasons of a year — and getting a feel for this rhythm is every trader’s secret weapon.

Though Bitcoin still wears the crown, its market share occasionally dips, creating openings for other cryptocurrencies — altcoins — to erupt with staggering gains. When they, as a pack, consistently leave Bitcoin in the dust, an "altcoin season" or "altseason" is officially on.

Why dominance shifts occur

Over the last decade, the power dynamic between Bitcoin and other cryptocurrencies has been a rollercoaster. Groundbreaking tech, especially Ethereum and its smart contracts, unleashed a wave of new possibilities and ways to value digital assets.

Bitcoin: Undisputed king (2009-2016)

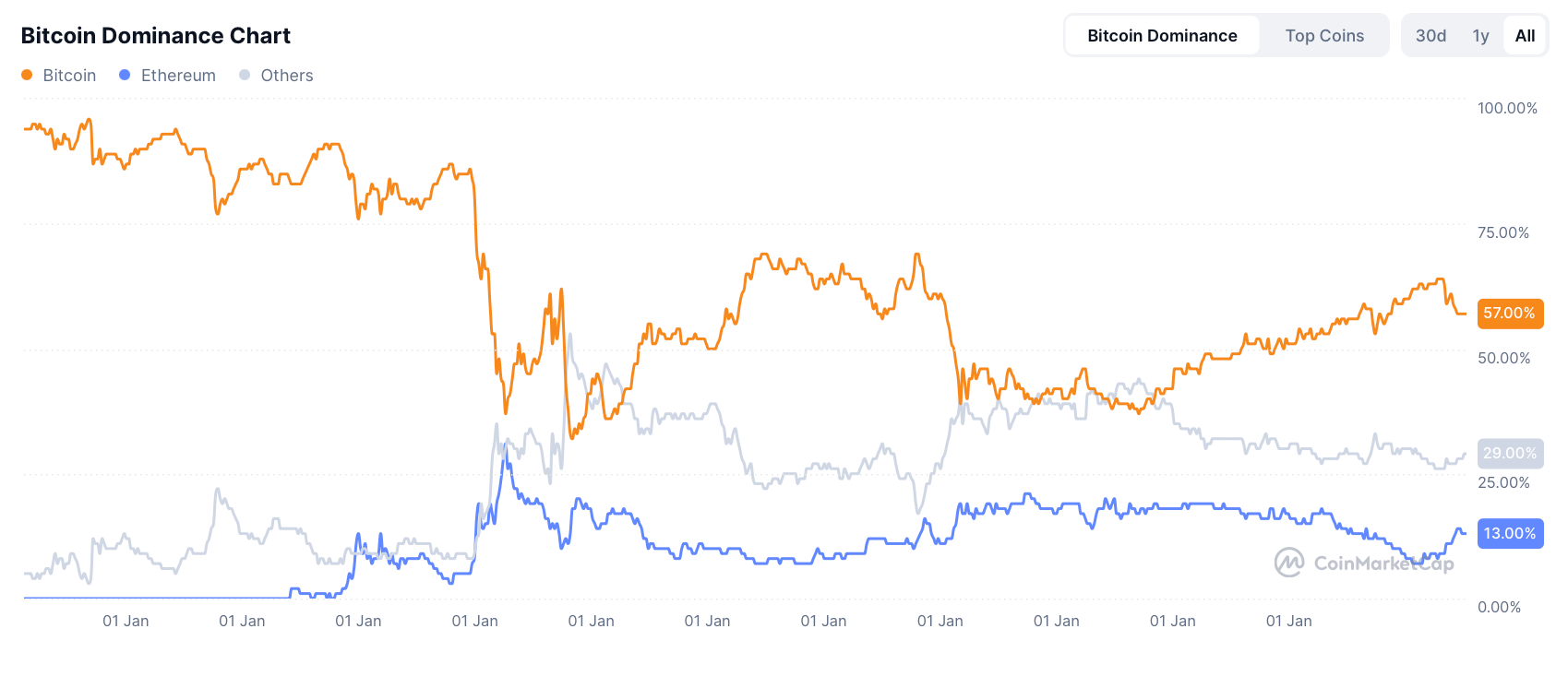

The dawn of it all. BTC commanded a staggering 90-95% of the entire crypto market, facing almost zero competition. Early altcoins like its offshoot Litecoin (LTC) or Ripple’s XRP were seen as little more than curious experiments.

