Earning with crypto: Fixed-term vs. flexible savings

If it’s sitting in your wallet, it’s not earning. Beyond HODLing or trading, crypto savings let you put your assets to work without lifting a finger.

These products aren't all that different from bank deposits. Here's a quick look at their features, trade-offs, and tips for choosing wisely.

At a glance

- Crypto savings pay interest on your idle assets — like a bank account, but with meaningfully higher rates.

- Fixed-term savings: Lock your funds for 1–12 months. Higher, guaranteed yield (e.g., up to 8.2% APR). Best for long-term goals or money you won't need immediately.

- Flexible savings: Withdraw your deposit at any time without penalties. Lower yield (e.g., 5.2% APY). Perfect for emergency funds or cash you might need soon.

- No wrong choice — many people use both to balance growth and liquidity.

- Choose a regulated platform with transparent terms and institutional-grade custody.

Basics of crypto savings

Crypto savings are similar to what your bank does — it lends out deposits, invests them, and shares a portion of the profit back with you.

- You deposit crypto (e.g., BTC, ETH, or stablecoins).

- The platform pools your funds with others and puts them to work through lending, staking, or yield farming.

- You receive a cut of that generated revenue as yield (your actual return, including interest and any compounding).

Depending on the product, interest may be calculated daily, weekly, or monthly. With compounding (as in flexible savings), you earn interest on interest — not just on the principal (your original deposit). This helps your savings grow faster over time.

Yield decoded: APR vs. APY

These terms often get thrown around interchangeably, but they aren’t the same.

- APR (Annual Percentage Rate) is the simple interest rate on your crypto deposit. For example, putting 1,000 USDT at 8% APR will earn you exactly 80 USDT — bringing your total to 1,080 USDT over a year.

- APY (Annual Percentage Yield) includes compounding. Interest gets added to your balance periodically and starts earning its own interest. That same 1,000 USDT at 8% APR with daily compounding (APY of 8.33%) earns you more — 83.28 USDT, for a total of 1,083.28 USDT after one year.

Put simply, APY is what you actually earn. APR is the starting point before compounding does its magic.

Crypto vs. TradFi bank savings

The real difference is in the numbers.

EU bank savings accounts currently offer around 2.00%–3.00% APY. Crypto savings can deliver 3%–8% or more, depending on what you deposit and how you choose to save.

The catch is specific risks — namely volatility and regulation. That’s why choosing a transparent, secure, and properly regulated platform matters.

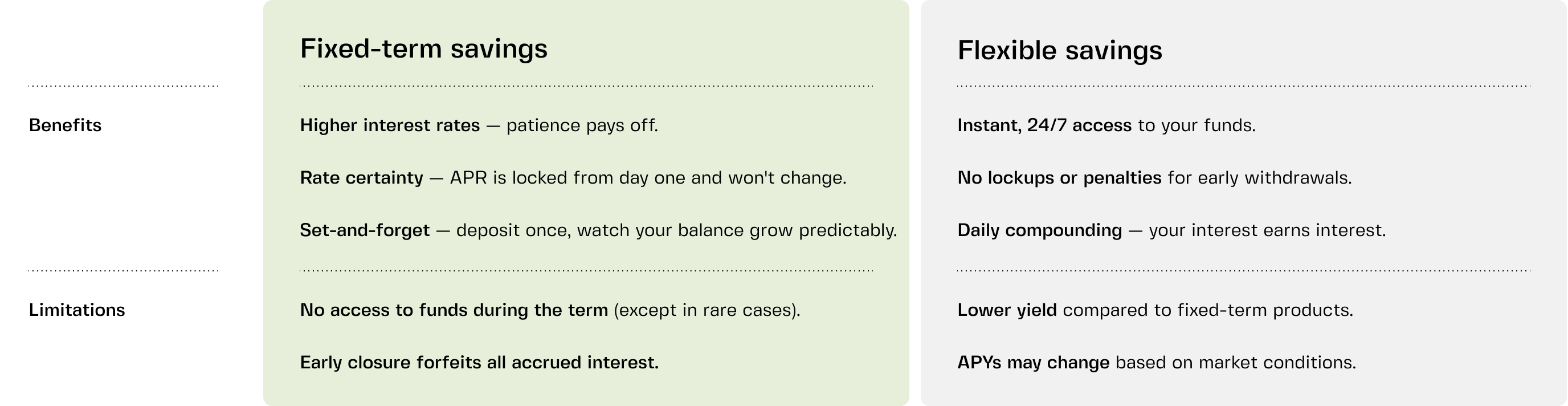

Fixed-term vs. flexible savings

Broadly, crypto savings fall into two categories. Both have their place, and neither is inherently better — it depends entirely on your goals.

