Crypto borrowing made simple: Credit lines vs. loans

Own crypto and need cash? Selling isn’t your only option. Borrow against your assets and keep the exposure — without giving up potential upside or triggering a taxable event.

The market has moved beyond rigid, one-size-fits-all loans. Here's what you need to know.

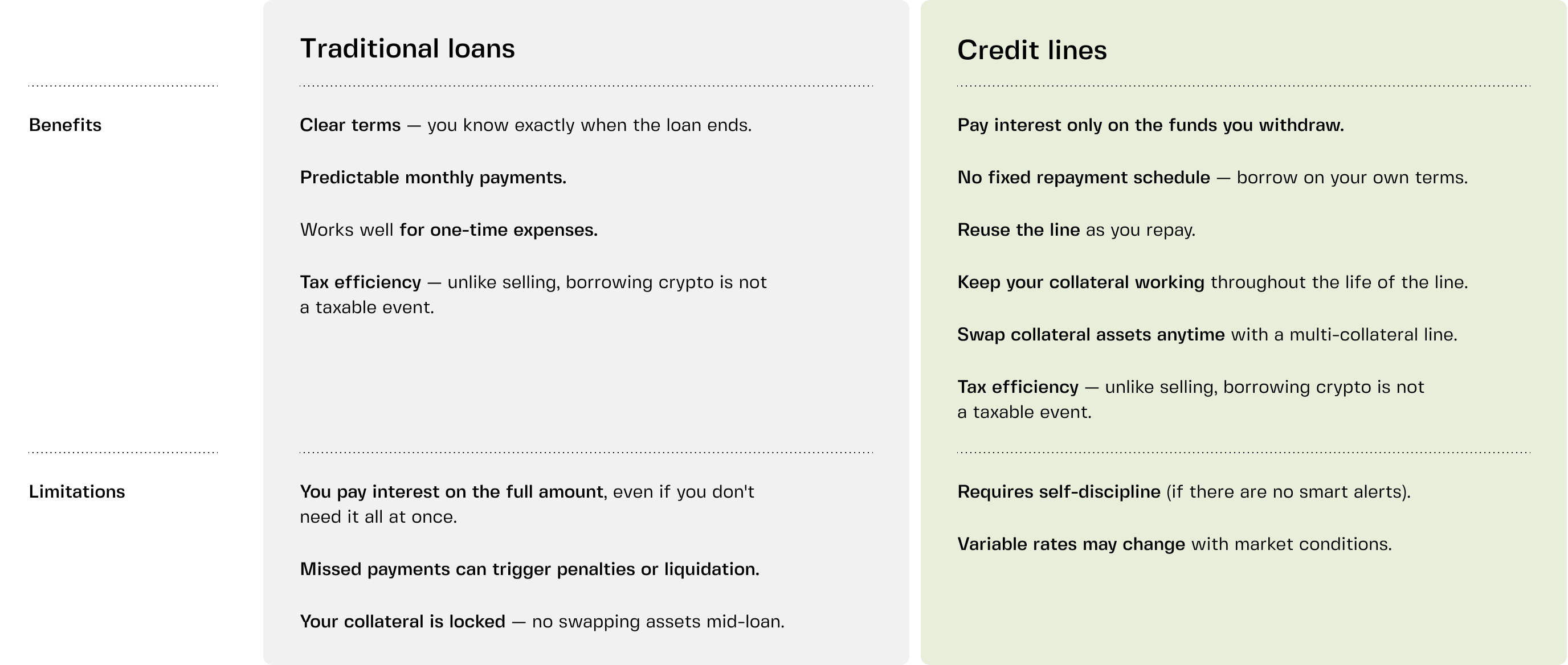

At a glance

- Crypto loans let you borrow fiat or stablecoins against cryptocurrencies. You deposit collateral, receive funds, and repay with interest.

- Traditional crypto loan: Fixed term and repayment schedule, single asset as collateral. Borrow a lump sum, pay it back in installments, and get your collateral back at the end.

- Crypto credit line: Revolving access to funds. Draw only what you need and pay interest only on what you use. No fixed schedule or monthly minimums.

- Multi-collateral credit line: Combine multiple assets (BTC, ETH, stablecoins) into one collateral pool and swap them anytime without closing your line.

How crypto borrowing works

It’s a lot like taking out a mortgage: you don’t sell your house, you borrow against it. With crypto, you do the same with BTC, ETH, or other assets to get cash in hand.

