Clapp Weekly: Soaring Bitcoin, ETF frenzy, SEC-driven DeFi rally

BTC price

Bitcoin is flirting with record highs as corporate adoption surges. The public feud between President Trump and Elon Musk did not derail the price — BTC even ticked up to $107k in the aftermath, and is holding firm despite the Los Angeles riots.

The price dipped from over $105k to $100,984 on Friday, June 6, before gradually recovering over the weekend. On Monday, June 9, BTC soared, eventually peaking at $110,266 yesterday, June 10.

Currently at $109,640, BTC is up 0.2% over the past 24 hours with a 3.8% 7-day gain.

ETH price

Ether has recently outshone Bitcoin's gains, largely due to renewed institutional interest. Over the past two weeks, ETH ETFs have attracted $812 million, the biggest amount year-to-date.

The ETH price mirrored BTC, sinking from $2.6k to $2,419.51 on Friday, June 6, and climbing over the weekend. Monday's push helped it hit $2,695.58, but the rally did not stop there. This morning, ETH breached the $2.8k level.

Now at $2,789.23, ETH has gained 3.8% in 24 hours and 6.0% over the past week.

7-day altcoin dynamics

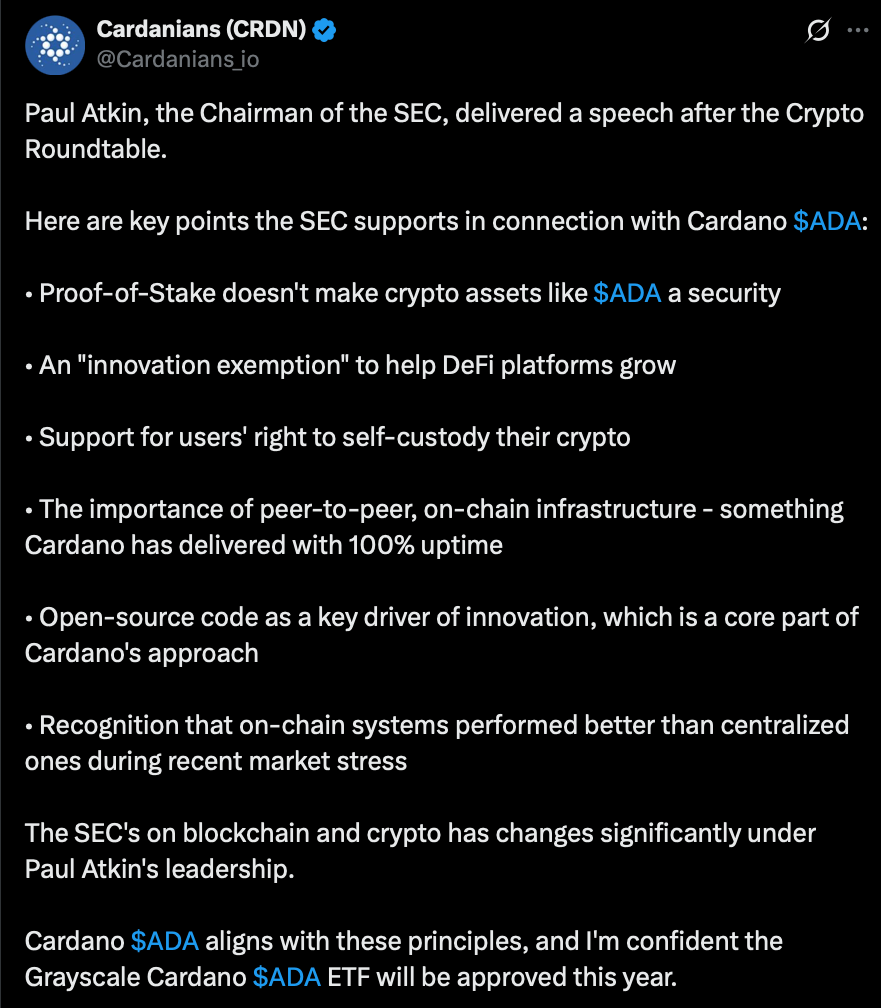

On Monday, DeFi-related comments by SEC Chair Paul Atkins spurred an altcoin rally, aligned with Bitcoin's push above $110k. Binance founder CZ even declared that June 9 “will be remembered as DeFi day.”

