The big chill: Is this a new crypto winter?

Bitcoin just got hammered by its worst weekly decline in over three years, but bulls are scratching their heads over the cause. The Wall Street Journal has proclaimed the onset of a new crypto winter, Bloomberg calls it the “worst ever” — yet the freeze may have actually begun months ago. Let’s dig into the current selloff.

TL;DR

- Past winters ('14, '18, '22) all followed the same brutal script: a major internal blow-up (like Mt. Gox or Terra-Luna) shatters trust.

- The current downturn was sparked by external factors, and the old "all boats rise and fall together" model is dead.

- We’re not in a classic winter, but a "regulated" — or "post-regulation" winter — a prolonged chill from outside forces, freezing a now-mature market where compliant and speculative capital are starkly divided.

- Possible bull run catalysts include a killer app combined with a macro shift (like rate cuts), strong economic growth, and clearer regulation.

What is a classic crypto winter?

A crypto winter, akin to a bear market in stocks, is defined as a “period in which the cryptocurrency market performs poorly, significantly influencing investor mentality.”

During these slumps, the majority of cryptocurrencies bleed out for 13 months on average. The top three triggers include market crashes, exchange breakdowns or hacks, and regulatory crackdowns.

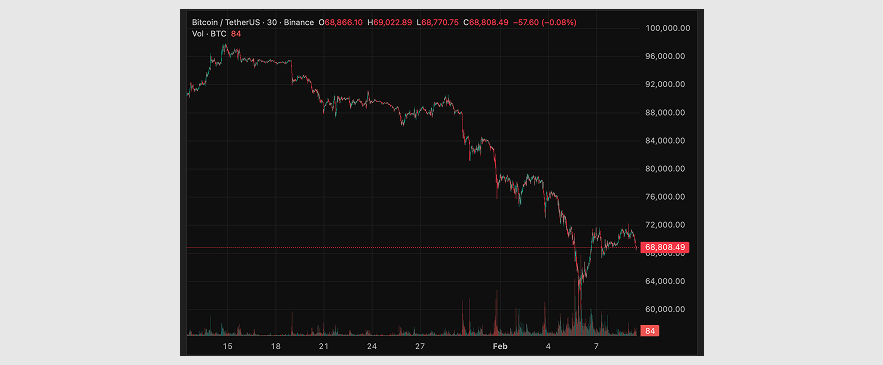

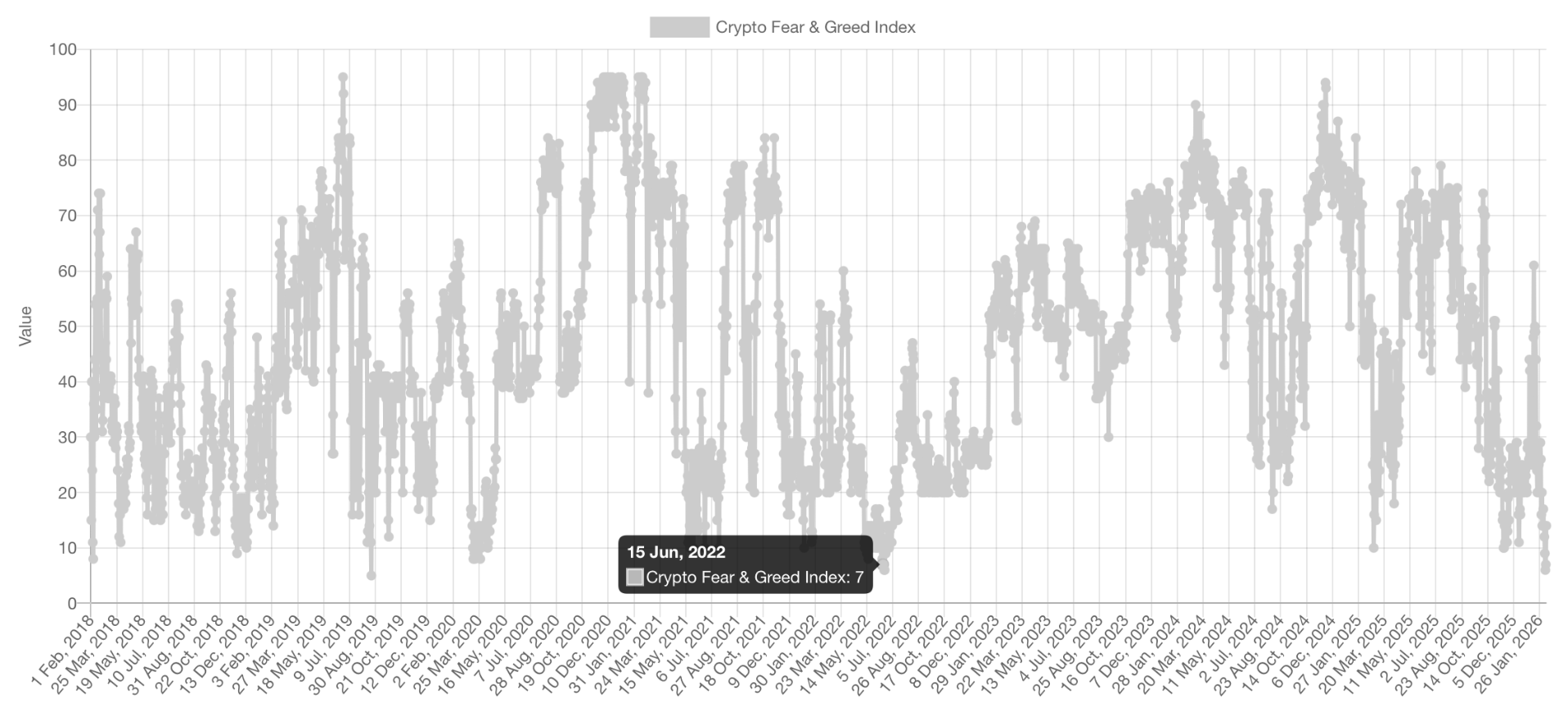