ICO boom: Great paradigm shift (2017)

In a dramatic shift between February 2017 and January 2018, Bitcoin’s dominance plummeted from 85% to around 38%.

Ethereum’s arrival with its ERC-20 token standard kicked off a revolution. The Initial Coin Offering (ICO) — crypto's wild version of a stock market launch — spawned a dizzying array of new projects as the floodgates of capital swung wide open.

"DeFi summer" & NFT craze (2020-2021)

In 2021, Bitcoin's dominance tumbled from a peak of over 70% to around 40% by May.

As Ethereum matured, innovative earning schemes like liquidity mining offered yields that dwarfed those in TradFi. The siren songs of Decentralized Finance (DeFi), Non-Fungible Tokens (NFTs), and GameFi seduced billions of dollars of capital. This "DeFi Summer" felt different — more mature and backed by powerful stories.

Modern balance (since 2024)

Bitcoin has solidified its role as a sturdy counterweight to altcoin growth—potentially setting a higher "floor" for its dominance.

The next wave of innovation had to claw its way back from the brutal crypto winter, triggered in 2022 by the collapse of Terra and Three Arrows Capital and ending with FTX’s implosion.

The blockbuster debut of spot Bitcoin ETFs in the United States, led by giants like BlackRock, funneled a massive wave of institutional money into the space. Meanwhile, the wild west of meme coins and platforms like Pump.fun pushed altcoins to dizzying new valuations.

Anatomy of a market cycle

As we’ve seen, an altseason is that magic window where altcoins, as a group, wildly outperform Bitcoin. These seasons are born from a massive rotation of money, fueled by shifting crowd psychology.

As investors get greedy for bigger rewards, they hunt for bigger opportunities in smaller, riskier digital assets. You can watch this play out through sentiment, which typically dances through four stages:

#1 Bitcoin supremacy

A new bull run almost always ignites with a flood of cash into BTC. As its price skyrockets, it steals the spotlight from sluggish altcoins, and Bitcoin’s Dominance (BTC.D) climbs.

#2 Big alt awakening

After booking huge profits, BTC’s price takes a breather. Meanwhile, the euphoria from the rally emboldens investors to rotate their winnings into major altcoins like ETH and SOL. BTC.D usually flattens out or starts to slip.

#3 Large-cap altcoins catch fire

Now, both BTC and the top alts have made serious moves. Fresh capital continues its journey down the risk curve, pouring into other large-cap altcoins.

BTC.D drops more decisively — this is the starting gun for the altseason.

#4 Full-blown altseason & speculative mania

Speculation goes into overdrive. The rally explodes beyond the big names, engulfing mid-cap and tiny micro-cap tokens. This tidal wave of green pushes BTC.D to its lowest point in the cycle.

Key signals an altseason is coming

When these clues stack up, it’s time to pay very close attention.

- Declining BTC.D: Watch for a steady, sustained drop in Bitcoin dominance from a major peak. History shows altcoin rallies often kick off after BTC.D hits the 60-70% range.

- Bitcoin takes a breather: After a powerful BTC rally, its price starts moving sideways. This consolidation is the classic launching pad for altcoin explosions.

- Altcoin market cap wakes up: Keep an eye on metrics like TradingView’s TOTAL2 (total market cap minus BTC) and TOTAL3 (total market cap minus BTC and ETH). A strong, rising trend here signals money is flowing into the rest of the market.