Atkins proposed exploring regulatory exemptions for DeFi firms — a sharp contrast to the SEC’s traditionally restrictive approach. He called self-custody rights “a foundational American value” (read more below).

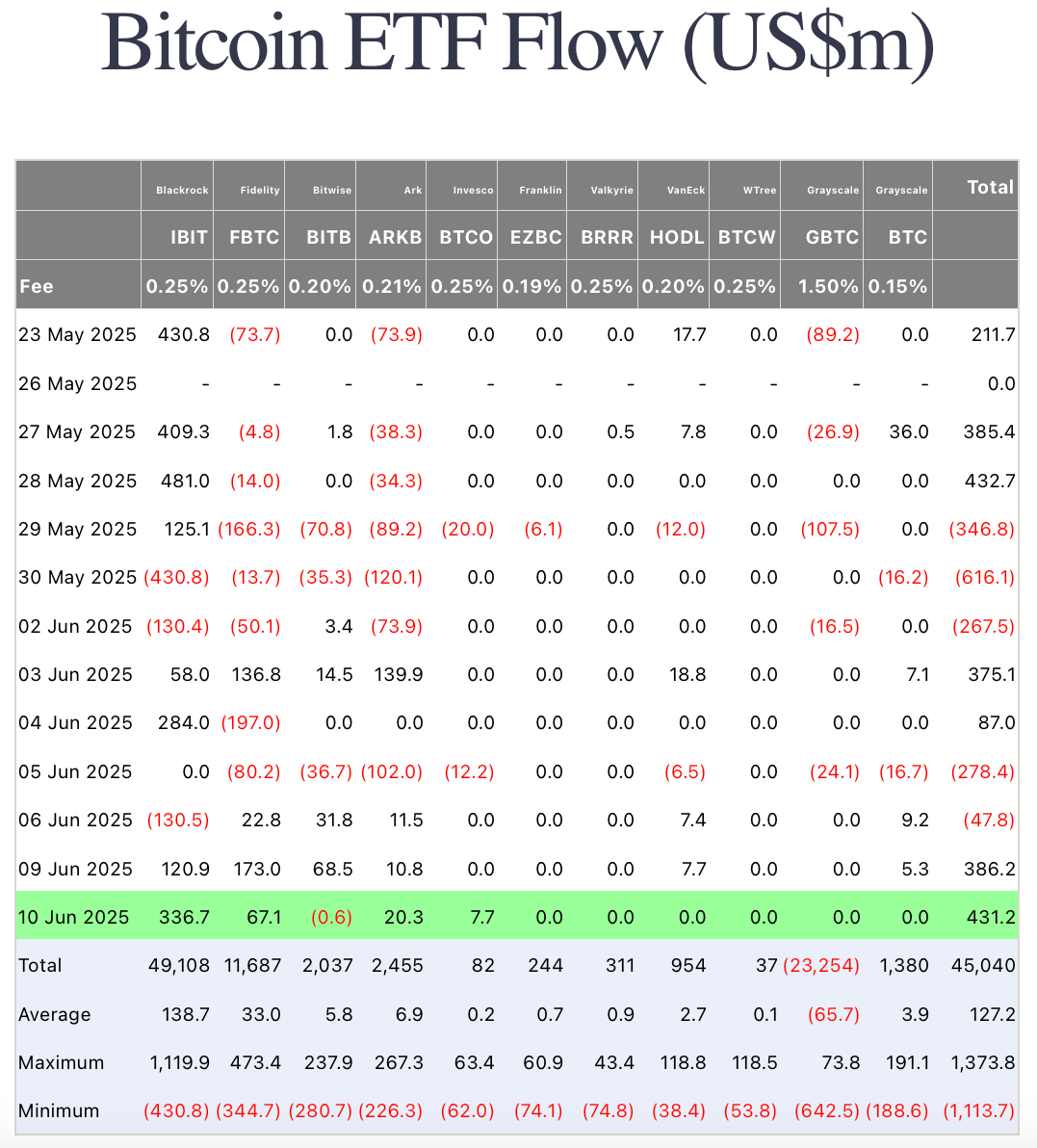

However, leverage-proxy metrics like funding rates and Bitcoin ETF flows suggest market sentiment remains cautious. Investors are closely monitoring US-China trade talks and key inflation data — including today’s CPI report and tomorrow’s PPI release.

