Clapp Weekly: BTC at $67k, Saylor's 'forever buying,' Bithumb debacle

BTC price

Bitcoin remains in a tight range under $70k ahead of today's US jobs report. Despite the pressure from a hawkish macro outlook, whales have just had their biggest buying spree since November — accumulating around 53,000 coins over the past week. Such purchases helped stabilize prices after previous drawdowns, but the broader trend and uneven support point to caution.

BTC bottomed at $62,822.26 on February 6 after sliding from $76.5k. It bounced to $71.3k the following day, stalled, and spent the weekend struggling to stay above $71k. Monday brought a fresh dip to $68,592.06 and a short-lived recovery to $70.9k — followed by another leg down.

Currently, BTC is trading at $66,684.14, down 3.5% over the past 24 hours with an 12.3% weekly loss.

ETH price

Ethereum whales are also buying the dip — large wallets accumulated over 520k ETH in 4 days, offsetting retail distribution. After one of the largest weekly drawdowns for the runner-up, it is still trading below the average cost basis ($2,310). However, the heaviest exchange withdrawals since last October (220k ETH in just a few days) show traders intend to accumulate.

Tailing BTC's downturn, ETH tumbled from $2.3k to $1,824.77 on February 6 before bouncing. It briefly topped $2k the next day, only to slide again and struggle at $2.1k. After Monday's drop below $2k came another recovery that went nowhere.

Currently at $1,938.86, ETH is trading with a 3.6% 24-hour loss and a 14.0% weekly decline.

