Clapp Weekly: Risk-off mood, BlackRock's staking play, stablecoins as 'everyday money'

BTC price

The boost from a cooler CPI report faded quickly. After trading at $68k-$70k over the weekend, Bitcoin sank lower, following plunging software stocks. Despite Strategy's $168 million buy, the coin slid as US-Iran tensions escalated. Another headwind came from ETFs: $360 million left spot US Bitcoin funds last week — the fourth straight week of net outflows.

The Bitcoin price rebounded from $66k last Wednesday, February 11, peaked at $68,308.51 the next day, and nosedived to $65,373.15 before a sharp recovery. Following a high of $70,786.27 on Sunday, February 15, BTC declined choppily.

Currently at $67,890.24, BTC is up 0.1% over the past 24 hours with a 0.4% gain over the past week.

ETH price

Ether is struggling to hold $2k, remaining in a confirmed downtrend. Yet beneath the price action, fundamentals are building: Ethereum's tokenized real-world asset market cap has grown four-fold (315%) YoY. That's the kind of momentum BitMine's Tom Lee is betting on — he calls 2026 a "defining year for Ethereum" — as the firm added 45,759 ETH to its treasury last week.

Initially mirroring BTC, ETH slipped to $1.9k a week ago, re-approached $2k, and bottomed at $1,907.12 on Thursday, February 12. After a 7-day high of $2,098.07 over the weekend, it plunged to $1,942.22 and entered a tight range of $1.95k-$2k.

Now at $2,005.54, ETH is up 2.0% over the past 24 hours with a 2.9% seven-day gain.

Seven-day altcoin dynamics

Altcoins joined Tuesday's stock sell-off as Iran closed the Strait of Hormuz — the world's most vital oil export route — for a live-fire drill. A shaky Japanese bond market is another likely contributor. Paul Howard, senior director at trading firm Wincent, explained:

“Macro news has been closely correlated with crypto's risk profile the last 12 months and expectations are that macro numbers remain soft, implying a risk-off trade mentality.”

Meanwhile, the software sector sank under pressure from the AI threat, worsening crypto sentiment.

