Clapp Weekly: Sea of red, Trump's tariff shocks, Ethereum's gas limit hike

Price dynamics

BTC price

Bitcoin has plunged below six figures, shedding almost 10% of value overnight following President Trump’s weekend tariff announcements. It extended losses after the David Sacks-led press conference mentioned a Bitcoin strategic reserve only briefly.

BTC traded at $102k a week ago before peaking at $105,893 on Thursday, January 30, and then declining steadily throughout the rest of the week. The downturn accelerated on Monday, February 3 — BTC hit a low of $92,876.12 before starting to recover.

Currently priced at $98,127.49, the leading cryptocurrency is down 2.6% over the past 24 hours, with a 7-day decline of 3.5%.

ETH price

Ether has suffered an even steeper drop as almost $1 billion flowed out of exchanges. Meanwhile, Eric Trump appeared to endorse the coin, posting on X: “In my opinion, it’s a great time to add $ETH.” That same day, World Liberty Financial transferred $212.6 million in ETH to Coinbase Prime.

Mirroring BTC, ETH climbed from $3,100 to $3,422.19 on Friday, January 31, before reversing. A gradual four-day decline turned into a nosedive on Monday, February 3, with the price bottoming out at $2,460.55.

After rebounding, ETH is currently trading at $2,729.62, down 2.7% over the past 24 hours with a staggering -12.2% for the week.

Seven-day altcoin dynamics

President Trump’s aggressive policies and escalating global trade tensions have heightened fears of a market crash. Following the weekend announcement of tariffs on imports from China, Canada, and Mexico, most assets saw significant declines.

Major tokens like XRP (-19.2%) and ADA (-20.5%) have suffered even steeper losses than BTC. However, SOL (-10.9%) has remained relatively resilient, sparking concerns among ETH holders about its potential to challenge the second-largest cryptocurrency.

Winners & losers

A handful of tokens have bucked the trend. OM (+30.7%) reached a new all-time high on February 3, fueled by a partnership with DAMAC that positions its protocol as the preferred RWA ledger in the UAE and beyond. HYPE (+14.1%) is the second-best performer, driven by strong fundamentals, while DEXE (+10.6%) is supported by ecosystem developments.

Meanwhile, the TRUMP (-35.2%) meme coin has plunged, though its team has still managed to generate a staggering $802 million since launch. Following the tariff announcement, its price collapsed to 75% below its ATH.

Other assets are also deep in the red. MOVE (-27.0%) has taken a hit after Movement Labs denied the existence of an alleged token swap agreement with World Liberty Financial after its $2 million purchase. FIL (-24.9%) has erased its entire 2024 gains as investors shift away from utility tokens in favor of meme coins.

Cryptocurrency news

Crypto on edge as Trump’s tariffs stoke fears of a $4T bubble burst

Crypto is reeling from a massive sell-off, with nearly $300 billion wiped out as fears over Trump’s escalating trade wars send shockwaves through TradFi and digital asset markets. Investors have been spooked, leading to a sharp decline across the board. While tariffs on China took effect yesterday, those on Canada and Mexico have been postponed by a month.

Petr Kozyakov, CEO of Mercuryo, described the situation as a “tidal wave of fear, uncertainty, and doubt” gripping the crypto space. Investors are bracing for prolonged higher interest rates and tighter trading conditions, further rattling both traditional and digital asset markets.

