Clapp Weekly: September reversal, Solana's Alpenglow boost, WLFI's rocky debut

BTC price

Bitcoin is back at $111k after a very rough close to August (-6.5%). September, historically a weak month for BTC, started at the $107,500 level before US traders returned to their desks after Labor Day. In stark contrast, expansion into high-powered computing helped top Bitcoin miners set a market cap record in August.

BTC climbed from $110,712 to $113,220 last Thursday, August 28, before sinking sharply to a low of $107,696 on Saturday, August 30. Rebounding, it breached the $109k level the next day, dropped to $107,414 on Monday, September 1, and then changed course.

Currently at $111,222, BTC is up 1.0% over the past 24 hours and 0.5% over the past 7 days.

ETH price

Ether fell harder than the broader market, facing pressure from 1 million coins scheduled for withdrawal from staking. Record transaction wait times highlight the network’s persistent scaling challenges. Meanwhile, BitMine Immersion's holdings grew to $8.1 billion worth of ETH, solidifying its position as the largest listed ETH treasury firm.

The ETH price descended from $4,653.79 a week ago to $4,280.51 on Saturday, August 30, before regaining some momentum over the weekend and nearly reaching $4.5k. Monday’s decline halted at $4,241.81 on Tuesday, September 2, before a rebound attempt.

Now trading at $4,322.47, ETH has lost 1.0% over the past 24 hours and 5.6% over the past week.

Seven-day altcoin dynamics

The crypto market got off to a strong start in September, lifted by Bitcoin’s climb to nearly $112k. A strong bounce in stocks likely helped the tone — tariff news and rising global benchmark interest rates had triggered losses as the month began, with the Nasdaq sliding 2%.

