Why Smart Investors Open a XRP Credit Line Instead of Selling

Selling your XRP is a taxable event that kills your long-term position. A Clapp XRP Credit Line is a wealth management tool designed for the modern HODLer.

Avoid Capital Gains Tax

When you sell XRP for profit, you pay taxes. When you borrow against it via a credit line, you get tax-free liquidity (debt is generally not considered income).

Keep Your Upside

If XRP hits a new All-Time High, you still own the asset. You profit from the growth, even while you spend the cash today.

Revolving Access

Unlike a standard XRP loan, our credit line stays open. Repay and re-borrow as often as you like without filling out new forms.

The Most Flexible XRP Lending Platform

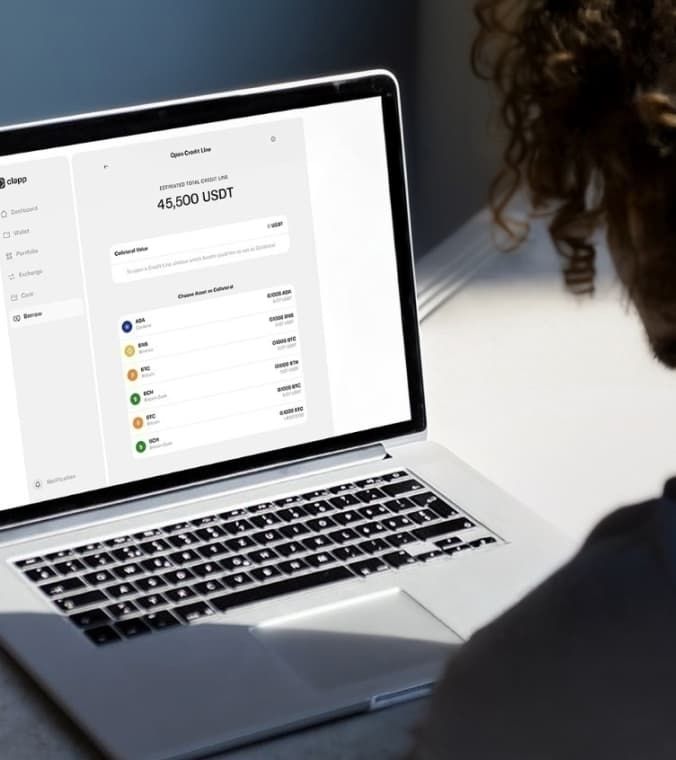

Calculate Your Credit Line Instantly

Select your borrowing currency. Activate by choosing 1–25 assets for multi-asset collateral to unlock the maximum Credit Line. You can edit data and view the full Credit Line summary anytime.

Access 24/7 support

Need help? Clapp's expert team is ready to assist anytime, ensuring your experience is smooth and hassle-free.

Frequently Asked Questions

How does interest work on my credit line?+

Unlike a term loan, you only pay interest on the funds you actually withdraw. If your line is open but unused, you pay 0% APR. Active interest rates are dynamic based on your Loan-to-Value (LTV) ratio—lower risk means lower rates.

Is borrowing against crypto a taxable event?+

Generally, borrowing against your assets is not considered a sale, meaning it is typically a tax-efficient way to access liquidity without triggering capital gains taxes. We recommend consulting a tax professional for your specific jurisdiction.

Are there fixed monthly payments?+

No. Clapp gives you full repayment flexibility. Pay back any amount, anytime, and your interest automatically adjusts as you repay.

Can my interest rate change over time?+

Yes. Our rates are risk-based and floating. The more you borrow relative to your collateral (higher LTV), the higher the interest rate; the less you borrow (lower LTV), the lower your rate.

Can I change my collateral after drawing funds?+

Yes! With Clapp, you can easily add, remove, or swap assets in your collateral basket — even after drawing funds. Lock in gains on one asset and use another to back your credit line, all without complicated refinancing.

How do I avoid a margin call?+

A margin call occurs if your collateral value drops significantly. Clapp provides automatic alerts to notify you before this happens, allowing you to add collateral or repay part of the balance to stabilize your health factor.

What is LTV and why does it matter?+

LTV (loan-to-value) measures how much you've borrowed compared to the value of your collateral. A lower LTV means a bigger "safety cushion," keeping your credit line secure. For example, if you pledge $10,000 in collateral and borrow $2,000, your LTV is only 20% — a very safe level.

How will I know if my LTV becomes risky?+

We'll notify you if your LTV rises, giving you time to adjust and sleep easy, without surprises.