Surviving the dip: Top 10 worst Bitcoin crashes

On Oct. 10, 2025, a post from President Trump threatening China with 100% tariffs triggered a crypto Black Friday. Panic wiped out a staggering $19 billion in leveraged crypto positions in a single day — yet it wasn't even the most brutal percentage drop in Bitcoin's wild history.

From the Mt. Gox hacks to China's crackdowns and the stunning FTX meltdown, here’s a look back at every time Bitcoin plunged.

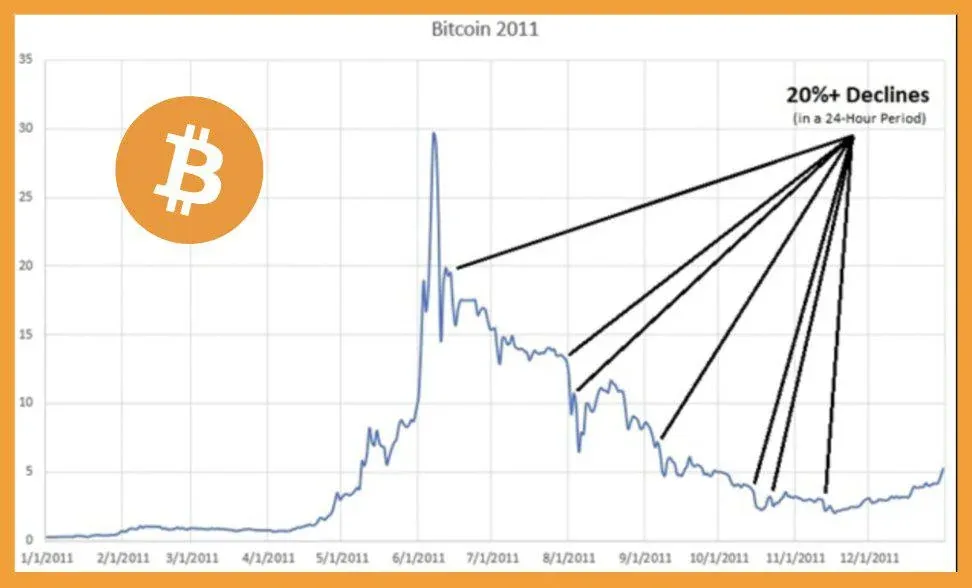

#1 Mt. Gox flash crash (June 2011)

Back in 2011, the Tokyo-based Mt. Gox exchange was the epicenter of the crypto world, handling a massive 70% of all Bitcoin trades. An infamous hack saw millions in BTC vanish, siphoned off to a single whale — the hacker. This breach shattered the community's faith in crypto security and ignited a panic.

The attack happened on June 15, but wasn't discovered for days. Using a compromised auditor account, the thief made off with 840,000 BTC. When they started dumping these coins, the market imploded.

In a single day, BTC nosedived a mind-boggling 99.9% — to just one cent — right after hitting a peak above $32. To this day, this remains the most severe crash in Bitcoin's history.

At the time, the stolen coins were worth about $460,000. Today, that haul would be worth a breathtaking $94 billion.

