From Monero to Canton: Rewriting crypto privacy for Wall Street

Privacy is one of the leading stories of 2026, with coins like Monero hitting new highs as governments tighten restrictions on retail cash use. Institutional players champion TradFi adoption of on-chain privacy, making it a crucial feature for merging blockchain and real-world business.

Transparency is a cornerstone of blockchain philosophy. Yet its downside exposes a material risk for corporate users — their investment strategies and trade secrets would be public if etched on-chain.

Institutions want to shield transaction data while remaining fully compliant with applicable regulations. Fully anonymous coins do not fit their needs, as they sidestep KYC and AML safeguards. The answer is selective privacy — models that limit disclosure to specific information for verification purposes.

Default blockchain privacy vs. institutional needs

Blockchain technology is based on public ledgers. Anyone can track what wallets transacted, what amounts were sent, and at what time. This transparency reduces the need for intermediaries. It’s a shared, unchangeable, and visible record that builds trust, supercharges security, and increases efficiency.

From an institutional angle, however, on-chain transparency is precisely the problem. Competitive rivalries require that some transactions — like business-to-business transfers or capital deployment — stay hidden from the public eye.

The timing of investments and transactions is highly sensitive. Furthermore, different institutions have different appetites for information disclosure. Default blockchain systems are unsuitable, pushing the need for tailored privacy solutions to the forefront.

Full anonymity vs. selective privacy

As mentioned above, blockchain privacy can be full or selective.

The first case (full anonymity) is the direct opposite of default blockchain transparency. All user and transaction data is shrouded, including senders, recipients, and amounts.

The key objective is shielding against third-party surveillance. External observers have no way of extracting any meaningful data.

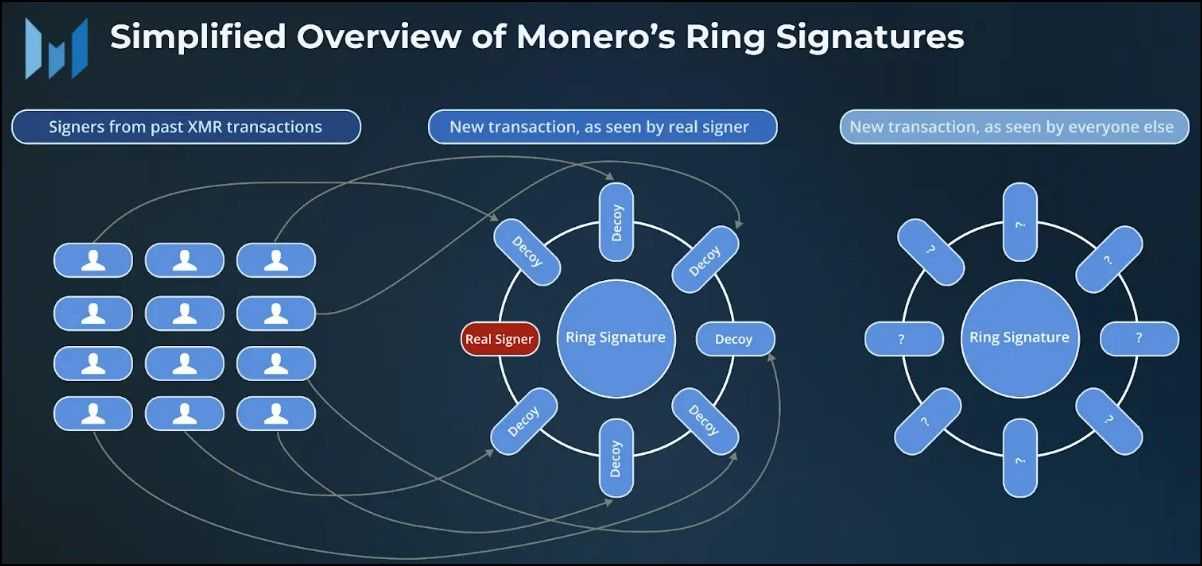

This is how Monero works. Its blockchain cloaks all counterparties and transfer amounts without exception.

- Transactions are recorded, but the amounts are marked as “confidential.”

- The system mixes each sender with multiple decoys, making it look as if several parties sent funds simultaneously.

