The final Bitcoin: what happens after the last coin is mined?

According to Satoshi Nakamoto's design, the final Bitcoin is due to be mined around the year 2140. When the capped supply is fully distributed, miner rewards will be limited to a share of transaction fees — and a dwindling security budget could potentially make the network more vulnerable to attacks.

Here's a deep dive into how this watershed could affect the biggest coin.

What will actually happen in 2140?

The Bitcoin blockchain is programmed to stop issuing new coins once the maximum supply (21 million) is reached. Miners — the powerhouses that process and validate transactions to secure the network — will then receive compensation solely from transaction fees, as the block rewards will be a thing of the past.

This shift is crucial because these fees act as the network’s “security budget.” A significant drop in this budget could, in theory, weaken Bitcoin's long-term defenses.

Doomed future?

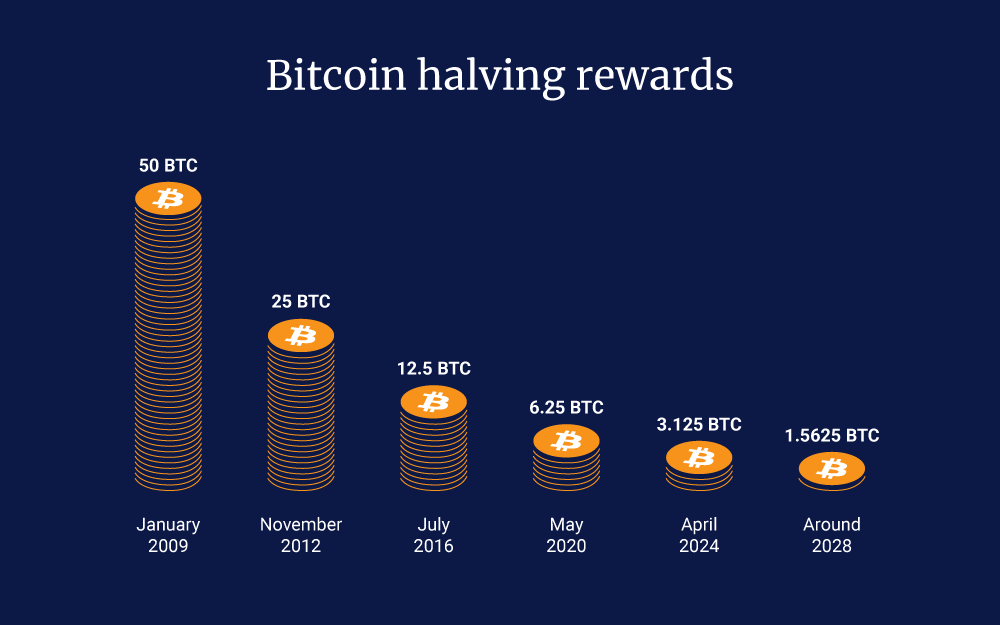