On February 6, 2026, BTC stunned traders with a plunge to $62,822, a level last seen in October 2024. Two days later, the Crypto Fear and Greed Index nosedived to 7/100, a level last seen on June 15th, 2022.

With the coin clinging to the $69k level — 44.8% below its peak of $126,080 — market observers are picking the downfall apart. Matt Hougan, Chief Investment Officer at Bitwise Asset Management, believes a crypto winter is exactly what we have:

“This is not a “bull market correction” or “a dip.” It is a full-bore, 2022-like, Leonardo-DiCaprio-in-The-Revenant-style crypto winter—set into motion by factors ranging from excess leverage to widespread profit-taking by OGs.”

According to Hougan, this winter started in January 2025, but it was masked by the institutional frenzy. While retail bled, big players “papered over” the decline. If this theory is true — and the typical duration holds — the current plunge is a late-stage chapter of this decline.

Let's see how it measures up against the deep freezes of the past.

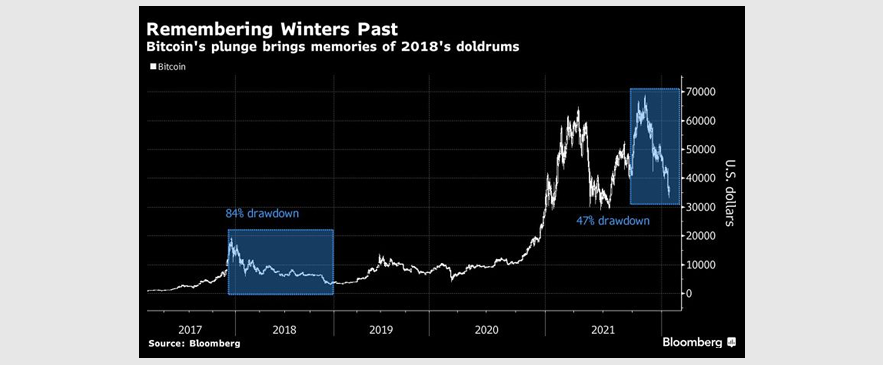

Looking back at crypto winters (2014-2022)

2014: Mt. Gox hacks & woes

The first crypto winter kicked off during the Mt. Gox era. A hack funnelled roughly 850k BTC from the exchange, which processed around two-thirds of global BTC trading volume at the time. A crisis of trust ensued.

Exchanges began to implement audits and internal control measures to win back skeptics. Meanwhile, Ethereum’s ICO sparked fresh possibilities for innovation and fundraising. The ICO boom of 2017 triggered a new bull market — but sadly, the majority of projects raising billions had empty promises.

