Clapp Weekly: CPI-fueled recovery, CLARITY Act delay, privacy rally

BTC price

Bitcoin touched $93,500 after the December CPI report made further rate cuts and a "soft landing" more likely. Mining stocks followed Bitcoin's recovery. The market is drifting away from leveraged speculation — Bitcoin options open interest is persistently outpacing futures. Whales are increasing exposure, while retail traders have been taking profits after the early-January rally.

The price slipped from nearly $93k to $89,799.73 on Thursday, January 8, seesawed, and teetered below $91k for three days. On Monday, January 12, it pushed above $92k, reversed, and regained momentum, eventually soaring to $95,724.32 hours ago.

Currently at $95,537.44, BTC is up 4.8% over the past 24 hours and 3.4% over the past 7 days.

ETH price

Ether's buying momentum is back amid steady network growth. Over 100k ETH have left exchanges since the start of the week, while active addresses and transaction counts soared. Meanwhile, BitMine Immersion Technologies shareholders are about to vote on a proposal that would boost authorized shares to 50 billion, potentially reshaping Ethereum's future.

The price collapsed from around $3.25k to $3,068.56 on Thursday, January 8, and wobbled around the $3.1k level before a brief spike to $3,155.34 on Monday, January 12. Reversing after another plunge, ether impressed traders with an explosive surge, hitting $3,350.31 hours ago.

Currently at $3,350.39, ETH has gained 7.6% over the past 24 hours and 3.2% over the past 7 days.