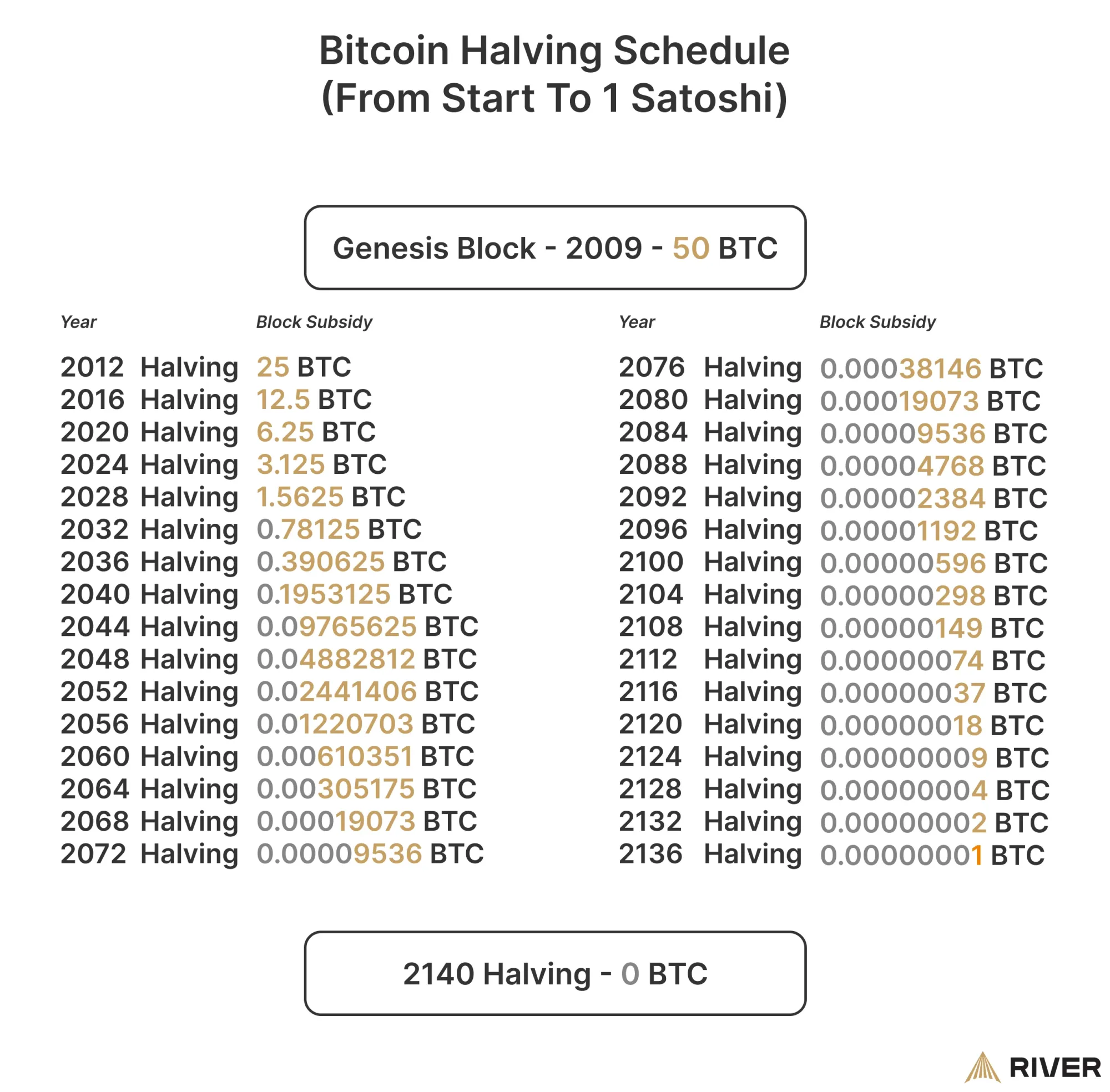

Bitcoin's legendary scarcity — the core fact that there will only ever be 21 million coins — is one of its most cherished features, forming the bedrock of its “digital gold” narrative. This very principleensures block rewards, or the subsidy for miners, taper off every four years through events known as Bitcoin halvings, until they vanish completely.

However, these regular reductions create a pressing long-term challenge. The block subsidy is currently the main incentive for miners, who pour computing power into protecting the network. Once it's gone, they will only collect transaction fees.

The multi-billion-dollar question is: will that be enough to keep the network safe?

Bitcoin's incentive model

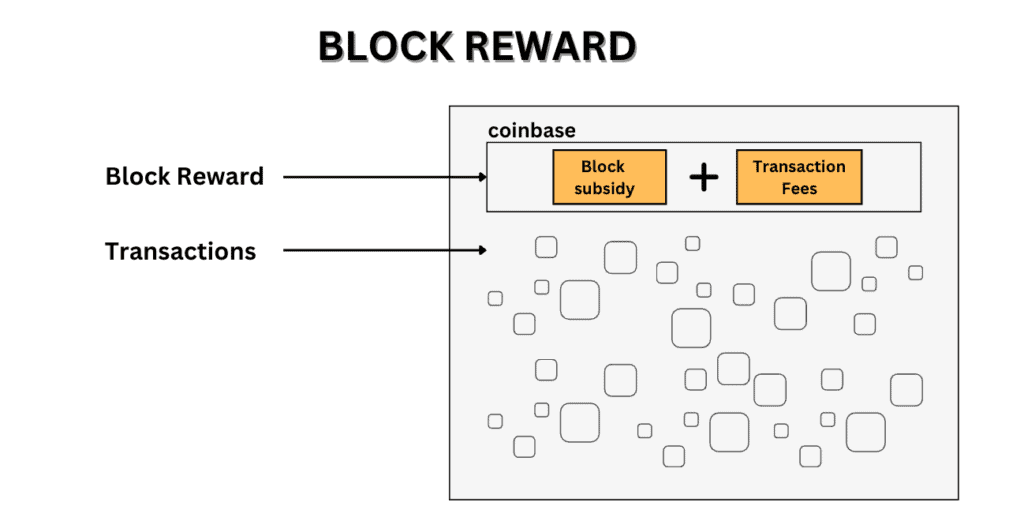

Here is how Bitcoin security works today. Roughly every ten minutes, a miner successfully processes a new block of transactions and receives a two-part reward: the block subsidy plus a bundle of transaction fees.