2018: From ICO crackdowns to pandemic

The following year, the US, China, and Korea clamped down to protect investors from misleading ICO hype. As the bubble burst, the market plunged into its second crypto winter, which dragged on until late 2020.

Fresh liquidity didn’t flood back until after the COVID pandemic. The advent of DeFi — specifically, decentralized protocols like Uniswap and Aave — sparked a new flame.

2022: Crypto’s domino effect

The crypto winter of 2022 became the longest and harshest to date. It all started with the implosion of the LUNA token, which underpinned Terra, a top-10 crypto project by market cap. LUNA was used to prop up UST (TerraUSD), a native stablecoin that eventually depegged from the US dollar.

The event sparked a negative feedback loop - the ‘death spiral,’ where investors yanked funds from UST and LUNA en masse. Celsius, Three Arrows Capital, and other crypto businesses folded in a domino effect, eventually culminating in the meltdown of the FTX exchange.

With the very foundation of the industry in tatters, it took the market over 2 years to bounce back. That crypto winter appeared to end with the approval of the first US spot Bitcoin ETFs in January 2024. Later, Bitcoin's fourth halving (April 2024) and Donald Trump's crypto-friendly policies fueled a renewed capital influx.

How crypto winters unfolded: Typical pattern

According to Tiger Research, all preceding crypto winters followed the same script: "Major Internal Event → Trust Collapse → Talent Exodus."

We've seen trust evaporate and talent flee the industry every time, albeit on a different scale. This playbook repeated after the Mt. Gox hacks, ICO crackdown, the Terra-Luna fiasco, and the FTX collapse. Every time, the market — and trust — were shaken to the core.

With the very essence of crypto technology called into question, finger-pointing replaced builders’ collaborative spirit. Talent fled to sectors that appeared more certain: “In 2014, they left for fintech and big tech. In 2018, they left for institutions and AI.”

So, is this a crypto winter?

By Tiger Research's logic, the current downturn does not fully qualify as a crypto winter because the shock was external, not from within the industry.

The market has been at the mercy of macro factors and geopolitics, from the Fed’s refusal to cut rates to Trump's tariff threats to US-Iran tensions. In 2024, the market rode high thanks to Trump and Bitcoin ETFs — now, it is feeling the heat from the outside.

However, other patterns are eerily familiar.

- Signs of speculative bubbles. The TRUMP memecoin (Official Trump) crashed 90% after its market cap peaked at $27 billion within 24 hours of launch.

- Shock liquidation events. On October 10, 2025, now known as crypto’s Black Friday, $19 billion worth of leverage got wiped following a Donald Trump tweet about 100% tariffs on China. The wipeout was exacerbated by a massive whale short placed hours before and issues with Binance's collateral system.

- Trust erosion and talent exodus. As criticism mounted, developers started eyeing artificial intelligence (AI).

The crypto market peaked in October 2025, when Bitcoin hit its ATH above $126k. Soon after, crypto’s “Black Friday” erased over $19 billion in one day. On February 6, BTC briefly touched sub-$63k — nearly half of its all-time high.

If you focus on the source of disruption, this decline is unlike any before. New narratives are still sprouting, builders are still here, and infrastructure is being built up. Prediction markets, privacy coins, perpDEXs, and RWAs continue making headlines.

Taking the broader definition as a “sustained period of negative market sentiment and decline in cryptocurrency or digital asset values,” a crypto winter appears to be in full swing. So, what changed?

Market is fundamentally different

The previous crypto winters were triggered by internal blow-ups that eroded confidence and caused a stampede for the exits, making the crash worse. Now, the fundamental structure has matured, and capital flows have evolved.

