Utility tokens: Investor's guide to crypto's hidden fuel

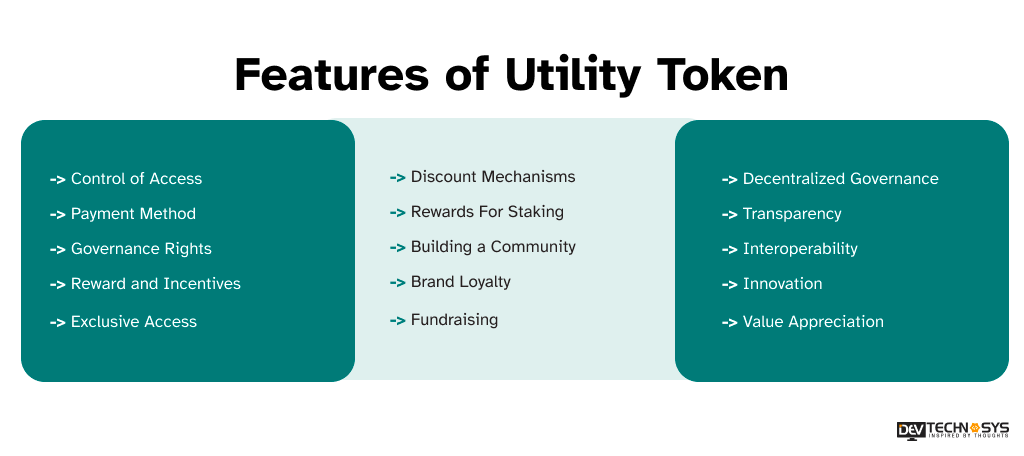

Utility tokens are a cornerstone of the blockchain space, reshaping how users interact with decentralized networks and exchange value. As essential building blocks of blockchain ecosystems, they grant access to exclusive products, services, and governance mechanisms.

For investors, utility tokens offer a way to engage with dApps while gaining exposure to ecosystem growth. Here’s what you need to know.

Defining utility tokens

These digital assets are designed for specific purposes within the issuing network. Unlike Bitcoin, which primarily serves as a store of value, utility tokens empower holders to influence project development and governance.

Utility tokens are crucial to the functionality and growth of blockchain networks, DeFi projects, and dApps. They enable users to interact with them, contribute to their future, and benefit from their success. Utility tokens provide:

- Access to specific products or services within the native ecosystem. For instance, Filecoin (FIL) is exchanged for decentralized file storage space.

