Clapp Weekly: Wild ride, post-inauguration limbo, Ethereum tussle

Price dynamics

BTC price

Bitcoin (BTC) reached a fresh all-time high of $108,786 on Monday, January 20, just hours before Donald Trump’s inauguration. The rally was further fueled by MicroStrategy’s latest purchase of 11,000 BTC for its treasury, reinforcing institutional confidence.

After trading at $97k a week ago, BTC regained six-figure territory on Thursday, January 16. It surged to $105,850 the next day and sustained momentum over the weekend. A dip below $100k on Inauguration Day preceded a new record high. Following a rebound from $101k this morning, the coin is in the green once again.

Trading at $105,315, BTC is up 1.6% in the past 24 hours and 8.7% over the past seven days.

ETH price

Ether (ETH) has traced Bitcoin with wilder swings but smaller gains, weighed down by internal discord at the Ethereum Foundation. Amid calls for executive director Aya Miyaguchi to resign, co-founder Vitalik Buterin labeled the community criticism as “pure evil” and scapegoating (more below).

ETH started the week at $3.2k and climbed to $3,454.32 on Thursday, January 16, before seesawing. A weekend rebound to $3.5k faced a major pullback, with a low of $3,138.35 before a strong recovery — ETH briefly crossed $3.4k on Inauguration Day.

At $3,322.26, ETH is up 2.4% over the past 24 hours with a +2.9% weekly change.

Seven-day altcoin dynamics

AI-agent cryptos zoomed yesterday on the news about President Trump's plan for $500 billion private sector AI infrastructure investment, with OpenAI, Oracle, and SoftBank involved. In addition, Trump has rescinded Biden's 2023 executive order addressing consumer AI risks, effectively rolling back sector regulation efforts. AI16Z led the rally, skyrocketing 35% during the day.

Meanwhile, the broader market showed a cautious stance. Most large-cap tokens posted modest gains after a weekend of frenzy, triggered by the launch of the Official Trump (TRUMP) and Melania Meme (MELANIA) tokens. The former rocketed on his first day in office, pushing BTC to a new ATH before a sharp market-wide correction.

Despite Trump's pledge to position the US as the world's "crypto capital," digital assets were absent from his initial executive orders. The administration’s connections to crypto and discussions of a potential Bitcoin strategic reserve fuel optimism, but there are also ethical concerns — Trump's ties to the industry include World Liberty Financial, his DeFi platform, and memecoins.

Speculation and memecoins take center stage

FARTCOIN leads 7-day gains, boasting a new all-time high after a meteoric weekend rally. Greenlight Capital’s David Einhorn regards its rise as emblematic of unbridled speculation: “We’ve reached the ‘Fartcoin’ stage of the market cycle... Beyond trading and speculation, it serves no clear purpose.”

SOL (+35.4%) benefits from the launch of TRUMP and MELANIA on Solana. However, TRUMP has also seen the steepest dip, followed by PENGU (-24.4%) and MOVE (-15.8%). S, formerly FTM (-11.2%), continues an extended correction despite its exchange-supported conversion. Meanwhile, BONK (+20.5%) has extended its lead among dog-themed tokens.

Cryptocurrency news

Trump’s return sends Bitcoin on a rollercoaster

Bitcoin's ascent to a new record high on Inauguration Day was fueled by optimism that Trump’s return would immediately favor the market. Disappointment followed — with no crypto-focused policy changes announced during his first day in office, the price dropped 9% to $100k.

Adding to the uncertainty, the initial list of priorities focused on immigration, energy, and bureaucracy improvement. None of the 26 day-one executive orders addressed crypto, leading to a short-term dampening of investor sentiment.

“There was probably some hope that crypto-related executive orders would be part of Trump's first slew of actions,” noted Matthew Sigel, head of digital assets research at VanEck.

Hope rebounded slightly on Tuesday as the SEC unveiled a new crypto task force “dedicated to developing a comprehensive and clear regulatory framework for crypto assets.” Bitcoin responded positively, climbing 3% to reach $107k, nearing its earlier peak.

Speculation is now rife about the administration's next steps, including repealing Biden-era enforcement policies like SAB 121, designating crypto a “national priority,” creating a strategic Bitcoin reserve, and restricting government sales of seized tokens.

While the crypto community awaits concrete actions, the market continues to reflect both promise and uncertainty, with the potential for large shifts in the coming weeks.

