Clapp Weekly: Crypto free fall, Trump’s Fed pick, Tether’s MiningOS

BTC price

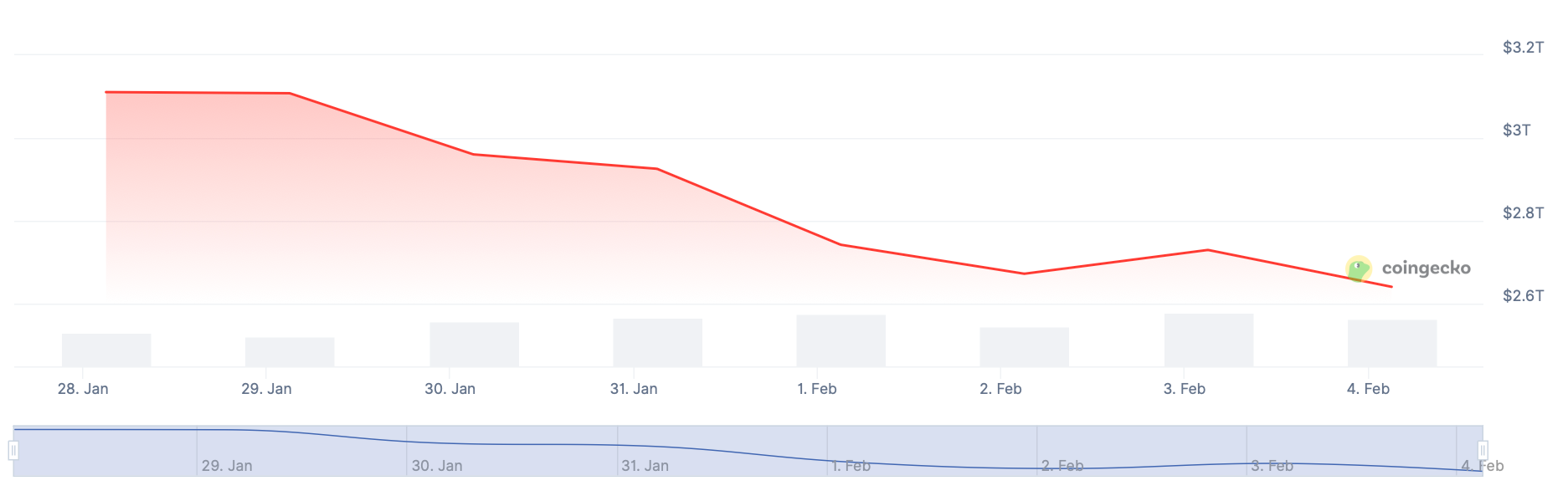

Bitcoin has bounced from its 15-month low near $74k amid crumbling S&P 500 and Nasdaq Composite. Yesterday's plunge contrasted with gold and silver's renewed bull run, invalidating the “debasement trade” narrative. Looking ahead, QCP Capital warns that weakening momentum leaves BTC vulnerable to further downside and liquidation-driven moves.

The price slipped below $90k last Wednesday, January 28, hit $82k two days later, and edged up briefly. Following a low of $77,690.91 on Saturday, January 31, it rose above $78k and lost momentum — after bouncing off $75,442.36, BTC fell to $73,111.91 yesterday. It is now stabilizing around $76k.

Currently at $76,110.16, BTC is down 3.5% over the past 24 hours with a massive 14.5% weekly loss.

ETH price

Ether is leveling off after the lowest low since June 23, despite a surge in network transactions (40%) and active users (45%) in the last 30 days. It led 24-hour leveraged liquidations on February 3 ($84.3 million vs Bitcoin's $57.6 million) — while a 90% decline in HODLer accumulation since January suggests the market has not reached a true bottom. Analysts say a fall to $2k is likely.

ETH plunged alongside BTC, sliding far below the $3k mark. Its nosedive accelerated on Saturday, January 31, when it sank to $2,380.23 and failed to regain momentum. Sunday's plunge culminated in $2,196.42 before a brief recovery to $2.3k. Yesterday, the price touched $2,120.74 and reversed.

At press time, ETH is changing hands at $2,270.21 with a 24-hour loss of 2.4% and a 7-day loss of 24.6%.