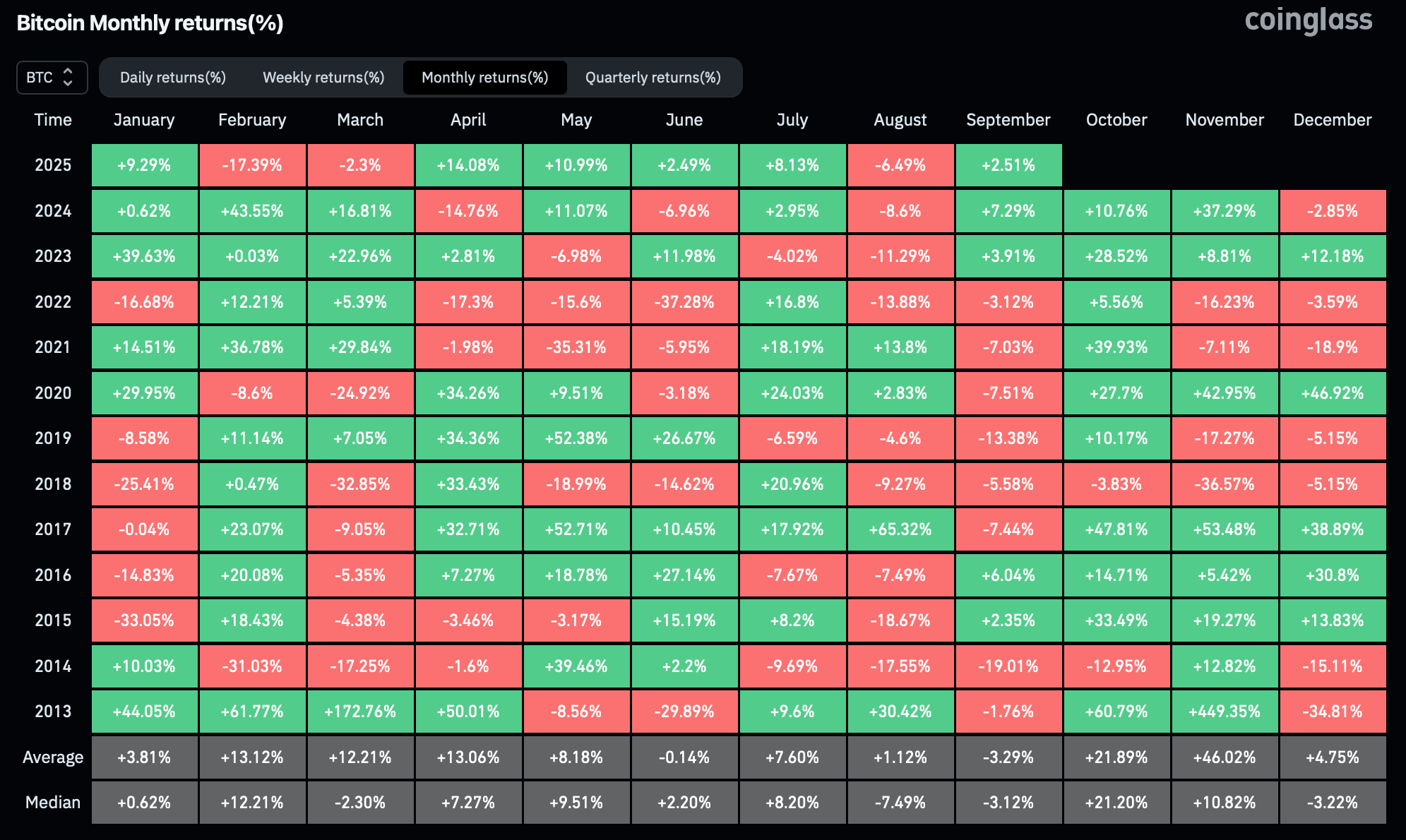

Traders are cautious due to macro uncertainty and thinning volumes. The total crypto market capitalization is now at $3.91 trillion, down from $4.25 trillion in mid-August. History is not on crypto’s side — BTC has dipped in nine of the last 14 Septembers, with an average monthly loss of nearly 12%.

Crucial macro driver looms

The August US jobs report (due Friday) could determine whether the Fed will cut interest rates on September 17 and by how much. Yesterday, the ISM Manufacturing PMI for August (48.7) missed forecasts, showing continued contraction in the sector and supporting hopes for a Fed cut.

Altcoin optimism

Bets on crypto options platform PowerTrade suggest traders are confident in a strong year-end rally for several altcoins, including SOL, XRP, TRUMP, HYPE, and LINK. The approval of the Alpenglow upgrade has helped the Solana coin gain 3.7% over the past week (more below).

Weekly winners

- M (+86.8%) is fueled by strategic momentum including the MemeX liquidity event — which injected $5.7 million into its ecosystem — and a partnership with Web3 token launcher D-Pump. The collaboration aims to “focus on ecosystem interconnection, technical collaboration, and market expansion, jointly empowering the meme economy and on-chain assets.”

- PUMP (+28.7%) broke its prolonged downtrend after Pump.fun deployed over $62 million in commission revenue for a strategic buyback — drastically reducing sell pressure and restoring investor confidence.

- IP (+27.4%) is bolstered by meme coin debuts on its ip.world platform, the launch of the Grayscale Story Trust, Heritage Distilling’s treasury, and a liquidity surge post-Upbit listing.

Weekly losers

- HYPE (-12.1%) corrected after explosive August growth, even as the platform eclipsed Solana in activity and cemented its “killer app” status with over $110 million in revenue.

- HBAR (-9.0%) extended its August slump despite steady whale accumulation, lacking clear catalysts to reverse its bearish momentum.

- FLR (-8.2%) mirrored the broader market decline, with enthusiasm dampened by Flare’s Learn & Earn campaign on Revolut, which restricted immediate token rewards.