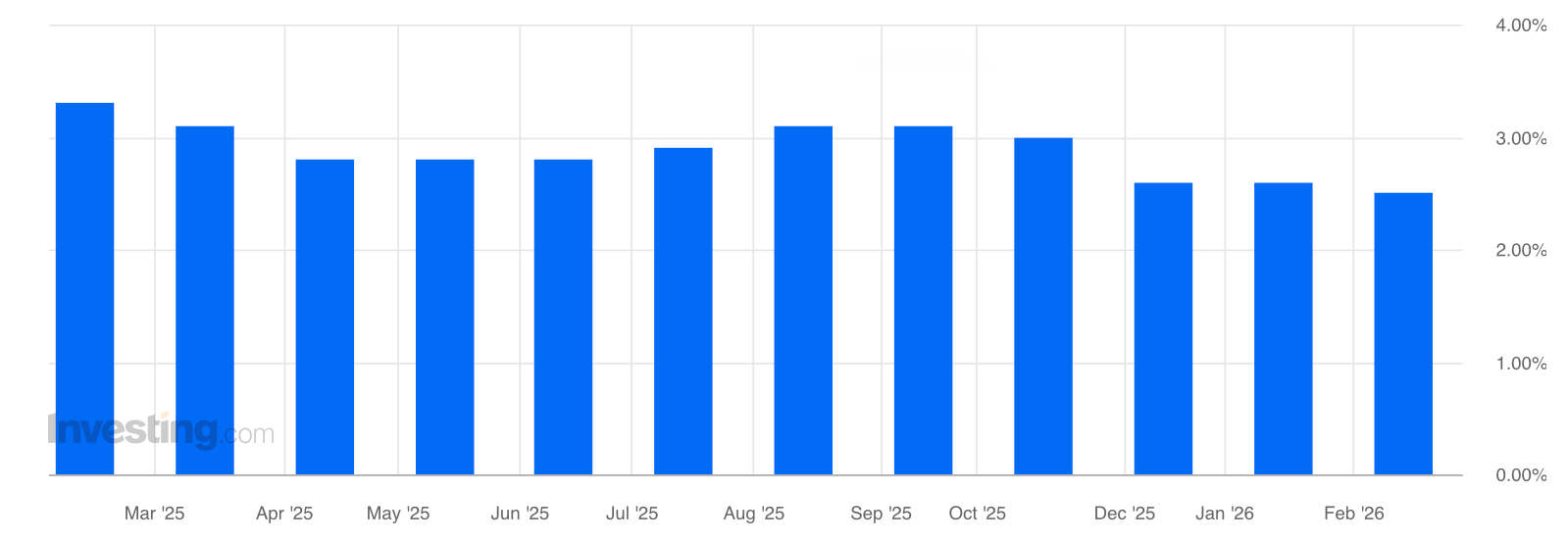

Inflation boost fizzled fast

The outlook for Fed rate cuts is back in focus after last week’s inflation data. A cooler-than-expected CPI reading, released on February 13, sparked renewed interest in risk assets, but only briefly. In January, headline inflation dropped to 2.4% YoY from 2.7% YoY, while core inflation fell to 2.5% YoY from 2.6% YoY.

Looking ahead, Friday’s PCE print could significantly sway crypto prices. If it supports the “continued cooling” narrative, Fed easing might become more likely in the near term, suppressing returns on bonds and pushing investors toward higher-risk alternatives.

Furthermore, this week promises a potentially bigger near-term catalyst than economic updates — the US Supreme Court's potential ruling on President Trump's tariffs. This decision may also come this Friday, February 20.

Bitcoin follows software stocks

As noted by Bloomberg, Bitcoin has behaved like a high-beta tech proxy in recent months. Its correlation with troubled software stocks, particularly the iShares Expanded Tech Software ETF (IGV), has jumped to 0.73 on a 30-day rolling basis. While the ETF has shed 20% year to date, BTC is down 16%.

Weekly winners

- PI (+40.2%) is defying market pressure amid a short-term pause in mainnet migration since Friday. As the migration involves users depositing mined PI from the testnet, pressure on the token supply has weakened.

- MORPHO (+33.0%) is supported by a collaboration agreement between the Morpho Association and Apollo Global Management — a US investment firm overseeing over $930 billion in assets. Apollo's affiliated entities will purchase around 9% of the total token supply over the next four years.

- STABLE (+27.5%) is rallying on sustained momentum, rather than a single news catalyst, and has just reached a new all-time high of $0.03361. Analysts point to a negative funding rate creating a fragile balance — a potential short squeeze might fuel the next leg higher.

Weekly losers

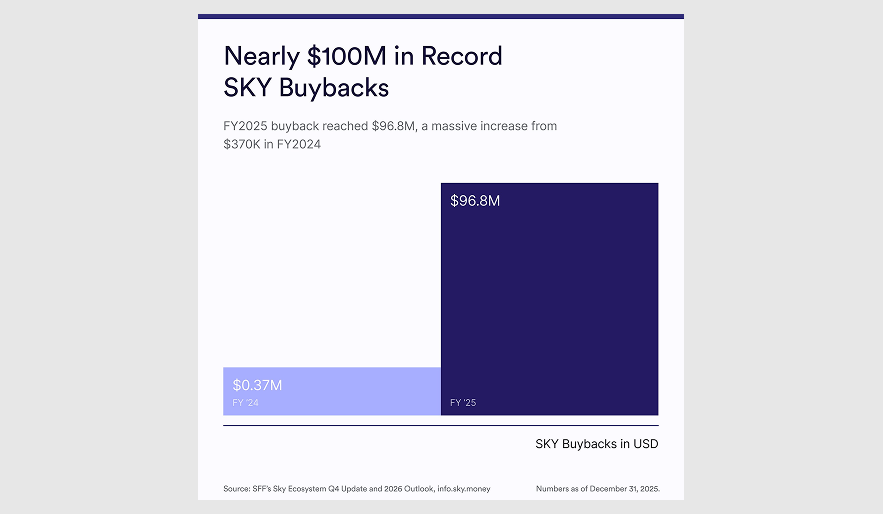

- SKY (-9.0%) sank sharply after soaring on the latest disclosure about the protocol's buybacks. In 2025, the total repurchased amount approached $100 million in SKY, growing 261x since 2024.

- APT (-7.9%) has been struggling since late January; the latest recovery, reflecting a broader rebound, was not strong enough to flip the board. Some analysts have linked deteriorating sentiment to competition from Sui.

