Clapp Weekly: Maduro catalyst, Wall Street FOMO, Strategy's reprieve

BTC price

Bitcoin slipped from $94k following the US capture of President Maduro — proving the break in its weeks-long decline pattern was short-lived. However, US spot ETFs absorbed $697 million on January 5 — the largest single-day inflow since last October. Asset managers are redeploying capital after a period of de-risking and new year portfolio rebalancing.

The BTC price bounced off a low of $87,526.24 on Wednesday, December 31, and rose steadily for five days. After peaking at $94,420.78 on Monday, January 5, it retreated, plunged to $91,544.95 the next day, and rebounded.

Currently, BTC is changing hands at $92,751.09, down 1.1% over the past 24 hours but up 4.8% over the past week.

ETH price

Ether's price action has lagged behind network activity, reflecting short-term sensitivity to liquidity shifts and market sentiment. Despite RWA tokenization pushing daily transactions a record 2.02 million, traders show more optimism for gold than Ethereum. On Myriad, 67.8% of bettors expect gold to hit $5,000 before ETH does.

The ETH price closely followed BTC's ascent, rising from below $3k on Wednesday, December 31, to $3,275.89 a week later. After a brief plunge to $3.2k, it peaked at $3,292.52 a few hours ago.

At press time, ETH is trading at $3,264.58, up 1.3% over the past 24 hours with a 7-day gain of 9.6%.

Seven-day altcoin dynamics

Sentiment improved over the weekend as Bitcoin retook $90k and pushed forward. At press time, the Crypto Fear and Greed Index is back in the Neutral territory at 41, after weeks in Extreme Fear.

Maduro’s capture lifts prices

The markets are digesting escalating geopolitical pressure after US airstrikes in Caracas and the capture of Venezuelan President Nicolas Maduro. The prospect of falling oil prices is boosting hopes for cooler inflation. The odds of a Fed rate cut in March currently stand at approximately 50%.

Optimism is also fueled by rumors about Venezuela's "shadow stash" of BTC, worth roughly $60 billion. Theoretically, seizing those crypto holdings for the US Strategic Reserves could dramatically reduce Bitcoin's selling volume, propping up its price.

Hopes for an Altcoin Season

Capital is rotating back into high-risk, high-reward assets. The bounce started shortly after Christmas, when fear, uncertainty, and doubt among retail investors had peaked. Periods of extreme pessimism have often coincided with short-term market bottoms in speculative factors like memes.