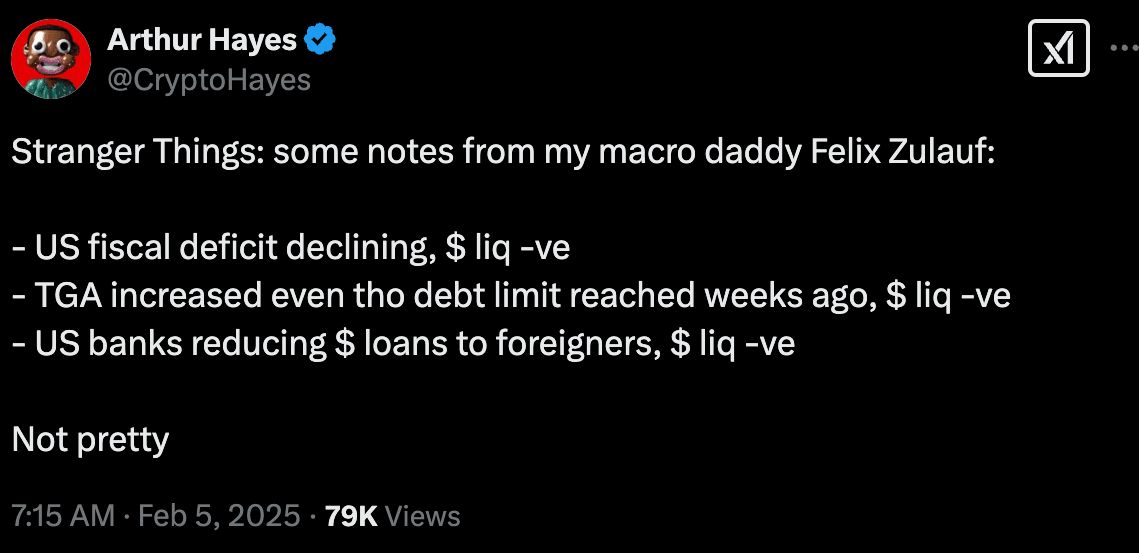

Furthermore, fiat liquidity — including that for the USD — is tightening. Arthur Hayes, chief investment officer at Maelstrom, highlights several reasons.

Despite the downturn, some analysts remain optimistic. Jeff Park of Bitwise argues that the trade war could ultimately benefit Bitcoin, as both sides of the trade imbalance may turn to crypto as a hedge, driving its value higher. Meanwhile, Wall Street giants like BlackRock continue embracing digital assets, with spot Bitcoin ETFs further normalizing crypto’s presence in mainstream finance.

Trump’s policies remain a wild card. His pro-crypto stance — evident in NFT sales and support for a US Bitcoin reserve — has helped shift regulatory sentiment. Yet, some investors fear he is stoking an unprecedented price bubble, while his tariffs have left the market in a state of uncertainty.

Traders are treading with caution ahead of Friday’s jobs report, which could either reverse or reinforce the current bearish trend. Quantitative analyst Benjamin Cowen notes that a deviation from the current 4.1% unemployment rate — either too high or too low — could deepen market uncertainty, preventing BTC from rallying into February and March.

While crashes can present buying opportunities, the underlying issue of mounting global debt remains a significant long-term threat. Once again, crypto finds itself at the crossroads of geopolitics and finance, navigating uncharted waters.