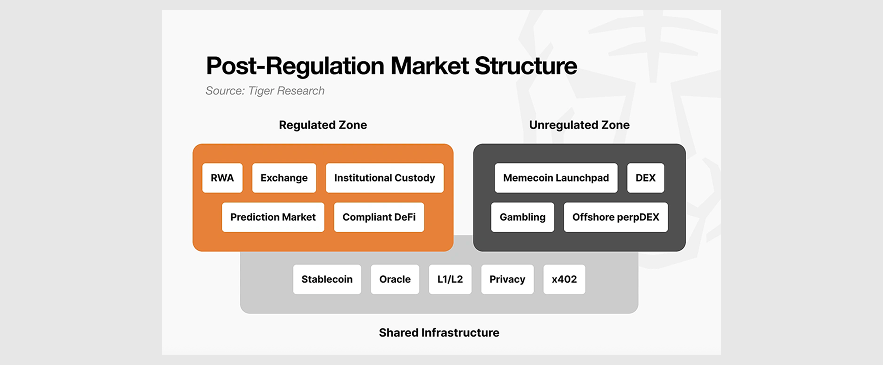

This is no longer just a cyclical downturn, or the simple “altseason” playbook, with Bitcoin shooting up, and alts following. According to Tiger Research, the crypto market is now split into three distinct layers — regulated, unregulated, and shared infrastructure in-between.

- The regulated corner enjoys legal protection while embracing audits and disclosures. The shift toward compliance makes moon-shots less likely.

- The unregulated wild west (DEXs, memecoin launchpads, offshore perpDEXs, gambling) can still see dramatic upswings, with low entry barriers and high volatility.

Both worlds use the third component — stablecoins and oracles.

Regulated capital hunkers down “where value was proven” — it does not stray into unregulated zones. ETF capital is unlikely to find its way into perp DEXs or meme launchpads.

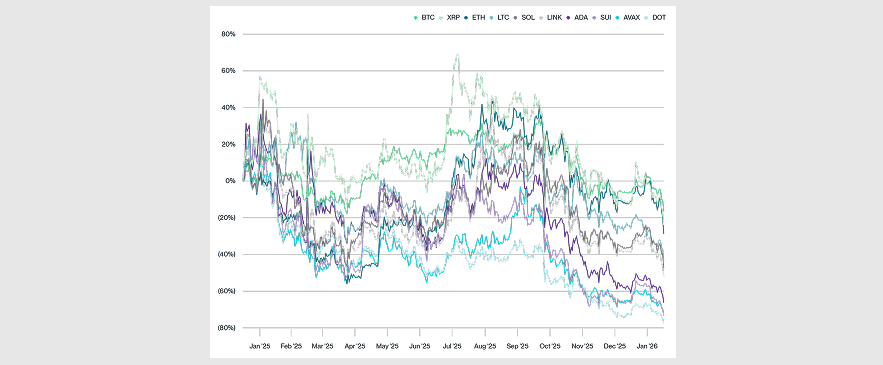

Regulation and institutional support — the ETF boom and the explosion of Digital Asset Treasuries (DATs)* — did not benefit the market evenly:

- BTC and ETH (ETFs + DATs) were clear beneficiaries.

- Tokens like SOL, LTC, and LINK (ETFs approved later in 2025) saw a classic bear market.

- Altcoins like ADA, AVAX, and SUI (no ETFs) got crushed the worst, with losses exceeding 64%.

*Digital Asset Treasuries (DATs) are public companies or entities that purchase, hold, and manage cryptocurrencies directly on their balance sheets. At press time, Strategy remains the biggest Bitcoin DAT, while BitMine Immersion Technologies operates the largest publicly traded Ethereum treasury.

What would it take to break the freeze?

Beyond simply waiting it out, analysts point to a confluence of catalysts needed to spark a true thaw:

- A "killer use case" emerging from the unregulated zone. The market needs a fresh, undeniable narrative — like DeFi Summer — that creates real value from the experimental fringes.

- Shifting macro winds, as crypto cannot defy the Fed's gravity. The broader environment of high interest rates and tight liquidity needs to reverse.

- Strong economic growth. A robust, risk-on rally in traditional markets would lift all boats, including crypto's regulated core.

- Regulatory milestones. Renewed progress on stalled frameworks like the CLARITY Act could unlock institutional confidence.

- Sovereign adoption. Concrete signs of a major nation-state adopting BTC would be a powerful legitimizing signal.

Conclusion: New kind of winter?

The evidence points to a market in distress, but its anatomy has changed. Overall, the classic crypto winter has given way to a fundamental split, under pressure from external macro drivers and regulation. This is a new game in a space where the old rules are broken.

We are not in a 2018-style or 2022-style crypto winter, defined by a single catastrophic internal failure. Instead, we may be in a new paradigm: a "regulated" winter, where a mature, divided market endures a prolonged chill driven by external macro forces and a stark divergence between compliant and highly speculative capital. The big chill is here, but it's frostbiting different sectors in profoundly different ways.