Uniswap's UNIfication proposal: Reshaping DeFi's future

Uniswap's UNIfication proposal, unleashed on November 10th, 2025, ignited a fiery 40% rally in just 24 hours. This sweeping governance overhaul — finally tethering the token's value directly to protocol fees — sent UNI soaring. Here is a deep dive into one of the most earth-shaking proposals for DeFi in 2025.

What is UNIfication?

Unveiled by Uniswap founder Hayden Adams, the UNIfication proposal introduces a radical, top-to-bottom reevaluation of the ecosystem. It finally flips the switch on long-debated protocol fees, pumps token burns, and overhauls governance and treasury management.

Uniswap has been the heart of decentralized trading for over 5 years. Yet, despite a staggering cumulative volume of $1.8 trillion, it has run without protocol fees, leaving UNI with just governance utility. This meant zero yield opportunities and no revenue backbone for the token.

UNIfication aims to morph UNI into a versatile income-generating asset. For the entire DeFi landscape, it signals a seismic shift toward a more transparent, value-driven, and sustainable model — potentially setting the gold standard for how protocols generate and distribute revenue.

Reshaping UNI’s value capture

At its heart, UNIfication unleashes two fundamental changes that finally allow UNI to harness real value from the network.

Activating protocol fees

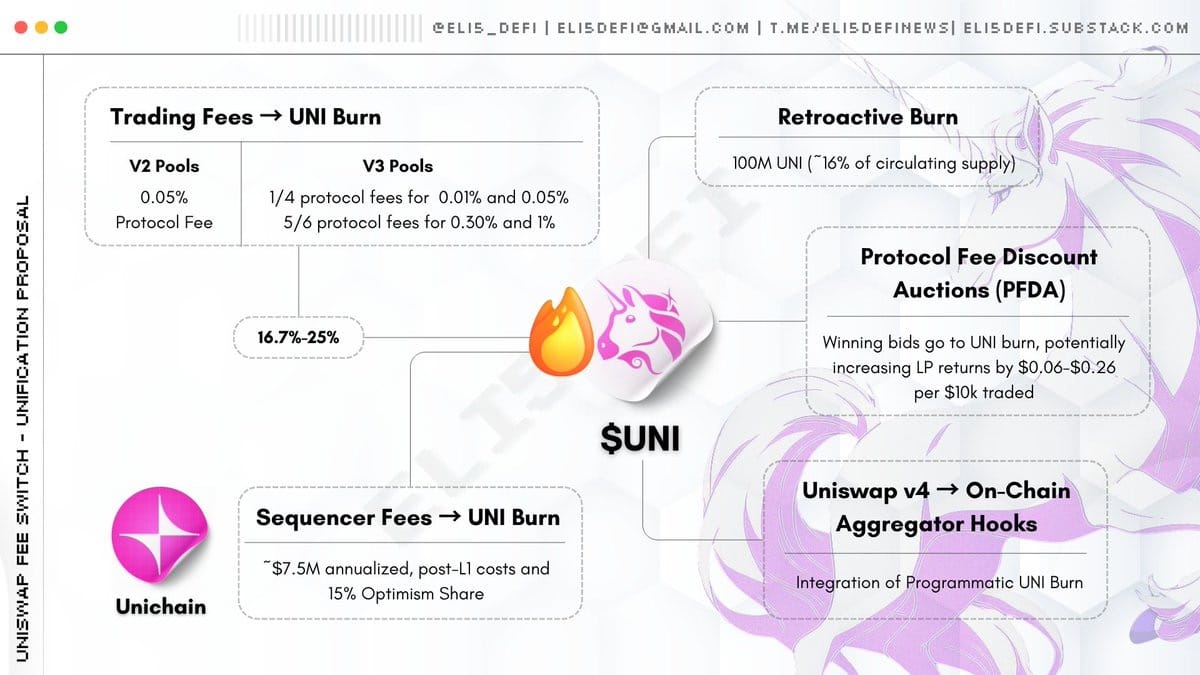

The proposal will impose a protocol fee, rolled out over time to minimize impact.

- First, v2 pools and select v3 pools — making up 80-95% of LP fees on Ethereum mainnet — will implement a 0.05% fee, dedicated to UNI buybacks and burns. This will slim liquidity providers’ (LPs) cut from 0.3% to 0.25%.

