Clapp Weekly: Macro-driven plunge, Coinbase's win, crypto executive orders

Price dynamics

BTC price

Bitcoin has stumbled, hurt by concerns about the Fed's window for further interest rate cuts in 2025. Monday's rebound to $97,300 came on the anticipation of US inflation data and speculation about Trump's first-day executive orders benefiting crypto.

After slipping from $96.5k a week ago, the price dipped below $92k on Friday, January 10, before reversing. Three days of teetering above $94k preceded a 7-day low — $90,897.72 on Monday, January 13. Changing course again, BTC hit $97,344.13 this morning.

At press time, BTC is changing hands at $97,133.03, up 2.1% over 24 hours with a +0.6% 7-day change.

ETH price

Short-term confidence in ether is subdued by its 20.7% weekly correction between January 6 and 13. Derivatives data suggests strong retail and institutional demand, but critics emphasize high gas fees and Layer-2 security concerns.

Echoing BTC's losses, ETH dove below $3.3k, hitting $3,195.97 on Friday, January 10. After three days above $3.2k, Monday's plunge to $3,004.42 triggered $395 million in leveraged long liquidations.

At $3,215.04, ETH is up 1.1% in 24 hours and down 4.0% over the past week.

Seven-day altcoin dynamics

Amid market turbulence, Bitcoin's renewed gains have sparked signs of recovery across altcoins. The XDC network token (XDC) is a standout performer, up over 50% YTD and 30.9% over the past week, supposedly driven by Trump optimism after a lackluster 2024.

XRP (+24.5%) aims for a new all-time high as JP Morgan expects XRP ETFs to attract up to $8.4 billion in inflows within 6-12 months of launch. While the SEC has been slow to consider applications outside BTC and ETH, the incoming Trump administration could "open the door for new opportunity in cryptocurrency innovation."

XRP's perception is further improved by Ripple's $150,000 donations in XRP and RLUSD to aid the California wildfire relief efforts and first responders. Other cryptos that survived the downturn include KAS (+22.1%), XLM (+12.2%), S, previously FTM (+12.4%), and DOGE (+4.8%).

TKX (-29.0%) is the biggest loser, dipping after a rally driven by the issuer's Taiwan expansion plans. WIF leads meme coin losses at -16.5%, trapped in a broader bearish trend.

AI16Z (-24.9%) is the top victim in the AI agent sector, hit particularly hard by the decline — several tokens have fallen sharply in recent weeks, including VIRTUAL (-15.7%). On the upside, a whale withdrawal of $2.9 million worth of SOL from Coinbase Prime to purchase AI16Z reflects anticipation of a potential rally.

A two-year high in Bitcoin's 30-day correlation with the Nasdaq 100 Index suggests crypto will take cues from stocks' reaction to today's US CPI print. Experts predict further signs of inflation pressures.

Cryptocurrency news

Court tells SEC to clarify rejection of Coinbase’s crypto regulation request

A federal appeals court has directed the US Securities and Exchange Commission (SEC) to better explain its decision to deny Coinbase’s request for tailored crypto regulations. The 3rd US Circuit Court of Appeals ruled 3-0 that the SEC’s rejection lacked adequate reasoning, though it stopped short of forcing the agency to draft new rules.

The court sided partially with Coinbase, which filed the petition in July 2022, arguing that clear guidelines are essential for the booming crypto industry. The SEC has been applying existing securities laws to digital assets, prompting the exchange to push for a more explicit regulatory framework.

Judge Thomas L. Ambro criticized the SEC’s vague response, labeling it “vacuous,” and noted that the agency failed to justify its position. “It has said that it believes the existing securities-law framework is not unworkable for digital assets, but we have no basis in the record for determining why it believes that or how it arrived at that conclusion,” he noted.

Coinbase’s Chief Legal Officer, Paul Grewal, expressed gratitude for the court’s thorough consideration. The ruling comes amid ongoing legal battles, including a June 2023 SEC lawsuit accusing Coinbase of operating as an unregistered broker, exchange, and clearing agency. The enforcement action remains pending.

Judge Stephanos Bibas echoed concerns, calling the SEC’s approach “caginess” that undermines due process. While the court didn’t mandate rulemaking, it emphasized the need for the SEC to provide a more robust rationale.

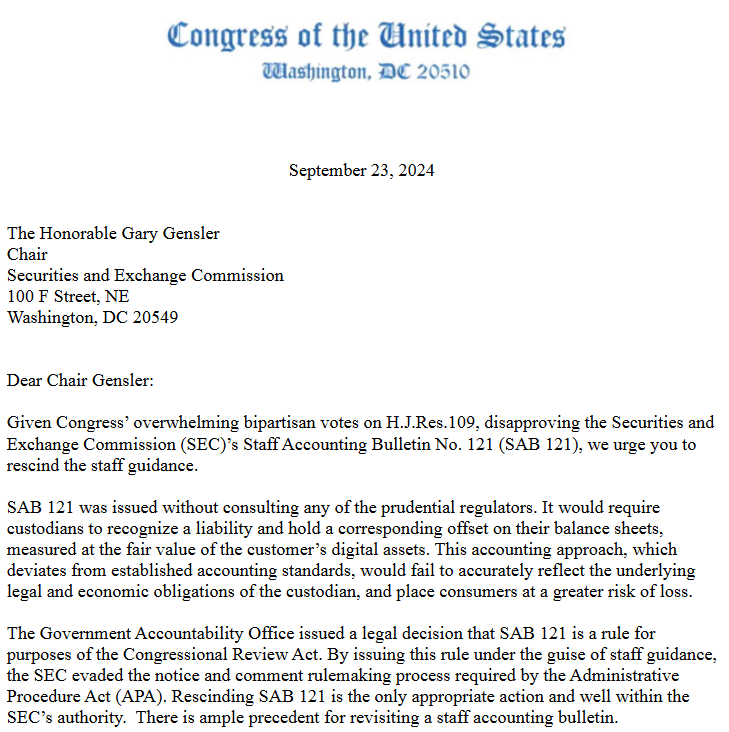

Traders anticipate a crypto executive order on Trump’s day one

Speculation is swirling about Donald Trump potentially issuing a pro-crypto executive order on his first day back in the Oval Office. According to The Washington Post, his initial executive orders could address crypto de-banking and the repeal of the Staff Accounting Bulletin (SAB) 121. The latter mandates banks holding cryptocurrencies to list them as liabilities.

An insider told the newspaper, “the Trump team has made it very clear that this is a priority.” Previously, Reuters reported crypto industry officials had urged the president-elect to issue crypto executive orders within his first 100 days in office. Some anticipate at least one such order on the first day.

The SEC’s SAB 121, which took effect in March 2022, has drawn significant opposition from the crypto industry. In September 2024, House Republicans called on the agency to revoke what they described as a “disastrous” bulletin. They argued that the policy disrupted custody rules, weakened consumer protections, and stifled financial innovation.

Further executive actions on crypto may follow in the weeks and months after Trump’s return to the White House. Reports suggest he might propose the creation of a unified working group for the SEC and CFTC to streamline crypto regulations and include international crypto innovation in the portfolio of the US Secretary of State. Notably, Trump’s financial interests through his World Liberty Financial project could motivate changes to SEC rules affecting the DeFi sector.

The market is closely watching for clarity on the new administration’s stance and initial actions. However, the response remains uncertain. Ruslan Lienkha, YouHodler's Chief of Markets, predicts a “neutral-to-negative flat market over the next several weeks, characterized by limited net capital inflows or outflows.”