- Altcoin trading volume spikes: A surge in trading volume for altcoins is a crystal-clear sign that investor interest is heating up.

Stablecoin wildcard

Stablecoins like USDT or USDC are part of the total market cap, so they directly fiddle with dominance math. But they’re not speculative assets; they’re pegged to flat money. This creates a quirk: every dollar parked in a stablecoin still counts as "altcoin" market cap, artificially diluting Bitcoin’s share and creating confusion.

Imagine a "risk-off" moment — say, the Fed hikes rates and spooks investors into safer havens. If they dump BTC and alts for stablecoins, that influx still props up the total market cap while BTC.D falls.

To a casual observer, it looks like alts are holding strong. In reality, everyone is running for cover. The stablecoin market cap acts as a mirror to sentiment: it swells in fear and shrinks when confidence returns and money flows back into volatile crypto.

Tools for identifying an altseason

Altcoin Season Index

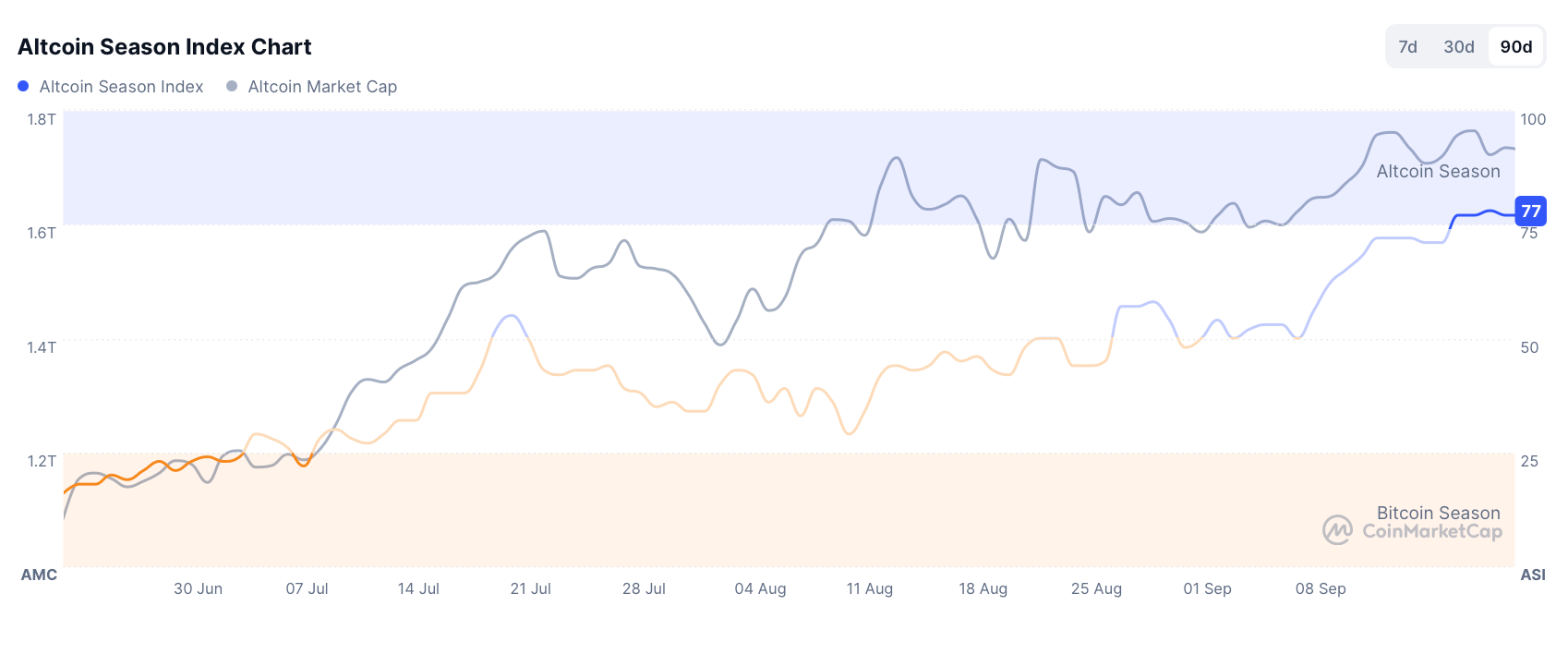

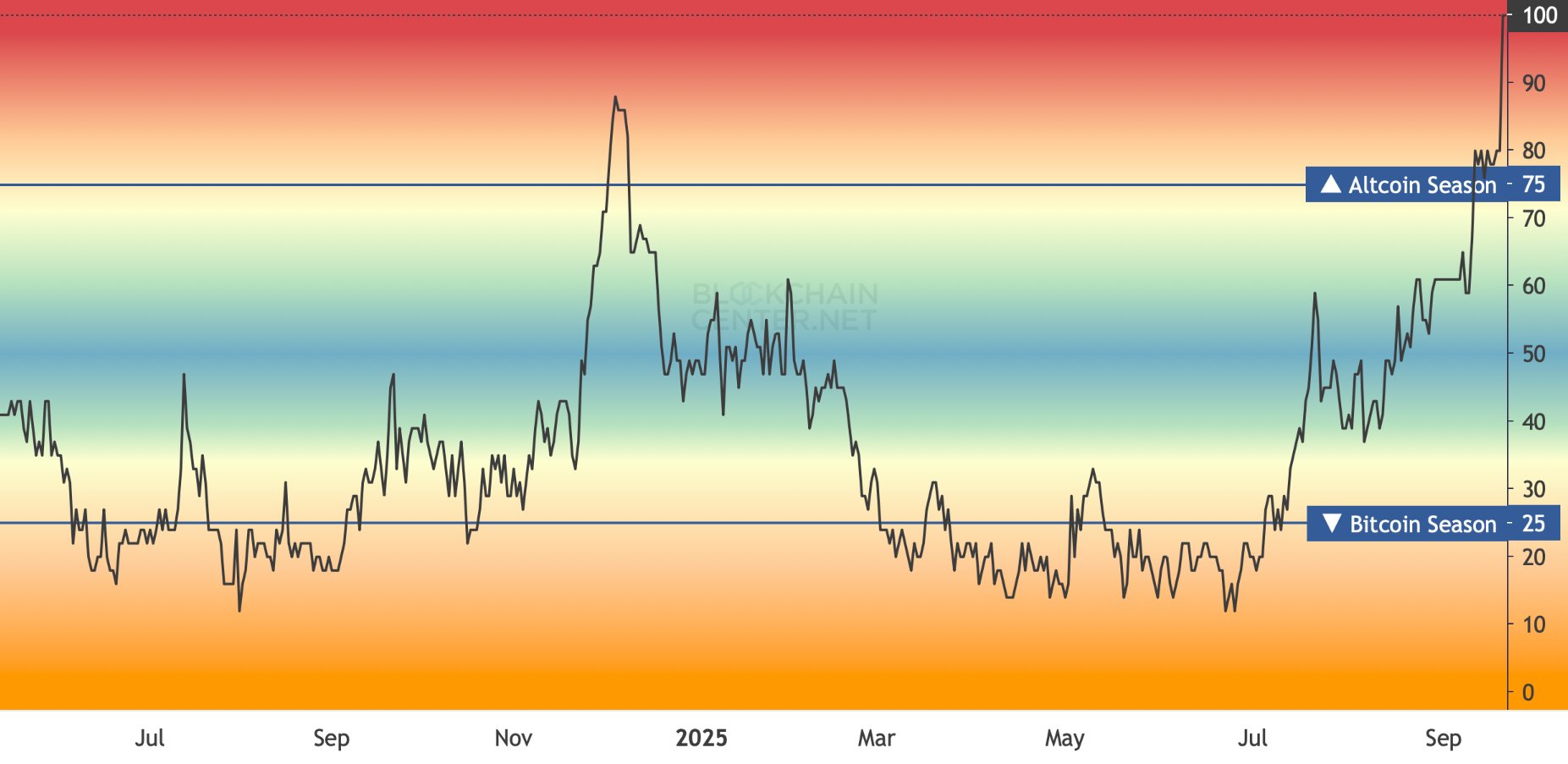

This handy tool tells you if the market is currently in an altseason — meaning a majority of top altcoins are beating BTC over the last 90 days. It’s great for confirmation, not prediction.

