Privacy сoins explained: Your guide to anonymous crypto

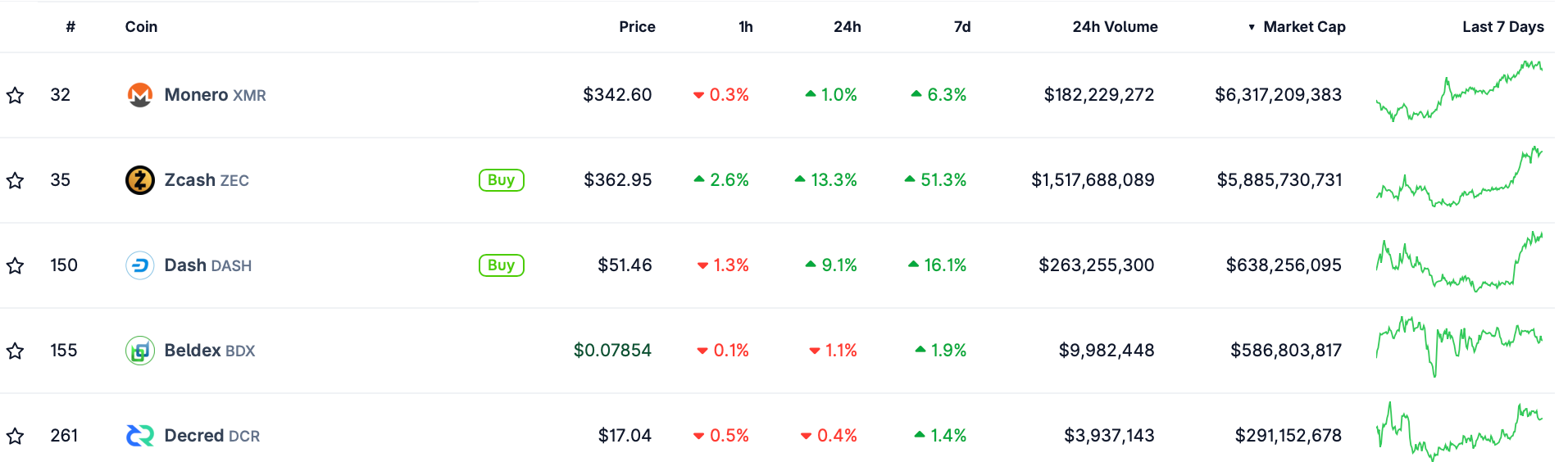

With Zcash skyrocketing an eye-popping 350% in two weeks, privacy coins are blazing back into the headlines. Traders are buzzing about a potential super cycle, fueled by surging demand for financial anonymity as governments worldwide tighten their grip with transparency rules.

Here’s your essential guide to the technology, use cases, features, and risks tied to privacy-focused crypto.

What are privacy coins?

Also known as Anonymity Enhanced Coins (AECs), these cryptocurrencies are engineered with a core focus on user privacy and transaction anonymity. While conventional crypto transactions are etched onto a public ledger for anyone to inspect, privacy coins shroud these details, making them nearly impossible to trace.

This digital sleight of hand is achieved through advanced cryptographic techniques. Compare this to Bitcoin:

- Bitcoin is pseudonymous: Transaction details are public, but user identities are hidden behind wallet addresses.

- Privacy coins are anonymous: They aim to completely conceal the entire transaction trail — the sender, the recipient, and the amount — from prying eyes.

Privacy coins are also fungible (each unit is identical and interchangeable) and decentralized, staying true to crypto's original ethos. Like regular cryptocurrencies, you can trade them on major exchanges and store them in standard crypto wallets — be it hardware, software, or online versions.

Furthermore, coins like Monero and ZCash can be mined. Similar to Bitcoin, miners use powerful computers to solve complex puzzles, validate transactions, and reap block rewards for their efforts.

A look at the major players

Here are a few of the most prominent privacy coins:

- Monero (XMR): The privacy powerhouse. It combines ring signatures and stealth addresses to conceal the sender, recipient, and amount of every single transaction.

- Zcash (ZEC): Offers "shielded" transactions. While data is encrypted on the blockchain, it uses zk-SNARKs (zero-knowledge proofs) to verify transactions without revealing any sensitive information.