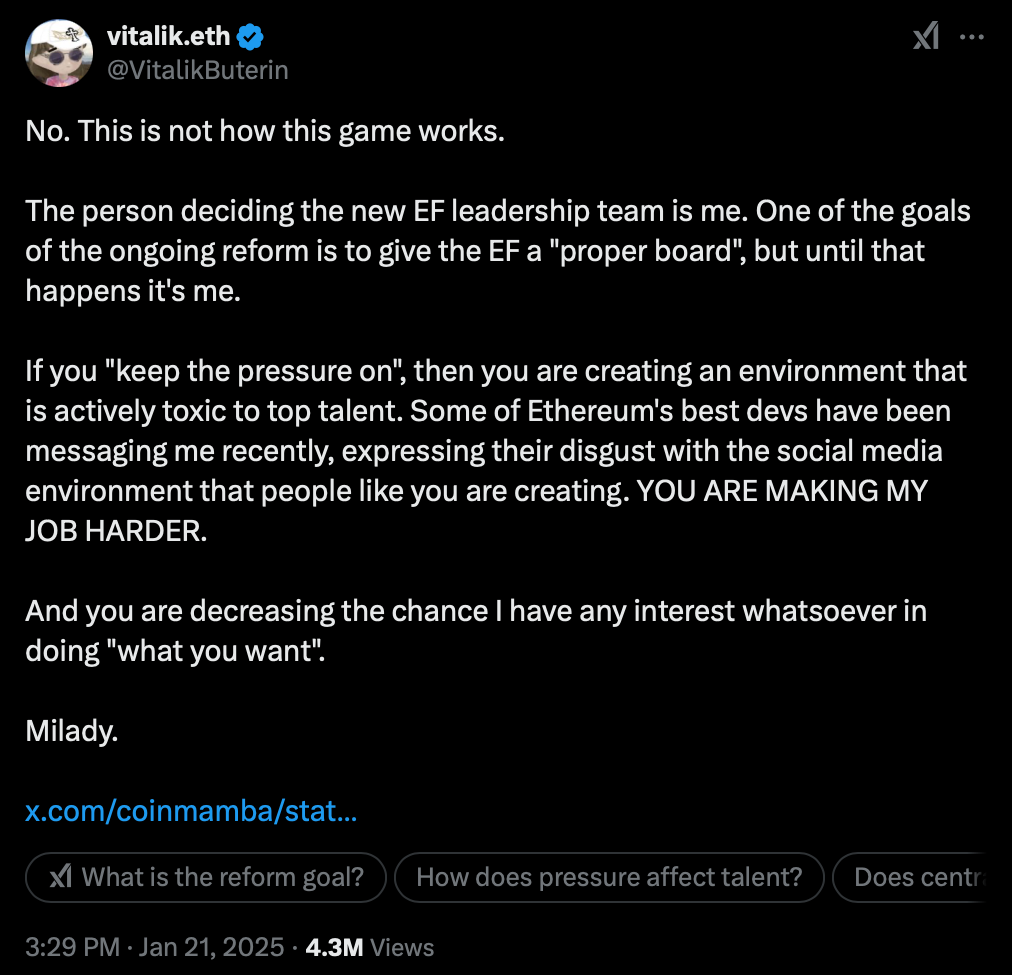

Vitalik Buterin takes charge amid Ethereum leadership shake-up

Ethereum co-founder Vitalik Buterin has addressed mounting challenges at the Ethereum Foundation (EF), the nonprofit supporting the world’s second-largest blockchain. As it battles declining market dominance and internal discord, Buterin unveiled a plan to overhaul the leadership structure and restore confidence in the ecosystem.

In a series of X posts, Buterin outlined key goals for the EF’s transformation, stressing leadership's enhanced technical expertise and stronger ties with the broader Ethereum community. He reassured stakeholders that the reforms would avoid centralization, corporatization, or politicization as the entity remains committed to its ethos.

The shake-up follows a tumultuous year for the network, criticized for being inefficient, yet too powerful. As competitors like Solana gain traction with faster, cheaper networks, it reportedly lacks a cohesive vision. Scandals involving conflict-of-interest accusations and controversial payments to EF employees have further tarnished its reputation.

Aya Miyaguchi, EF’s executive director since 2018, has been the primary target of criticism. Responding to calls for Miyaguchi's removal, Buterin has stepped in as the entity's sole decision-maker. He condemned inflammatory social media posts, including death threats, as "pure evil," warning that such behavior harms the ecosystem by driving away top developers.

The leadership overhaul marks a pivotal moment for Ethereum as it seeks to regain trust, attract talent, and maintain its position as a blockchain leader in an increasingly competitive market.