Seven-day altcoin dynamics

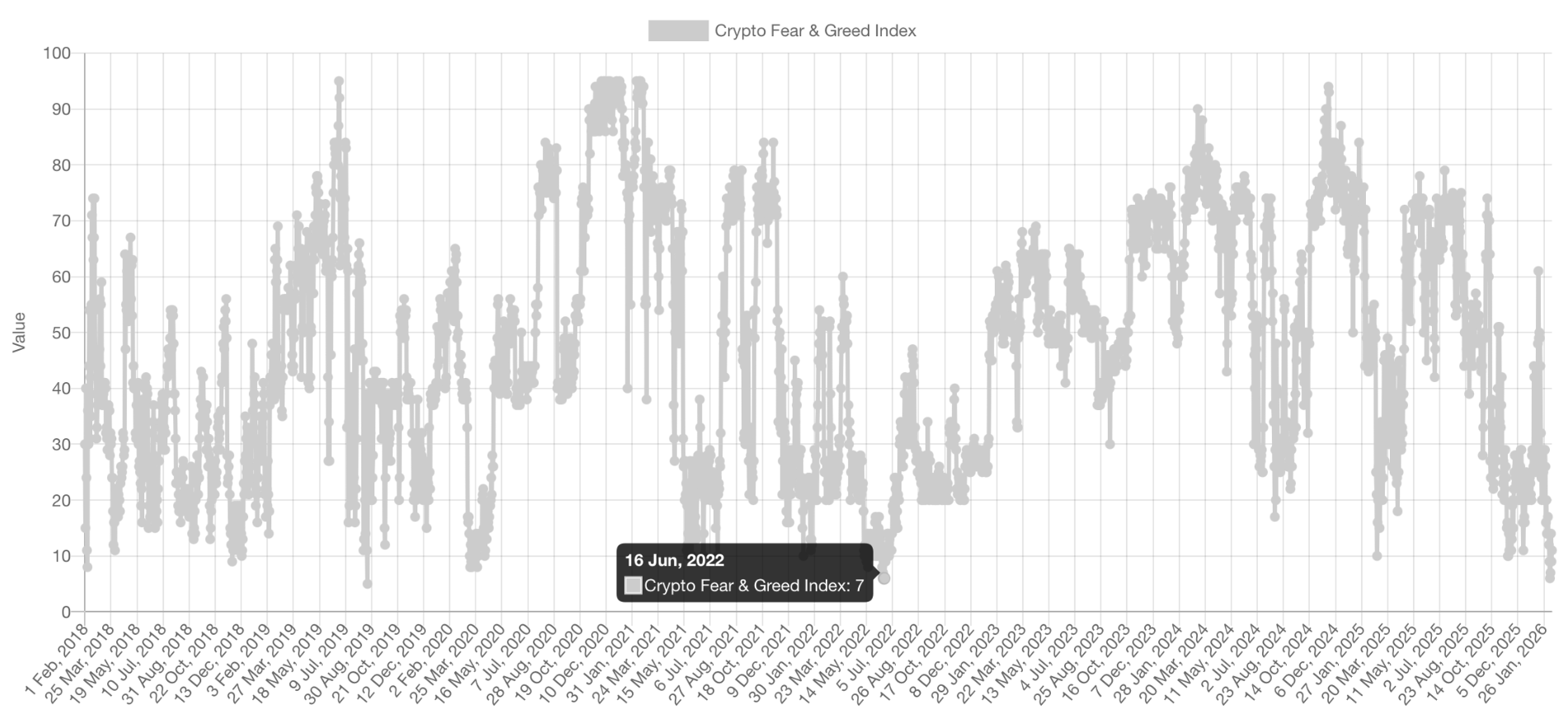

The Crypto Fear and Greed Index remains in the "Extreme Fear" zone (10/100) after last week’s selloff. On February 7, it plunged to 6 — below the worst point in the harshest crypto winter (7/100 on June 16, 2022). AI tokens (with a 41.7% weekly loss) have been hit especially hard, while meme coins, from DOGE to TRUMP (-14.3% collectively), are also struggling.

Market observers mainly blame shifting expectations around the US macro landscape. The latest plunge came after President Trump nominated Kevin Warsh — known for his preference for monetary discipline — as Federal Reserve Chair. Traders anticipate tighter liquidity and fewer rate cuts ahead.

Institutional capital appears to be holding back, waiting for clearer catalysts before a fully re-entry. Persistent ETF momentum or fresh macro drivers could break the hesitation, as noted by Kronos Research CIO Vincent Liu. Meanwhile, derivatives data suggests most excess leverage has been flushed out.

January jobs report on tap

Originally scheduled for last Friday, the January jobs report is now due this morning (February 11) after the four-day federal shutdown last month. Experts forecast 70k added jobs, up from 50k in December, with an unchanged unemployment rate of 4.4%.

However, two Trump administration officials — White House trade counselor Peter Navarro and economic adviser Kevin Hassett — have warned the data may turn out weaker than expected. Nationwide Insurance senior economist Ben Ayers expects a number closer to 55k.

Continued slow hiring would match a slow-growing workforce — a "low hire, low fire" balance expected due to the nationwide immigration crackdown. A combination of steady unemployment, hiring, and wage growth could prompt the Fed to hold interest rates steady at the March meeting.

Weekly winners

- ZRO (+32.9%) swung wildly amid rumors about the proprietary Layer-1 Zero blockchain. Its rollout, confirmed Tuesday, involved partnerships with Google Cloud and DTCC, while Citadel Securities and Ark Invest have bought ZRO. Meanwhile, the upcoming LayerZero token unlock sparked speculative retail buying.

- ASTER (+14.7%) is propelled by a sharp surge in trading volumes on the Aster perp futures DEX and a recent technical breakout. Trading activity boosts retail demand as ASTER is closely linked to platform use. On the downside, a token unlock scheduled for February 17 creates short-term risk.

- SKY (+8.9%) rose as Sky Protocol officially confirmed it had repurchased 31 million SKY tokens worth 1.9 million USDS last week. Formerly known as Maker, the platform has spent over 108 million USDS since the buyback program launched in February 2025.

Weekly losers

- TAO (-24.0%) fell to its 2023 levels, as broader pressure appeared to accelerate a slide that has been stretching on for months — while developer activity and investor interest cool.