- The v3 split will vary. Selected pools will fork over between a quarter and one-sixth of LP fees to the protocol. This blueprint will also govern Layer-2 networks, v4, and future versions. Governance will hold the power to tweak the rates through voting.

- Additionally, Unichain will kick in roughly $7.5 million worth of annualized sequencer fees for token burns. However, layer-1 costs and Optimism’s 15% share will be skimmed off the top.

New buyback mechanism

The new structure echoes classic corporate buybacks but is powered by smart contracts — cutting out any centralized middleman. It should chip away at the UNI supply over time, mirroring corporate stock buybacks. However, the end result will hinge on trading volume and future governance calls.

The mechanism boasts several key components:

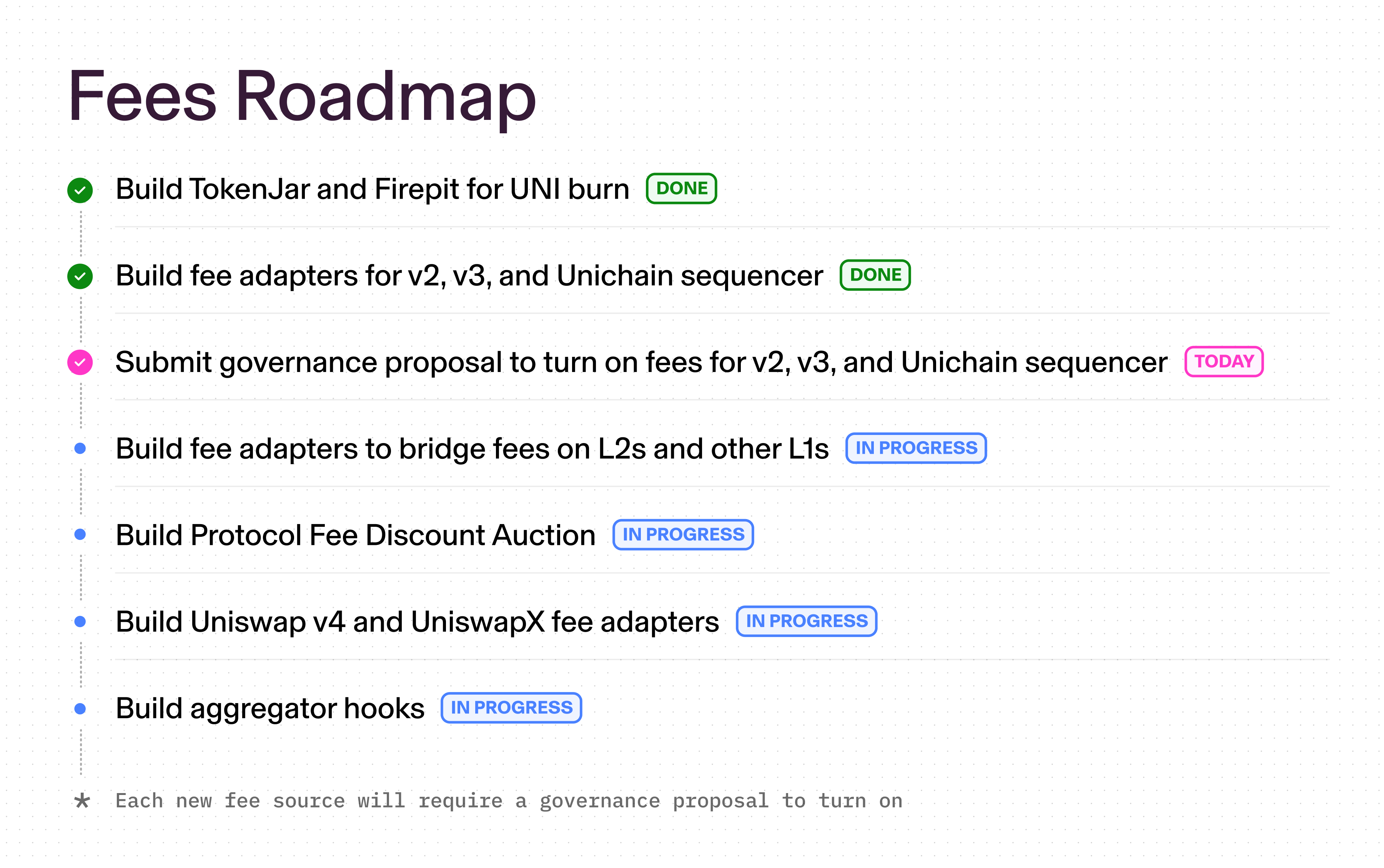

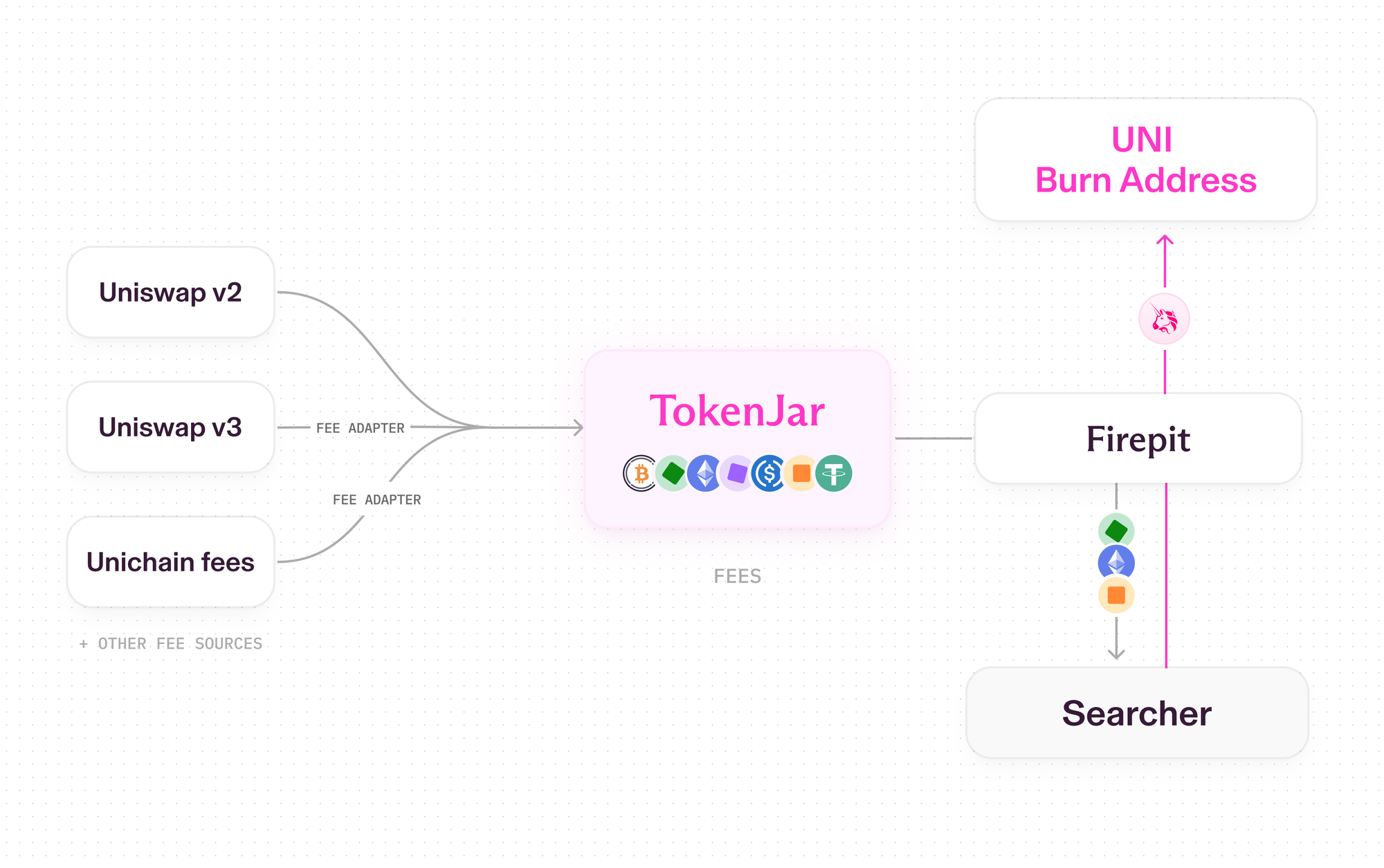

- The “TokenJar” contract will siphon fees from across the ecosystem, including V2 and V3 adapters and Unichain.

- The “Firepit” contract will stand as the sole withdrawal method, demanding an equivalent token burn.

- A massive one-time retroactive burn will vaporize 100 million tokens from circulation.

- Perpetual token burns will be fueled by ongoing protocol activity.