Seven-day altcoin dynamics

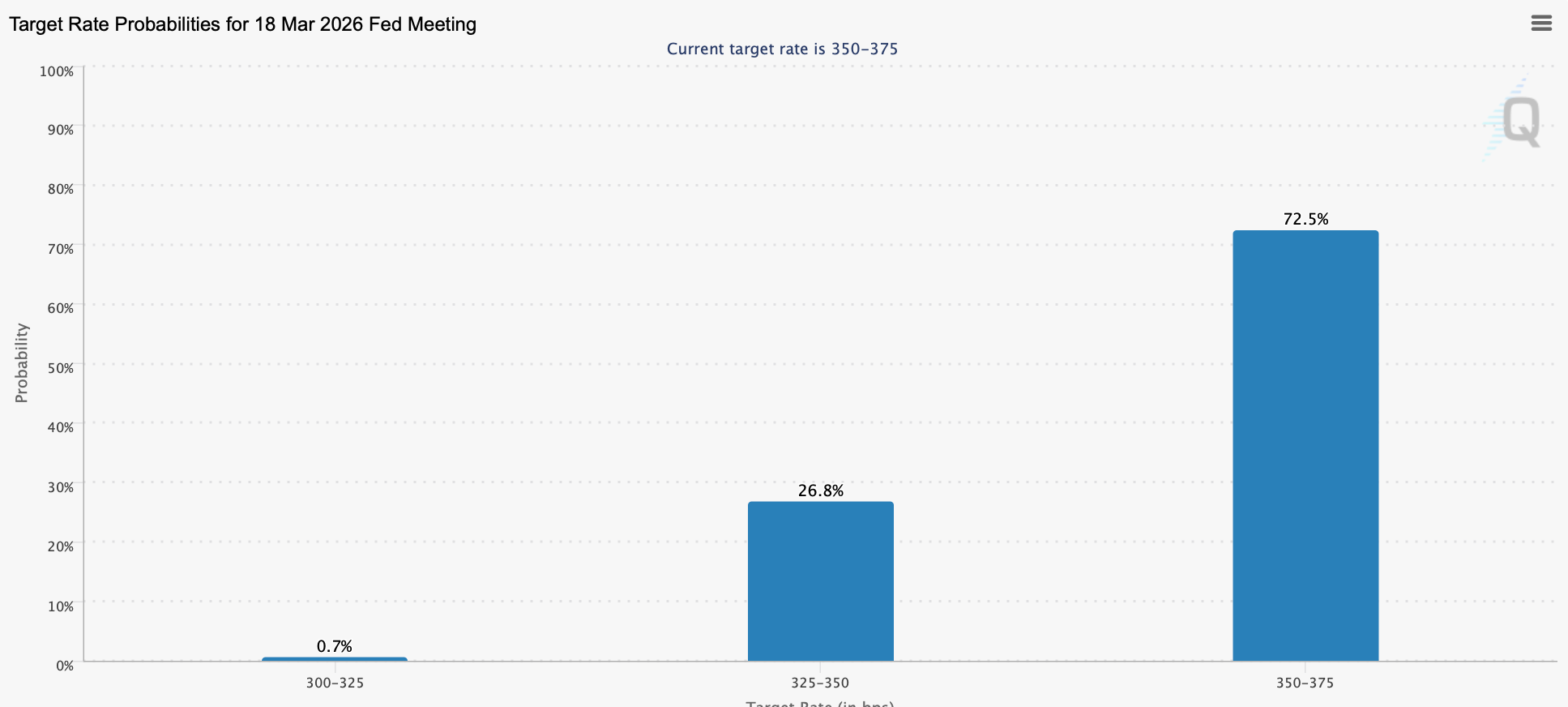

Altcoins have followed Bitcoin's CPI-triggered jump, despite political noise around the DOJ's investigation into Fed Chair Powell. Hopes for further Fed rate cuts rose, though CME FedWatch puts the January 28 odds at just 5%.

Cooling inflation has eased pressure on bond yields and enhanced liquidity conditions — a favorable setup for risk assets. Bitcoin's break past $94,500 liquidated over $500 million in futures positions, with some of that capital rotating into altcoins.

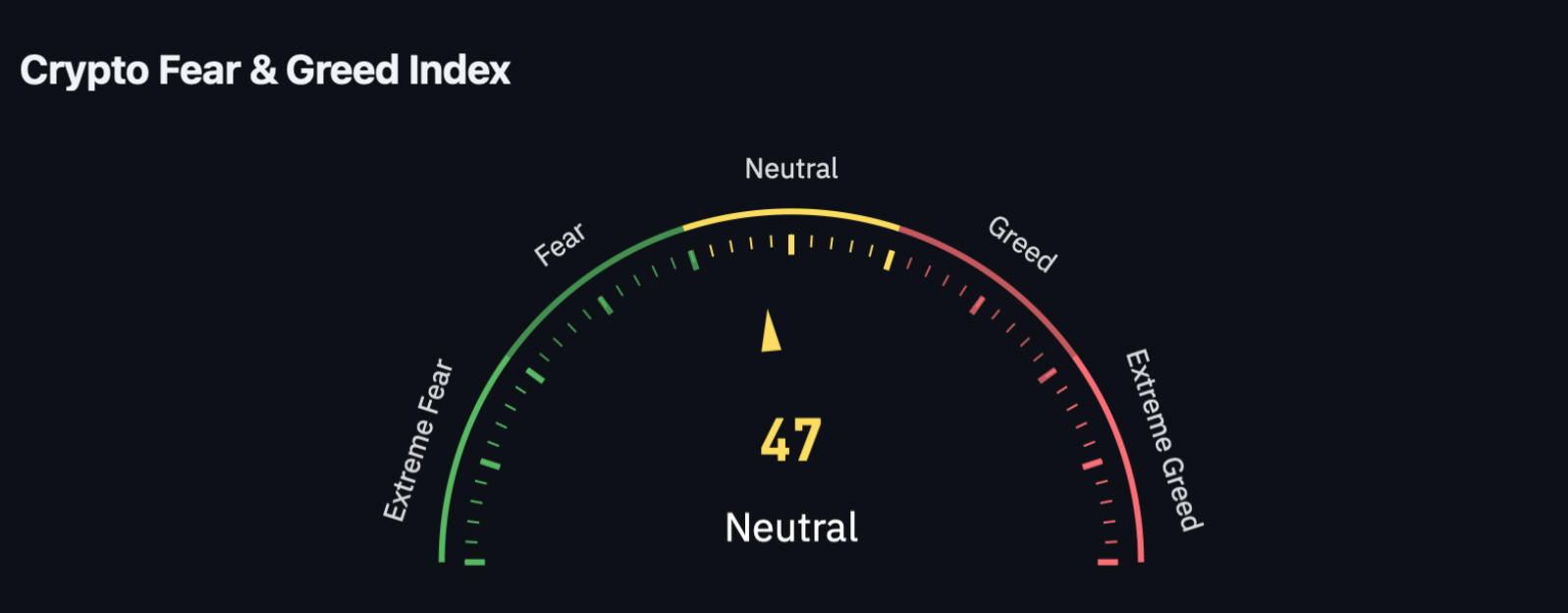

Sentiment returns to neutral

Crypto has seemingly shrugged off the recent negativity — the Fear & Greed Index jumped to "Neutral" (47) after sinking back to "Fear" last week. CoinDesk analysis suggests the broader market remained heavily oversold following the $19 billion liquidation cascade ("Crypto's Black Friday" on October 10, 2025).