- Dash (DASH): Provides bolstered privacy through an optional service called PrivateSend, which mixes user transactions together. It uses a modified version of the popular CoinJoin protocol, which mixes multiple inputs and outputs.

- Beldex (BDX): Powers a decentralized privacy-centric ecosystem that includes a messaging app (BChat), a VPN (BelNet), and a browser. Once a fork of Monero, Beldex is a proof-of-stake (PoS) blockchain and uses ring signatures and stealth addresses.

- Decred (DCR): Uses StakeShuffle, a proprietary coin-mixing protocol that anonymizes output addresses and removes the link between senders and recipients. However, privacy may be compromised if users reuse wallet addresses or mishandle the change outputs. Decred also uses PoW.

Why do privacy coins matter?

The hunger for confidential transactions is a direct response to relentless data breaches and increasing government scrutiny. For those who prioritize financial autonomy, these coins are a vital shield against surveillance. Regulators, however, often view them with deep suspicion.

Stablecoins and coin mixers feel the heat

Governments are cracking down on stablecoins, with traditional finance rules seeping into the crypto world. “Soon, any stablecoin issued by a country could face strict government regulation, similar to traditional banks,” according to CryptoQuant CEO Ki Young Ju.

This could mean smart contracts that automatically siphon off taxes at the moment of transfer. Regulations could also grant powers to freeze wallets or demand extensive paperwork.

Coin mixers, which obscure the money trail by blending transactions, are also in the crosshairs. In 2022, the US Treasury sanctioned Tornado Cash for allegedly helping launder over $1 billion.

More recently, in May 2025, German authorities seized €34 million from eXch, which was allegedly involved in laundering funds from the massive $1.4 billion Bybit hack. Like other mixers, it pooled user funds, making on-chain tracking a nightmare. The platform was ultimately shut down.

How do privacy coins actually work?

Privacy cryptocurrencies deploy a powerful arsenal of cryptographic techniques. When combined, they make it incredibly difficult to trace the flow of funds or link transactions to specific individuals.

- Ring signatures (Monero): A user's transaction is mixed in with decoy ones from the blockchain, making it virtually impossible to identify the true sender.

- Stealth addresses (Monero): Every transaction generates a one-time address, keeping the recipient's actual wallet address permanently off the books.

- Ring Confidential Transactions (RingCT on Monero): This clever technology hides the transaction amount from outside observers.

- Optional Features (Zcash): Users can toggle between public and private transactions, balancing their need for speed and privacy.

