Clapp Weekly: AI shock amid Fed unease, pro-crypto Treasury chief, Lunar New Year

Price dynamics

BTC price

Bitcoin rebounded above $100k yesterday, a modest recovery after the market was rattled by DeepSeek, a Chinese AI app that rivals ChatGPT. The coin is holding above the six-figure mark as investors prepare for the Federal Reserve’s interest rate decision today.

From $105k last Wednesday, January 22, BTC dipped to $101.5k before surging to a 7-day high of $106,462 on Friday, January 24. A steady weekend at roughly $105k preceded a Monday plunge to $98,380.59 amid the AI shake-up before recovering.

At press time, BTC is at $102,884, up 0.2% over 24 hours with a +2.1% weekly change.

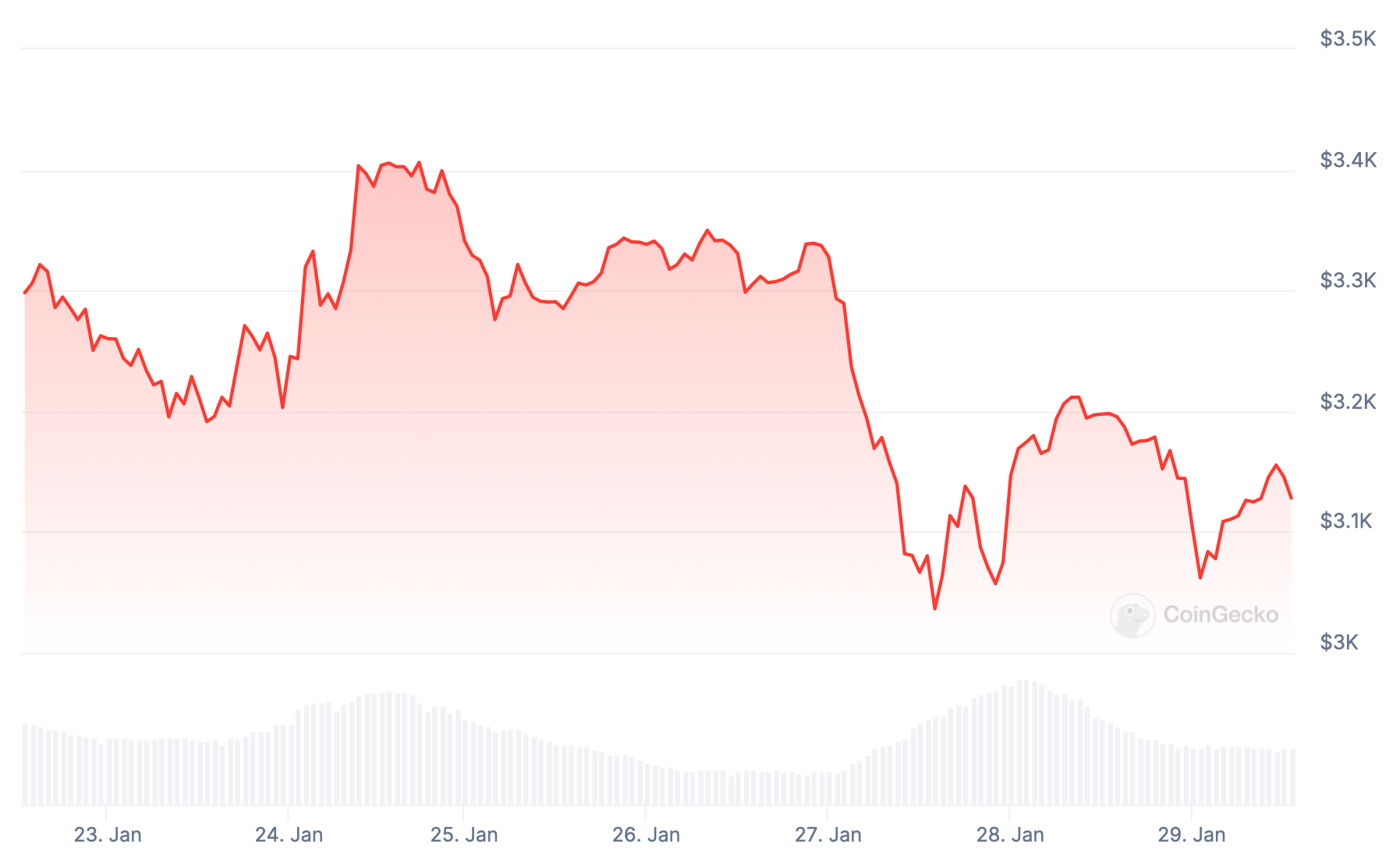

ETH price

Ether has seen a relief rally following Monday's AI upheaval. The uptick is largely attributed to cooler leveraged crypto trading. Whales have been sending mixed signals, with encouraging signs amid weakening spot ETF inflows.

