Scarcity, burns, and airdrops: Investor's guide to tokenomics

Every cryptocurrency runs on code, but survives on economics. Tokenomics is crypto's financial DNA that governs supply, inflation, and distribution. These hidden rules separate flashy gambles from assets built to last.

What is tokenomics?

Tokenomics — the science of crypto economics — decodes how digital assets are designed and valued. It covers everything from launch strategies and token flows to real utility and investor rewards.

The level of complexity varies. Some projects mint tokens as purely speculative vehicles, others build multiple layers of utility around their native assets.

Components of tokenomics

A project's tokenomics reveals:

- How the asset will be/has been distributed to its community

- How much of its supply is circulating, locked, or vested

- How the holdings are divided between different insiders and investors

Tokenomics separates the long-term winners from the short-term hype. Traders and investors scrutinize these mechanics to predict sell pressure and spot hidden risks. Here's what really matters:

Token supply

This term describes the amount of a project's tokens in existence, calculated as total supply, circulating supply, and max supply.

- Circulating supply — The total amount of unlocked and tradeable assets.

- Total supply — All assets currently in existence (circulating supply + locked and vested tokens).

- Max supply — The total amount of assets that may ever be created within the cryptocurrency's lifetime.

The circulating supply is always equal to or below the total supply, which in turn is always equal to or below the max supply. If a project releases all of its tokens at a token generation event (TGE), its total supply and max supply are the same.

Some projects do not have a max supply at all, as there is no hard cap on issuance. For instance, Ethereum mints ETH perpetually to reward its validators. In comparison, Bitcoin has a max supply of 21 million coins — with 19,908,015 BTC circulating as of August 18, 2025.

Token distribution

Token distribution is a project's game plan with allocations and release schedules. It tells you when new tokens will enter circulation, how much of the total supply is locked, and who holds the rest.

Mining/staking rewards

Depending on a blockchain’s consensus mechanism, transactions and blocks are validated by miners (e.g., Bitcoin) or stakers (e.g., Ethereum).

