Clapp Weekly: BTC rebound, Truth Social ETF, Ethereum's 10x boost

BTC price

Despite nearly $1 billion in crypto liquidations and $430 million in ETF outflows, Bitcoin has mostly shrugged off the tumult from renewed US-China tariff tensions. After accusing China of violating a trade truce, President Trump announced a tariff hike to 50% on steel and aluminum — yet BTC is holding firm above $105k.

The BTC price slipped from $108,945 a week ago. A sharp plunge culminated at $103,414 on Saturday, May 31, before a gradual recovery. The coin reclaimed $105k on Monday, June 2, and moved higher in a choppy fashion.

Currently at $105,631, BTC is up 0.1% over 24 hours but down 3.0% over the past week.

ETH price

The SEC's Division of Corporation Finance has stated that securities laws do not apply to staking activities — specifically, self-staking on PoS networks. This boosted interest helped ether ETFs outperform the broader market with $321 million in inflows, extending their streak to 6 weeks.

ETH rose from $2.6k to $2,771.24 last Thursday, May 29, before mirroring BTC's plunge. After hitting a 7-day low near $2.5k last Saturday, May 31, the coin languished over the weekend before reaching $2,644.19 yesterday.

Now at $2,631.74, the second-biggest cryptocurrency is up 1.2% over the past 24 hours but down 0.6% over the past week.

7-day altcoin dynamics

Digital assets have seen a broader pullback over the past week amid renewed investor caution. Sentiment has worsened due to trade tensions and macro uncertainty, triggering sharp sell-offs and a reset in risk appetite.

Meme coins shot up on Monday, fueled by Bitcoin's sudden recovery. WIF and SPX led the rally with double-digit gains. Meanwhile, Ethereum's leadership in ETF flows following the Pectra upgrade could suggest an upcoming altcoin season.

XRP has rallied after Ripple's RLUSD stablecoin was officially recognized as approved for use within the Dubai International Financial Center (DIFC). Over 7,000 enterprises licensed by the DFSA (Dubai Financial Services Authority) can now integrate RLUSD into their services.

SOL briefly dipped 2% on traders’ knee-jerk reaction to news about Pump.fun. The platform aims to raise $1 billion in a token sale at a $4 billion fully diluted valuation.

Winners & losers

SPX (+19.8%) has seen the highest daily close in four months on Monday, following Bitcoin’s recovery. The market cap has returned to nearly $1 billion, a dramatic comeback from the prior crash.

MKR (+13.8%) continues its rally after the debut of staking on the rebranded Sky protocol triggered a frenzy. Meanwhile, TON (+6.9%) is holding steady, supported by Toncoin claiming the largest NFT trading volume, fueled by demand for Plush Pepe and the sale of Telegram usernames and numbers.

On the downside, FARTCOIN (-21.7%) is sinking despite significant whale accumulation ($9.5 million), as hype-driven support thins out. On Friday, May 30, FARTCOIN derivatives saw the largest long liquidation ever — $7.74 million erased. VIRTUAL (-19.6%) is reversing after a multi-day rally that added 500% in six weeks, suggesting fading momentum.

BONK (-17.4%) is recovering after plunging with the broader market, as the launch of Bonk Arena, the first licensed game for the token, revitalizes interest.