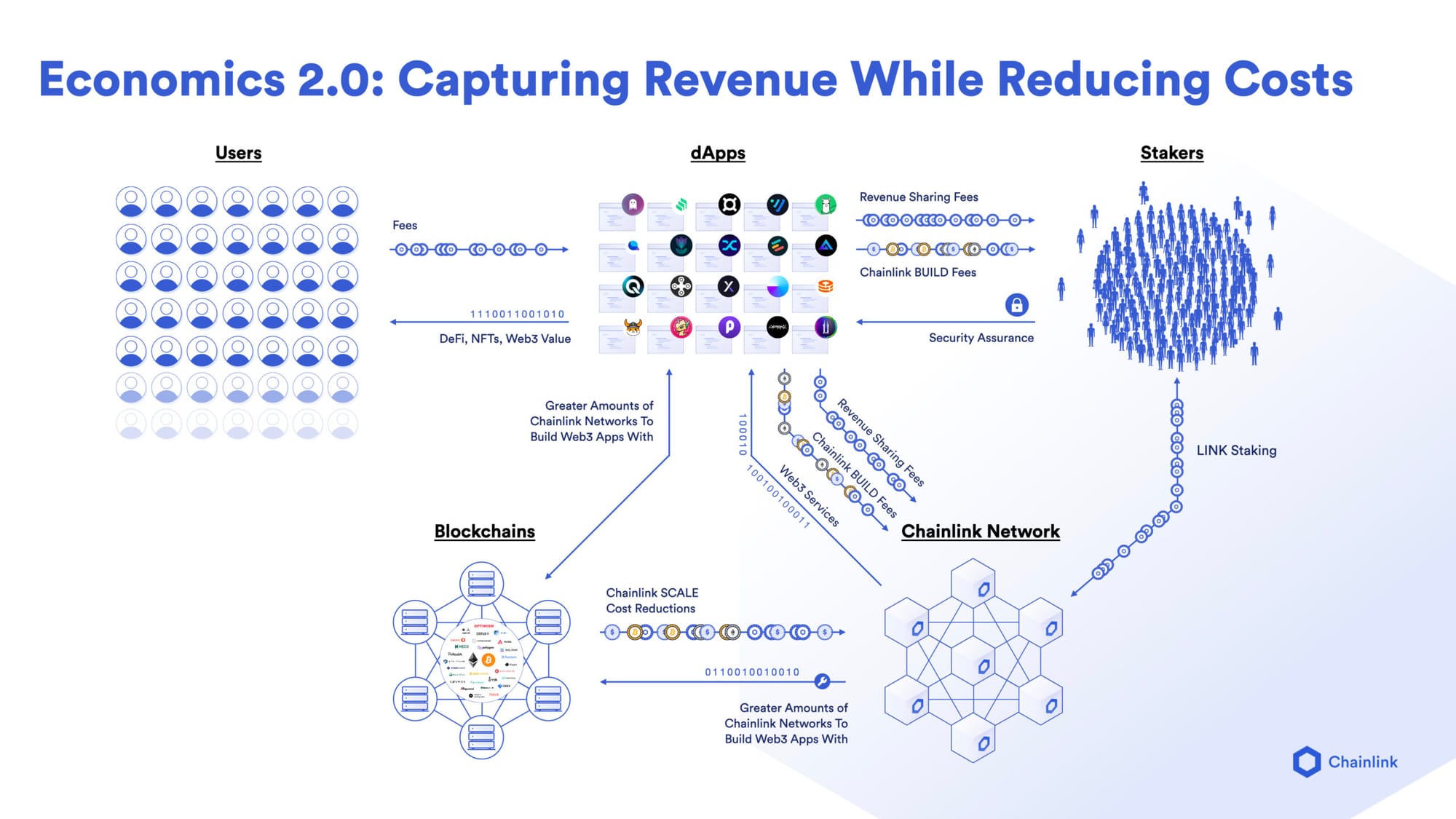

- Incentives for user behavior through privileges and rewards. Chainlink’s LINK, for example, rewards node operators for retrieving data for smart contracts.

- Governance — activities involved in reaching agreements and implementing changes in crypto projects. Some utility tokens grant holders voting rights on development proposals, influencing future protocol updates (more below).

- Unique value propositions tied to the native ecosystem. Issuing networks typically operate on other blockchains like Ethereum, Solana, or Polygon.

- Gaming and NFT integration. Tokens like Axie Infinity’s AXS are used to purchase assets, unlock characters, and earn rewards, while NFT platforms may require them for listings or upgrades.

How utility tokens work

Common standards for utility tokens include ERC-20 (Ethereum-based assets), which defines token supply mechanics, balance tracking, and transfer rules.