- XMR (-2.9%) remains under pressure due to weakening retail demand and long liquidations; yesterday, the price jumped almost 10% after the release of TRM Labs' report highlighting its shadow market dominance.

Cryptocurrency news

BlackRock's staking ETF gamble: 82% for you, 18% for them

Wall Street's embrace of Ethereum just got a whole lot tighter. BlackRock, the world's largest asset manager, has filed an updated S-1 for its upcoming iShares Staked Ethereum Trust ETF (ETHB). The fine print reveals how it plans to split the spoils of staking — and the numbers are drawing both investor attention and side-eye from Ethereum's founder.

According to the filing, investors will pocket 82% of the staking rewards generated by the fund's ETH holdings, while BlackRock and its execution partner, Coinbase, split the remaining 18%. Under normal market conditions, the trust plans to stake 70%-95% of its ether, targeting an annualized yield around 3% based on early 2026 benchmarks.

That means on a hypothetical 4% gross yield, investors would net roughly 3.28% before the sponsor fee — which ranges from 0.12% to 0.25% — kicks in. Not bad for a regulated product that spares you the hassle of running your own validator.

But the fee structure has reignited a familiar debate: at what point does institutional convenience start eating into decentralization?

Vitalik Buterin voices concerns

The same week BlackRock unveiled its staking ambitions, Ethereum's co-founder warned that surging Wall Street control over the network risks centralizing its governance and validator operations. Buterin suggested major asset managers concentrating staked ETH could wield disproportionate influence, subtly undermining the very ethos Ethereum was built on.

BlackRock's one-stop shop

BlackRock's move isn't happening in a vacuum. The firm already dominates the Ethereum ETF landscape with its $9.1 billion ETHA fund — dwarfing Grayscale's $2.3 billion ETHE. Now, with ETHB, it's offering yield on top of exposure, effectively creating a one-stop shop for institutional investors who want crypto upside without touching a private key.

Grayscale and VanEck are also circling the staked ETF space, but BlackRock's sheer scale — and its 0.12% promotional fee on the first $2.5 billion — signals it's playing to win. For investors, the product is a sleek on-ramp. For Ethereum purists, it's another step toward a future where the network's security and rewards are increasingly brokered by the very institutions crypto was meant to bypass.

A BlackRock affiliate has provided the initial capital for ETHB by purchasing 4,000 seed shares of the fund for $100,000. The question now: will the market embrace the yield or heed the warning?

Beyond trading: How $300 billion in stablecoins became "everyday money"

For years, stablecoins were crypto's quiet workhorses — the boring but essential rails for moving funds between exchanges and circling trading desks. A new global study suggests that narrative is officially outdated.

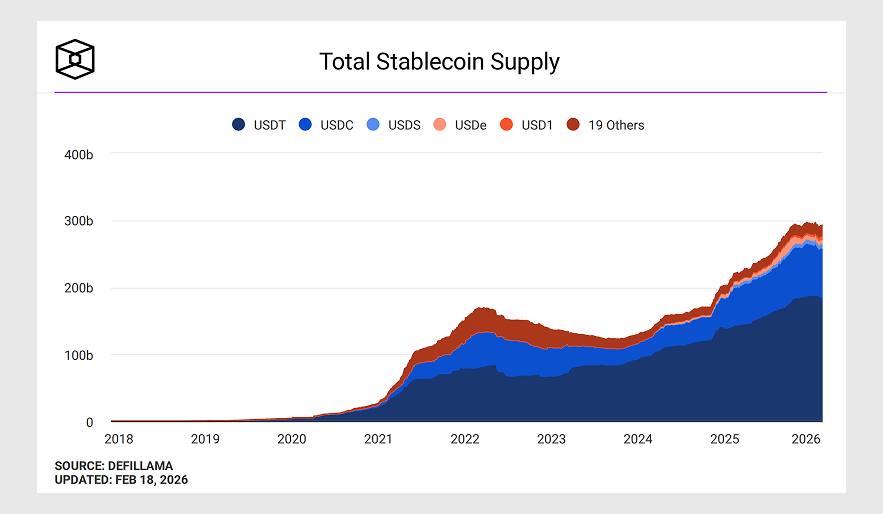

According to The Stablecoin Utility Report 2026 — a multi-firm study conducted by BVNK in partnership with Coinbase and Artemis — the $300 billion stablecoin market is increasingly functioning as genuine everyday money. The findings, based on a YouGov survey of over 4,600 adults across 15 countries, paint a picture of an asset class growing up.