Cryptocurrency news

Trump’s Truth Social ventures into crypto with spot Bitcoin ETF

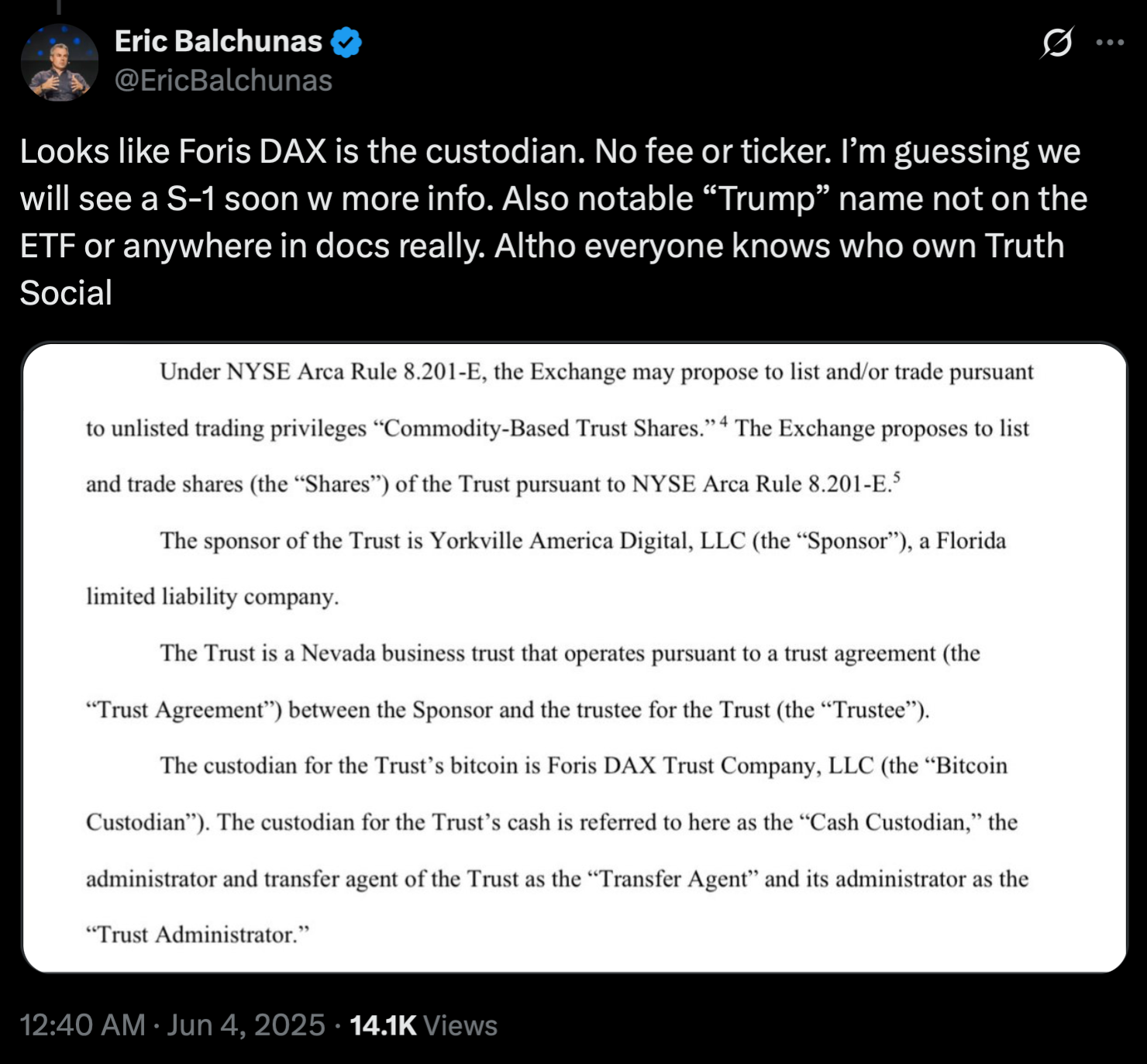

President Trump’s media company, Trump Media & Technology Group (TMTG), is stepping into the crypto arena with plans to launch a spot Bitcoin ETF under its Truth Social brand. NYSE Arca filed a 19b-4 application with the SEC yesterday, marking a significant step toward offering retail investors a new way to gain BTC exposure.

The proposed Truth Social Bitcoin ETF, managed by Yorkville America Digital in partnership with TMTG, would track Bitcoin’s price while relying on Foris DAX Trust (Crypto.com’s custodian) to hold the underlying assets. Notably, the filing avoids direct mention of Trump’s name, but the connection is unmistakable — Truth Social’s parent company, TMTG, is majority-owned by the former president.

This move follows TMTG’s recent $2.32 billion corporate Bitcoin treasury pledge and a partnership with Crypto.com to develop crypto-linked financial products, including ETFs bundling Bitcoin and Cronos tokens. If approved, the ETF would enter a competitive market dominated by giants like BlackRock’s $69 billion iShares Bitcoin Trust (IBIT), but with a unique twist: the Trump brand’s polarizing appeal.

Critics have raised concerns over potential conflicts of interest, given Trump’s other crypto ventures, including meme coins and the USD1 stablecoin. Yet, the filing underscores the growing convergence of politics and digital assets. With Bitcoin trading above $105k, the ETF could attract both supporters and speculators — fueling further debate over crypto’s role in mainstream finance.

As regulators review the proposal, Trump’s influence continues to reshape industries far beyond politics. Whether this new ETF become the next big crypto play or not, the SEC’s decision could set the tone for the 2025 crypto landscape.

Ethereum's 10x scale-up within a year: Buterin’s vision

Ethereum has long been the backbone of decentralized applications, from DeFi to NFT marketplaces. Yet its challenges — congestion, high fees, and slower transaction times — persist. Ethereum co-founder Vitalik Buterin has addressed these issues, proposing a bold solution: Ethereum’s Layer-1 (L1) should scale by 10X within the next year.

Despite the rise of Layer-2 chains (L2s) like Arbitrum and Optimism — which help reduce costs and improve speed — Buterin believes the base layer itself must evolve. Speaking at the ETHGlobal Prague 2025 conference, he suggested that a tenfold increase in L1 capacity is both achievable and necessary.

Why scaling L1 matters

While L2s have alleviated some pressure, they introduce fragmentation and could, over time, divert value away from Ethereum’s ether (ETH). A stronger, more scalable L1 ensures Ethereum is not overshadowed by these secondary networks, remaining the centerpiece of DeFi.

Buterin also pushed back against more aggressive scaling proposals, such as a 1,000x increase. "A year would be great," he said, cautioning that moving too fast could risk centralization — a core concern for Ethereum’s community.

The road ahead

With ETH’s price rebounding (up 40% in a month to over $2,500), the timing for scaling is critical. Competitors like Solana have capitalized on Ethereum’s limitations, but Buterin’s vision could help Ethereum reclaim its edge.

The next year will be pivotal. If Ethereum successfully scales while maintaining decentralization, it could solidify its position as the leading smart contract platform for years to come. One thing is clear—Vitalik Buterin is betting big on it.