Cryptocurrency news

Solana's Alpenglow upgrade set to supercharge speed and efficiency

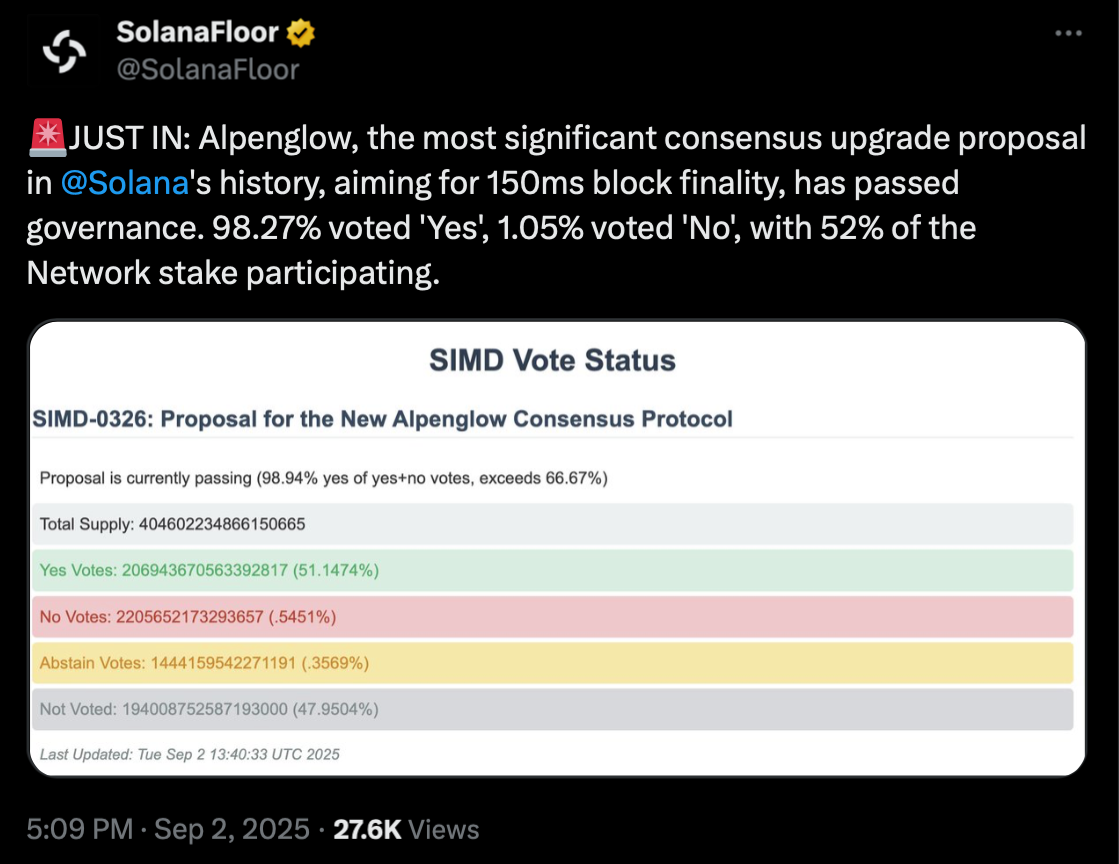

The Solana network has decisively approved its most significant technical overhaul to date — SIMD-0236, an improvement proposal implementing Alpenglow. Yesterday, an overwhelming 98.27% of voting SOL stakers gave the green light to the highly anticipated upgrade, marking a pivotal moment in the blockchain's evolution.

Changes included in Alpenglow

At its core, Alpenglow is a fundamental rewrite of Solana’s consensus mechanism. It will replace the existing Proof-of-History and TowerBFT systems with two new components: Votor and Rotor. This shift addresses key limitations to propel the network toward its goal of handling internet-scale demand.

- Votor: Drastically reduces finality to under 200ms for near-instant confirmations.

- Rotor: Aims to minimize data transfers between validators, boosting efficiency for high-throughput use cases like DeFi and gaming.

The upgrade is being rolled out in phases. For users and developers, the changes promise to be transformative.

The immediate benefit is speed: Votor component could slash confirmation times from over 12 seconds to a near-instantaneous 150-200 milliseconds. This 5x improvement will make decentralized applications feel significantly snappier and allow exchanges to process deposits much faster.

Prominent ecosystem players have praised the vote. Kyle Samani of Multicoin Capital called Alpenglow a critical "mile marker" on the path to achieving one million transactions per second. The upgrade is seen as a crucial step in solidifying Solana’s position as a leading platform for high-performance, global finance.

Potential impact on SOL price

The landmark upgrade is generating positive price momentum for SOL. Analysts suggest its implementation could potentially drive the price toward $250 by the end of the year. This optimism is reflected in the market, with SOL already trading around $209 following the news.

Focus shifts to implementation

With the governance hurdle cleared, the focus now shifts to implementation. Developers at Anza, the R&D firm behind the proposal, are targeting a testnet release by the Solana Breakpoint conference in December. A mainnet launch is tentatively planned for the first quarter of 2026.