- Block subsidy. Since Bitcoin's launch in 2009, the subsidy has plummeted from 50 BTC per block to 3.125 BTC today — thanks to four halvings (in 2012, 2016, 2020, and 2024).

- Transaction fees. These are essentially “tips” paid by users to jump the queue and get their transactions added to a block. As of now, the average fee hovers around $1.30 per transaction.

Bitcoin block rewards in 2025

As of July 2025, each new Bitcoin block contained roughly 0.025 BTC in transaction fees, paired with the 3.125 BTC subsidy. The total earnings per block therefore amounted to ~3.15 BTC.

The stark reality is that transaction fees currently represent a minuscule part of a miner's income, meaning their operations would almost certainly be unprofitable without the block subsidy.

Bitcoin halving: a recurring efficiency test

Every halving instantly slashes each miner's revenue by 50%. It is a brutal survival of the fittest — only the most efficient operations remain profitable, while less competitive miners are forced to throw in the towel.

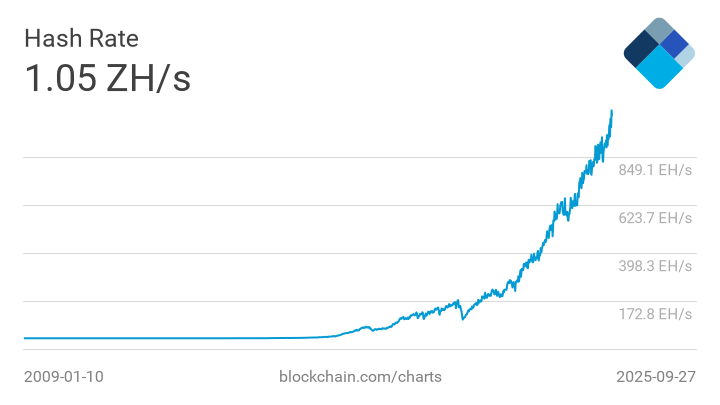

The biggest potential consequence is a decline in the total network hashrate.

Bitcoin's network hashrate & security

Hashrate is the combined computational power dedicated to securing the Bitcoin network. As miners power down, it tends to drop, potentially rendering the network more exposed to cyber attacks and/or leading to greater centralization.

However, Bitcoin optimists point to the coin's soaring price and projected demand growth. They argue these factors could still make a transaction fee-only model financially sustainable for miners.

Bulls vs bears: Bitcoin’s post-subsidy future

Each halving eats into the security budget, theoretically making the network incrementally less secure. Could a massive surge in demand change this trajectory? Let's weigh the arguments from bulls and skeptics.

Fee revenue

- Bull case: Demand for Bitcoin block space could rocket, naturally pushing transaction fees higher as new use cases (like a potential Bitcoin DeFi ecosystem) emerge.

- Bear case: This growth is far from guaranteed — such hopeful projections rely on widespread institutional adoption, Layer 2 rollups, and breakthroughs we haven't even imagined yet. Historically, fees have been notoriously volatile and a negligible part of the security budget, with no clear pattern of rising enough to offset the shrinking subsidy.

Use cases

- Bull case: Enthusiasts expect Bitcoin to evolve into a global payment rail and settlement layer for high-value transactions. In this vision, high fees would be a reasonable cost of doing business.

- Bear case: If Bitcoin falls short of this goal, transaction volume might be too low to generate meaningful fee revenue.

Price

- Bull case: In theory, as BTC climbs in value, so does the dollar-denominated value of fees — making even small BTC fees enough to sustain security. Proponents see the network blossoming into a multi-trillion dollar asset class, guaranteeing substantial revenue for miners even without subsidies.

- Bear case: Relying on a forever-rising price is a gamble, pure and simple.