But cryptocurrencies are volatile, so lenders build in a safety buffer. That cushion is the loan-to-value (LTV) ratio.

That’s why crypto loans are always over-collateralized — you borrow less than your collateral is worth.

If the value of your collateral falls and your LTV reaches a certain point, you’ll need to either top up your crypto or pay down part of the loan. Ignore it, and the platform may sell some of your collateral to cover the shortfall.

- On DeFi platforms, liquidation is usually automatic — there’s no warning, so you need to keep a close eye on your LTV yourself.

- On CeFi platforms, you’ll often get alerts as your LTV hits a critical level, giving time to top up or repay before anything is sold.

That’s the basics. Things get more interesting when you look at how the loans themselves are set up.

Traditional (fixed-term) crypto loans

Think of this like a car loan or mortgage. You borrow a fixed amount (principal) and agree to a repayment schedule (usually monthly installments). The lender starts accumulating interest on your principal from day one.

This works well for one-time expenses, but your crypto collateral is locked until full repayment.

Crypto credit lines

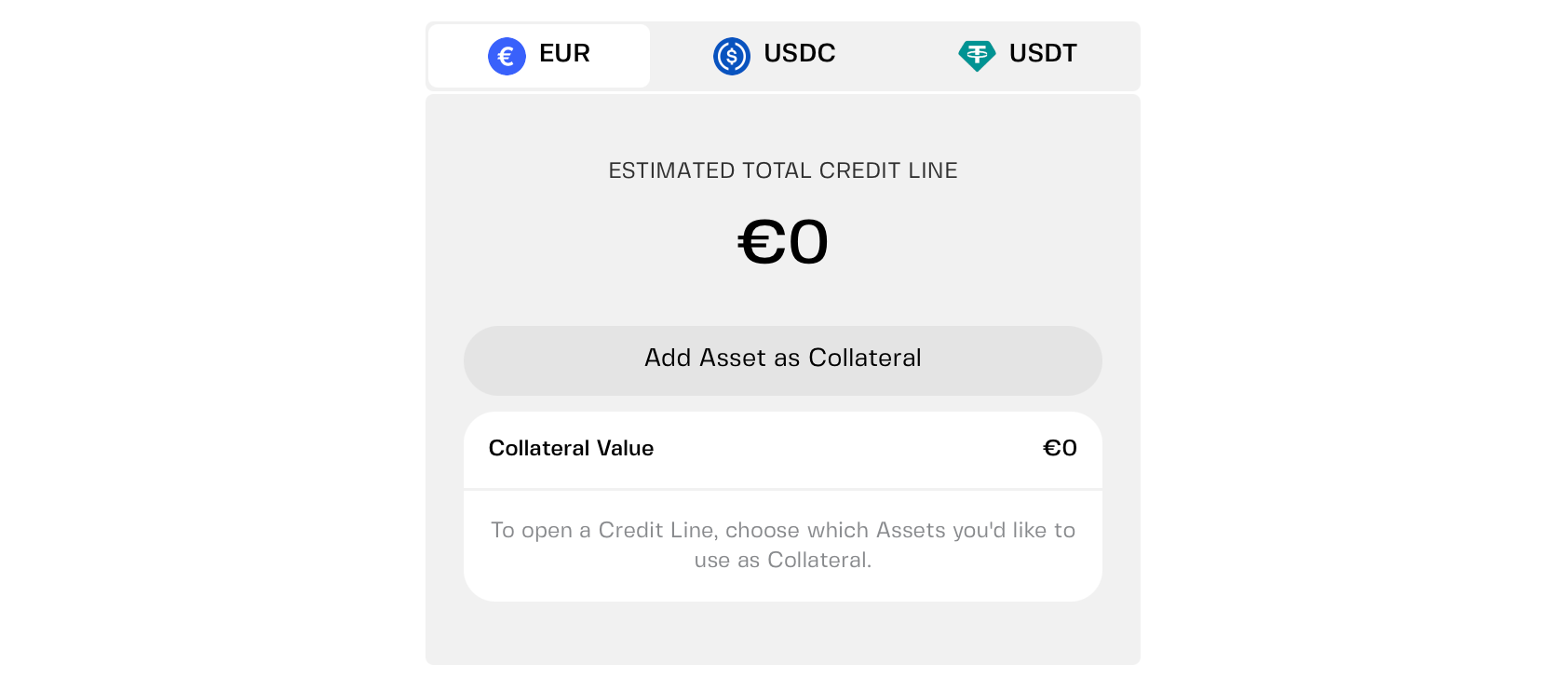

This works more like a credit card or home equity line of credit (HELOC), but built for crypto.