- The PFDA (Protocol Fee Discount Auction) feature will allow traders to bid for fee discounts, funneling the proceeds straight into the burn. Coupled with MEV internalization, it may supercharge LP returns, potentially adding $0.06 to $0.26 for every $10,000 traded.

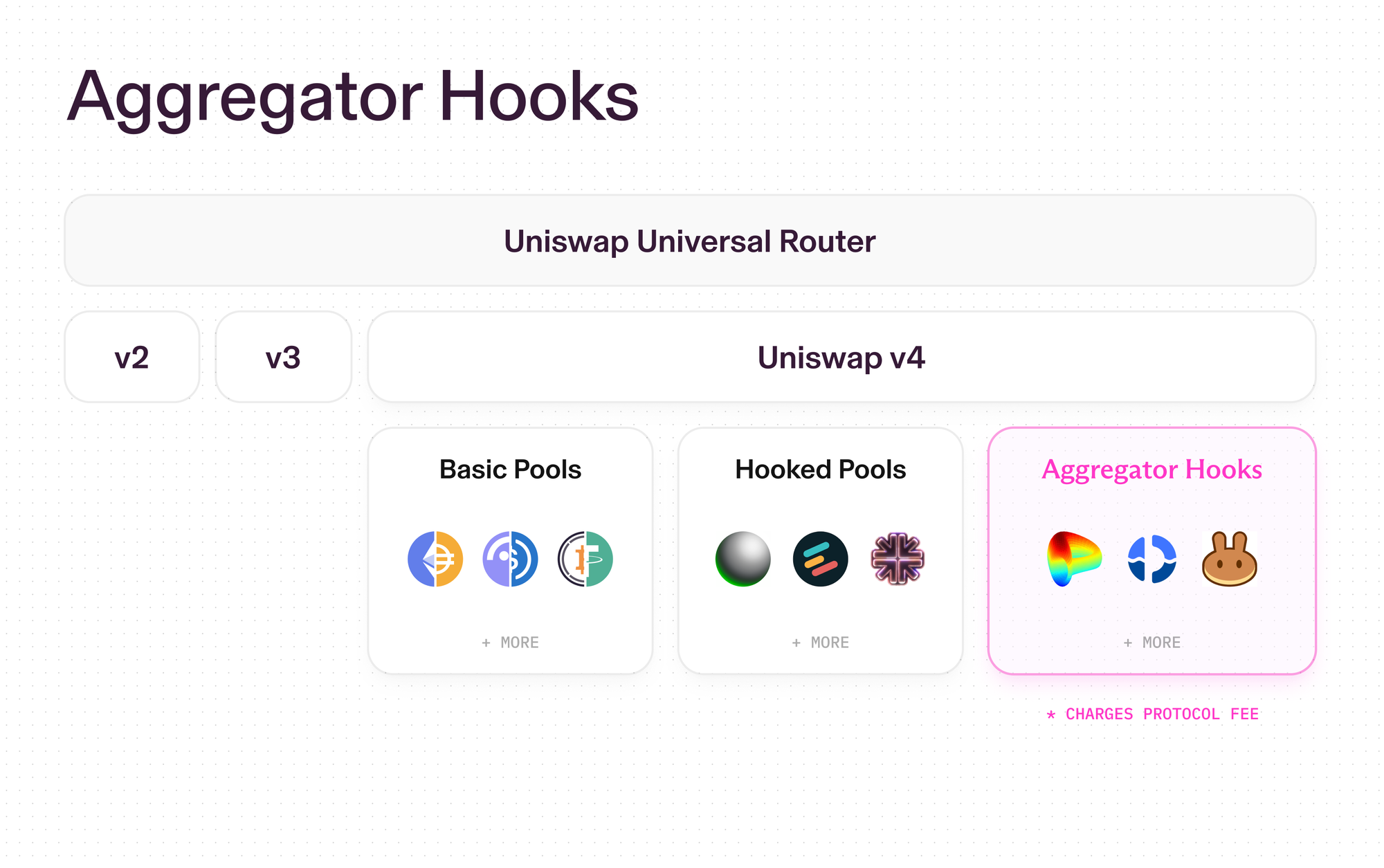

- Aggregator hooks will capture a slice of fees from external liquidity sources, effectively transforming V4 into an on-chain DEX aggregator.