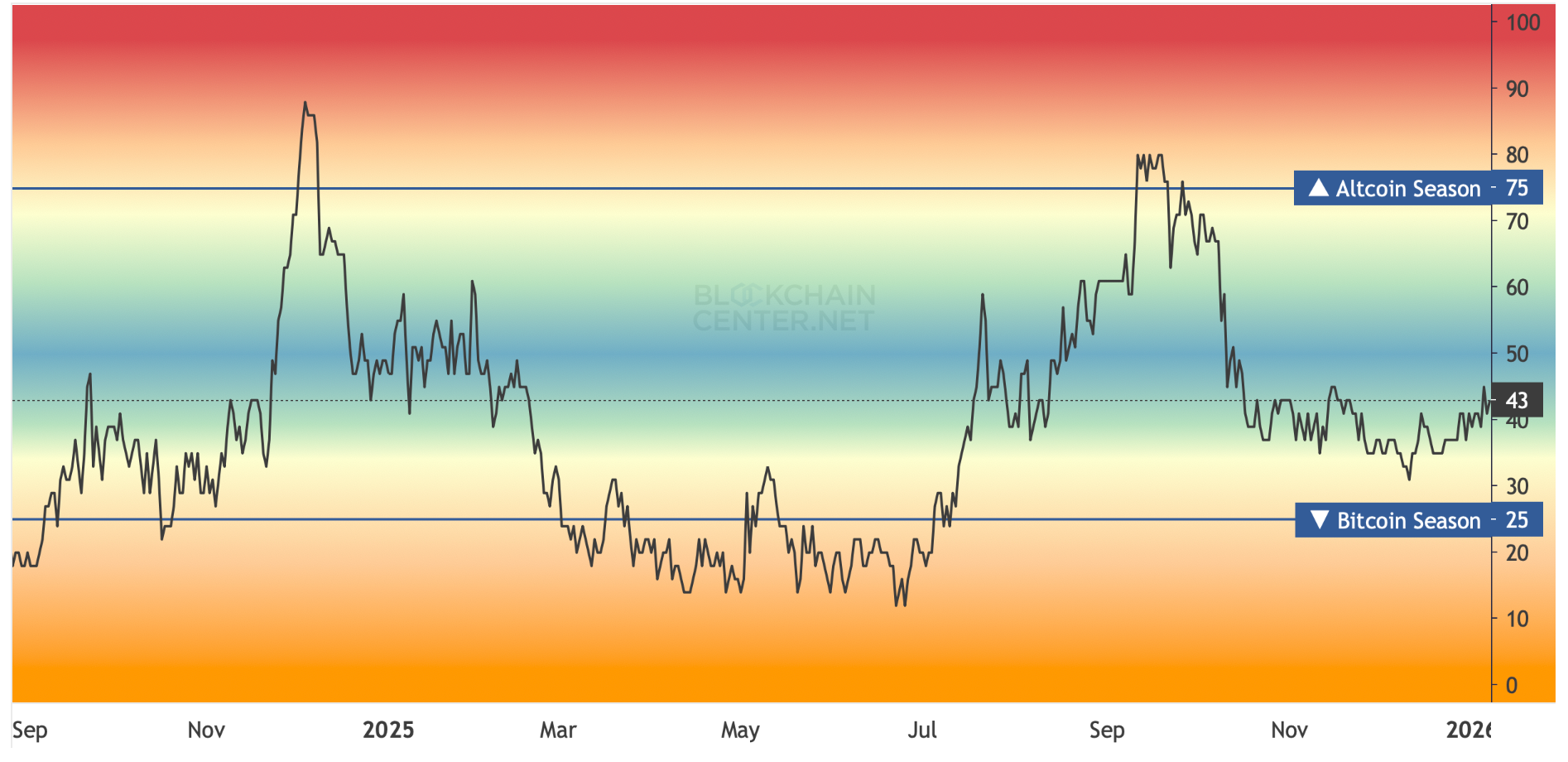

The Altcoin Season Index, recently at 23, has climbed to 43, shifting away from a pronounced Bitcoin-centric phase. Over $657 million in token unlocks this week could push more capital into alts, triggering a sustained breakout.

Weekly winners

- RENDER (+79.0%) continued its rally after gaining over 50% in the previous week, supported by commercial adoption, including the use of its GPUs at a Vegas Sphere concert. Amid a broader AI sector rebound, its market cap surpassed $1.2 billion, while rising on-chain metrics reflect growing participation.

- PEPE (+60.7%) soared after crypto trader-influencer James Wynn predicted a $69 billion market cap in 2026, a 40x increase. Analysts warn that a rapid reversal is highly likely.

- BONK (+51.6%) rocketed as the meme coin sector showed renewed strength post-holidays. With almost 9,000 active addresses added in 5 days, interest is rising, and whales are holding on to what they bought earlier.

Weekly losers

- NIGHT (-16.6%) has shed 83% in a few weeks post-launch, pressured by heavy liquidations from airdrop recipients, high initial circulating supply, and investor sentiment shifting toward large-cap assets.

- CC (-7.9%) retreated after a rally sparked by the Canton Network's collaboration with the Depository Trust and Clearing Corporation (DTCC). The push was also supported by Bitwise's filing for a CC Strategy ETF in late December.

- ZEC (-6.2%) is feeling the pressure of weakening investor sentiment, while a massive $35.75 million whale deposit to Binance fuels sell-off fears. However, technical analysts attribute the decline more to leveraging imbalances than fundamental weakness.