It analyzes the top 50 altcoins (excluding stablecoins and wrapped assets like wBTC).

- 0–25: Bitcoin is running the show

- 26–74: Neutral zone

- 75–100: It’s altseason!

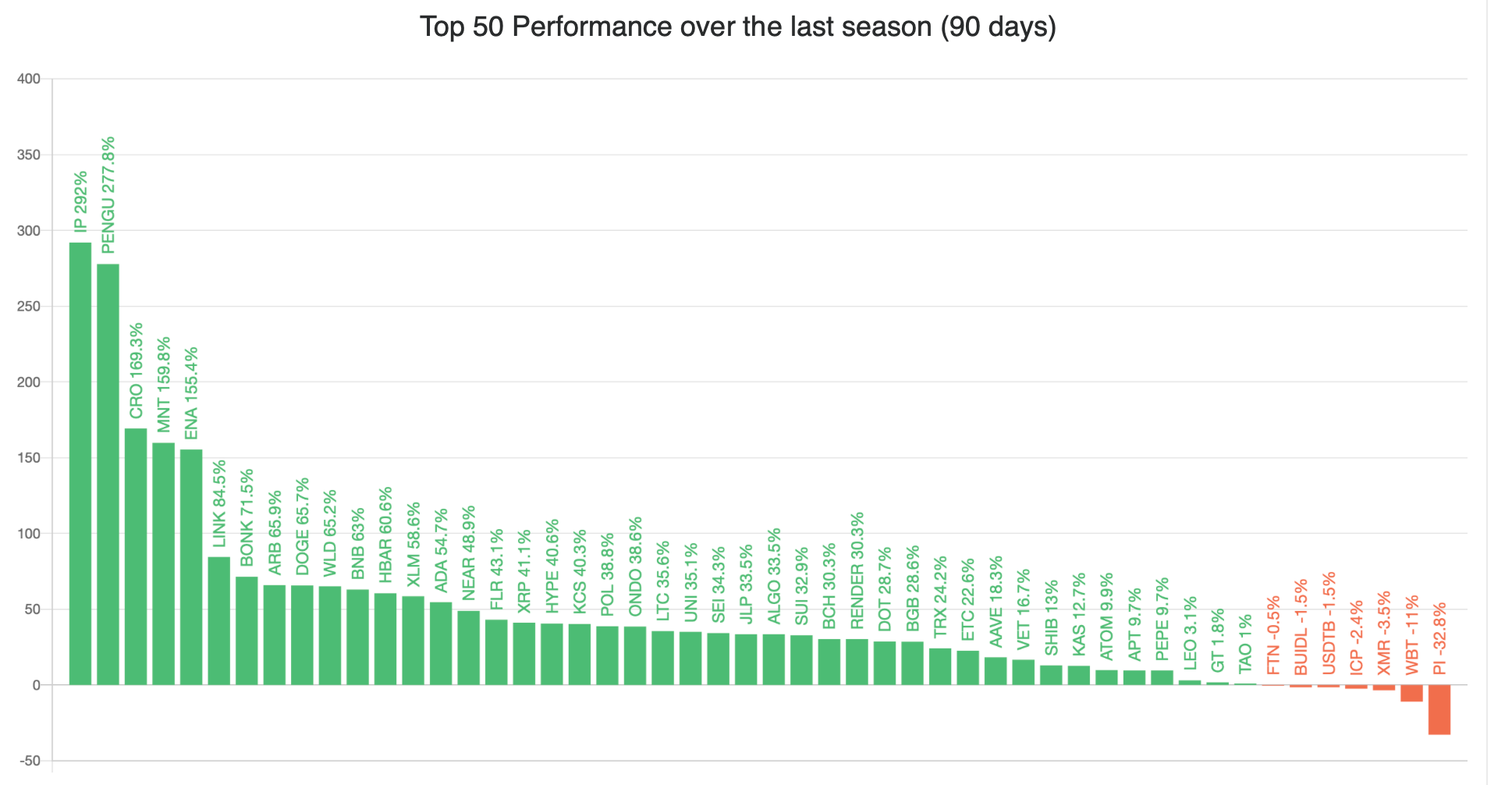

As of September 22, 2025, the index reveals an ongoing Altseason (100). This means that at least 75% of the top 50 coins have performed better than BTC over the past 90 days.

Your crypto dashboard

To spot the shift early, watch these charts:

- Total Crypto Market Cap (on CoinGecko or CoinMarketCap)

- Bitcoin Dominance Chart: The ultimate scoreboard.

- Stablecoin Market Cap Chart: Your fear gauge (remember the wildcard!).

- Altcoin Market Cap Chart: The pure altcoin story (everything except BTC).

- TradingView’s CRYPTOCAP:OTHERS.D: Tracks everything outside the top 10 coins. Steady growth here often means a hungry, risk-loving rally is brewing.

- Glassnode charts: For deep, on-chain intelligence on capital flows and what the smart money is doing.

Strategies for navigating an altseason

Here’s how to steer your portfolio through the chaos and cash in.

Playing the phases

Consider aligning your portfolio with the market’s mood swings:

- Phase 1. Bitcoin dominance: While BTC.D is climbing, you could let Bitcoin lead your portfolio.

- Phase 2. The rotation: As BTC.D peaks, it’s time to strategically shift profits into major alts like ETH and SOL.

- Phase 3. Altcoin dominance: With BTC.D falling and OTHERS.D rising, it’s time to boost your exposure to a wider range of altcoins.