- TRUMP (-24.0%) is being pummeled amid fading investor enthusiasm and meme coin hype. The broader market fatigue has hit the speculative sector hard. This latest drop came roughly a year after the token began to lose investor support following Trump's inauguration.

- BGB (-22.3%) is struggling to recover after following BTC’s plunge on February 6.

Cryptocurrency news

Michael Saylor doubles down on Bitcoin, losses be damned

Strategy founder Michael Saylor is building a fortress. As Bitcoin hovers nearly 45% below its all-time high, his company's paper loss exceeds $5 billion — yet its 714,644 BTC stash keeps growing. For the famous bitcoin bull, the buying never stops.

In a recent CNBC interview, Saylor dismissed market fears as “unfounded,” vehemently reiterating that Strategy will not be a seller. “We’re going to be buying Bitcoin,” he stated. “I expect we’ll be buying Bitcoin every quarter, forever.”

Staggering volatility and liquidity concerns

Strategy just reported a Q4 operating loss of $17.4 billion, largely a non-cash accounting reflection of BTC’s price decline. Yet, Saylor frames this volatility not as a bug, but as a feature of what he calls “digital capital.” He argues Bitcoin’s potential for outperformance justifies its wild swings, claiming it will outpace traditional assets like gold or equities over the next decade.

To soothe liquidity concerns, Saylor highlighted the firm’s fortified balance sheet. Strategy holds a dedicated cash reserve to cover over 2.5 years of debt and dividend obligations, a buffer recently expanded through stock issuance.

His stance is apocalyptic-proof:

“If Bitcoin falls 90% for the next four years, we’ll refinance the debt. It literally has to fall to $8,000… But I don’t think it’s going to $8,000 either.”

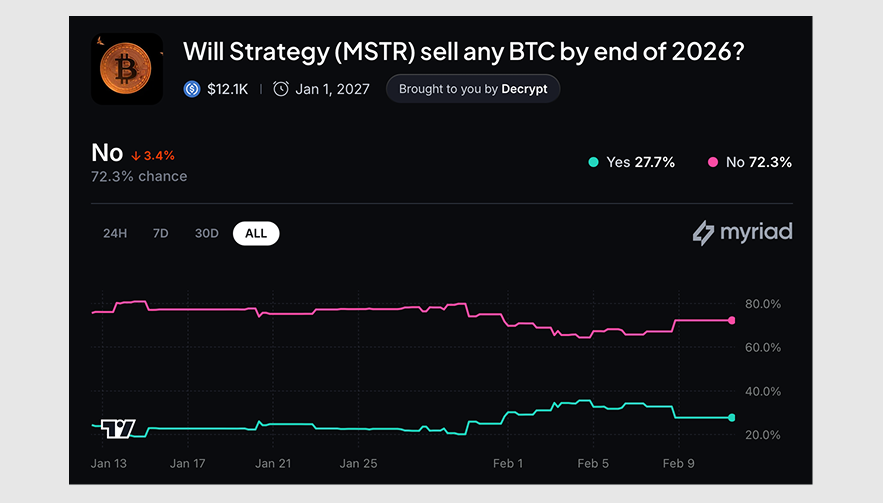

While predictors on platforms like Myriad still assign a ~28% chance of a Strategy BTC sale by 2026, Saylor isn’t blinking. He is betting the company’s future on a conviction that transcends quarterly earnings reports.

Elsewhere in institutional moves: BitMine’s Ethereum bet

While Strategy remains squarely focused on Bitcoin, other institutions are making waves in ether. BitMine has aggressively purchased roughly $84 million worth of ETH (40,000 coins) in a single day this week, bringing its total holdings to nearly 4.4 million ETH. The company is now over 70% of the way toward its ambitious goal of accumulating 5% of Ethereum's circulating supply.

And BitMine isn't just hoarding; it's actively putting its stack to work. About 67% of its ETH holdings have been staked to generate an estimated $202 million in annualized revenue.