ETH eyes revival with gas limit boost and enhanced utility

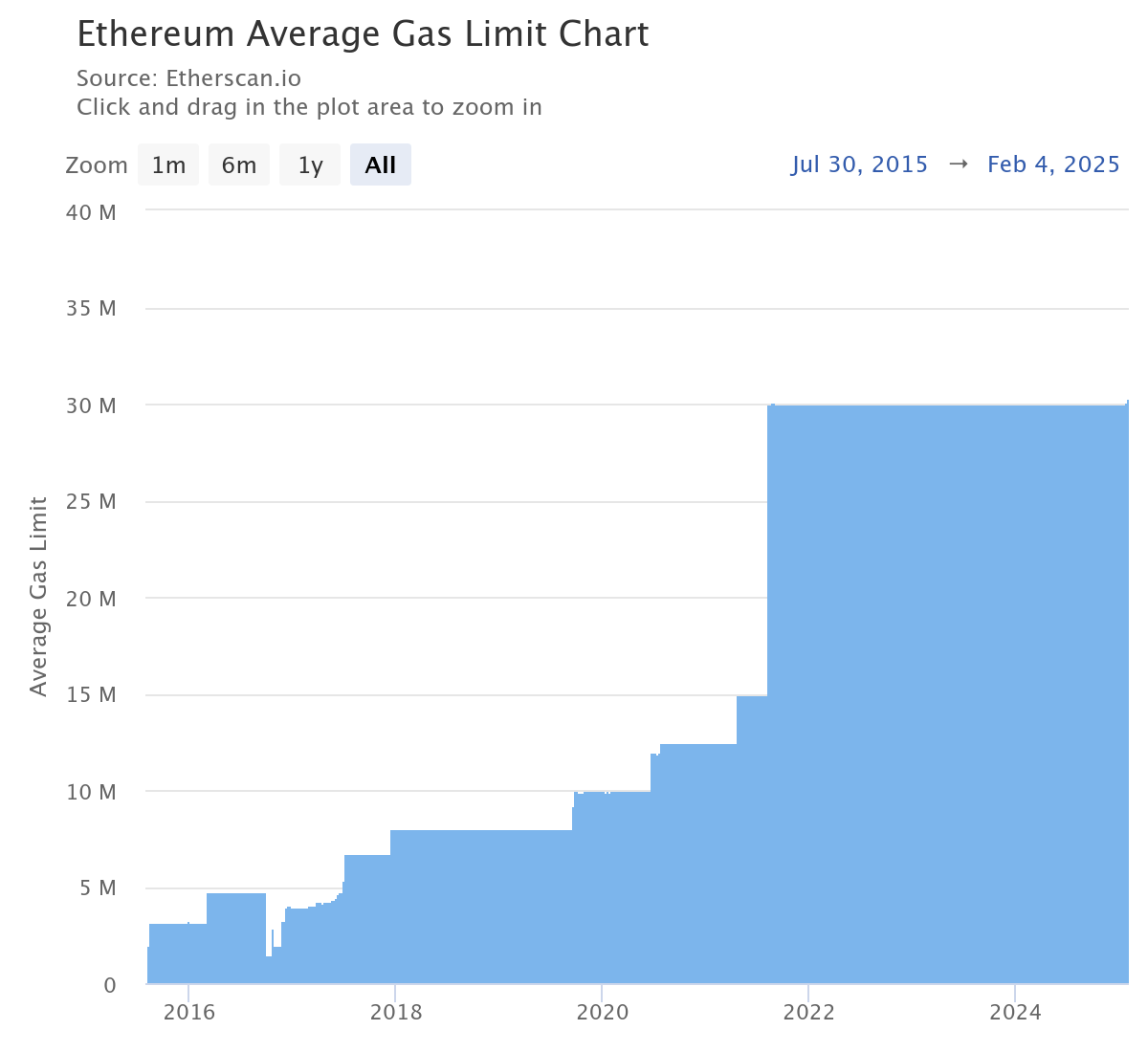

Ethereum has increased its gas limit for the first time since 2021, making a pivotal move to enhance network throughput in the post-Merge era. Validators agreed to raise the limit to nearly 32 million units, with a potential maximum of 36 million, expanding the capacity for transactions and complex operations.

Gas units measure the computational energy required for actions like transactions and smart contract execution. Previously, in 2021, Ethereum raised the gas limit from 15 million to 30 million units. This latest adjustment was automatically implemented after gaining support from over half of the validators, eliminating the need for a hard fork.

By enabling more transactions per block, the upgrade is expected to reduce congestion and lower costs during peak times—a crucial improvement for decentralized finance (DeFi) platforms. Increased throughput could also help Ethereum retain users who might otherwise migrate to cheaper, faster alternatives like Solana.

However, some critics caution that raising the gas limit too much could threaten network stability. In particular, increases beyond the 40 million threshold have been linked to potential performance issues.

What’s next for Ethereum?

Looking ahead, Ethereum’s Pectra upgrade, due in March, aims to double the capacity of layer-2 solutions by increasing the blob target from 3 to 6. This enhancement will significantly improve data storage capabilities, reinforcing Ethereum’s position as a foundational layer for dApps.

Meanwhile, ETH has struggled to keep pace with Bitcoin. The ETH/BTC ratio hit a low of 0.03 in January — down nearly 50% from 2024 — as Bitcoin surged amid shifting political and economic conditions. However, the gas limit increase could reignite investor interest in ETH by strengthening the network’s utility and appeal.