Traders flocked to gold, silver, and AI stocks. While multiple tokens were undervalued, buyers lacked the appetite after the traumatic wipeout.

Now, investors are reacting to mounting uncertainty as a sharp escalation in US-Iran tensions ramped up geopolitical risk. On January 13, Donald Trump posted on Truth Social, "Iranian Patriots, KEEP PROTESTING – TAKE OVER YOUR INSTITUTIONS!!! … HELP IS ON ITS WAY."

While it was unclear what that "help" implied, political and economic turmoil in Venezuela and Iran could spark a new wave of demand for assets outside of the TradFi ecosystem.

ETPs see outflows

Crypto ETPs recorded $454 million in net outflows last week, interrupting the bullish momentum that marked the start of 2026. Bitcoin accounted for the largest share of exits ($405 million). The pullback followed a shift in macro sentiment, as falling odds of a Fed interest rate cut in March prompted investors to scale back risk asset exposure.

Weekly winners

- IP (+82.6%) jumped on a narrative revival, with South Korean traders contributing the most trading volume. However, experts warn the rally is speculation-driven, as the network has not added many active accounts.

- XMR (+56.2%) hit a new all-time high of $700.96 today, fueled by a resurgence in the privacy trade as governments tighten cash restrictions and ramp up payment oversight.

- POL (+25.7%) rallied as real network activity exploded following the announcement of the Open Money Stack, described as “one vertically integrated stack of on-chain solutions”. The Polygon network beat all other major blockchains by network revenue over the past 7 days.

Weekly losers

- HASH (-28.0%) is leading the losses, failing to regain momentum after a steep plunge on January 8 due to a lack of news catalysts for the RWA network.

- ZEC (-16.4%) faces a deepening crisis after its core development team, the Electric Coin Company (ECC), left following a clash with Bootstrap. Despite continued whale accumulation, development activity is at its weakest level since late 2021.

- MNT (-9.8%) is pressured by trader caution, though its fundamentals remain strong. This comes after Mantle became the best-performing Layer 2 through 2025, likely driven by its push for tokenization-as-a-service.