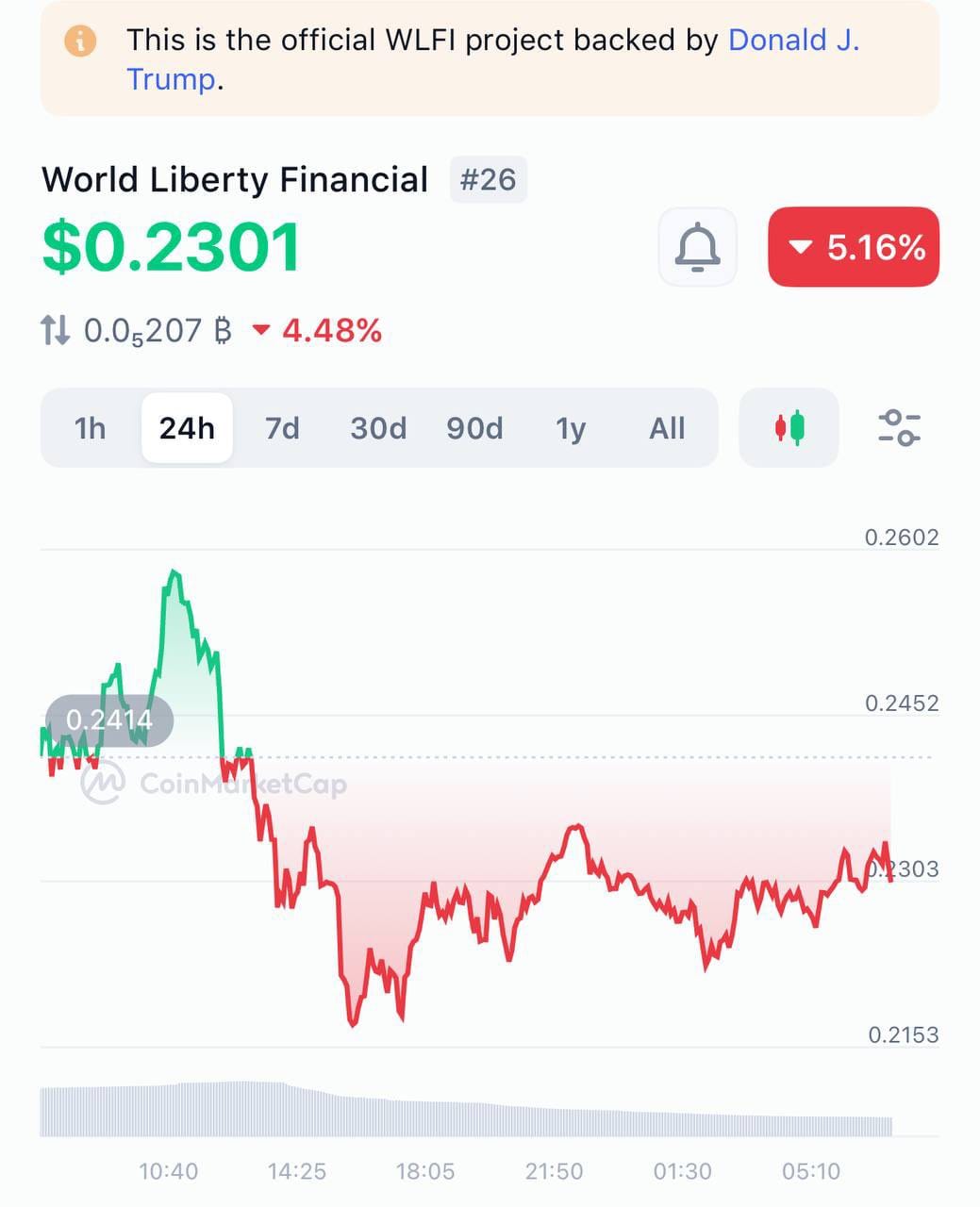

Trump-linked WLFI sees volatile debut amid buyback proposal

World Liberty Financial’s $WLFI token — a new crypto venture with deep ties to the Trump family — began public trading on Monday, sparking both investor enthusiasm and significant market volatility. Trading opened at a massive premium to the early sale prices before experiencing a sharp pullback.

WLFI has fallen roughly 25% from its intraday high of $0.31. Trading at $0.23 at press time, it has still brought a substantial gain to earliest backers. Investors who bought in during the first two private rounds for just $0.015 and $0.05 per token have seen their holdings grow 5-15 times.

The project, which credits former President Donald Trump as its "co-founder emeritus" and involves his sons, allocated 22.5 billion tokens to a Trump-owned entity. The turbulent debut has already prompted the project team to propose a deflationary measure to stabilize WLFI's value.

This governance proposal for a “buyback-and-burn” program includes the following elements:

- Funding mechanism: 100% of the fees generated from WLFI’s own protocol-owned liquidity would be used to purchase tokens on the open market.

- Deflationary goal: The purchased tokens would be sent to a burn address, permanently removing them from circulation to reduce overall supply and create scarcity.

Apparently, this move is an effort to shore up confidence and shift the narrative away from concerns over the massive total supply of 100 billion. A separate community proposal suggests auto-staking locked tokens to reduce selling pressure, though it has garnered less support than the official burn initiative.

For now, the Trump family itself has not been able to capitalize on the initial price surge. Their founder tokens remain subject to a lock-up period, with a future community vote deciding the unlocking schedule that will determine when they can begin selling.

The project’s rocky start echoes a pattern observed in other Trump-affiliated crypto ventures, where early investors often profit while later, smaller entrants frequently face losses. The market now watches to see if the proposed tokenomics can steady the ship.