Potential risks of a shrinking security budget

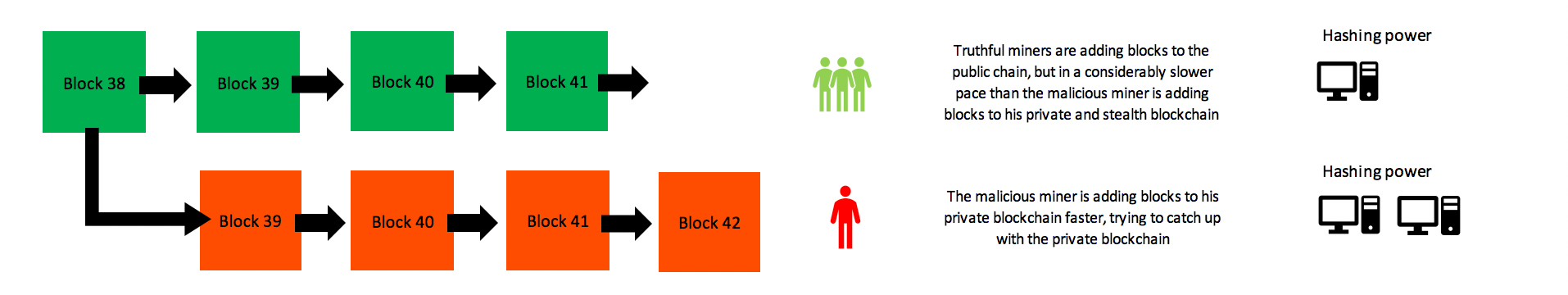

Simply put, the lower the miner profitability, the lower the total network hash rate — which could trigger a domino effect of risks. The most feared of all is the 51% attack.

In this nightmare scenario, a single entity seizes control of the majority of the network's hashrate (at least 51%), gaining the power to reverse transactions (double-spend) or block certain transactions.

A hefty security budget draws in more hashrate, making such an assault more prohibitively expensive. Right now, the cost is astronomical for any sane actor: the BTC price would tank, and the attacker's own hardware would become worthless.

However, a nation-state willing to wreak havoc could stomach such losses — for instance, for geopolitical gain. The smaller the security budget, the cheaper the attack, and the more realistic the threat becomes in the long term.

Hashrate volatility

The most direct risk from vanishing subsidies is miner capitulation — a situation where a wave of miners cease operations as their revenue dries up. The resulting drop in hash rate does trigger a difficulty adjustment, but a sudden, mass exodus could briefly open a dangerous window of vulnerability.

Solution: Incessant innovation

Bitcoin adoption is the ultimate key to mitigating the risks of its gradually shrinking security budget. Currently, the most promising examples include:

Layer 2 (L2) blockchains

L2 solutions are secondary networks built on top of the Bitcoin mainnet that aim to overcome its on-chain capacity limits. Moving transactions to L2s makes them lightning-fast and far more affordable.

For instance, the Lightning Network enables Bitcoin use for small, everyday transactions. In Vietnam, the Bitcoin Saigon community has teamed up with local coffee shops and markets that accept BTC payments seamlessly via the Lightning Network.

Bitcoin Runes

Runes is a token standard that lets users create meme coins and community tokens on the Bitcoin blockchain. After exploding in popularity in 2024, it leverages two key elements:

- Bitcoin’s UTXO model: A wallet's balance is made up of individual pieces of unspent BTC, much like bills and coins in a physical wallet.

- OP_RETURN opcode: A function that allows a tiny amount of data to be attached to a BTC transaction, akin to writing a memo on a check.

At its frenzied peak in April 2024, Runes drove average BTC transaction fees to a staggering $127 per transaction. Unsurprisingly, the hype has since cooled.

Future BTC Experience: Users vs. investors

Looking ahead, sending transactions directly on Bitcoin’s main chain (Layer 1) will likely become a premium service — and hence reserved for high-value transfers. Your daily coffee purchases, however, will almost certainly run on other technical solutions — such as Layer-2 chains like the Lightning Network.

Investors, meanwhile, will watch a high-stakes tug-of-war between Bitcoin's security and its scarcity. Its fixed supply has lured massive institutional and retail capital — but if network security is perceived as weak, it could undermine its long-term value.

In the end, the BTC price will depend not only on its technical underpinnings but also on the market's collective faith in its ability to stay secure.

Wrapping up

With a whole century remaining between now and 2140, any discussion of a subsidy-free Bitcoin is inherently speculative. But one thing is clear — when the last Bitcoin is mined, the world's firstcryptocurrency will face its ultimate trial.

The protocol's final state, as envisioned by Satoshi Nakamoto, is a bold challenge to its long-term security and value. Layer 2 innovation and a thriving, competitive fee market, fueled by high-value settlement demand, seem essential to its enduring success. But in the end, only time will tell how the original crypto will navigate its slowly shrinking security budget.