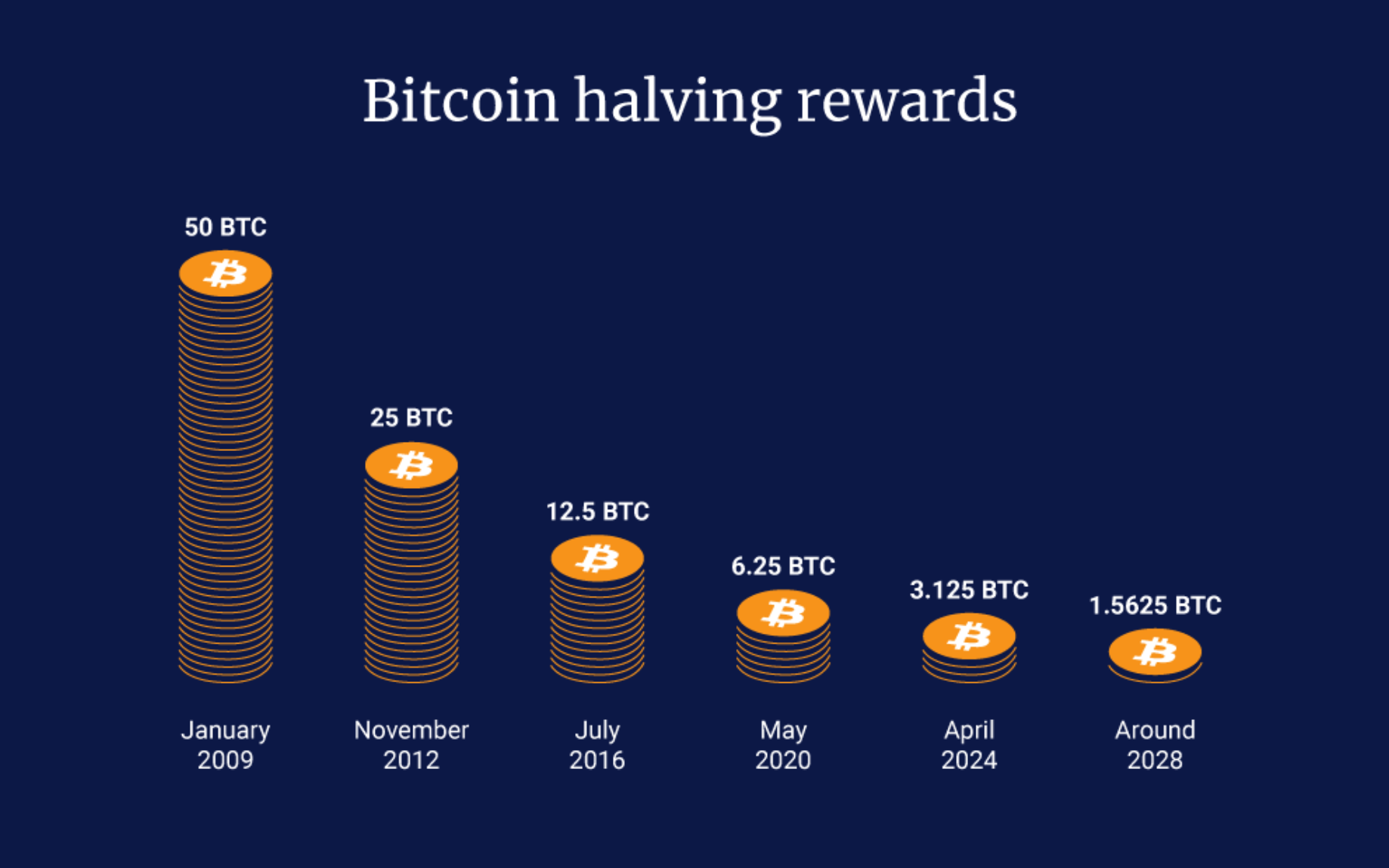

Validating a new Bitcoin block requires substantial computational resources. The size of mining rewards (in newly minted BTC) shrinks by 50% after each halving event — roughly every four years. In addition, miners earn all the transaction fees included in the blocks they successfully validated.

Ethereum's proof-of-stake (PoS) system picks validators at random from those who have staked at least 32 ETH. When selected, they bundle transactions into a block and propose it to the network. Other validators then vote on the proposed block. If approved, it is added to the blockchain, and the proposer earns a reward.

Initial Coin Offering (ICO)

Similar to companies going public by selling stocks in initial public offerings (IPOs), crypto projects can raise money by offering tokens to investors.

This tactic was extremely popular in 2017–2018, when multiple ICOs reached billion-dollar valuations. The largest ICO in history was conducted by Block.one for the EOS token, with over $4 billion raised and over 1 billion tokens sold.

Legal complications and lawsuits against high-profile ICOs made them less prevalent in later years. Yet in July 2025, memecoin launch platform Pump.fun made headlines with an ICO that raised $500 million in about 12 minutes.