ETH slipped from $3.3k a week ago before recovering to $3.4k on Friday, January 24. It mainly held above $3.3k through the weekend before Monday's nosedive. After a low of $3,036.49, ETH is struggling to recuperate its losses.

At $3,150.26, ETH has lost 1.4% over the past 24 hours and 4.3% over seven days.

Seven-day altcoin dynamics

On Monday, January 27, AI tokens plunged after Chinese startup DeepSeek launched a free, open-source AI model surpassing OpenAI's performance at a fraction of the cost. DeepSeek's debut shook the industry, with Nvidia stock dropping a spectacular 13%.

Key AI categories booked double-digit losses, ranking among the five worst crypto performers: AI agents (-23.5%), meme coins (-24%), launchpad tokens (-38.3%), and the Virtuals protocol ecosystem (-42.3%).

DeepSeek challenges the narrative that AI tokenization drives innovation. Its superior, open-source model casts doubt on the relevance of established AI crypto tokens like Griffiain (-32.4%) and Aixbt (-21.4%), dependent on American AI models. Meanwhile, meme coins tied to DeepSeek are surging.

The Monday losses totalled over $1 billion in futures liquidations across the board. The next day, BTC rose to nearly $103k to usher market-wide gains. Today's conclusion of the two-day FOMC meeting, which has typically impacted BTC prices, is almost certain to keep the rates steady.

Winners & losers

OM (+29.9%) boasts the largest weekly gains, with MANTRA expanding into RWAs via a $1B tokenization partnershipwith DAMAC. JUP (+26.5%) is the runner-up due to the upcoming $3.6B token burn and $600M buyback. Meanwhile, MOVE (+18.8%) has jumped on Movement's reported talks with Elon Musk's Department of Government Efficiency (DOGE) and a $2M purchase by Trump's World Liberty Financial.

The official Trump meme coin is the biggest loser: whales and smart money investors have dumped TRUMP (-33.6%) after its stellar debut. VIRTUAL (-31.6%) is affected by fears that DeepSeek could undermine AI-driven US tech stocks, while S (FTM) (-24.4%) keeps grappling with persistent selling pressure.

Cryptocurrency news

Trump appoints pro-crypto Treasury Secretary

Scott Bessent, a billionaire former hedge fund manager, has joined the Trump administration as Treasury Secretary with plans to advance the president’s pro-crypto agenda. Known for his support of digital assets, Bessent was confirmed by the US Senate on January 27.

Bessent’s confirmation passed with a 68-29 vote, succeeding Janet Yellen. While Trump’s primary focus remains on tax cuts, his recent executive orders position Bessent to shape US cryptocurrency policy. The Treasury will collaborate with a governmental working group, leveraging input from digital asset leaders, to deliver policy recommendations within six months.

Notably, the executive order bans work on a US central bank digital currency (CBDC), aligning with Bessent’s stated opposition to a domestic digital dollar during his confirmation hearing. His personal investments in a Bitcoin ETF were disclosed prior to liquidation upon his nomination.

As Treasury Secretary, Bessent will oversee the Financial Crimes Enforcement Network (FinCEN), historically focused on crypto-related enforcement, including sanctions on mixers like Tornado Cash. With a mandate to reform existing regulations, Bessent’s leadership is expected to bring significant crypto policy changes, balancing innovation with enforcement.

Bitcoin could gain 20% during Lunar New Year, based on historical patterns

Bitcoin may see a 20% price surge as the Chinese (Lunar) New Year kicks off on January 29, according to a new Matrixport report. Historically, BTC has delivered positive returns in 11 of the past 12 China's Spring Festival periods, boasting an 83% success rate.

Matrixport attributes this seasonal rally to Bitcoin’s network effect, where increased user adoption fuels price growth. The period of high financial activity and gifting, has consistently acted as a key catalyst for BTC price spikes.

BTC trading activity has already started tipping to Asian trading hours, as noted by Cointelegraph. As usual, exchanges began rewarding users with "digital red packets," ahead of the event, and snake-themed meme coins are now prominent.

However, this year’s rally may face external influences, as the Fed’s Federal Open Market Committee (FOMC) meeting coincides with the holiday. While analysts expect interest rates to remain between 4.25% and 4.50%, markets will closely watch for future rate guidance.

Fed Chair Jerome Powell's press conference remarks will be dissected for clues about the prospects of further easing. If the upcoming US PCE report, due on January 31, contrasts with Powell's tone, markets will be alarmed.

“When the Fed cuts rates, crypto tends to thrive," as Rushi Manche, co-founder of Movement Labs, put it. Beyond macro trends, growing DeFi volumes, stablecoin adoption, and mainstream utility are keeping users engaged. With bullish seasonal trends and expanding adoption, Bitcoin could see a strong rally if historical patterns hold.