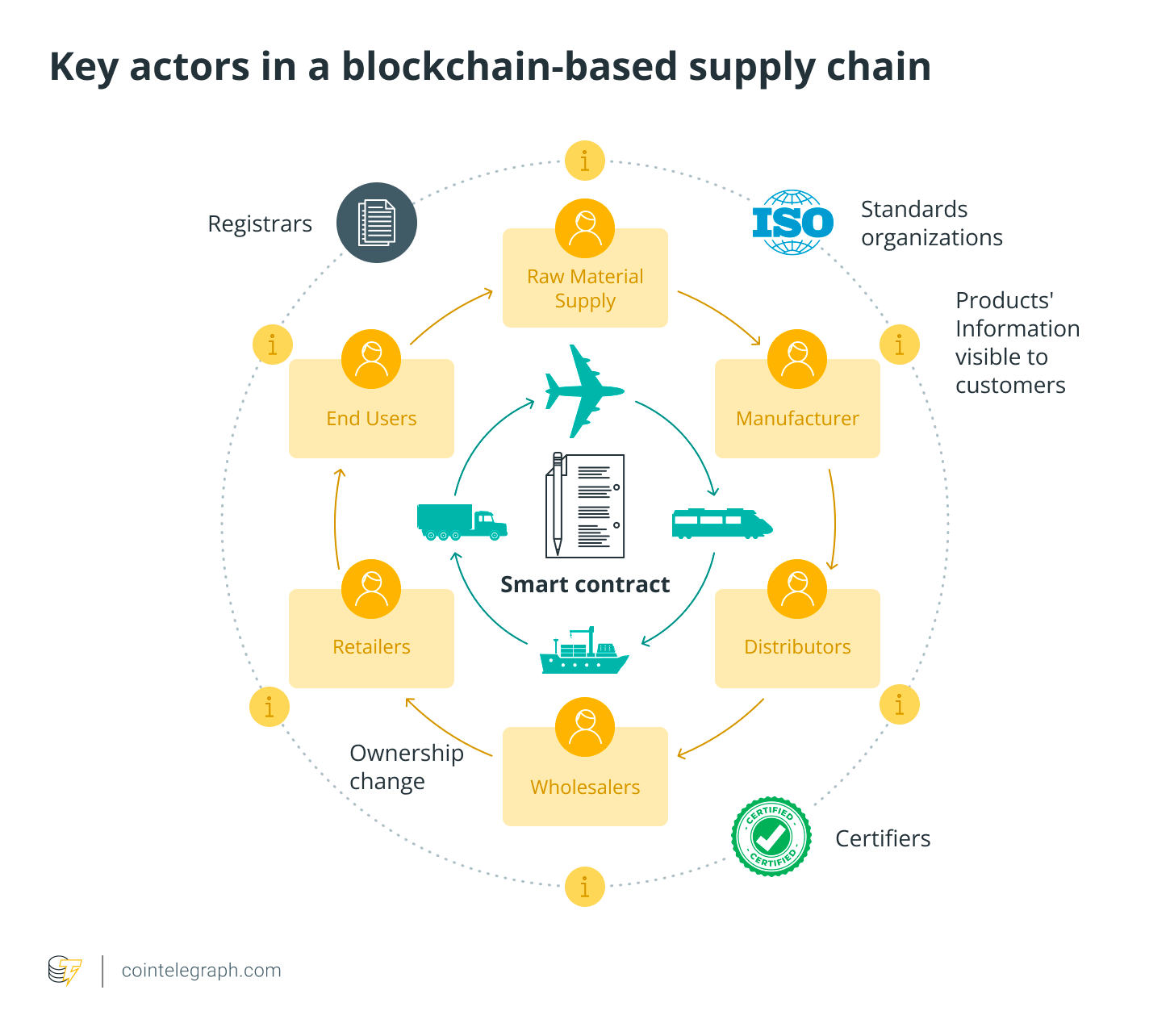

Users interact with utility tokens through compatible wallets, decentralized apps (dApps), or browser extensions like MetaMask. These tokens act as gatekeepers to platform functionality, with their behavior dictated by smart contract programming.

When a user interacts with a platform, its smart contract may:

- Verify their token balance

- Deduct tokens for accessing a feature

- Record the interaction on-chain

For example, when a dApp charges a transaction fee, its contract checks if the user holds enough tokens before processing the request.

Once deployed, smart contract logic is immutable — contract history cannot be modified or changed after its creation, which ensures transparency. However, this also complicates flaw correction, making pre-launch audits crucial.

Where to buy utility tokens?

Utility tokens are traded on centralized (CEXs) and decentralized exchanges (DEXs). New projects may also distribute them via token sales or initial coin offerings (ICOs) before launch.

Real-world use cases

Utility tokens drive innovation across industries:

- Supply chain management: VeChain’s VET enables real-time product tracking with blockchain-verified provenance.

- Decentralized economy: Uniswap’s UNI lets holders vote on fee structures and upgrades.

- Exclusive access & rewards: BNB reduces trading fees on Binance, while BAT rewards Brave users for ad engagement.

Examples of utility tokens

Binance's BNB

Binance Coin (BNB) unlocks discounted trading fees on the world's biggest crypto exchange, participation in token sales, and other benefits. Originally an ERC-20 token, it now powers smart contract operations on Binance’s native blockchain, BNB Chain.

The Sandbox’s SAND

SAND powers a metaverse where users create, own, and monetize virtual experiences. It’s required to purchase land, upgrade avatars, and access premium features. Additionally, SAND grants voting rights and integrates with NFTs representing in-game assets.

Brave Browser’s BAT

Basic Attention Token (BAT) rewards users for viewing privacy-focused ads. Advertisers pay in BAT, creating a direct link between user attention and revenue. Built on Ethereum, it incentivizes engagement for both parties.