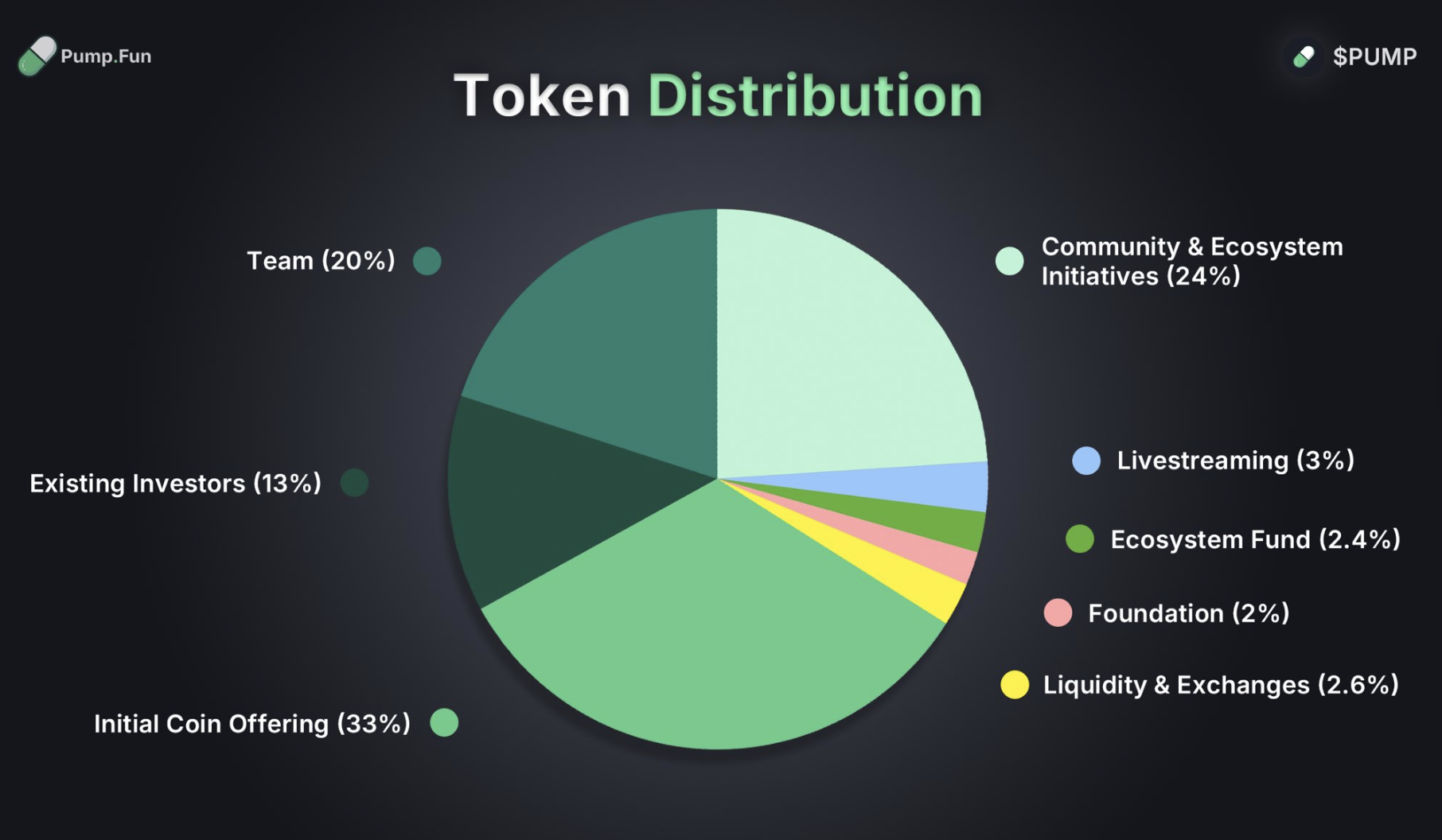

From the maximum PUMP token supply of 1 trillion, 33% was allocated to the ICO — with 18% distributed to institutions and 15% offered to retail traders.

Airdrops

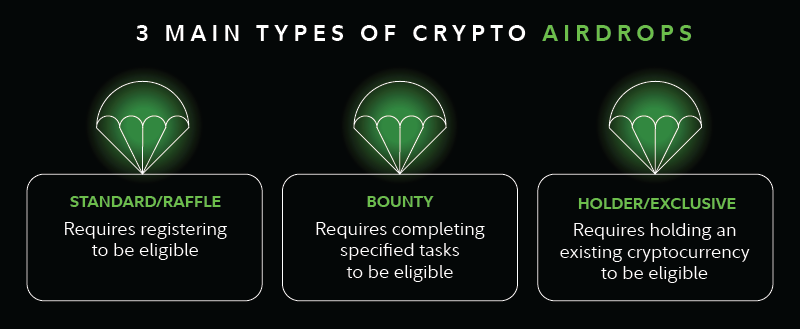

Some projects release a portion of native tokens to their communities for free. These assets are either sent to members’ wallets directly or claimed manually.