Seven-day altcoin dynamics

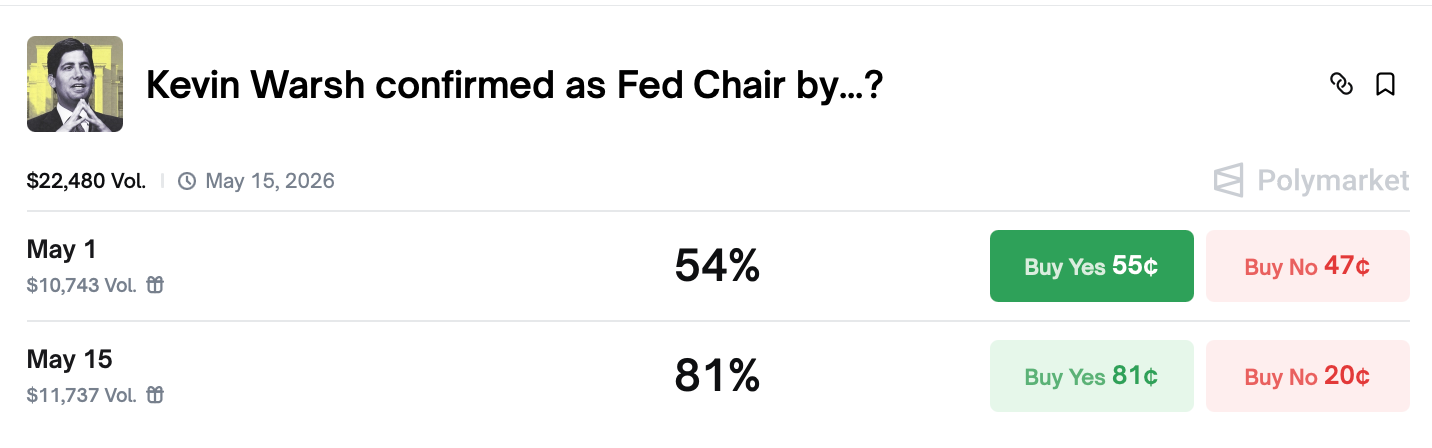

The crypto market is being pressured by diverse macro risk — particularly the uncertainty and liquidity concerns following Kevin Warsh’s nomination as Fed Chair. Fears of a US-Iran military conflict, the recent reversal of gold and silver rallies, and a sell-off in AI stocks have added to the challenging backdrop.

This convergence of factors creates unfavorable conditions for capital rotation into Bitcoin, as noted by Four Pillars researcher Siwon Huh.

Kevin Warsh's nomination sours sentiment

Trump's Fed Chair pick is generally interpreted as bearish due to Warsh’s preference for monetary discipline. The former Fed Governor prioritized inflation risks during the global financial crisis (2007-2009).

Emphasis on elevated real rates outweighs his occasional praise for crypto, spooking markets. Higher real interest rates mean a higher cost of borrowing after accounting for inflation — which prompts investors to scale back exposure to risk assets (read more below).

Tech sector adds to crypto’s woes

The panic plunge accelerated on February 4 amid a broad sell-off in the tech sector. AI stocks, software names (including Adobe and Shopify), and private equity all tanked.

Pressure had been building for months. The downturn sped up after Friday's BlackRock TCP Capital filing— the private debt fund announced its intention to mark down the net value of its assets by 19% after a string of troubled loans.

The news hinted at a liquidity crunch and economic crisis, pushing Bitcoin, which had just risen to around $91k, down hard. Crypto stocks followed suit — Galaxy (GLXY) led losses with an 18% crash.

Bitwise CIO Matt Hougan sees this decline as part of “a full-bore, 2022-like, Leonardo-DiCaprio-in-The-Revenant-style crypto winter” that started in January 2025 — and might be nearing its end. Placing the onset of the bear market at January 2025 means the bottom might come within weeks, as downturns typically last around 13 months.

Shutdown over, macro in limbo

Crypto’s freefall appeared to slow yesterday as the House of Representatives passed a $1.2 trillion funding package. President Trump signed the bill, ending the partial US government shutdown that started over the weekend.

The shutdown delayed crucial macro updates — the Bureau of Labor Statistics will now reschedule the January jobs report and other data.

Furthermore, the current package only funds the Department of Homeland Security through Feb 13. The stage is set for a fiery debate in Congress over Homeland Security funding.

Weekly winners

- MORPHO (+8.6%) rocketed as Morpho and Mystic Finance launched on the Flare Network, creating the first modular lending market for XRP. Leveraging Flare’s infrastructure, it enables the creation of permissionless, institutional-grade XRPFi vaults, boosting capital efficiency for XRP holders.