Filecoin’s FIL

FIL facilitates decentralized storage, allowing users to rent out unused disk space. Clients and providers are matched via smart contracts, with all transactions verified on-chain.

Axie Infinity’s AXS

AXS is the lifeblood of this play-to-earn game. Players use it to buy, trade, and stake Axies (fantasy creatures), earning rewards and participating in governance.

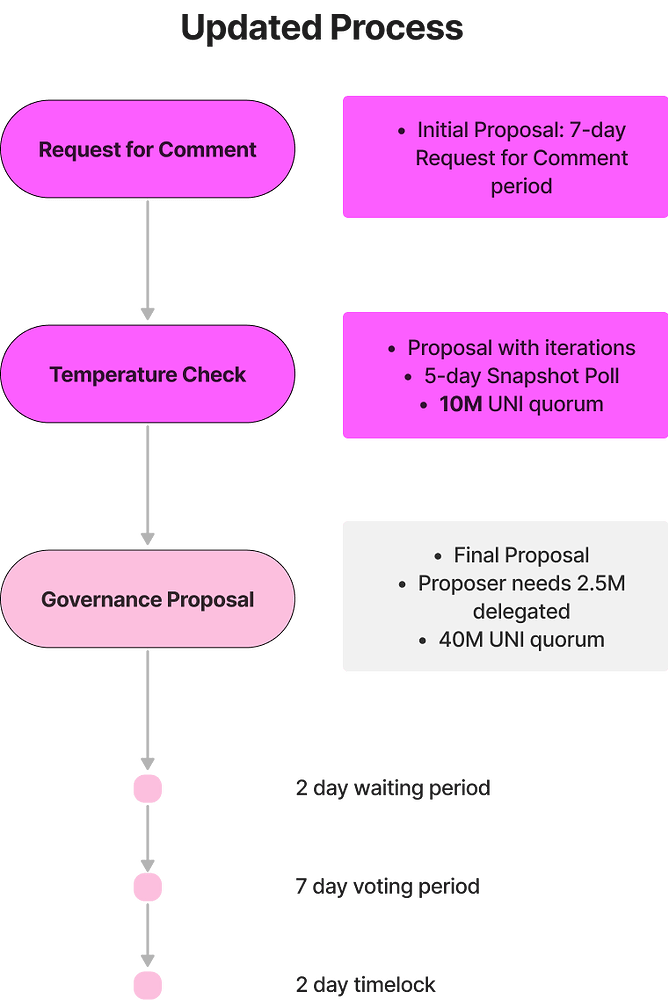

Governance tokens: Subset of utility tokens

While most utility tokens grant access, some also enable governance in DeFi. Governance tokens (e.g., UNI, COMP) let holders vote on proposals like:

- Treasury allocation

- UI/UX upgrades

- Liquidity provider rewards

Voting power scales with token holdings, and proposals are executed via smart contracts. DeFi projects launch governance tokens on networks like Ethereum.

To vote, users must connect their crypto wallet and submit the number of tokens they wish to commit to a proposal’s smart contract. The more governance tokens staked, the greater the voting power.

- UNI holders can vote on the management of Uniswap’s treasury, which held over $3 billion in assets as of early 2025.

- COMP, the governance token of Compound Finance, enables the community to influence interest rate models, protocol changes, and supported assets — with voting power proportional to their holdings.

Every dApp has a unique, public issuance mechanism, typically described in its whitepaper. Some governance tokens may be earmarked for community incentives — such as rewarding contributors to liquidity pools.