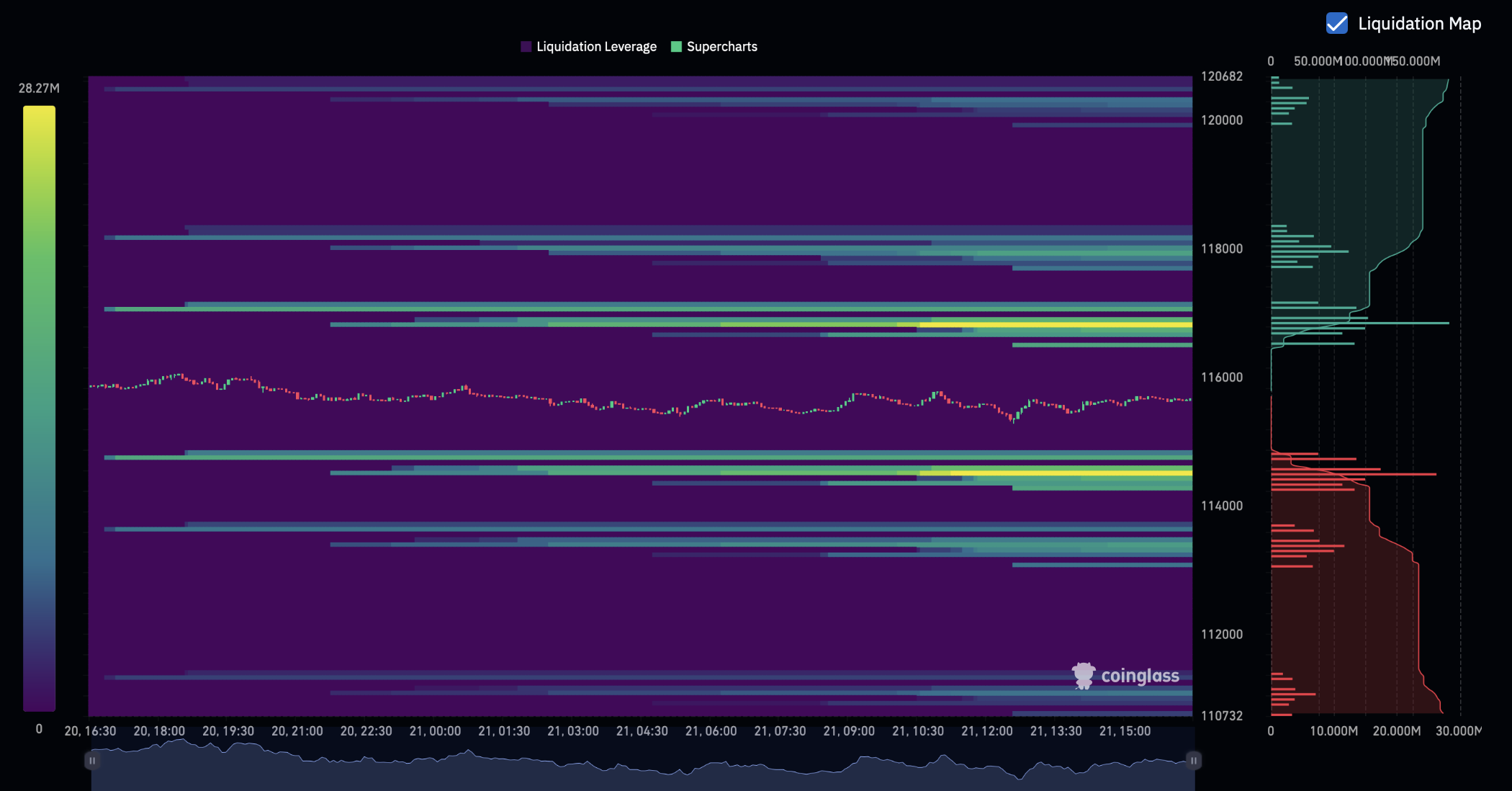

Watch the liquidation heatmaps

Altseasons are leverage festivals. Liquidation heatmaps show you where too many people are overextended. Use them to avoid — or anticipate — brutal snapbacks that can wipe out gains in minutes.

In simple terms, the heatmap predicts the price levels where a large number of leveraged trades are set to get automatically closed (or "liquidated") because traders have run out of collateral. Like an X-ray of the market, it reveals the hidden pressure points that could trigger a cascade of forced selling or buying.

The color scale shows the density of these potential liquidation clusters. A big blob of yellow is a danger zone — it’s where the market is most vulnerable, according to Coinglass.

- Magnet effect: A huge cluster of potential liquidations can pull the price toward it. Big players may even push the price there intentionally to trigger liquidations for their own gain.

- Support/resistance: High-liquidation zones often become major support or resistance. If the price reaches one of them and doesn't break through, the resulting wave of liquidations can create a powerful reversal.

Your two-metric sanity check

For a quick read on market mood, remember this simple combo:

- Rising BTC.D + rising USDT.D = FEAR (The crowd is fleeing to safety).

- Falling BTC.D + falling USDT.D = GREED (Sidelined cash is pouring back into the game).

Wrapping up

Navigating an altseason is all about understanding the market's rhythm — watch the flow of money, not just the price. A declining Bitcoin dominance, consolidation, and money rotating out of stablecoins reflect shifts in sentiment before the crowd takes notice.

Altseasons are born from a hunger for bigger risk and bigger reward; your job is to see that hunger building and position yourself accordingly in advance. Use tools like the Altcoin Season Index for confirmation, watch liquidation heatmaps to avoid the traps, and have a plan for each phase with clear risk management rules.