Airdrops attract attention, reward early users, and expand the project's following. They are legally safer than ICOs — and thus more common, requiring no financial investment from the recipients.

An airdrop may involve an allowlist with eligibility criteria. Alternatively, allocations could follow a point system — with users rewarded proportionately for specific protocol interactions.

Team/investor allocations

Projects reserve portions of token supply for their developers and investors. These allocations are typically locked and/or vested over several years to align incentives with long-term value creation and encourage continual development.

Locked and vested amounts translate into looming sell pressure. Token unlock events — when additional assets enter circulation — often trigger substantial price volatility.

DAO/grants

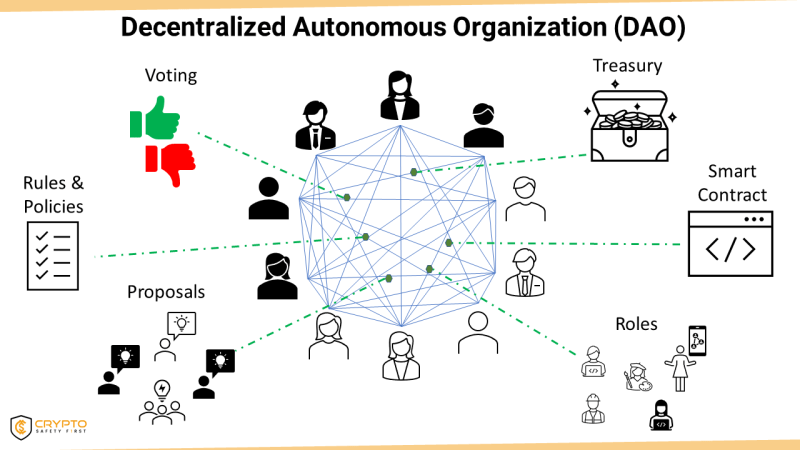

Some token issuers operate as decentralized autonomous organizations (DAOs), co-owned by all stakeholders. A project may allocate a portion of its supply to fund grants for other projects building within its ecosystem.

Token utility

Token valuations generally involve a mix of present utility and speculation on future price movements. Utility is defined by practical use cases and value propositions, including:

- Transaction fees — Using a cryptocurrency to cover transaction costs on a blockchain (e.g., ETH for gas fees on Ethereum).

- Staking — Some projects reward users who lock up tokens to participate in governance or support network security. Rewards often come in the form of additional tokens or airdrops.

- Access — Tokens may grant access to features, services, or membership tiers within a platform (e.g., holding tokens to join an exclusive community).

Demand & incentive programs

Demand for a token (the number of willing buyers at various price points) can be influenced in multiple ways.

- Incentives — Rewards for actions like onboarding, voting, or contributing to security.

- Token burns — Permanently removing tokens from circulation to reduce supply and create scarcity (e.g., Sky Protocol, formerly MakerDAO, uses buyback-and-burn mechanisms).

- Liquidity mining — Rewarding users who deposit assets into DeFi protocols (e.g., Compound’s 2020 COMP token rewards for depositors).

Governance

Governance encompasses decisions that determines a token's future. Some protocols leverage these mechanisms to drive value to their assets — with varying degrees of success. Governance may be classified as:

- Centralized: A single entity (e.g., a company or core team) controls all major protocol decisions.

- Decentralized: Power rests with tokenholders that vote on proposals — often via on-chain systems. DAOs typically hold a dedicated allocation to fund development, grants, or ecosystem growth, ensuring long-term stakeholder alignment.