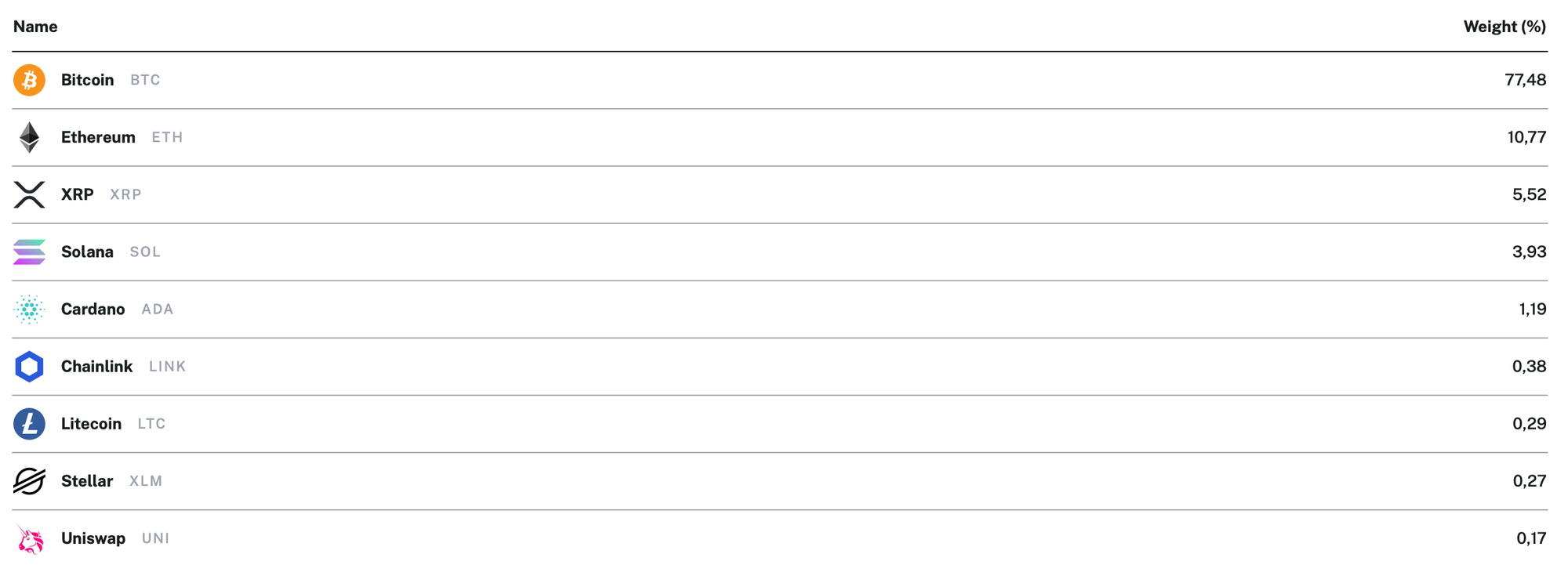

Solana's SOL (+5.5%) surged after Blockworks reported progress on spot SOL ETF approvals. According to the report, the SEC has requested amended S-1 filings from issuers and will review them within 30 days of submission. Meanwhile, Cardano's ADA (+2.5%) saw its trading volumes spike 68% in 24 hours after being added to Nasdaq’s crypto benchmark index.

Winners & losers

The past week saw SPX (+32.7%) emerge as a standout performer, with its adoption rate hitting a two-month high of 25% as investors increasingly recognize its growth potential. Meanwhile, FARTCOIN (+24.9%) extended its year-long rally (nearing 1,000x returns) after Coinbase added it to its roadmap listing — a key validation milestone for the meme coin.