Cryptocurrency news

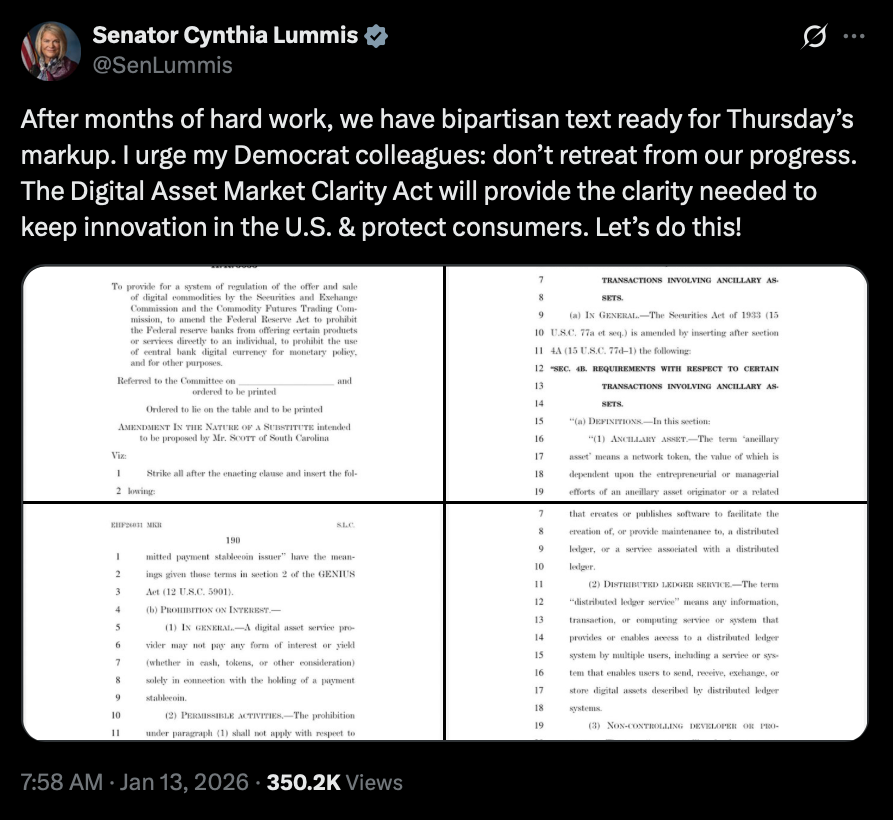

Clarity Act delayed amid a flood of amendments

The long-awaited crypto market structure bill has hit another snag — pushed from January 15 to the final week of the month as lawmakers scramble for bipartisan support. While the delay is frustrating, a leaked draft of the CLARITY Act reveals a potential game-changer that makes the wait infinitely more interesting.

Buried in the text is a provision that could reshape the entire regulatory landscape. The draft proposes that any token serving as the principal asset of a listed ETF as of January 1, 2026, would be classified as a "non-ancillary" asset.

In plain English? It would be exempt from SEC securities regulations, placing it in a category similar to Bitcoin and ether.

This isn't just about XRP, Solana, or Dogecoin — though they are the immediate beneficiaries based on current ETP listings. It's about establishing a new, powerful precedent: regulatory legitimacy through institutional adoption.

Compliance doors swinging wide open?

A clear statutory path out of classification limbo means more traditional institutions — banks, funds, advisors — can finally engage with these assets without legal fear. This is about unlocking the next wave of institutional capital.

The delay now feels critical. This provision is a political lightning rod, and its survival into the final bill is not guaranteed. The coming weeks will see intense negotiation, with key trade-offs already visible — like the notable omission of stablecoin yield provisions.

Senator Cynthia Lummis is pushing for passing the bill as soon as possible.

However, the CLARITY Act has its critics. Crypto exchange Coinbase has raised concerns that the bill seeks to limit staking rewards on stablecoin holdings.

Barrage of amendments

Now, the plot thickens. Senators have filed over 75 amendments to the draft bill released on Monday. The proposed changes are a mixed bag, targeting everything from core policy to political flashpoints.

The most concentrated fire is aimed at the stablecoin yield provision. Multiple amendments seek to modify or outright ban yield payments, with one key bipartisan proposal aiming to delete the word "solely" from the clause prohibiting yield "solely in connection with the holding of a payment stablecoin" — a change that could significantly broaden the restriction.

Other amendments venture far afield, including an "anti-corruption provision" to block public officials from profiting from crypto interests, and measures addressing the partisan makeup of financial regulatory agencies. In a typical markup, most amendments are destined for the cutting-room floor, but they reveal the fault lines and priorities of each senator.

Congress is sketching a blueprint where integration into TradFi, symbolized by an ETF listing, becomes the definitive gateway to regulatory clarity. The race for legitimacy is being formalized, but first, it must survive the amendment gauntlet.

What's really driving this privacy coin rally?

Look across the crypto board this week, and one sector is stealing the show. Monero (XMR) is up 54% on the week, Dash posted a staggering 39% single-day surge, and privacy tokens are collectively leaving major altcoins in the dust. This isn't just another speculative pump. A powerful confluence of regulatory pressure, capital rotation, and a resurgent narrative is fueling this move.