- CC (+8.3%) rose after Fireblocks' custody integration, which reinforces the Canton Network's role in regulated tokenization. While expanding Fireblocks’ infrastructure offerings, it introduces direct custody and operational support for CC.

- BDX (+7.6%) soared after Philippines-based exchange Coins.ph announced that the Beldex native token will list on its platform with a BDX/PHP pair. The CEX, established in 2014, stands as the Philippines' premier cryptocurrency exchange.

Weekly losers

- DASH (-35.4%) and ZEC (-28.8%) succumbed to the broader crypto market downturn, and the entire privacy sector bled amid macro tensions. Additionally, Indian crypto exchanges started delisting both coins to comply with new AML/CFT requirements from the country's Financial Intelligence Unit.

- PUMP (-25.2%) joined the broader sell-off despite Pump.fun’s DEX volume doubling in January along with its generated revenue. The number of returning users reached a record high last week.

Cryptocurrency news

Warsh’s Whiplash: What Trump's Fed Chair pick means for Crypto

Donald Trump’s pick of Kevin Warsh as the next Fed Chair has sent a shiver through the crypto markets, with Bitcoin stumbling to multi-month lows. On the surface, it seems contradictory: Trump wants aggressive rate cuts, and Warsh has recently echoed that dovish tune. So why is crypto panicking?

Warsh’s hawkish DNA

Markets have long memories, and they’re replaying the tapes from the 2008 financial crisis. While the global economy teetered on the brink of deflation, Warsh was a lone voice on the Fed fretting about inflation risks. His infamous quote from the month Lehman Brothers collapsed — “I'm still not ready to relinquish my concerns on the inflation front” — has become a chilling reminder of his priorities.

For crypto, this isn’t just about interest rates; it’s about liquidity and narrative. Warsh’s core philosophy of monetary discipline and higher real rates frames assets like Bitcoin not as a digital gold hedge against debasement, but as speculative excess that thrives on easy money. His nomination signals a potential regime where the financial spigot is tightened, not flung wide open as some had hoped under Trump.

Pricing in a hawkish reversal

The immediate reaction — billions flowing out of Bitcoin ETFs and a flight to traditional safe havens like gold — shows the market’s verdict. Traders aren’t betting on the new, politically convenient Warsh. They’re pricing in the return of the old guard economist who could prioritize fighting theoretical inflation over supporting risk assets.

In short, the Warsh pick feels like a bait-and-switch for crypto. It swaps the promised era of reflation and dollar weakness for a reminder of stricter, more traditional central banking. Until he proves otherwise, the crypto market will assume the hawk hasn’t changed his feathers, and that means a tougher, drier environment for digital assets to grow.

Tether drops a new OS: Why its mining move could reshape Bitcoin

We've all heard the stats: mining Bitcoin is an industrial-scale game dominated by giant pools and proprietary tech. It's often seen as a closed shop, where small rigs face a steep climb. This week, Tether, the powerhouse behind the $1 trillion USDT, just tried to kick that door wide open.

At the Plan ₿ Forum in San Salvador, Tether unveiled its own open-source Bitcoin Mining Operating System (MOS). Think of it less as a product and more as a foundational tool — a free, public blueprint for running a mining operation.

