Winter is here: 5 proven strategies for crypto survival

In crypto, volatility isn't a surprise — it's the price of admission. But when markets crash, those price drops can feel personal. A red portfolio can mess with your head, your sleep, and your decision-making.

Crypto winters are a kind of Darwinian phase. The weakest projects get weeded out. So do the weakest trading habits. The goal is to emerge on the other side with your capital (and your sanity) intact.

Here are five ways to navigate the downturn, from portfolio mechanics to emotional regulation.

TL;DR

- Reduce fragility in your portfolio. Shift the majority (80–90%) into core assets and limit high-risk bets to what you can afford to lose.

- Maintain a stablecoin buffer. Keep 20%–30% in stables to protect purchasing power and avoid forced selling.

- Rebalance systematically. Stick to target allocations and let rules — not emotions — drive buy/sell decisions during volatility.

- Use dollar-cost averaging (DCA). Invest fixed amounts at regular intervals instead of trying to time the bottom.

- Protect your psychology. Limit market noise, set boundaries around price-checking, and avoid making decisions in panic mode.

What is a crypto winter?

A crypto winter is an extended bear market marked by falling prices, weak sentiment, and reduced liquidity across digital assets. It typically follows a major bull run and, historically, has lasted around 13 months. During this phase, speculative projects collapse, funding slows, and even leading assets can lose 50% or more of their value before the cycle eventually turns.

Rotate out of most volatile assets

Most of your downside risk is probably concentrated in a small part of your portfolio.

Speculative assets — low-utility tokens, micro-cap coins, NFTs with no real use case — tend to get absolutely wrecked in bear markets. They can drop 80–90% while blue chips fall 30–40%. That's where permanent capital loss happens.

Take a hard look at your holdings. Be honest about which projects have genuine long-term viability and which were bets that didn't pan out. This is the time to cut the latter.

Position yourself to sleep at night while still having some powder dry for opportunities. A useful framework is the 80/20 rule:

- 80–90% in core holdings: BTC, ETH, stablecoins, and maybe some cash

- 10–20% in trades you're prepared to lose (higher-risk, speculative)

For the higher-risk positions you keep, manage your exposure systematically: use stop-loss orders, predefine entry and exit points, and stick to a disciplined plan.

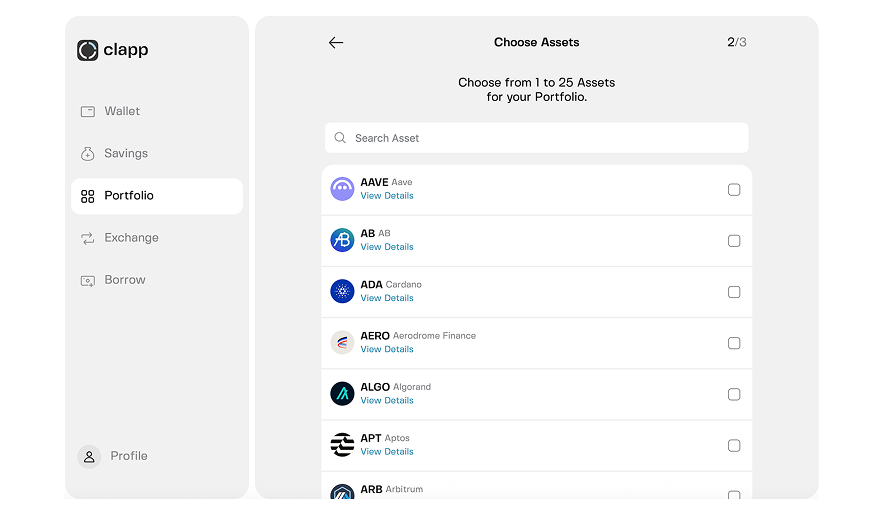

Clapp lets you compose portfolios with target allocations — say, 60% BTC, 30% ETH, 10% stables — and monitor performance at a glance.You can also select from curated sets or simulate strategies with Time Machine’s backtesting before committing.