You get a pre-approved limit based on your collateral. Draw funds only when you need them, and interest accrues only on the amount you actually use. Repay any amount, anytime, with no penalty for early repayment.

Flexibility goes even further with multi-collateral products like Clapp Credit Lines. Feel free to mix BTC, ETH, and stablecoins into a single collateral pool — or swap them out as your strategy evolves. It's modern borrowing for a modern portfolio, without the old-school rigidity.

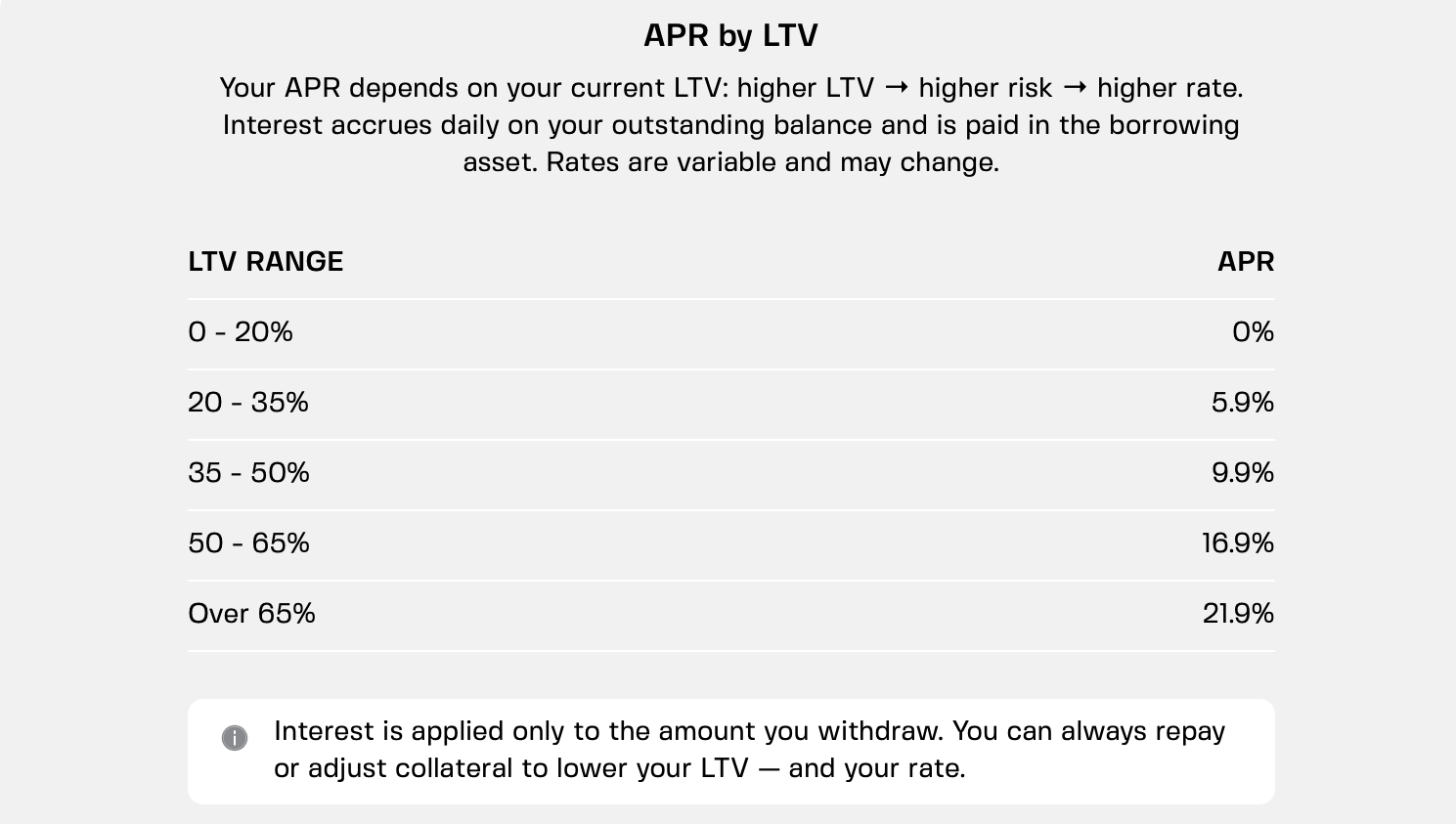

APR decoded: What you'll actually pay

How much will borrowing cost? It depends.