Fixed-term: Maximized guaranteed returns

Fixed-term savings means exactly what it sounds like: you lock your crypto for a set period — commonly, 1, 3, 6, or 12 months. Choose your term upfront, and your funds stay put until maturity (with limited exceptions).

Best for: Savers with long-term goals. Use it for a portion of your portfolio you won't need soon, or simply to lock in today's high rates.

Fixed-term products reward your commitment with a higher, guaranteed yield. On Clapp, that's up to 8.2% APR on EUR and stablecoins, up to 6% APR on ETH, and up to 5% APR on BTC.

Flexible: Everyday saver's tool

Flexible savings are the opposite end of the spectrum. Your funds remain fully liquid, accessible anytime — day or night, weekends included — with no lockups or penalties for early withdrawal.

Best for: Emergency funds, short-term goals, or any cash you might need at a moment's notice.

This is freedom to withdraw on demand. Your balance grows steadily, and while the rate is typically lower than with a fixed term, interest compounds daily.

With Clapp's Flexible Savings, you can earn up to 5.2% APY on EUR/stablecoins, 4.2% APY on ETH, and 3.2% APY on BTC — as long as you choose, with instant withdrawals back to your wallet or bank.

Comparison overview

How to choose

There's no wrong answer here — just the right fit for your situation.

Ask yourself:

- Am I risk-averse about access? Keep what you might need in flexible; lock the rest.

- Do I want absolute certainty? Fixed locks your rate. Flexible gives you freedom.

- Can I comfortably set aside a portion for a few months? Fixed-term will reward you for it.

- Do I need this money soon? If yes, flexible is your friend.

Many users do both: keep emergency cash in Flexible Savings for instant access, while locking another portion in Fixed Savings to secure higher guaranteed yield.

Explore Clapp Savings today

Whether you're building a rainy-day fund or growing wealth for the long haul, Clapp Savings gives you both options — transparent, secure, and built on a fully regulated EU framework.

No complexity. No hidden terms. Just smarter savings for your crypto and fiat.

Activate Clapp Savings in the app and put your idle assets to work.

Frequently asked questions

How do crypto savings work?

Crypto savings work similarly to a bank deposit. You deposit crypto or stablecoins, and the platform puts these funds to work through lending, staking, or yield farming. A portion of the revenue generated is paid back to you as yield, which may include interest and compounding depending on the product.

What assets can I deposit?

With Clapp Savings, you can also yield on fiat (EUR), crypto (BTC, ETH) and stablecoins (USDT, USDC).

What’s the difference between fixed-term and flexible savings?

Fixed-term savings lock your funds for a set period — usually 1, 3, 6, or 12 months — in exchange for a higher, guaranteed yield. Flexible savings let you withdraw your funds at any time, with no penalties, but the interest rate is typically lower. Many people use a combination of both: fixed-term for long-term growth and flexible for liquidity and emergency access.

What’s the difference between APR and APY?

APR (Annual Percentage Rate) is the simple interest rate — it tells you the interest you’ll earn on your deposit over a year, without compounding. APY (Annual Percentage Yield) includes compounding, meaning your interest earns interest over time. In short: APR shows the starting rate, while APY shows what you actually earn in your account if compounding is included.

How is interest paid?

It depends on the product. With Clapp Flexible Savings, interest is calculated daily and credited to your balance — you'll see it grow in real time. With Fixed Savings, interest accrues daily and is paid out in full at the end of your term.

Do I need to lock up a lot of money to start?

Not at all. With Clapp Flexible Savings, you can start with as little as €10 or the equivalent in USDT, USDC, BTC, or ETH. Fixed Savings requires a minimum of $250 equivalent — still far lower than what most traditional high-yield accounts demand.

Are crypto savings products safe?

Yes, provided you use a reputable, regulated platform. Clapp keeps all users' savings deposits in segregated accounts with Fireblocks institutional-grade custody. We're also a registered VASP in the EU, which means we operate under strict compliance and transparency standards. Your funds are always yours.

Is the interest taxable?

It depends on where you live. In many jurisdictions, interest earned on crypto or fiat savings is considered taxable income. We recommend checking with a local tax professional to understand your obligations.