A closer look: Inside Zcash

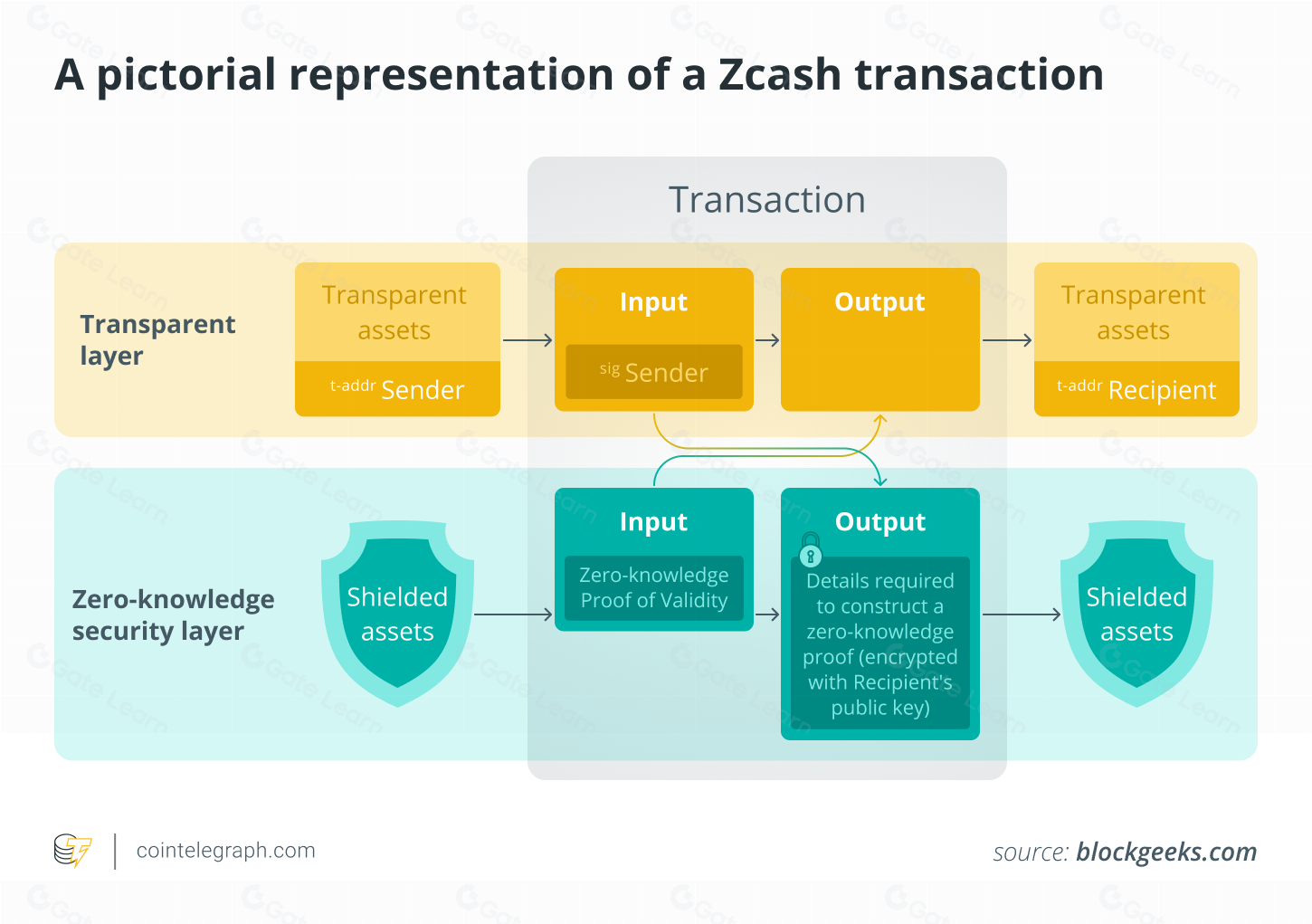

Like Bitcoin, Zcash is a proof-of-work coin with a capped supply of 21 million and quadrennial halvings to prop up its value. However, its blockchain merges Bitcoin’s battle-tested security with next-generation privacy.

The key innovation is in transaction verification — the sender, recipient, and amount stay hidden. Zcash users can transact without leaving a public data trail.

- zk-SNARKs technology: This mouthful (Zero-Knowledge Succinct Non-Interactive Arguments of Knowledge) allows the network to verify a transaction is valid without revealing a single detail about it.