Cryptocurrency news

Dominoes are falling: Your bank wants you in crypto

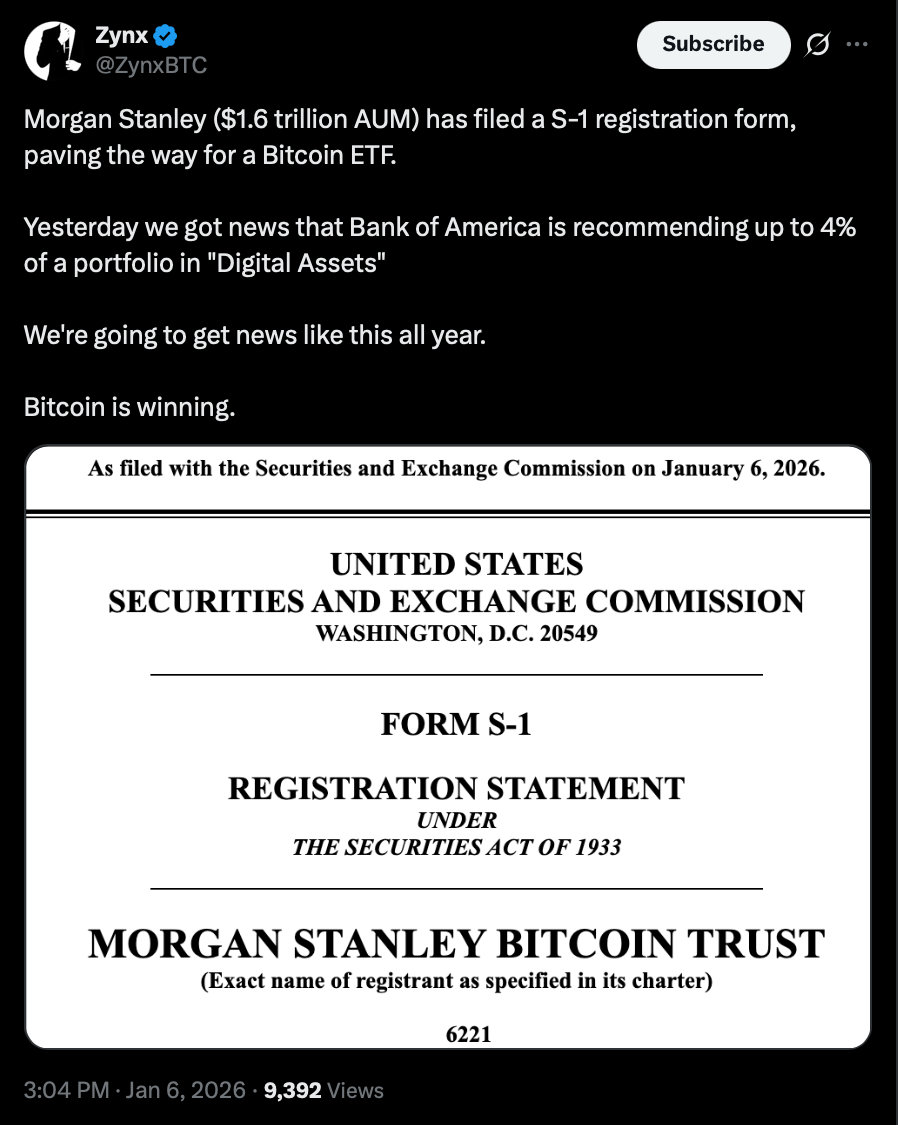

Crypto FOMO is taking over Wall Street's oak-paneled boardrooms. Bank of America began formally advising its wealth management clients to allocate up to 4% of their portfolios to digital assets. This mainstream strategic allocation puts crypto on the same footing as stocks and bonds for millions of investors.

Hot on its heels, Morgan Stanley filed for its own spot Bitcoin and Solana ETFs. This titan with $1.6 trillion in assets is putting its own brand and formidable distribution network behind crypto, seeking to build its own flagship vehicles.

Big banks are no longer just experimenting in the back office; they are in a full-scale race to capture client demand before it flows elsewhere. The transition from "passive experimentation" to concrete offerings is driven by new regulatory clarity that has given them the green light.

Banks expand their crypto footprints

- JPMorgan Chase's JPM Coin can be used on the Base blockchain as a means to keep collateral or make margin payments for transactions related to crypto purchases. The bank is also building broader infrastructure projects around digital assets.

- Goldman Sachs maintains crypto trading desks and has recently renewed access for institutional clients. Citigroup, although still in its early stages, has expressed an intention to explore custody and trading services.

- Charles Schwab has announced plans to offer direct BTC and ETH trading on its client platforms.

- PNC Bank has partnered with Coinbase to enable seamless crypto trading through its clients' accounts.

Custody and institutional services formed the first, quiet wave. Now, we're in the explosive second phase: wealth management and branded ETFs, bringing direct access to the retail mass-affluent. For banks like Charles Schwab and PNC, partnerships with giants like Coinbase offer a shortcut to market.

This institutional stampede validates the asset class while building an on-ramp of unimaginable scale. The liquidity, products, and simple accessibility are about to undergo a seismic shift. The question is no longer if traditional finance will adopt crypto, but how quickly you'll be able to buy a Morgan Stanley Solana ETF from your existing brokerage account.

Strategy remains on MSCI, but battle isn't over

For companies like Michael Saylor's Strategy, this week brought a critical, if temporary, win. In a move that sent MSTR shares up 6%, global index giant MSCI decided — for now — not to exclude so-called Digital Asset Treasury Companies (DATs) from its influential benchmarks.

Stakes were immense

An exclusion could have triggered a wave of forced selling by institutional funds that passively track MSCI indexes, stripping billions in potential capital from firms that hold Bitcoin as a primary treasury asset. MSCI’s statement acknowledged the complexity, noting that distinguishing between an "investment company" and a firm holding digital assets as a "core operation" requires more research.

Analysts react with cautious optimism

Benchmark’s Mark Palmer called it a “welcome reprieve,” suggesting Strategy’s vigorous arguments against exclusion had an impact. However, the relief may be short-lived. As TD Cowen’s Lance Vitanza pointed out, this could be merely “a stay of execution.”

MSCI left the door open for future, broader rule changes targeting "non-operating companies." Such amendments would put Strategy and imitators like Bitmine Immersion back in the crosshairs.

The decision is a microcosm of crypto’s larger institutional integration: hard-fought progress, but with regulatory and procedural hurdles still ahead. For now, the market breathes easier. The precedent that a company can treat Bitcoin as a core treasury asset without being banished from mainstream indexes stands firm.

Yet as Palmer noted, "this episode is not yet over." The fight for permanent legitimacy in TradFi frameworks continues.