Keep a stablecoin buffer

A stablecoin buffer (USDT, USDC, or even just EUR in your Clapp Wallet) serves two critical purposes during a downturn:

First, it protects your purchasing power. While your BTC and ETH are down 40–60%, your stablecoins are still worth exactly what you deposited. That’s dry powder — ammunition to deploy when prices inevitably look attractive again.

Second, it keeps you rational. When everything's bleeding red, having a chunk of your portfolio unaffected by the chaos provides psychological breathing room. You're not forced to sell your crypto at the worst possible moment because you need cash for real-life expenses. You can wait.

Around 20–30% of your portfolio in stables should give you both peace of mind and flexibility. If you're relying on crypto for day-to-day costs, a common rule of thumb is 6–12 months of living expenses in stablecoins or fiat.

In the meantime, those stablecoins don’t necessarily have to sit idle. Depending on the platform you use, you may be able to earn yield on USDT, USDC, or even EUR balances through fixed or flexible savings products. For example, Clapp currently offers up to 8.2% APR on supported stablecoins and EUR.

The key is understanding how that yield is generated and what risks are involved. During a downturn, capital preservation comes first, yield is secondary. Your buffer’s primary job is stability and liquidity — any return on top is a bonus.

Rebalance your portfolio

If you've been in crypto for a while, your portfolio is probably not what you started with. Some assets outperformed. Some got crushed. Your carefully planned allocations are now a mess.

Rebalancing is the act of selling assets that have grown too large and buying those that have shrunk — bringing your portfolio back to its target allocation. You're not deciding to sell ETH because you're scared; you're executing your strategy.

There are several approaches to rebalancing you can follow today:

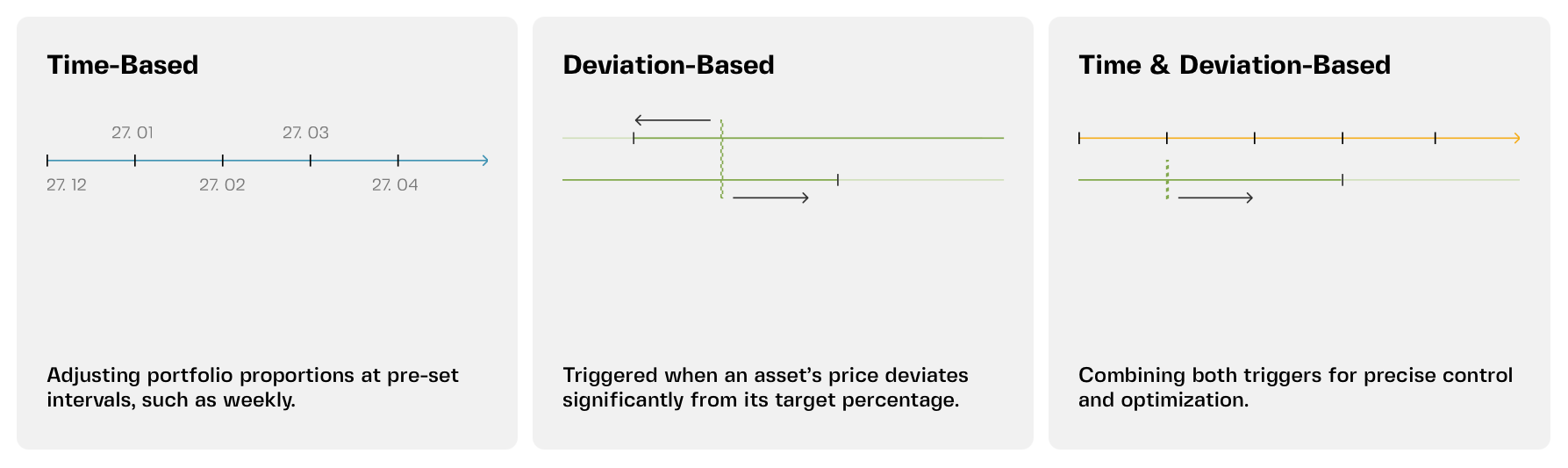

- Time-based: Adjust at regular intervals, such as weekly, monthly, or quarterly. This ensures consistent maintenance without having to monitor every market move.