Ecosystem impact

Until now, Uniswap's token has languished as a voting tool. The proposal supercharges its utility — UNI is becoming a deflationary asset with its destiny hitched to protocol performance. If approved, value will be driven by scarcity.

- Traders and LPs: Will navigate minor fee adjustments. For instance, V2 LPs should break even thanks to PFDA benefits. MEV capture and aggregator efficiency could unlock fatter returns. Beware, though — volume could flee to zero-fee alternatives in the immediate aftermath.

- Developers and users: Will reap the rewards of scrapped fees on the interface, wallet, and API, a potential catalyst for mass adoption.

Governance changes

Uniswap Labs and the Uniswap Foundation are slated to merge, ending the current divide where one focuses on development and the other on oversight.

- Labs will now march in lockstep with governance, a move that could defuse tensions between founders and the community.

- Fee adjustments will be a snap via Snapshot and cross-chain votes, ditching the need for cumbersome on-chain proposals.

Starting in 2026, Uniswap will allocate a 20 million annual UNI fund (roughly $200 million at current prices) to fuel growth on all fronts. This war chest, distributed quarterly, will strategically divide its firepower:

- 30% for developer grants for building v4 Hooks

- 20% for acquiring key DeFi tools and aggregators

- 50% for supercharging the Unichain ecosystem and cross-chain liquidity

Community reaction

The UNIfication proposal supercharged community participation. A firestorm of discussions on the governance forum erupted, growing fivefold in 24 hours, while the proposal raked in over 75% support in early voting — securing one of the most resounding mandates in Uniswap’s history.

Breathing real economic life back into governance

In the past, voting often felt hollow and symbolic, with few tangible rewards on the line. Now, with protocol revenue directly lining the pockets of UNI holders, every vote carries serious financial weight. Governance has been transformed from a civic duty into a powerfulexpression of economic ownership.

Reinvigorated market confidence

DeFi’s total value locked (TVL) witnessed a sharp rebound, and liquidity positions swelled. Analysts were quick to call the proposal a breakthrough for DeFi growth: by directly plugging governance tokens into the protocol's cash flow, it creates a powerful, self-sustaining incentive loop.

This flywheel effect explains why the excitement bled over from UNI to the broader DeFi sector, lifting all boats in a market-wide rally. UNIfication is now widely hailed as the potential catalyst for DeFi’s long-awaited second growth phase, proving that sustainable value, not just speculation, is the future.

Criticism of UNIfication: Key concerns

The proposal lands in a highly competitive DEX arena. While the revenue-sharing move has been widely praised, some rivals have called it a strategic blunder.

The bone of contention is liquidity provider (LP) returns. By redirecting a portion of trading fees to the protocol, UNIfication slightly reduces the immediate take for LPs. Critics from competing platforms have suggested LPs will migrate to wherever they can earn the highest returns for every dollar deposited.

Uniswap's rival Aerodrome believes that reducing LP profitability will ultimately benefit their platform. This means Uniswap must perform a delicate balancing act: reward UNI holders without driving away the liquidity that makes the protocol viable.

Uniswap is betting that its comprehensive value proposition will outweigh minor fee adjustments. First, PFDA is designed to boost LP returns by internalizing MEV (see above). Secondly, by eliminating fees on its frontend, wallet, and API, Uniswap Labs is making its entire ecosystem more competitive, which could drive more volume and ultimately benefit LPs.

The road to implementation

For the UNIfication proposal to become reality, it must first successfully navigate Uniswap's decentralized governance process. This journey is a carefully structured democratic exercise that gives the community the final say.

The process is expected to unfold over approximately 22 days, following a clear and transparent timeline set forth by Hayden Adams.

- 7-day community consultation period where any member can discuss, debate, and suggest amendments to the proposal.

- 5-day "Temperature Check" vote conducted via Snapshot, which gauges overall community sentiment without incurring on-chain gas fees.

- 10-day binding on-chain vote, where UNI holders cast their final verdict. If successful, the proposal is then executed.

Potential impact on DeFi industry

Uniswap Labs' new role as a de facto service provider may become the blueprint for hybrid DAOs. As other DeFi protocols rush to copy revenue-sharing mechanisms centered on buybacks, token value could become deeply intertwined with usage.

This dramatically cuts reliance on hype-driven speculation and fuels real, sustainable growth. Overall, governance is being rewired to fuseprotocol activity directly with tokenomics, pushing the entire industry toward maturity.