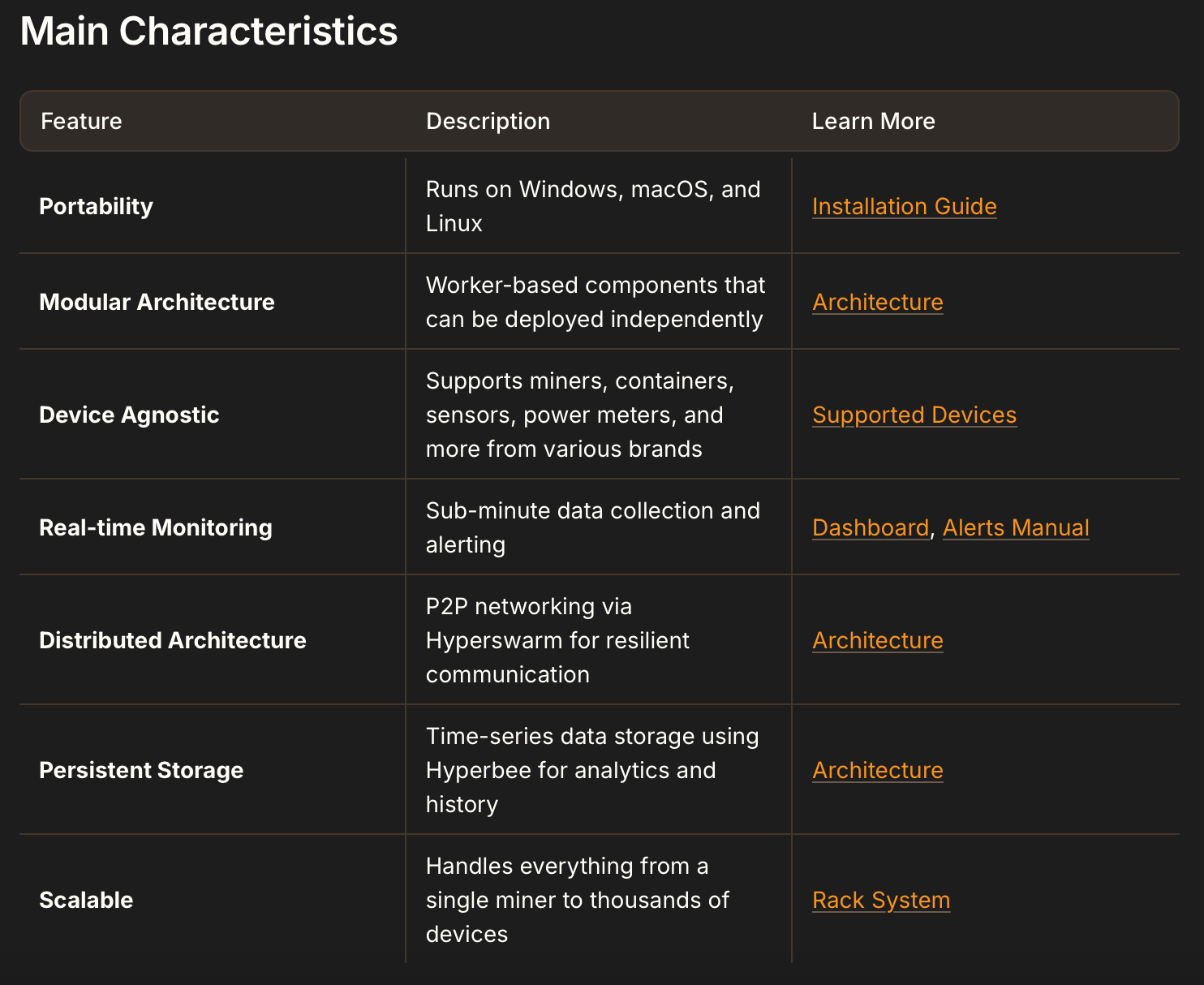

So, what exactly is MOS?

In simple terms, it's a unified software layer designed to manage the chaotic symphony of a mining site: the rows of whirring ASICs, the power systems, the cooling, and the network connections. Instead of juggling multiple, incompatible vendor dashboards, MOS treats every component as a "worker" in a single, controllable system.

Whether you're running five machines in a garage or 50,000 across a Texas field, it aims to provide the same clear view of your hashrate, energy use, and hardware health. But the real story isn't just about better management software.

Strategic shift in power and philosophy

By releasing MOS under an open-source Apache license, Tether is making a direct play to decentralize mining infrastructure itself. This is about challenging the "black box" of proprietary systems and lowering the technical barrier to entry. The goal, as stated by CEO Paolo Ardoino, is to make Bitcoin mining "more open, modular, and accessible."

What does this mean for the future of crypto?

- Democratizing mining: empowering a new wave of smaller, independent miners. With access to industrial-grade management tools for free, the competitive landscape could diversify, potentially making the network more resilient and geographically distributed.

- Infrastructure gambit: stretching ambitions far beyond stablecoins. With over $10 billion in net profit last year, Tether is leveraging its war chest to become a foundational player in Bitcoin's core infrastructure — mining, payments, and now, its operational software.

- Trend towards openness: joining initiatives like Jack Dorsey's Block in pushing for open and accessible mining tech. This growing trend suggests a future where the bedrock of Bitcoin is built on transparent, community-driven tools rather than walled gardens.

In essence, Tether's MOS is an attempt to rewrite the rulebook on who gets to mine Bitcoin and how. By open-sourcing the operational brain, the company is betting that a more decentralized and accessible mining industry is a stronger one for Bitcoin's long-term future. The crypto world will be watching closely to see if the community picks up the tools and starts building.