- Deviation-based: Adjust only when an asset’s allocation deviates significantly from its target percentage. This is useful for reacting to sudden market swings without overtrading.

- Time & deviation-based: Combine both methods — check allocations at regular intervals but only rebalance if deviations exceed a predefined threshold. This balances efficiency with precision.

Auto-rebalancing tools handle these adjustments in the background, letting your strategy run systematically even when fear is running the show.

Set up recurring buys

Trying to time the bottom is extremely difficult. Even professional traders get it wrong more often than they get it right. The better approach is to start averaging.

Dollar-cost averaging (DCA) is exactly what it sounds like: you invest a fixed amount at regular intervals, regardless of price. Weekly, bi-weekly, monthly — pick a rhythm and stick to it.

Here's why it works: when prices are low, your fixed dollar buys more crypto. When prices are high, it buys less. Over time, this smooths out your entry price and removes the emotional weight of "did I buy at the worst possible moment?"

Say you have $1,000 to deploy. Instead of going all in and praying, you could split it into $250 monthly purchases over four months. You'll catch some highs, some lows, and probably end up with a better average price than anyone who tried to nail the perfect entry.

Just keep an eye on transaction fees — frequent small buys can eat into your returns if you're not paying attention. Factor them into your math.

DCA during a crypto winter forces you to stay engaged in a good way. Instead of panic-selling, you're methodically building a position while everyone else is doom-scrolling.

Turn off the noise

This might be the hardest tip of all. Crypto never sleeps, and neither does the anxiety factory that runs 24/7 on X, Reddit, and Telegram. Every crash is a "bloodbath." Every dip is "the end." The endless scroll of fear amplifies your own doubts and drives herd behavior — usually at exactly the wrong moments.

Take breaks. Log out. Close the apps. Give yourself permission to not know what's happening for a few hours — or a few days.

The market will still be there when you get back. The panic posts will still be there. But you'll return with a clearer head, less likely to make impulsive moves you'll regret when the cycle turns.

A few practical guardrails:

- Set specific times to check prices — not a continuous open tab

- Mute or unfollow accounts that thrive on fear-mongering

- Remember that every crypto winter in history has been followed by a recovery. The people who fared best were the ones who didn't panic.

This too shall pass. Just make sure you're still in the game when it does.

Frequently asked questions

How long do crypto winters typically last?

Historically, crypto winters have lasted anywhere from 12 to 24 months. The 2018 bear market bottomed out after about a year, while the 2022–2023 winter stretched closer to 18 months. No one can predict the exact timing, but the pattern is consistent: every downturn has eventually given way to a recovery.

Should I sell everything and go to cash?

That depends on your personal situation and risk tolerance. If you need the money in the next 6–12 months, moving to stablecoins or fiat might be the right call. But for long-term believers, bear markets are historically the best times to accumulate — not exit. The key is not being forced to sell at the worst moment, which is where a stablecoin buffer helps.

What's the difference between rebalancing and just trading?

Rebalancing is systematic and rules-based. You're not making a bet on where the market is going; you're simply maintaining your desired allocation. Trading is directional — you're trying to predict price movements. During volatile times, rebalancing removes emotion from the equation. Clapp's automated portfolios handle this for you in the background.

Is dollar-cost averaging better than lump-sum investing?

Studies show that lump-sum investing tends to outperform DCA about two-thirds of the time — in hindsight. But that requires perfect timing and iron nerves. DCA is about managing psychology and reducing regret, not maximizing returns. If a lump sum investment drops 30% the day after you buy, most people panic. DCA spreads that risk and keeps you in the game.

How do I know when the crypto winter is over?

You likely won't know until well after it's happened. The bottom is only visible in retrospect. By the time everyone declares the bear market over, prices are usually already 50–100% off the lows. That's why trying to time the exact bottom is a trap. Focus on positioning yourself to survive — and thrive — regardless of when the recovery comes.