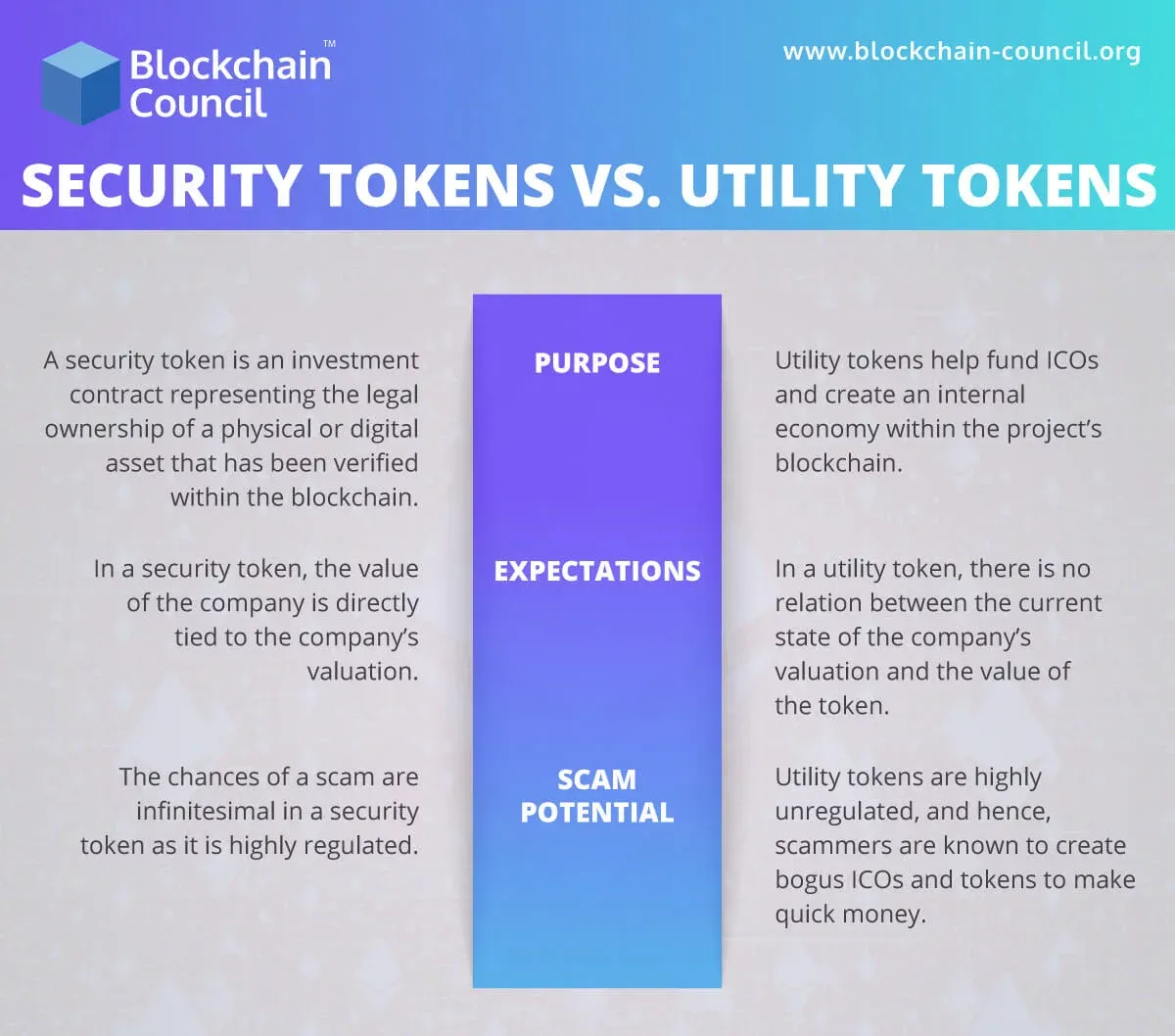

Utility tokens vs. security tokens

Unlike security tokens (which represent ownership or profit-sharing), utility tokens derive value from usage, not speculation. They are not inherently investment contracts — though demand for their ecosystem can drive price appreciation. Furthermore, security tokens are classified as financial instruments, so they fall under the scope of securities laws.