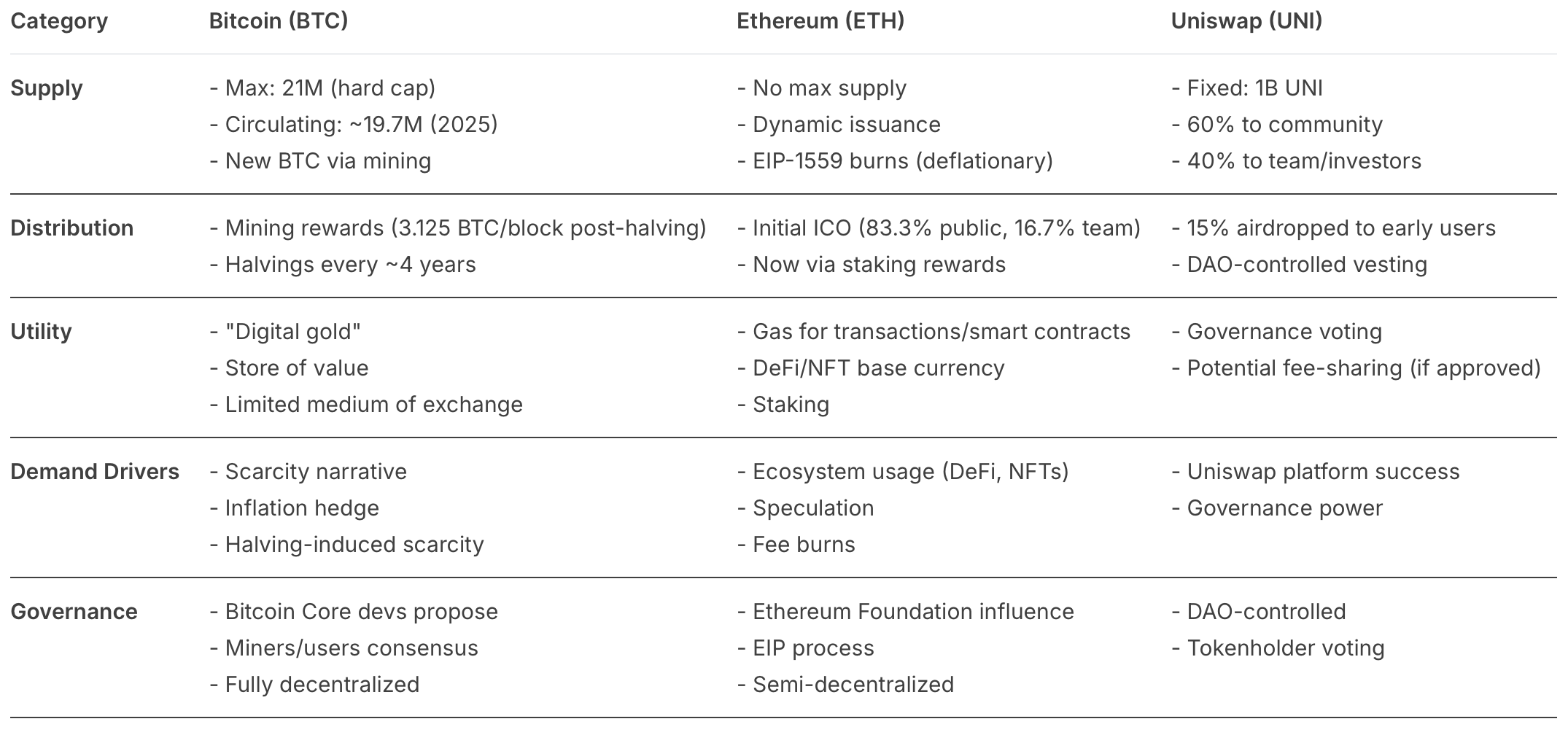

Comparing tokenomics: BTC, ETH, UNI

Wrapping up

Tokenomics is the backbone of every crypto project, shaping everything from price swings to long-term survival. From Bitcoin’s predictable scarcity to Uniswap’s community-driven governance, it tells you who really holds power, where sell pressure might hit, and whether a token has staying power.

Ignoring tokenomics is like trading stocks without checking a company’s financials — you might get lucky, but you’re playing blind.