Executive Chairman Tom Lee has framed the recent market pullback — with ETH down 57% from its highs — as an "attractive" entry point. He argues that the current price lags behind the network's fundamental utility and its envisioned long-term role in the future of finance, suggesting a strong conviction in Ethereum's roadmap alongside its yield potential.

Bithumb debacle: $43B typo exposes crypto’s centralized control

South Korean crypto exchange Bithumb accidentally distributed roughly $43 billion worth of Bitcoin to users last week. This blunder of almost unimaginable scale stemmed from a promotional event where reward amounts were entered in BTC instead of Korean won. A single input error sent a financial tsunami through the exchange.

Localized price crash exposing fragile controls

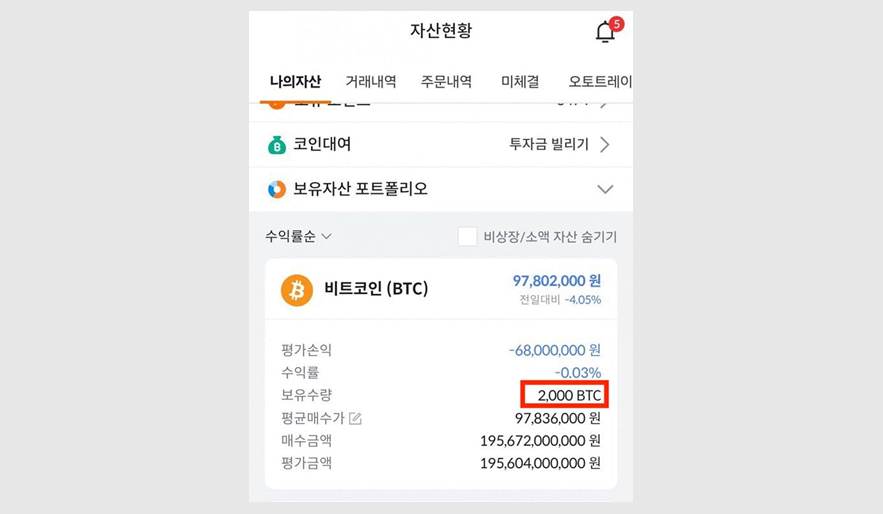

The incident unfolded during a "Random Box" event intended to distribute small cash rewards of 20,000-50,000 won ($14-$35). Instead, some users received at least 2,000 BTC each — a life-changing sum worth nearly $200 million per person at the time.

As screenshots flooded social media, some recipients swiftly sold their windfall, causing the BTC price on Bithumb to plummet more than 10% below global market levels. Chaotic price dislocations followed.

Bithumb froze accounts and recovered 99.7% of the erroneously sent BTC within 35 minutes. Yet while it moved quickly, the damage was done. The CEX's compensation plan — a 20,000 won "consolation" payment plus a week of zero trading fees — cannot undo the regulatory and legal reckoning triggered.

Legal battleground and regulatory fallout

Legally, Bithumb's clearest path to recover the remaining funds lies in civil claims under "unjust enrichment" law. Experts note the exchange is on solid ground, as there was never a lawful basis for users to keep the billions.

The defense for those who sold may hinge on proving they acted in "good faith" before realizing the credit was an obvious mistake. However, the astronomical sums involved makes this a difficult argument to make.

Criminal charges are less likely. Prosecutors would need to prove users knowingly exploited the glitch, a high bar since the error originated from Bithumb’s own internal failure, not a hack.

The true impact is regulatory — the measures that could follow would reshape the industry's ownership landscape. South Korea’s Financial Supervisory Service has called the error a revelation of structural problems in exchange ledger systems.

The incident is accelerating plans to tighten the Virtual Asset User Protection Act. Discussions are already underway to cap major shareholders' stakes in exchanges at 15-20% and mandate stricter internal controls and real-time asset verification.

Cautionary tale on finality

The Bithumb saga reveals the tension in crypto’s ethos. While the industry champions finality on-chain, the most expensive mistakes are still profoundly human, and the consequences are controlled by centralized powers.