Savings, not just speculation

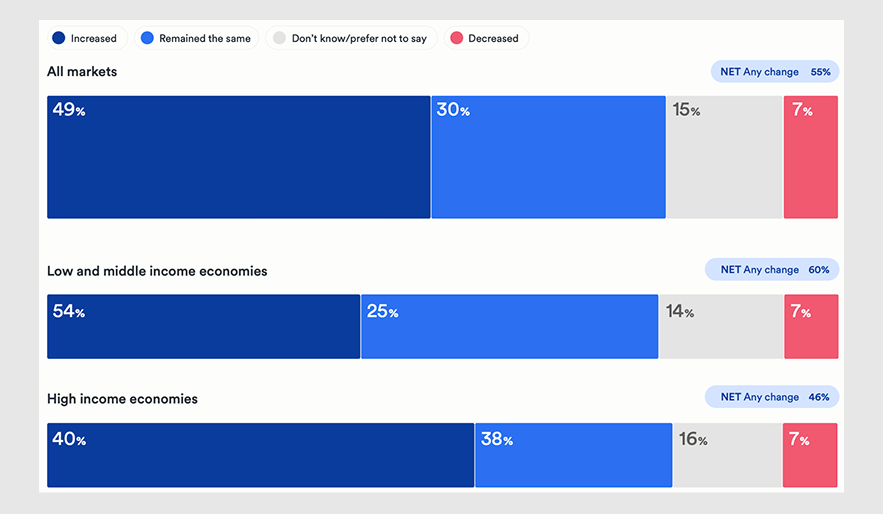

The data reveals a fundamental shift in how people hold stablecoins.

- More than half of surveyed crypto users have held stablecoins in the past year, and 56% plan to acquire more.

- Holders now allocate roughly one-third of their total savings to crypto and stablecoins combined — a sign that these assets are moving from speculative side bets to core components of personal balance sheets.

This trend is most pronounced in emerging markets. Ownership rates in low- and middle-income economies outpace those in wealthier nations, with Africa leading the charge at 79%. For people dealing with volatile local currencies or unreliable cross-border payment rails, dollar-pegged stablecoins offer a lifeline.

Getting paid in digital dollars

Perhaps the most striking finding: stablecoins are becoming a legitimate payroll tool. Lower transaction costs, better security, and the ability to transact across borders rank as the top motivations for choosing stablecoins over conventional methods.

- Among freelancers, gig workers, and marketplace sellers who receive crypto payments, stablecoins account for roughly 35% of annual earnings on average.

- Nearly three-quarters say stablecoins have improved their ability to work with international clients.

- Respondents report saving an average of 40% in fees compared to traditional remittance services.

Spending, not just holding

Stablecoins aren't sitting idle, and demand for merchant acceptance is growing fast.

- 27% of holders say they spend directly on goods and services.

- 45% convert to local currency as needed.

- Over 25% convert or spend within days of receiving funds.

- 52% have made a purchase specifically because a business accepted stablecoins. In developing economies, that figure jumps to 60%.

Yet desired spending still outpaces current options across every major category, from daily coffee runs to large lifestyle purchases.

Friction points remain

Users cite frustrations including irreversible payments, too many transaction steps, and confusion around blockchain selection and wallet management. What they want, the study suggests, is an experience that mirrors mainstream payment systems — universal acceptance, clear fees, and stronger consumer protections.

Regulatory tailwinds

The findings arrive as regulatory clarity expands, particularly in the US following the GENIUS Act. With the stablecoin market now valued at $307.8 billion — up from $260 billion in July — policymakers are negotiating final federal frameworks that could accelerate or complicate the next wave of adoption.

The bigger picture

From a macro perspective, the rise of stablecoin-based wages and savings introduces structural shifts in how money circulates. Companies paying in stablecoins rely on private issuers rather than traditional banks, echoing elements of historical free banking systems. Meanwhile, the dominance of dollar-pegged tokens may reinforce the USD's global role, particularly in emerging markets.

Whether stablecoins ultimately complement central bank digital currencies or compete with them remains an open question. Nevertheless, the era of stablecoins as mere trading tools is over. For millions of users worldwide, they already are everyday money.