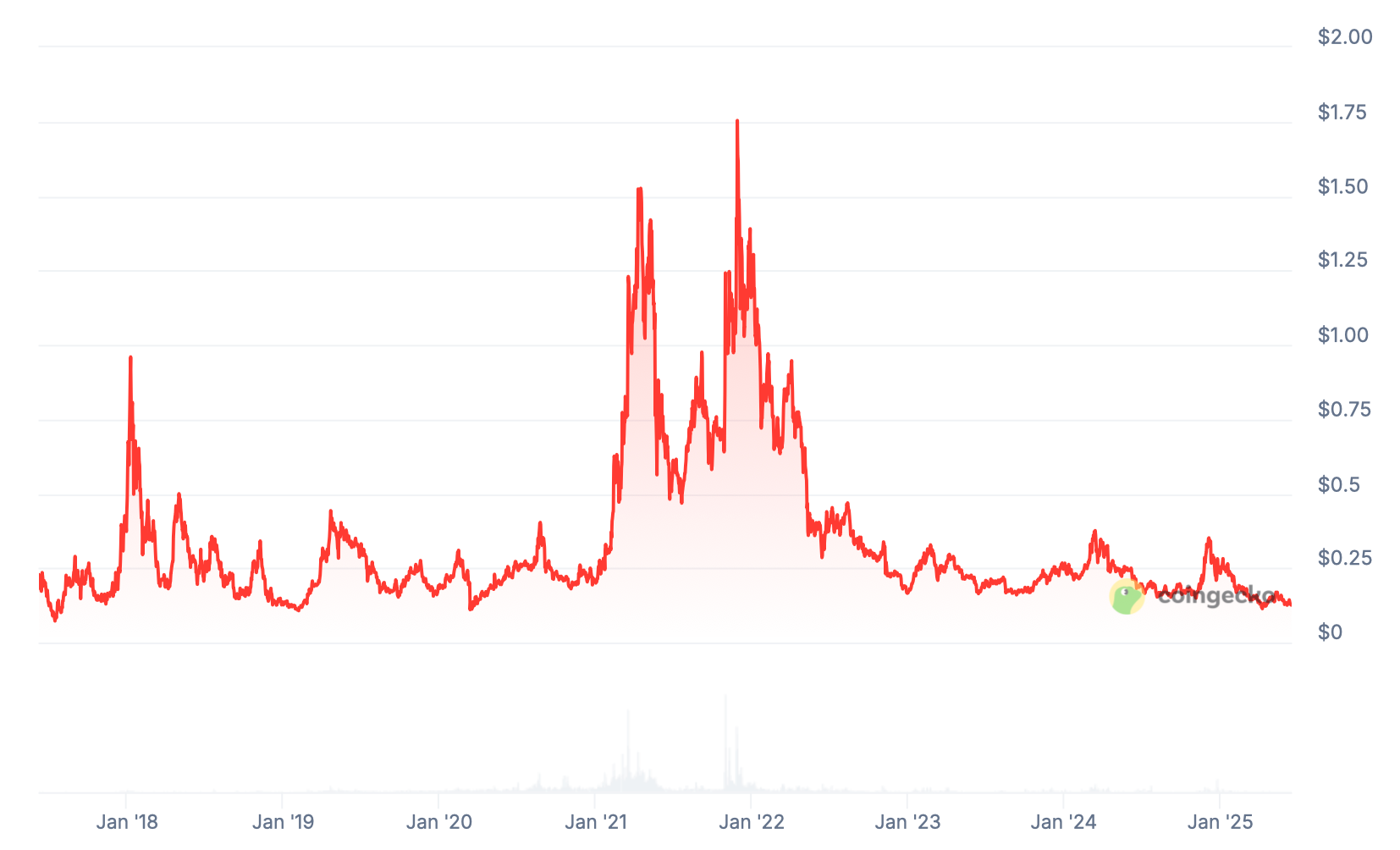

Investment in utility tokens

Unlike speculative assets, utility tokens are not inherently investment contracts—their value stems from ecosystem usage. Rather than granting profit rights or ownership, their primary purpose is to provide access to platform-specific services. However, rising demand for a platform's services can increase demand for its token, potentially boosting its inherent value.

Due diligence is key

Like all cryptocurrencies, utility tokens carry certain risks. While investing in them may be lucrative, it requires both in-depth knowledge and a clear understanding of the ecosystem.

Always Do Your Own Research (DYOR) and consider consulting qualified financial professionals. To properly evaluate a project's value and longevity:

- Analyze its use cases

- Verify the team's credibility

- Cross-reference information from reliable sources

Consider additional benefits

Many utility tokens offer benefits beyond potential investment returns, including:

- Reduced transaction fees

- Governance voting rights

- Access to premium network features

- Staking opportunities (locking tokens to help secure the network in exchange for rewards)

Final thoughts

Utility tokens power the crypto economy, connecting users to blockchain applications while offering unique incentives. For portfolio holders, they offer a unique diversification opportunity — while not traditional investments, their governance rights, staking rewards, and ecosystem access add layered value beyond price speculation. Whether for gaming, DeFi, or governance, their true worth lies in utility — making informed analysis essential.