Selective privacy models: Zcash vs. Canton

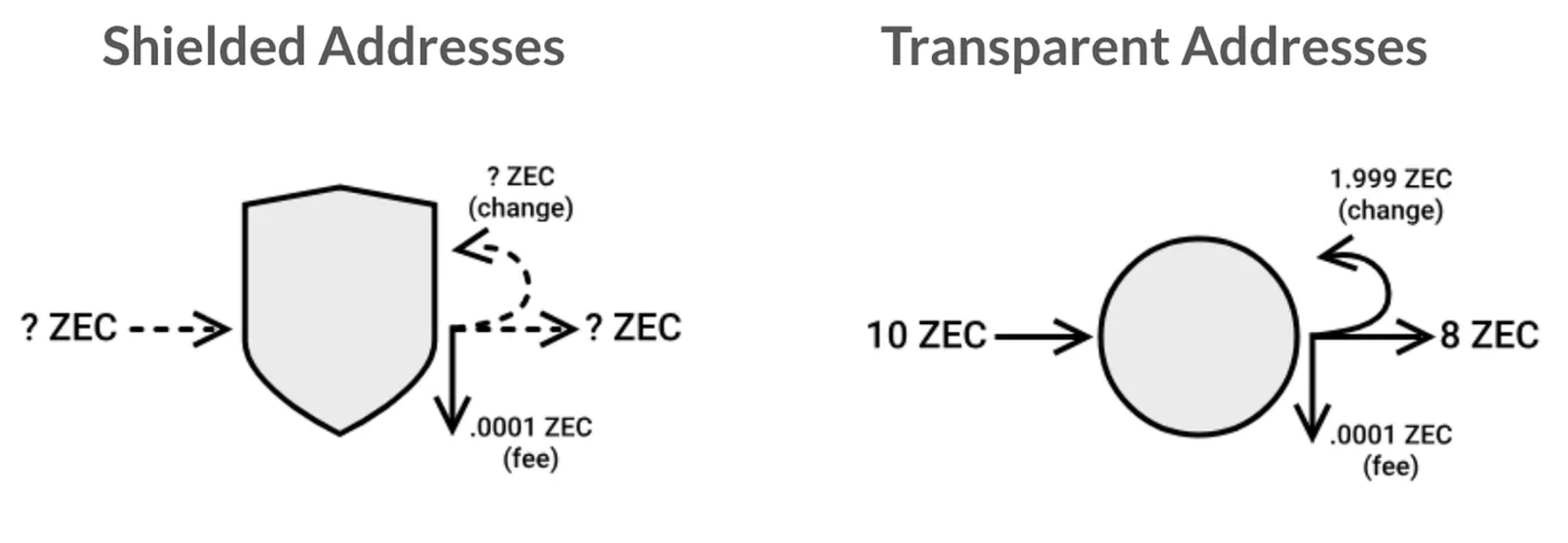

Selective privacy blockchains — like Zcash — keep transactions public by default, but users control who can view their details. Designated privacy-enabled addresses make transfers private.

Zcash provides two address types:

- Transparent (T): All transaction details are publicly visible.

- Shielded (Z): Transaction details (amount, sender, and recipient) are encrypted and hidden, while the footprint of a transaction remains visible.

Viewing transaction details is only possible with a special viewing key. When needed, a user can share it to verify transaction details to a specific external party.

However, users cannot choose which pieces of data to reveal — disclosure works for the entire transaction. For instance, in a transaction where “A sends B $1,000,” it is impossible to mask just the amount. This does not meet corporate needs, which is why Zcash has seen limited institutional adoption.

What makes Canton different

Canton Network allows exactly that — concealing only specific data components. For example, if an institution is required to reveal just the transaction amount for compliance, it may do so thanks to Daml, Canton’s smart contract language.

The network's architecture was designed with native institutional-grade privacy in mind. It delivers the interoperability of public L1 chains with selective privacy — Canton’s apps segregate data so stakeholders only see the details on a need-to-know basis.

- Privacy on a sub-transaction level: Parties involved in a transaction record parts of it that apply to them and share specific data if needed. This selective disclosure is unique to Canton.

- Proof-of-stakeholder consensus: Canton's consensus mechanisms guarantee that each transaction is validated only by its participants. Running a validator node on Canton does not require staking.