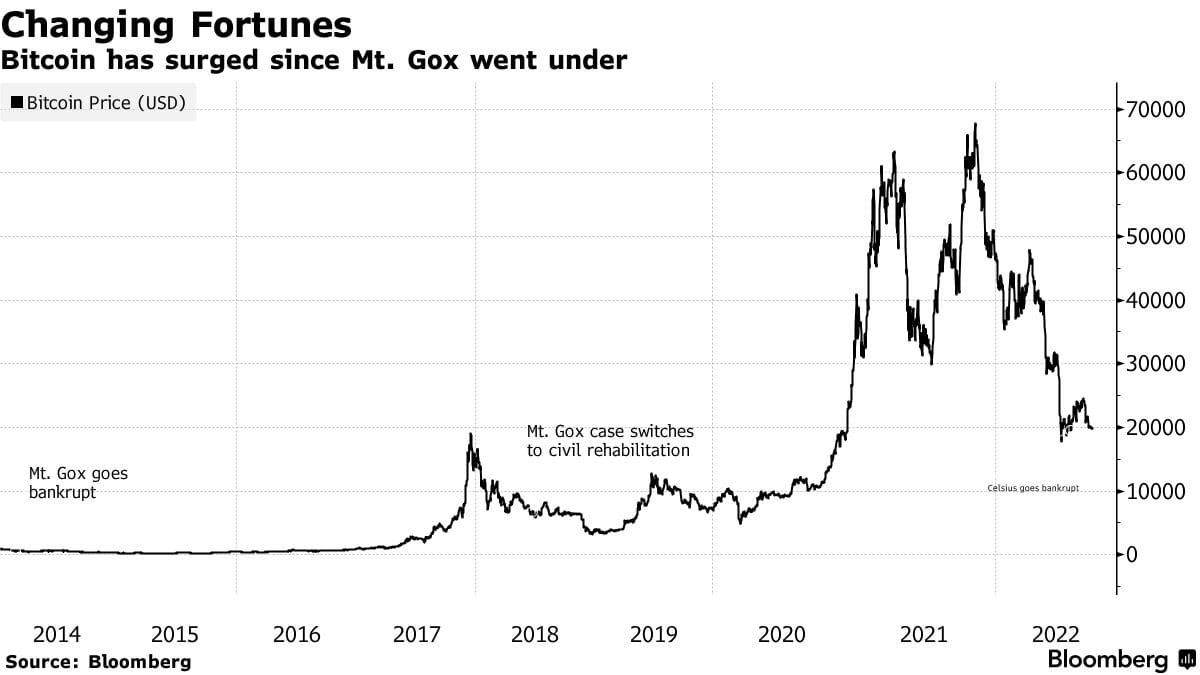

#2 Another Mt. Gox meltdown (April 2013)

Just two years later, Mt. Gox was bleeding again from another massive cyberattack. This time, the exchange blamed distributed denial-of-service (DDoS) attacks, which bombarded its site with traffic until it buckled under the pressure.

With trades constantly freezing, a sharp sell-off erupted. BTC tumbled about 43%, crashing from $265 to $150. In a since-deleted post, Mt. Gox laid out the hackers' ruthless strategy:

“Attackers wait until the price of Bitcoins reaches a certain value, sell, destabilize the exchange, wait for everybody to panic-sell their Bitcoins, wait for the price to drop to a certain amount, then stop the attack and start buying as much as they can. Repeat this two or three times like we saw over the past few days and they profit.”

#3 China ban panic (December 2013)

Late 2013 was a glorious run for Bitcoin, boasting an incredible 89-fold gain in a year. By November, it smashed through the $1,000 barrier for the first time, climbing to $1,200 by December 5. The party ended just two days later.

The People’s Bank of China dropped a bombshell, forbidding financial institutions from handling Bitcoin transactions and dismissing it as a “virtual good” with no legal standing.

The news slashed the price almost in half, dragging it below $600. Around the same time, former Fed Chairman Alan Greenspan piled on, publicly slamming the coin as a baseless “bubble.”

#4 Another China ban shock (September 2017)

In September 2017, rumors swirled that China was preparing to shutter its domestic crypto exchanges, unleashing fresh market panic. This came right after Beijing outlawed initial coin offerings (ICOs) as an “illegal” fundraising tactic.

The sell-off was fierce, pushing BTC down roughly 25% in just two days (September 14-15) — from $4,400 to $3,300. The crash coincided with major exchanges like BTCC, Huobi, and OKCoin confirming they were shutting their doors.

This ban marked the end of China's dominance in crypto, scattering global liquidity to friendlier hubs like Japan and Korea.

#5 Great leverage unwind (December 2017)

This crash was fueled by the frenzy around the first regulated Bitcoin futures markets. These cash-settled contracts debuted on Wall Street giants Chicago Board Options Futures Exchange (CBOE) and Chicago Mercantile Exchange (CME).

While Bitcoin derivatives already existed on unregulated, offshore platforms like BitMEX, the arrival of these mainstream players changed the game. Bitcoin was soaring toward the mythical $20,000 mark, but the celebration was short-lived.