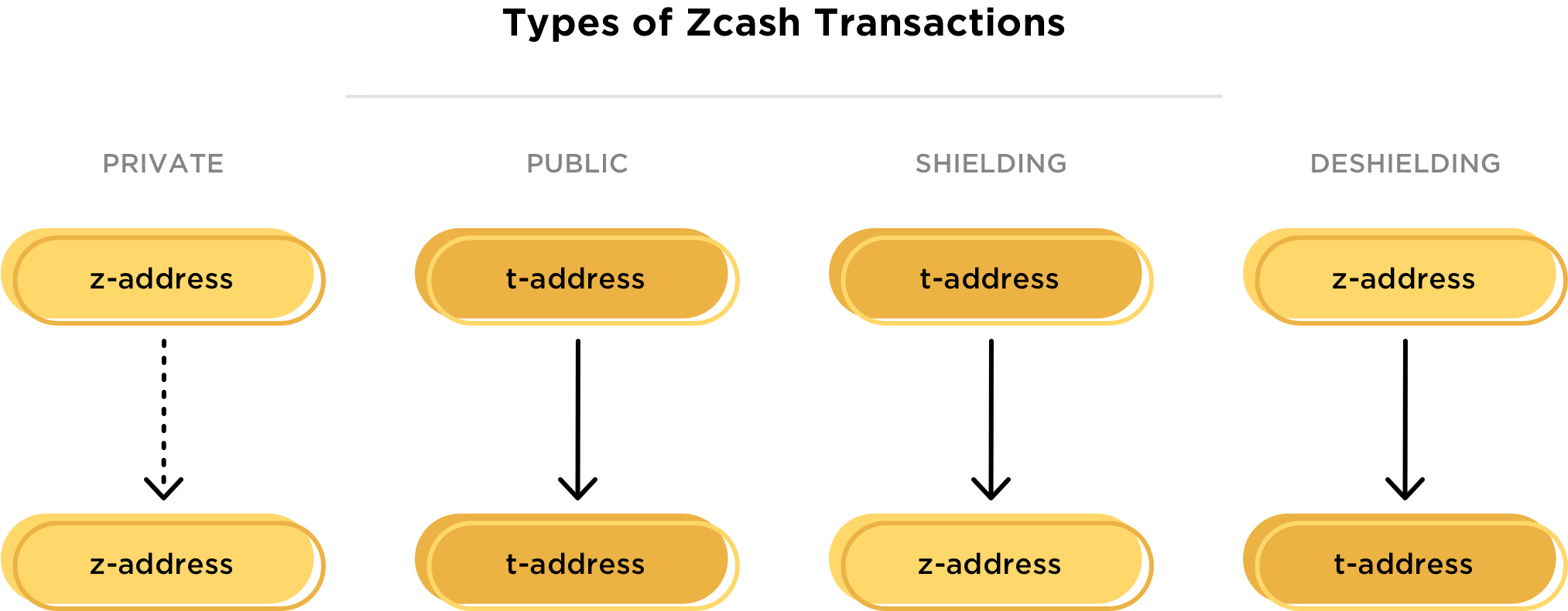

- Dual-address system: Users can choose between transparent addresses (t-addresses), which are public, or shielded addresses (z-addresses), which are fully private. This flexibility lets you move funds between public and private pools as needed.

- Proof-of-Work & Equihash: Zcash’s PoW consensus uses the Equihash algorithm, which resists the dominance of specialized ASIC miners, promoting a more decentralized and secure network.

Privacy coin use cases

Privacy coins have several compelling real-world applications:

- Shielding individual privacy: Allowing users to avoid financial tracking, censorship, and corporate or government surveillance.

- Confidential business dealings: Essential for transactions where secrecy is paramount, such as during mergers, acquisitions, or sensitive contract negotiations.

- Freedom in oppressive regimes: Providing a financial lifeline for people in countries where revealing wealth could lead to extortion or persecution.

- Empowering whistleblowers & activists: Enabling those fighting for change to transact safely without fear of reprisal.

- The dark side — illicit activities: Sadly, the very features that protect privacy also attract criminals looking to operate in the shadows.

Advantages of privacy coins

- These assets unlock true financial privacy. They offer a genuinely anonymous way to transact, which is non-negotiable for privacy-conscious individuals and organizations.

- The sophisticated cryptography behind these coins enables fortified security for your transaction data compared to traditional, transparent cryptocurrencies.

Risks & challenges for anonymous crypto

Regulatory hurdles

As of 2025, privacy coins are legal in the United States, but countries like Japan and South Korea have outright banned them from local exchanges. The EU is also preparing to ban anonymous crypto starting July 2027 under the new Anti-Money Laundering Regulation.

Overall, the regulatory landscape is a shifting patchwork, and their association with crime makes them a prime target for crackdowns.

Sheer complexity

The advanced tech under the hood can be a tough nut to crack for the average user, creating a steep learning curve for beginners.

Financial crime

Anonymity makes these coins a haven for money laundering, terrorist financing, and darknet market sales. Obfuscated transaction data and the cross-border nature of these networks create a nightmare for law enforcement: traditional investigation tools are nearly useless.

Should you invest in privacy coins?

Privacy coins offer a powerful tool for anonymous transactions, but they also navigate a regulatory minefield. As with any investment, it’s crucial to do your own homework, never invest more than you’re prepared to lose, and seek professional advice if you’re unsure.

Looking ahead: What's next for privacy crypto?

The future of privacy coins hangs in the balance of a high-stakes tug-of-war between regulators, technologists, and shifting public attitudes toward privacy. The methods to abuse and control this technology will advance lockstep with the technology itself.

While the growing global demand for digital privacy paints a promising picture, users must keep a wary eye on potential regulatory crackdowns. On the bright side, privacy coins are nimble by nature and are well-positioned to adapt and evolve, finding new ways to meet user needs while navigating the rules of the road.