The SEC’s exemption announcement has reignited hopes for a "DeFi Summer 2.0," driving bullish momentum in governance tokens. UNI (+23.1%) outshone them all, surging to a record $88B volume.

On the downside, STX (-10.3%) shows tentative recovery signs after last week’s broad market plunge, though weekend buying pressure suggests stabilization. JUP (-8.1%) faces mounting challenges: despite its Solana DeFi dominance and ecosystem progress, community backlash over tokenomics and team priorities has left it without clear support levels after Monday’s steep drop.

Supply dynamics continue to hamper GT (-4.5%), with less than 50% of its total supply circulating. Analysts warn that persistent inflation risks may cap near-term upside despite its utility.

Cryptocurrency news

Circle’s IPO ignites crypto ETF boom

Circle Internet Financial, the issuer of the USDC stablecoin, made a spectacular debut on Wall Street last Thursday. Its shares tripled shortly after the IPO, sending shockwaves through the market and reviving the kind of frenzied speculation not seen since Coinbase’s 2021 direct listing.

The two-day moonshot of almost 250% was the highest since 1980s. This success triggered an immediate flood of ETF filings betting on Circle’s momentum. Within days, three issuers — Bitwise, ProShares, and T-Rex — raced to file leveraged and options-based ETFs tied to the stock.

These funds promise amplified exposure, reflecting the insatiable appetite for high-risk, high-reward crypto plays. As Bloomberg Intelligence’s Athanasios Psarofagis put it, “It’s an alignment of the stars — a crypto company, leveraged bets, and a market starved for IPOs.”

Meanwhile, around 80 companies have added Bitcoin to their balance sheets. Corporates now hold roughly 3.4% of all coins in circulation, according to Bernstein. Giants like Strategy continue doubling down, amassing billions in BTC as an inflation hedge.

The Trump administration’s pro-crypto stance has further fueled the rally, with Bitcoin up 55% since the election. Bitcoin has outperformed gold and the dollar over the past five years, but not every corporate bet pays off — Trump Media and GameStop saw steep drops after announcing Bitcoin treasury plans.

SEC’s potential "innovation exemption" sparks DeFi governance rally

The US Securities and Exchange Commission (SEC) is modifying its approach to decentralized finance (DeFi), and the market is reacting. News of a potential "innovation exemption" for certain DeFi projects has sparked a surge in Ethereum-based governance tokens like UNI (Uniswap) and AAVE.

Speaking at a Monday roundtable of DeFi experts, SEC Chair Paul Atkins said he had instructed staff to explore possible changes to agency rules "to provide needed accommodation for issuers and intermediaries to seek to administer on-chain financial systems." This marked the conclusion of five crypto roundtables held since the SEC leadership transition under Trump.

Atkins also stated that software developers building DeFi tools should not be blamed for how they are used. The "innovation exemption" would let entities under the SEC's jurisdiction bring on-chain products and services to market "expeditiously."

Why governance tokens are rallying

Details remain scarce — yet the mere possibility of a pivot stance has sent governance tokens soaring. Cryptocurrencies granting holders voting rights in DeFi protocols, have long existed in a regulatory gray area — and many feared they could be classified as unregistered securities.

If the SEC adopts an exemption for sufficiently decentralized systems, it could remove a major overhang on the sector — unlocking new growth and institutional interest. Regulatory flexibility could legitimize DeFi while avoiding the heavy-handed enforcement of recent years.

Cautious optimism in DeFi

Despite the bullish reaction, skepticism remains. The SEC has yet to confirm any formal policy change, and SEC Chair's past statements suggest most tokens still fall under securities laws. Legal experts warn that any exemption would likely come with strict criteria — potentially excluding projects with significant centralized control.

For now, the market is betting that regulatory clarity — even in its early stages — could be a turning point for DeFi. If the SEC follows through, it may finally provide the legal certainty needed for decentralized finance to scale beyond its niche and into the mainstream.