The price collapsed 33.3%, plummeting from $16,500 on Dec. 22 to around $11,000 the next day. This plunge kicked off a grueling year-long bear market. A Fed report later dryly noted that the timing of the futures launch and the subsequent crash “does not appear to be a coincidence.”

#6 COVID and "Black Thursday" (March 12, 2020)

Bitcoin's pandemic crash began just after the WHO declared a global health crisis. BTC first slipped from nearly $10,000 below $8,000, and then went into a freefall, nosediving to near $4,850. The bloodbath vaporized almost half of Bitcoin's value and wiped out over $1 billion in leveraged long positions.

The liquidation cascade ripped through exchanges like BitMEX and Binance, earning the infamous title “Black Thursday.” The event reshaped the crypto landscape, with BitMEX permanently losing its crown as the king of BTC futures to rivals like Binance.

Yet, from the ashes came one of Bitcoin's most spectacular comebacks. The following months saw a historic bull run, smashing every record. By December 2020, BTC was flirting with $30,000.

#7 China crackdown and "Black Wednesday" (May 2021)

After hitting a stunning record high of $64,000 in April 2021, Bitcoin was sucker-punched the very next month. First, Elon Musk's Tesla backpedaled on accepting Bitcoin, citing environmental concerns around mining. The reversal wiped a staggering $1 trillion from the entire crypto market.

A week later, China delivered another blow, this time targeting Bitcoin miners. Within hours of the announcement, panic selling and liquidations vaporized roughly $8 billion from leveraged positions.

On what became known as "Black Wednesday" (May 19, 2021), BTC plunged 30% in a mere 12 hours, from $43,000 to $30,000. By late June, it had slumped below $30,000 for the first time in half a year.