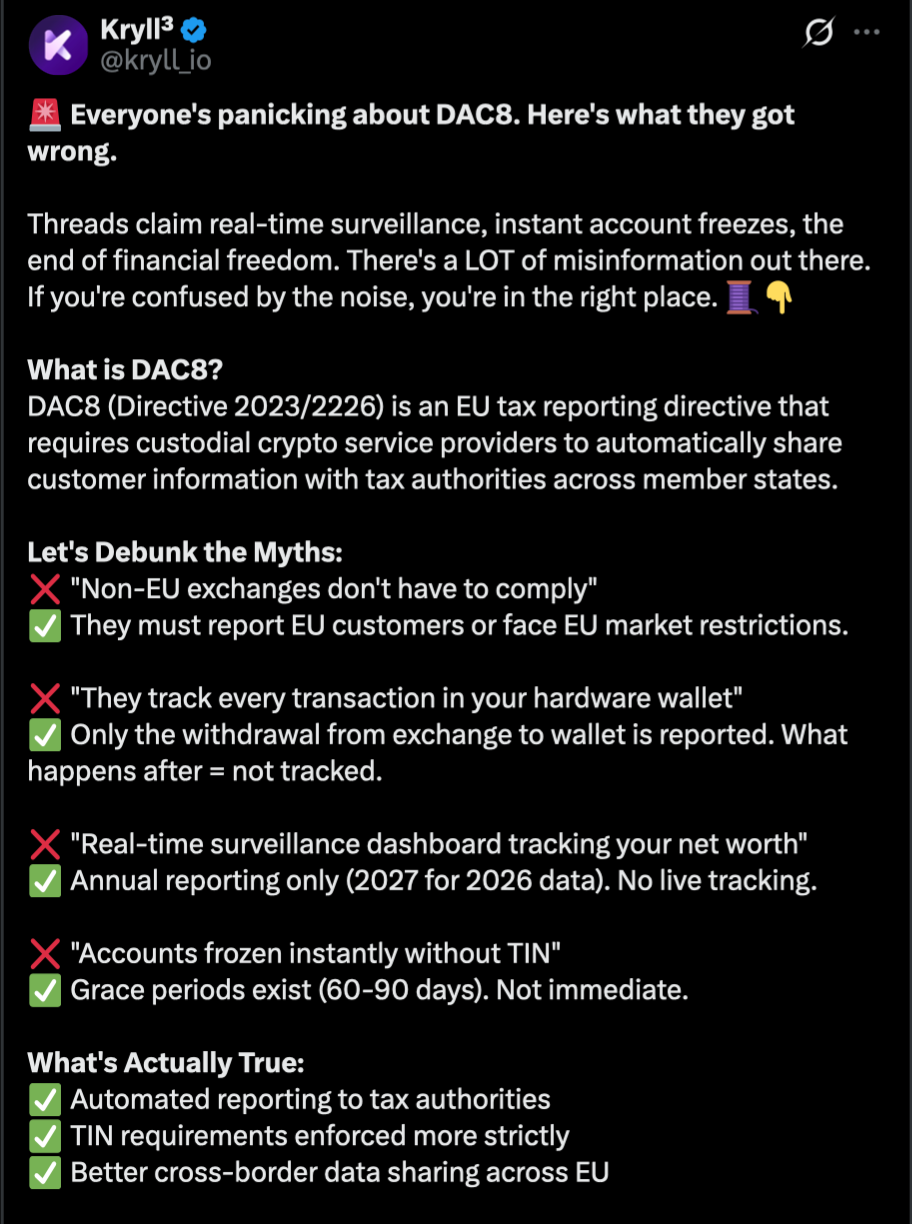

The fundamental trigger is a global regulatory squeeze that validates the privacy narrative. On January 1, the EU's DAC8 directive took effect, mandating that crypto service providers collect user tax data. Simultaneously, Dubai’s financial regulator enacted a sweeping ban on privacy tokens across its major financial centre.

Ironically, these crackdowns have only amplified demand. Traders are interpreting the bans as a stark admission that financial privacy is a powerful, threatening feature. In a world of increasing surveillance, the tools designed to obscure transactions are being re-evaluated not as niche curiosities, but as essential hedges.

Beneath this macro narrative, a critical sector-specific catalyst is the dramatic capital flight from Zcash (ZEC). The resignation of the entire Electric Coin Company development team in early January, citing a hostile board "misaligned with the mission," has sparked a crisis of confidence. With ZEC down roughly 50% from its recent highs, capital is rotating aggressively into perceived safer or more decentralized alternatives within the privacy niche.

This is where on-chain and fundamental dynamics converge.

- Monero, with its established, decentralized development structure and no central point of failure, is becoming the clear institutional-grade beneficiary. Its breakout into all-time-high price discovery reflects this flight to quality.

- Dash, with its lower price point and recent partnerships like the one with Alchemy Pay for broader fiat access, is acting as the high-beta, speculative bet for those chasing the momentum.

After years of compliance-driven delistings and regulatory friction, liquidity in privacy coins is thin. When a genuine fundamental bid meets a short squeeze — as seen dramatically with Dash — the moves are explosive and the order books offer little resistance. In an era of enforced transparency, privacy itself may be the ultimate scarce asset.