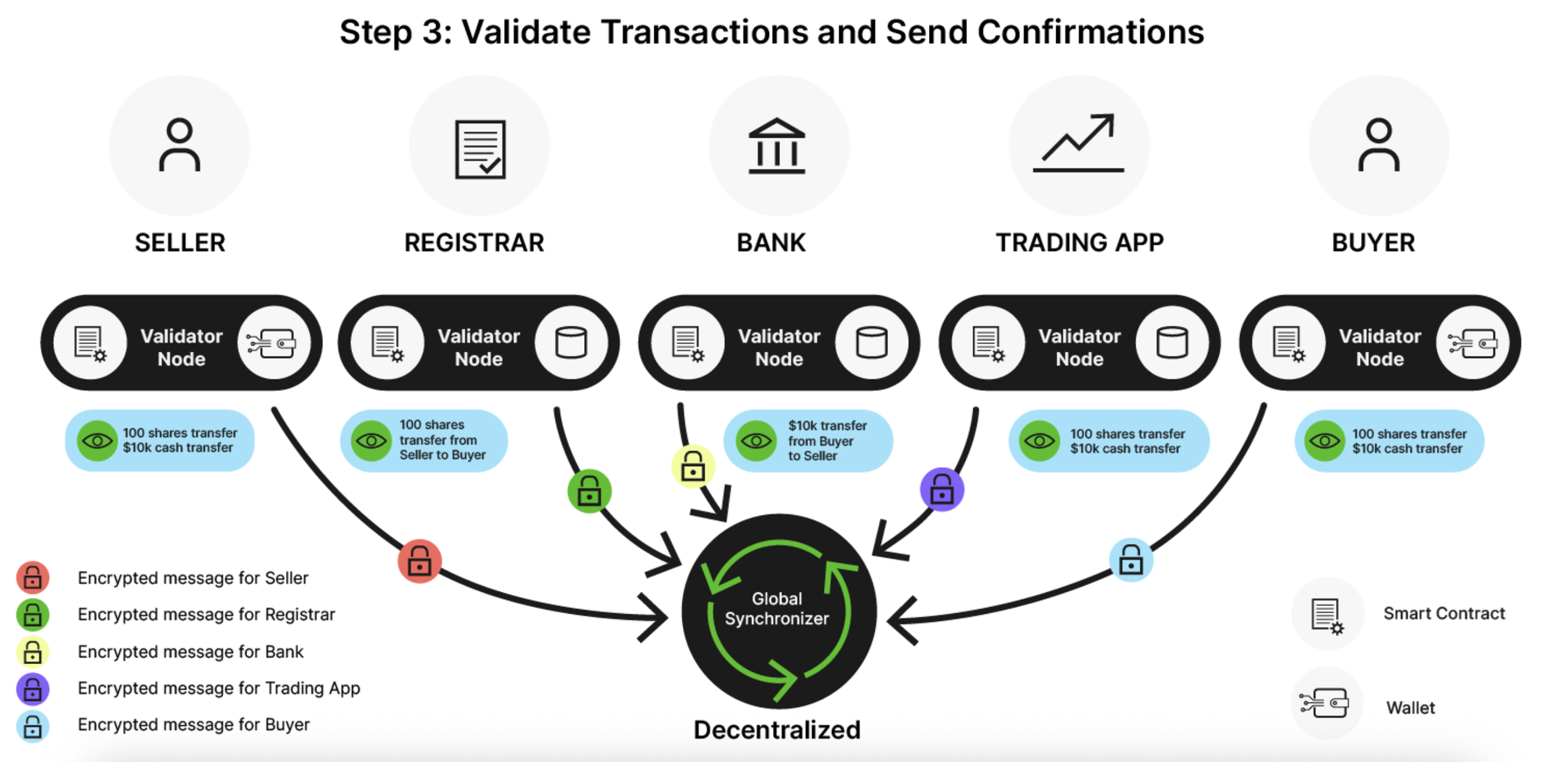

The example below depicts a Delivery vs. Payment (DvP) transaction, where an asset (100 shares) is exchanged for payment ($10k). The seller, registrar, bank, trading app and buyer must all validate the transaction for it to succeed.

Each validator node sends confirmations to the Global Synchronizer — a "decentralized and transparently governed interoperability service for the Canton Network." It sends a commit message to the nodes, updating the state for all parties, which results in the atomic settlement being complete.

In terms of visibility, the bank may only see the data for the cash transfer side of the transaction; the underlying securities remain hidden. Meanwhile, the securities registrar will only see the assets transfer data, not the cash movement details.

Canton Network is already being used by 400+ businesses and institutions. Recently, it has been embraced by the Depository Trust & Clearing Corporation (DTCC). This partnership will enable the tokenization of DTCC-custodied securities, including US Treasury securities.

Summing up: Why institutions prefer selective privacy

Full anonymity privacy — pioneered by early projects like Monero — irreversibly locks away all transaction data. Without a way to access or disclose it, institutions cannot fulfill their compliance obligations.

Selective privacy blockchains conceal either all or specific transaction details, depending on the network. Zcash offers only a binary choice (full disclosure/full privacy).

Most financial institutions must comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements for every transaction. This requires hoarding transaction data internally and responding to requests from regulators.

Access to all transaction data is not always needed. Instead, different parties require different pieces of information. This explains why Canton is winning the institutional race.

Privacy blockchains in the institutional era

The evolution of privacy blockchains is a direct countermove to shifting market demands.

As financial institutions and major enterprises began to wade into blockchain environments, the very definition of privacy was rewritten.

Privacy is no longer about making transactions vanish from all eyes. Instead, the core mission has become protecting sensitive transaction data while still bowing to regulatory mandates.

This fundamental shift illuminates why selective privacy models like Canton Network have gained such momentum. What institutions demanded was not just privacy technology, but an entire architecture designed to mirror the complex workflows of real-world finance.

In answer to this call, a new wave of institution-first privacy projects continues to surface. Moving forward, the critical battleground will not be the strength of the cryptography alone, but how seamlessly and effectively the privacy layer integrates into live transaction environments.