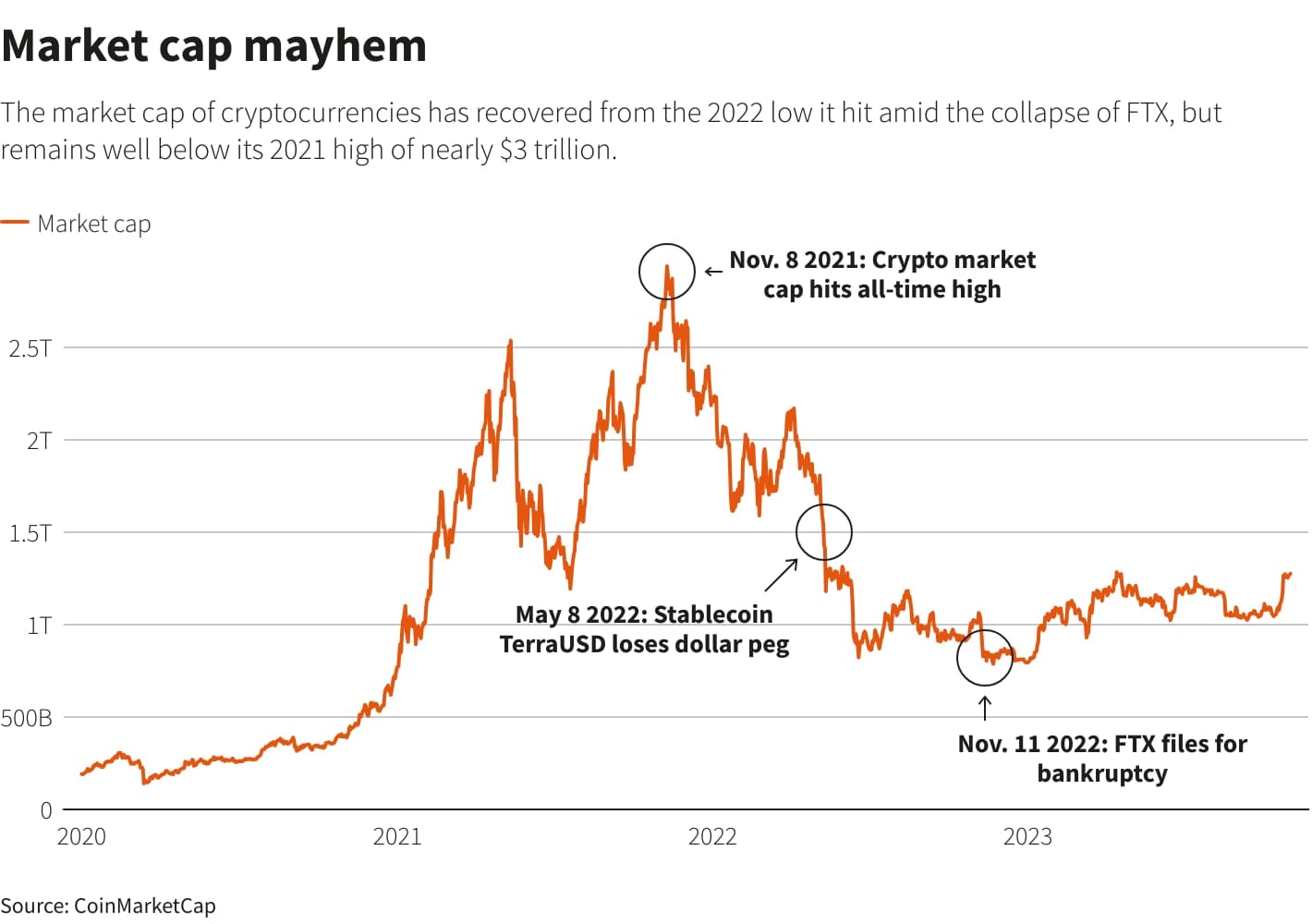

#8 Celsius freeze (June 13, 2022)

The crypto world was still trembling from the Terra/Luna catastrophe in May when a new nightmare erupted. On June 12, 2022, the giant lending platform Celsius Network froze all withdrawals, swaps, and transfers, blaming “extreme market conditions.”

The move ripped the curtain back on the shaky foundations of the "CeFi" lending model. Celsius had lured depositors with juicy yields but was rumored to be drowning in bad debts and exposure to the Terra collapse. Overnight, millions of users found their funds locked, sparking a full-blown liquidity crisis.

The panic hammered the markets immediately. Bitcoin, which had been hovering around $26,000, cratered 15% to below $22,000. The Celsius freeze unleashed a "crypto credit crunch" that would eventually swallow several other major players.

#9 FTX crumbles into bankruptcy (Nov. 8-9, 2022)

In late 2022, the market was rattled by whispers of a liquidity crunch at Sam Bankman-Fried's crypto empire, FTX. A staggering $451 million in stablecoins fled the exchange in a week, and rival Binance dumped its entire stash of FTX's token, FTT.

On Nov. 8, BTC crumbled from about $20,500 to $16,900, a brutal 17% loss in 24 hours. When FTX then halted withdrawals, the price spiraled further down to $15,600.

On November 11, the exchange filed for Chapter 11 bankruptcy—a collapse that would send shockwaves through the industry for years. The implosion, driven by fraud and epic mismanagement, shattered investor confidence and triggered "bank runs" on other platforms as everyone scrambled to get their money out.

#10 Grayscale & recession fears (April-September 2024)

After a blazing rally in late summer, Bitcoin hit a wall in September 2024. The price slid from over $64,000 in late August to a low of $53,000 in early September, a gut-wrenching 20% drop.

Two powerful forces drove the downturn. First, the Grayscale Bitcoin Trust (GBTC), now an ETF, was persistently offloading BTC in early Q2, flooding the market and creating relentless selling pressure. Second, a cloud of global economic gloom returned, with fears of the US Federal Reserve holding interest rates high. This spooked investors into fleeing risky assets across the board.

The one-two punch of Grayscale's technical selling and a souring macroeconomic mood was enough to kill Bitcoin's momentum and trigger a sharp correction.

Wrapping up

If there's one constant in the volatile world of Bitcoin, it's the certainty of another crash around the corner. These dramatic plunges are triggered by a familiar cast of characters: regulatory crackdowns, exchange failures, leveraged liquidations, and macro fears. Yet, each time the market is left for dead, it has staged a remarkable resurrection, clawing its way back to new heights.