APR stands for Annual Percentage Rate. It's the cost of borrowing expressed as a yearly percentage. For example, borrow $1,000 at 6% APR for exactly one year, and you'll pay around $60 in interest.

That’s how a traditional loan works: a debt obligation with a fixed repayment schedule, while interest accrues on the entire lump sum from day one.

Crypto credit lines flip the traditional model. You're not forced to borrow for a full year, and you pay interest only on what you actually borrow. For example, draw $500 from a $5,000 limit — interest accrues on the $500, while the rest sits ready at no cost.

It’s a financial safety net that costs you nothing until you use it. Responsible borrowing can even be cost-free — Clapp offers 0% APR at conservative LTV ratios (below 20%).

Which one should you choose?

There's no universal answer — it depends on what you need.

- Traditional crypto loans might be your fit if you have a specific one-time expense in mind, prefer knowing exactly when your debt will be paid off, and don't mind locking your collateral away until then. It's predictable and structured.

- Crypto credit lines make more sense when your liquidity needs are ongoing or uncertain. Maybe you want a safety net for emergencies, or you spot opportunities throughout the year and need capital ready to deploy.

You pay interest only on what you use, and you're not tied to a rigid repayment schedule. Plus, you can manage your collateral as markets shift — something traditional loans simply don't allow.

Multi-collateral flexibility with Clapp

Most crypto credit products tie you to a single collateral asset. You pledge BTC, you borrow against BTC. Want to switch your collateral from ETH to BTC? You'd have to close the loan and open a new one.

Clapp Credit Lines work differently.

Multi-collateral support lets you combine multiple assets — say, 60% BTC and 40% ETH — into a single collateral pool. Need to rebalance? You can add, remove, or swap collateral assets in real time, without closing your credit line or reapplying.

This matters because markets move. Maybe ETH is outperforming and you want to increase your exposure. Maybe you spot a tax-efficient way to rotate your collateral. With Clapp, you can adapt without disrupting your liquidity.

- 0% APR at low LTV — borrow responsibly and your safety net costs you nothing.

- No fixed repayments — pay back on your timeline, not a lender's.

- Multi-collateral — combine up to 25 assets as swap them anytime.

Bottom line

Crypto borrowing has evolved. What started as simple fixed-term loans has grown into something more flexible, more adaptable, and ultimately more useful for how people actually manage their finances.

Traditional loans still have their place. But for ongoing liquidity needs — or for anyone who wants to keep their options open — a flexible, multi-collateral credit line is simply a smarter tool.

Frequently asked questions

What is a crypto loan?

A crypto loan lets you borrow cash using your digital assets as collateral, without selling them. You deposit crypto (like BTC, ETH, or stablecoins), receive funds, and repay with interest.

How does a traditional (fixed-term) crypto loan work?

It works like a car loan or mortgage. You borrow a fixed amount, agree to a repayment schedule, and interest accrues on the full principal from day one. Your collateral stays locked until the loan is fully repaid.

What is a crypto credit line?

A crypto credit line is like a credit card for crypto. You get a pre-approved limit, draw only what you need, and pay interest solely on that amount. Repay anytime with no penalties.

What does multi-collateral mean?

Multi-collateral support lets you combine multiple assets (BTC, ETH, stablecoins) into one collateral pool. You can add, remove, or swap assets anytime without closing your credit line. This maximizes your flexibility as markets move.

What are the costs of borrowing?

Borrowing costs depend on the Annual Percentage Rate (APR). Traditional loans charge interest on the principal immediately, while credit lines charge only on what you withdraw. Clapp even offers 0% APR at conservative LTV ratios for responsible borrowing.

Which option should I choose: a loan or a credit line?

It depends on your needs. Choose a traditional loan for one-time expenses and predictable repayment. Opt for a crypto credit line if you want ongoing liquidity, interest only on used funds, and the flexibility to manage collateral as your strategy evolves.

Is my collateral safe?

On reputable and regulated platforms, your assets remain yours throughout the borrowing period unless liquidation becomes necessary. Clapp keeps your collateral in segregated accounts with Fireblocks institutional-grade custody, and helps you avoid liquidation with proactive alerts. As a registered VASP in the EU, we operate under strict compliance and transparency standards.